|

市場調查報告書

商品編碼

1433780

資料中心基礎設施管理 (DCIM):市場佔有率分析、產業趨勢與成長預測(2024-2029 年)Data Center Infrastructure Management (DCIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

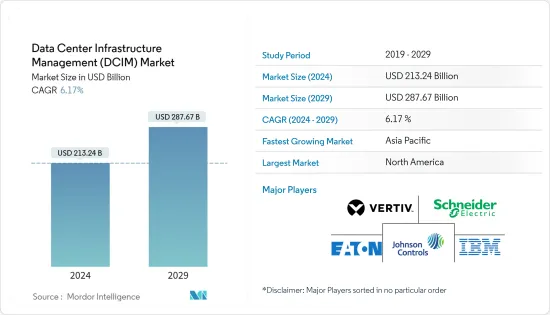

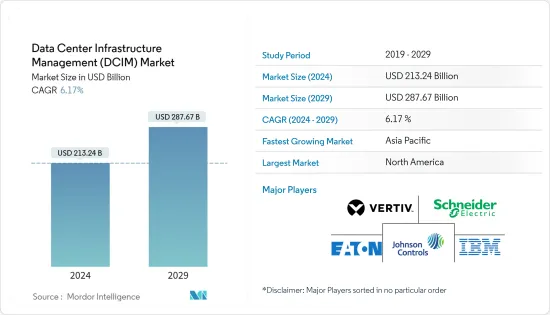

資料中心基礎設施管理(DCIM)市場規模預計2024年為2,132.4億美元,預計2029年將達到2,876.7億美元,預測期內(2024-2029年)複合年成長率為6.17%。

COVID-19 大流行增加了與新資料中心新建設相關的挑戰。大多數供應商推遲或取消了計劃和活動,這可能會增加感染的風險。據 Vantage 稱,由於多名工人在建築工地四處走動,施工停頓是不可避免的,這使得執行社會疏散規則變得困難,而不是確保工人的安全。

主要亮點

- 近年來,管理有限空間和高機架密度以及減少 IT 系統停機時間的需求推動了資料中心基礎設施管理 (DCIM) 市場的成長。

- 根據AFCOM估計,目前資料中心機架密度額定為16.9kW。根據資料中心協會 (AFCOM) 的一項調查,近 67% 的資料中心表示過去三年機架密度有所增加。此外,研究也強調,大多數資料中心在使用傳統空氣冷卻管理 IT 工作負載方面面臨挑戰,因為每個機架的平均功率密度約為 7 千瓦。

- 5G將在幫助政府和政策制定者將城市轉變為智慧城市、幫助公民實現和享受先進的資料集中數位經濟的社會經濟效益方面發揮關鍵作用。因此,政策制定者必須建置和升級光纖網路和資料中心等被動資產。

- 推動機架密度增加的因素包括雲端運算、巨量資料和人工智慧的成長。隨著越來越多的裝置進入資料中心空間,IT 管理變得至關重要。這些事實表明需要 DCIM 等解決方案。

- 對進出雲端和資料中心的資料流量的需求不斷成長預計將在預測期內推動市場成長。據Cisco稱,到 2021 年,雲端資料中心的 IP 流量預計將達到每年 19,509Exabyte,而傳統資料中心的每年 IP 流量為 1,046Exabyte。

- 市場上的供應商允許 API 整合到 DCIM 解決方案中。整體而言,雲端、邊緣資料中心、資料中心整合等資料量的增加可能會影響資料中心基礎架構管理。

- 2022 年 4 月,美國主機代管巨頭 Compass Datacenters 成立了業務部門,以服務形式銷售模組化資料中心。每個模組都有足夠的空間、電力和冷卻,以支援兩節點冗餘配置中的 100kW IT 設備。作為我們服務的一部分,Quantum 可以處理選址、許可、施工和設施維護。當不再需要資料中心時,它會被打包、整修並運送到另一個位置。最重要的是,消費者可以透過營運費用來支付七到十年的閒置頻段,而不是領先資本投資。您也可以在初始合約結束後購買資料中心。

- 資料中心產業長期以來一直在發生變化,但過去幾年尤其具有挑戰性,這主要是由於 COVID-19 大流行造成的。起初,所有這些變化似乎都是為了回應臨時的居家令而做出的,但情況已不再如此。遠距教育和工作的激增、使用 Zoom 代替電話進行商務通話以及使用應用程式處理一切似乎是永久的趨勢。

資料中心基礎設施管理 (DCIM) 市場趨勢

中小型資料中心可望維持高速成長

- 雖然稱為小型資料中心,但不一定意味著中小型企業就會引入資料中心。大型企業還可以根據業務需求和營運可行性,在其占地面積內建置和部署多個較小的資料中心。這些資料中心充當不同團隊和業務職能之間的分界點。

