|

市場調查報告書

商品編碼

1433793

高階加速度計 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)High-end Accelerometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

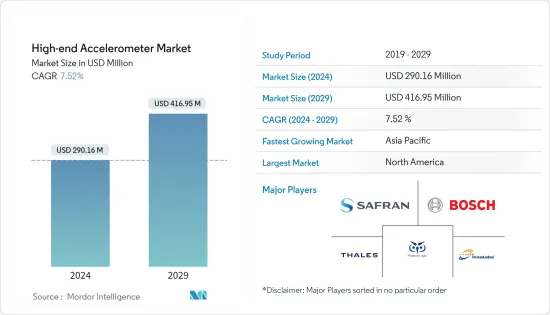

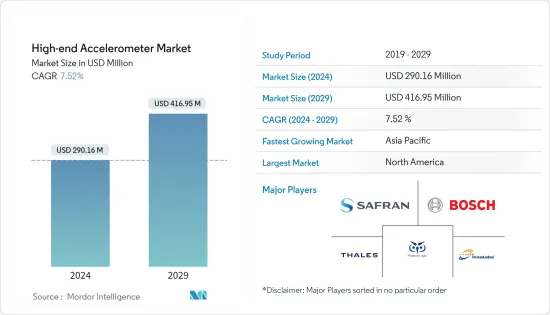

2024年高階加速度計市場規模預計為2.9016億美元,預計到2029年將達到4.1695億美元,在預測期內(2024-2029年)CAGR為7.52%。

在COVID-19大流行的初期階段,高階加速度計市場出現了供應鏈困難。2020年上半年,部分產業需求也有所下降,其中汽車、製造業等產業受到較大影響。然而,COVID-19 大流行也擴大了 MEMS 感測器的範圍,例如高階加速度計,適用於許多新應用。

主要亮點

- MEMS 技術的日益普及也透過縮小這些設備的尺寸和功耗而不影響性能指標,在擴大高階加速度計的應用基礎方面發揮了重要作用。

- 高階加速度計也擴大用於高速列車和自動駕駛汽車的導航系統。這些設備廣泛用於進行衝擊和振動測試,以評估汽車在脅迫下的表現。

- 用於汽車應用的高階加速度計具有比工業級應用更大的偏置穩定性範圍,且工作範圍取決於預期的最終應用。例如,防撞系統的工作範圍可能高達 40 克。

- 高階工業應用中的自動化機械在高速操作(例如切割或銑削)期間的振動程度增加,預計會損壞關鍵材料並降低精度。這種情況需要更高的穩定性以實現更高的機器控制。因此,高階加速度計在這些應用中已廣泛採用。

高階加速度計市場趨勢

導航應用程式將佔據主要佔有率

- 高靈敏度加速度計對於下一代導航和導引系統非常重要,包括與現有 GPS 引擎、壓力感測器和空間應用平台穩定性的緊密耦合。

- 將基於 MEMS 的慣性加速度計用於導航應用的動機是希望實現一種小型、低成本、輕量且高靈敏度的現有宏觀方法的替代方案。低成本、高靈敏度 MEMS 加速度計的成功製造為消費者和軍事用戶帶來了當前技術無法實現的新應用。

- 例如,用於軍事和消費應用的個人手持導航器,以及無法使用 GPS 的導航應用程式(例如在山谷、城市地區以及建築物和洞穴內)都使用高階加速計。

- 近日,2019年9月,先進MEMS感測器解決方案設計商和製造商Sensonor宣布推出其最新慣性IMU—STIM318 IMU。作為高精度戰術級 IMU,新解決方案目的是提供更高的加速度計性能,以支援國防和商業市場中要求苛刻的導引和導航應用。此外,STIM318 可以透過競爭性地取代光纖陀螺儀(FOG)為已經使用 STIM300(感測器 IMU)的應用和許多其他應用提供額外的功能。

北美將佔據最大佔有率

- 北美地區新型高性能加速度計的開發不斷成長,該地區的公司投資引進先進和創新的加速度計。美國國防部增加購買高性能設備的支出是推動該國高階加速度計成長的主要因素。

- 美國擁有全世界最大的國防預算。隨著這種成長,該國也關注精確導引彈藥(PGM),例如雷射制導炸彈和巡航飛彈,這些武器已成為美軍的首選武器,提供高精度,同時避免大範圍的附帶損害。這些應用需要高性能、緊湊外形、堅固耐用的加速度計,以改善戰術 IMU,以實現無需 GPS 的長時間引導。

- 美國軍方使用諾斯羅普·格魯曼公司開發的導航級慣性測量裝置。此小型化單元基於 MEMS 技術,透過感測加速度和角運動來實現導航,並提供車輛控制系統用於引導的資料輸出。

高階加速度計產業概況

高階加速度計市場由一些主要參與者組成,就市場佔有率而言,目前很少有主要參與者佔據市場主導地位。這些在市場上佔有顯著佔有率的主要參與者正致力於擴大其在國外的客戶群。這些公司利用策略合作措施來增加市場佔有率並提高獲利能力。

- 2020年 12月 - TDK 公司推出了適用於非安全相關汽車應用的 InvenSense IAM-20680HP 高性能汽車單片 6 軸 MotionTracking 感知器平台,其中包括 IAM-20680HP IMU MEMS 感知器和 DK-20680HP 開發套件。 InvenSense 的 IAM-20680HP 在薄型 3 x 3 x 0.75mm(16 引腳 LGA)封裝中結合了 3 軸陀螺儀和 3 軸加速度計,並符合 AEC-Q100 2 級汽車標準。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 市場促進因素

- MEMS 技術的採用不斷增加

- 國防和航太的成長傾向

- 導航系統的技術進步

- 市場限制

- 操作複雜度加上維修成本高

- Covid-19 對市場影響的評估

第5章 市場細分

- 依應用

- 戰術應用

- 導航應用

- 工業應用

- 汽車應用

- 地理

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Secret SA

- Safran Colibrys

- Physical Logic Ltd

- Innalabs Limited

- Sensonor AS

- Tronics Microsystems(EPCOS)

- Bosch GmbH

- Thales Group

- Analog Devices Inc.