- 雖然傳統的資料中心網路營運中心仍然很重要,但雲端採用的增加主要需要對公共雲端雲和私有雲端中的資料中心營運和雲端基礎的服務的端到端可見性,因此,整體管理結構預計將發生變化。隨著軟體定義資料中心 (SDDC) 的出現,無論資料中心規模如何,無論是舊部署還是新部署,它都有望成為資料中心營運的標準模型。因為這些資料中心按需添加服務的能力是當今大多數企業的首要任務。

- 此外,邊緣運算的興起預計將迅速增加在人口中心附近建造的小型資料中心的數量。例如,從現在到 2026 年,美國和歐洲的通訊業者和企業預計將在邊緣運算能力上花費約 2,720 億美元。因此,在預測期內,對小型資料中心的需求可能會增加。

- 無線醫療設備和感測器等邊緣技術缺乏直接處理大量複雜資料所需的運算能力。因此,我們預計未來將引入較小的資料中心,以在邊緣提供超當地語系化儲存和處理能力。

- 小型資料中心更加彈性,不需要大量空間。如果是中小型資料中心,可以利用現有設備在舊物業上建造。資料中心開發商發現,在人口稠密地區部署小型資料中心(主要是 750 千瓦至 1 兆瓦)的需求日益成長。

北美市場佔據主導地位

- 行動寬頻的擴展、雲端運算和巨量資料分析的成長正在推動該地區對新資料中心基礎設施的需求。此外,伺服器價格的下降正在增加整個北美雲端運算業務的採用,預計這將在預測期內推動對 DCIM 的需求。

- 在美國,西部地區正在發展成為一個成熟的資料中心市場。資料中心營運商受益於該地區的高連通性和靠近 IT 中心的地理位置,使其成為一項不錯的投資。在加州,雲端供應商等數位公司以及其他 IT 和技術公司約佔該行業的 90%。

- 在美國一級市場,2021年吸收量較2020年成長50%,創下歷史新高。因此,這些市場的總庫存增加了 17%,達到 3,358MW,新興市場仍有 728MW 正在開發中。在美國,2021 年一級市場吸收量創歷史新高,較 2020 年成長 50%。根據 CBRE 的《2021 年下半年北美資料中心趨勢》,這些市場的整體庫存增加了 17%,達到 3,358MW,另有 728MW 在建。

- 此外,2021 年 8 月,Blackstone Infrastructure Partners、Blackstone Real Estate Income Trust 和 Blackstone Property Partners 宣布以約 100 億美元(含債務)完成對 QTS Realty Trust 的收購。 QTS 普通股、A 系列優先股和 B 系列優先股將不再公開交易。

- 根據資料中心市場 Datacenter.com 的數據,美國近三分之二的資料中心的尖峰時段需求功率密度約為每個機架 15kW 或 16kW。據說有些資料中心的每個機架功率已超過20kW。因此,使用者和製造商有必要實施DCIM來有效率地管理和營運他們的資料中心。

- 該地區的主要企業正在專注於策略合作夥伴關係,以便為客戶提供更好的解決方案。例如,2022 年 8 月, VMware Inc. 和 IBM 將在混合 Explore 2022 上與全球客戶和合作夥伴合作,協助實現任務關鍵型工作負載現代化並加速混合雲環境中的價值實現。我們宣布擴大與IBM 和 VMware 正在共同努力,協助金融服務、醫療保健和政府等受監管行業的客戶降低將關鍵任務工作負載遷移和升級到雲端的成本、複雜性和風險。我們打算提供支援。

- 此外,2021 年 4 月,IBM 宣布對其儲存產品組合進行重大改進,以改善資料存取和管理,並在日益複雜的混合雲端環境中提高資料可用性和彈性。

資料中心基礎設施管理 (DCIM) 產業概述

資料中心基礎設施管理 (DCIM) 市場的競爭公司之間的敵意很高,主要參與者包括 IBM、西門子和Schneider Electric。 IBM、西門子和Schneider Electric等領先公司比競爭對手具有優勢,因為它們不斷提供創新產品。透過策略合作夥伴關係、研發和併購,他們在市場上獲得了更牢固的立足點。

- 2022 年 8 月 - 能源管理和自動化數位轉型的領先供應商Schneider Electric透過可靠且經濟高效的連接,為澳洲地區企業和社群帶來了對分散式雲端的更多存取權。前沿資料中心(LEDC) 宣布將使用Schneider Electric經過認證的預製邊緣資料中心技術,為澳洲地區居民提供更快、更可靠的連接。

- 2022 年 3 月 - Vertiv 與資料中心基礎架構平台 Elea Digital 合作。透過此次合作,Elea 將在整個巴西提供邊緣資料中心服務。我們也為位於庫里蒂巴、巴西利亞和阿雷格里港等主要城市的Elea Digital資料中心提供維護和營運服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 大流行對該行業的影響

第5章市場動態

- 市場促進因素

- 管理跨資料中心能源消耗的需求日益增加

- 資料中心數量增加

- 市場挑戰

- 需要加強實體和網路基礎設施的安全

第6章市場區隔

- 依資料中心類型

- 中小型資料中心

- 大型資料中心

- 企業資料中心

- 依部署類型

- 本地

- 主機代管

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Vertiv Group Corp.