- Honeywell International Inc.

- STMicroelectronics NV

- TE Connectivity Ltd

第7章 投資分析

第8章 市場機會與未來趨勢

The High-end Accelerometer Market size is estimated at USD 290.16 million in 2024, and is expected to reach USD 416.95 million by 2029, growing at a CAGR of 7.52% during the forecast period (2024-2029).

The high-end accelerometer market witnessed supply chain difficulties in the initial phase of the COVID-19 pandemic. The demand from some industries was also down during the first half of 2020. Industries like automotive and manufacturing were significantly affected. However, the COVID-19 pandemic has also expanded the scope of MEMS sensors, like high end accelerometers, for many new applications.

Key Highlights

- The increasing adoption of MEMS technology has also played a significant role in expanding the application base for high-end accelerometers by scaling down the size and power consumption of these devices, without compromising on the performance metrics.

- High-end accelerometers are also being increasingly used in navigation systems for high-speed trains and autonomous vehicles. These devices are widely used for performing shock and vibrational test for evaluating the performance of automobiles in duress.

- High-end accelerometers for automotive applications possess a bias stability range more significant than that of industrial grade applications, and the working range is dependent on the intended end-applications. For instance, the working range could be as high as 40g for crash avoidance systems.

- The increased vibration levels of automated machinery in high-end industrial applications during high-speed operations, such as cutting or milling, are expected to damage critical materials and reduce precision. Such cases require higher stability to have higher machine control. Thus, high-end accelerometers are being adopted significantly for these applications.

High-End Accelerometer Market Trends

Navigational Applications to Hold a Major Share

- High sensitivity accelerometers are crucial for the next generation navigation and guidance systems, including tight coupling to existing GPS engines, pressure sensors, and platform stabilization for space applications.

- The incentive for a MEMS-based inertial accelerometer for navigational applications is based upon the hopes of realizing a small, low cost, lightweight, and highly-sensitive alternative to existing macro-scale approaches. The successful fabrication of a low cost, high-sensitivity MEMS accelerometer results in new applications for both consumer and military users that aren't feasible with current technologies.

- For instance, personal handheld navigators for military and consumer applications, as well as GPS-denied navigation applications, such as in valleys, urban areas, and within buildings and caves, utilize high-end accelerometers.

- Recently, in September 2019, Sensonor, a designer and manufacturer of advanced MEMS sensor solutions, announced the launch of its latest inertial IMU - the STIM318 IMU. A high-accuracy tactical-grade IMU, the new solution is designed to offer increased accelerometer performance to support demanding guidance and navigation applications within the defense and commercial markets. Furthermore, the STIM318 can deliver additional capability to applications already using the STIM300 (Sensonor's IMU) and many other applications by competitively replacing the fiber-optic gyros (FOGs).

North America to Account for the Largest Share

- The North American region is witnessing growth in the development of new high-performance accelerometers, as companies in the region are investing toward introducing advanced and innovative accelerometers. The increased spending by the US defense department to acquire high performance equipment is the major factor driving growth of high-end accelerometers in the country.

- The United States has the world's largest defense budget. With this rise, the country also focusses on precision guided munitions (PGMs), such as laser-guided bombs and cruise missiles, that have become the weapons of choice for the US military, providing a high degree of accuracy, while avoiding widespread collateral damage. These applications demand high performance, compact form factor, ruggedized accelerometers to improve tactical IMUs for long-duration guidance without GPS.

- The US military uses a navigation-grade inertial measurement unit developed by Northrop Grumman. This miniaturized unit is based on MEMS technology to enable navigation by sensing acceleration and angular motion, and providing data outputs used by vehicle control systems for guidance.

High-End Accelerometer Industry Overview

The high-end accelerometer market consists of some major players, and in terms of market share, few of the major players currently dominate the market. These major players with prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- December 2020 - TDK Corporation introduced the InvenSense IAM-20680HP high-performance automotive monolithic 6-axis MotionTracking sensor platform for non-safety relevant automotive applications, which includes the IAM-20680HP IMU MEMS sensor and the DK-20680HP developer kit. InvenSense's IAM-20680HP combines a 3-axis gyroscope and a 3-axis accelerometer in a thin 3 x 3 x 0.75mm (16-pin LGA) package and is automotive qualified based on AEC-Q100 Grade 2.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of MEMS Technology

- 4.4.2 Inclination of Growth Toward Defense and Aerospace

- 4.4.3 Technological Advancements in Navigation Systems

- 4.5 Market Restraints

- 4.5.1 Operational Complexity Coupled With High Maintenance Costs

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Tactical Applications

- 5.1.2 Navigational Applications

- 5.1.3 Industrial Applications

- 5.1.4 Automotive Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Secret SA

- 6.1.2 Safran Colibrys

- 6.1.3 Physical Logic Ltd

- 6.1.4 Innalabs Limited

- 6.1.5 Sensonor AS

- 6.1.6 Tronics Microsystems (EPCOS)

- 6.1.7 Bosch GmbH

- 6.1.8 Thales Group

- 6.1.9 Analog Devices Inc.

- 6.1.10 Honeywell International Inc.

- 6.1.11 STMicroelectronics NV

- 6.1.12 TE Connectivity Ltd