- Schneider Electric SE

- Johnson Controls International PLC

- Eaton Corporation PLC

- IBM Corporation

- Siemens AG

- ABB Ltd

- FNT GmbH

- Nlyte Software Inc.

- Itracs Corporation Inc.(CommScope Inc)

第8章 廠商排名分析

第9章投資分析

第10章市場的未來

The Data Center Infrastructure Management Market size is estimated at USD 213.24 billion in 2024, and is expected to reach USD 287.67 billion by 2029, growing at a CAGR of 6.17% during the forecast period (2024-2029).

Due to the Covid-19 pandemic, challenges concerning the construction of new data center capacity have risen. Most vendors are postponing or canceling projects or activities, which could increase the risk of infection. As per Vantage, construction being stalled is inevitable as multiple workers move around building sites, making the social-distancing rules hard to implement instead of ensuring staff safety.

Key Highlights

- The need to manage limited space and high rack densities to reduce IT system downtime has driven the data center infrastructure management (DCIM) market's growth for the past few years.

- According to AFCOM estimates, the current rack density is valued at 16.9 kW in data centers. According to a data Centers Association (AFCOM) study, close to 67% reported increased rack density in the past three years. Moreover, the study highlights that with an average power density of about 7 kilowatts per rack, most data centers face challenges in managing their IT workloads with traditional air-cooling methods.

- 5G is expected to play a crucial role in supporting governments and policymakers to transform their cities into smart cities, allowing citizens to realize and partake in the socio-economic benefits of an advanced, data-intensive digital economy. Therefore, policymakers must construct and upgrade passive assets like fiber networks and data centers.

- Factors driving the rack density include the growth of cloud computing, Big Data, and AI. It is essential to manage IT since more equipment fits into the data center space. Such facts indicate the need for solutions such as DCIM.

- The increasing demand for cloud and data traffic moving from and within the data centers is expected to bolster the market's growth over the forecast period. According to Cisco Systems, the cloud data center IP traffic is expected to reach 19,509 exabytes per year by 2021, compared to 1,046 exabytes per year of traditional data center traffic.

- Vendors in the market are allowing API integration into DCIM solutions. Overall, the increasing data volumes in the cloud, edge data centers, data center consolidation, etc., are likely to shape data center infrastructure management.

- In April 2022, Compass Datacenters, an American colocation behemoth, formed a business segment named Compass Quantum to sell modular data centers as a service. Each module has enough room, power, and cooling to support 100kW of IT equipment in a two-node redundant arrangement. Quantum can handle site selection, permitting, building, and even facility upkeep as part of the service. If the data center is no longer needed, it will be packed up, refurbished, and sent to another location. Most importantly, rather than making an upfront capital investment, consumers can pay for their white space over the course of 7-10 years through operational expenses. When the initial contract expires, they will have the option to purchase the data center.

- The data center sector has been changing for a long time, but the last several years have been particularly challenging, mainly owing to the COVID-19 pandemic. At first, it may have appeared that all these changes were being made to accommodate stay-at-home orders on temporarily, but that is no longer the case. The surge in remote school and work, making business calls on Zoom instead of the phone, and utilizing an app for everything seems to be a permanent trend.

Data Center Infrastructure Management Market Trends

Small and Medium Sized Data Centers is Expected to hold Significant Growth rate

- The word small data center does not always mean implementing a data center in a small business. Depending on business needs and operational feasibility, a large enterprise can also create and deploy multiple small data centers within its footprint. These data centers are demarcation points between various teams or business functions.

- Although the traditional data center network operations center will remain crucial, owing to the rise in cloud adoption, the overall management structure is expected to change, primarily to provide an end-to-end view of the data center operations and the cloud-based services in both public and private clouds. With the advent of the software-defined data center (SDDC), it is expected to become a standard model for data center operations in both legacy and new deployments, irrespective of the data center's size. This is because the ability of these data centers to add services on demand will be a top priority for most companies today.

- Furthermore, with the rise of edge computing, the market is expected to witness a rapidly growing array of smaller data centers built closer to the population centers. For instance, Telecom operators and enterprises in the US and Europe are expected to spend about USD 272 billion on edge computing capabilities between now and 2026. This would fuel the need for smaller data centers over the forecast period.

- Edge technologies, such as wireless medical devices and sensors, lack the necessary computing capacity to process large streams of complex data directly. As a result, smaller data centers are expected to be deployed in the future to offer hyper-local storage and processing capacity at the edge.

- Small data centers are flexible and do not need much space. A small or medium-sized data center can be built in an old property utilizing the existing facilities. The data center developers are witnessing an increasing need to deploy small data centers, mainly between the capacity of 750 kilowatts to 1 megawatt, around highly populated areas.

North America to Dominate the Market

- The expansion of mobile broadband, growth in cloud computing, and big data analytics are driving the demand for new data center infrastructures in the region. Moreover, the declining prices of servers have increased the adoption of cloud computing businesses across North America, which is expected to fuel the demand for DCIM during the forecast period.

- In the United States, the Western area has a mature and developed data center market. Data center operators will benefit from the region's high connectivity and closeness to IT hubs, making it a good investment. Digital companies, such as cloud providers and other IT and technology enterprises, accounted for about 90 percent of the industry in California.

- Primary markets in the United States witnessed record absorption in 2021, up 50% from 2020. As a result, total inventory in these markets increased by 17% to 3,358 MW, with another 728 MW under development. In the United States, primary markets saw record absorption in 2021, up 50% from 2020. According to North America Data Center Trends H2, 2021 by CBRE, overall inventory in these markets climbed by 17% to 3,358 MW, with another 728 MW under construction.

- Moreover, In August 2021, Blackstone Infrastructure Partners, Blackstone Real Estate Income Trust, Inc., and Blackstone Property Partners announced that their acquisition of QTS Realty Trust for approximately USD 10 billion, including debt, had been completed. The common stock, Series A preferred stock, and Series B preferred stock of QTS will no longer be traded publicly.

- Almost two-thirds of data centers in the United States experience higher peak demands, with a power density of around 15 or 16 kW per rack, according to Datacenter.com, a data center marketplace. Some data centers are reportedly hitting 20 or more kW per rack. This has made it imperative for users and manufacturers to deploy DCIM, enabling them to manage and run their data centers effectively.

- The key players in this region are focusing on strategic partnerships to provide improved solutions to the clients. For instance, In August 2022, VMware Inc. and IBM announced an expanded relationship at VMware Explore 2022 to help global clients and partners modernize mission-critical workloads and accelerate time to value in hybrid cloud settings. IBM and VMware intend to work together to assist clients in regulated areas such as financial services, healthcare, and government with the cost, complexity, and risk of transferring and upgrading mission-critical workloads in the cloud.

- Moreover, In April 2021, IBM announced significant storage portfolio advancements to improve data access and management in increasingly complex hybrid cloud environments for increased data availability and resilience.

Data Center Infrastructure Management Industry Overview

The competitive rivalry in the data center infrastructure management market is high, owing to some major players, such as IBM, Siemens, and Schneider Electric. Their continually innovating offerings have given them a competitive advantage over other players. Through strategic partnerships, R&D, and mergers and acquisitions, they have obtained a stronger foothold in the market.

- August 2022 - Schneider Electric, the significant provider of digital transformation of energy management and automation, announced that Leading Edge Data Centres (LEDC), a company that provides Regional Australian businesses and communities with greater access to the distributed cloud through reliable, cost-effective connectivity, will use Schneider Electric's prefabricated, certified edge data center technology to drive faster and more reliable connectivity for regional Australians.

- March 2022 - Vertiv has partnered with Elea Digital, a data center infrastructure platform. Elea would supply edge data center services across Brazil due to this collaboration. Vertiv would also provide maintenance and operation services for Elea Digital data centers in key cities such as Curitiba, Brasilia, and Porto Alegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 Pandemic on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need to Manage Energy Consumption Across Data Centers

- 5.1.2 Increase in the Number of Data Centers

- 5.2 Market Challenges

- 5.2.1 Need for Heightened Security for Physical and Network Infrastructures

6 MARKET SEGMENTATION

- 6.1 By Data Center Type

- 6.1.1 Small- and Medium-sized Data Centers

- 6.1.2 Large Data Centers

- 6.1.3 Enterprise Data Centers

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Colocation

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vertiv Group Corp.

- 7.1.2 Schneider Electric SE

- 7.1.3 Johnson Controls International PLC

- 7.1.4 Eaton Corporation PLC

- 7.1.5 IBM Corporation

- 7.1.6 Siemens AG

- 7.1.7 ABB Ltd

- 7.1.8 FNT GmbH

- 7.1.9 Nlyte Software Inc.

- 7.1.10 Itracs Corporation Inc. (CommScope Inc)