|

市場調查報告書

商品編碼

1433774

5G 晶片組:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Global 5G Chipset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

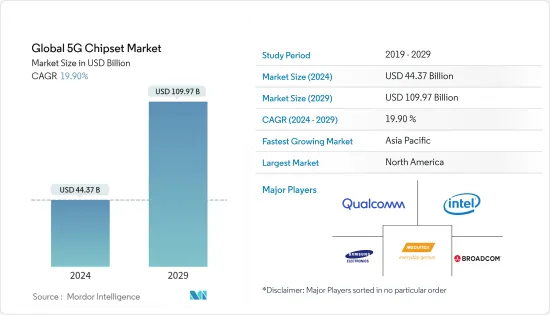

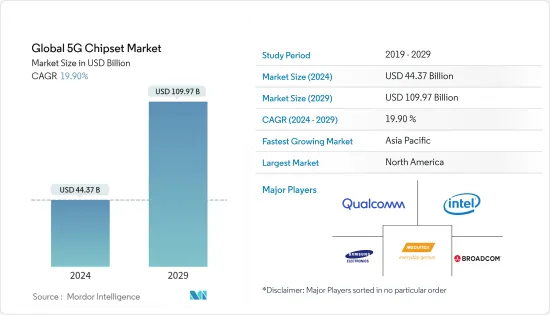

預計2024年全球5G晶片組市場規模為443.7億美元,預計到2029年將達到1,099.7億美元,在預測期間(2024-2029年)市場規模將增加199億美元,複合年成長率為% 。

與服務供應商結合,5G調變解調器晶片組主要服務於三個關鍵應用:增強型行動寬頻、超可靠和低延遲通訊以及大規模機器類通訊及其增強功能。預計該技術的應用將在預測期內推動 5G 晶片組的需求。

5G晶片組預計將成為5G網路的關鍵組成部分,並將很快為智慧型手機OEM和通訊業者大規模推出。為了提供超快的網路速度和資料速率,全球主要通訊服務供應商正在將其網路升級到 5G。

5G 的出現預計將加速已邁向第四次工業革命(工業 4.0)的產業中連網型設備的使用。工業 4.0 支援跨行業的蜂窩連接。物聯網和機器對機器連接的興起也有助於推動市場吸引力。多個智慧城市計劃和舉措正在世界各地展開,預計到 2025 年,全球將有約 30 個智慧城市,其中一半位於北美和歐洲。這些努力得到了全球投資的支持,據經合組織稱,預計 2010 年至 2030 年間城市基礎設施計劃投資總額將達到 1.8 兆美元。這是主要推動 5G 晶片組需求的主要因素之一。智慧城市連結應用。

多家通訊業者正在獲取頻譜以擴大 5G 連接的覆蓋範圍。例如,2022年8月,在印度首次5G頻譜競標中,Airtel以4,308.4億盧比購買了19,800MHz頻譜。在過去的二十年裡,900 MHz、2100 頻寬頻譜透過競標獲得的。在 3.5 GHz 和 26 GHz頻寬覆蓋全印度。該公司表示,這是實現最佳 5G 體驗的理想頻譜庫,能夠以最低的成本實現戰略性 100 倍容量擴展。

疫情期間,考慮到5G的額外技術優勢,準備了在家工作的設置。在全球工作場所分析(2020)調查中,超過 80% 的受訪者表示他們擁有在家工作所需的技術技能和知識。可靠地存取公司網路(可以透過固網和移動方式)。

3GPP規定5G必須提供基於IMS的語音或視訊通訊服務。這意味著 IMS 必須部署在 3GPP Release 16 中的 5G 到 3G SRVCC 或 3GPP Release 15 中的 VoNR、EPS FB、VoeLTE 和 RAT FB 上。因此,此類升級預計將增加基礎設施成本,從而對市場成長構成挑戰。所有架構都面臨獨特的挑戰,但都需要通訊業者網路內的 IP 多媒體子系統 (IMS) 的網路支援。

5G晶片市場趨勢

工業自動化將佔據很大佔有率

據Capgemini SA稱,過去 18 至 24 個月內,十分之三的汽車工廠變得更加智慧。此外,80% 的汽車製造商認為 5G 對於未來五年的數位轉型至關重要。例如,愛立信和奧迪正在後者位於德國蓋默斯海姆的製造實驗室使用無線連接的生產機器人來製造車身,使用的模擬流程類似於其英戈爾施塔特總部使用的流程,我們正在進行裝配等實際測試。

對智慧製造實踐的重視是影響市場的關鍵趨勢。 IBEF資料顯示,印度政府制定了雄心勃勃的目標,到2025年將製造業產出對GDP的貢獻從16%提高到25%。智慧先進製造和快速轉型中心 (SAMARTH) 舉措 Bharat 4.0 計畫旨在提高印度製造業對工業 4.0 的認知,並幫助相關人員應對智慧製造的挑戰。

工業 4.0 革命,即工業物聯網 (IIOT),透過利用智慧機器和對啞機產生的資料進行即時分析,正在對汽車、製造、倉儲和物流行業產生重大影響。然而,自動化在這些領域帶來了一些挑戰。由於缺乏必要的硬體整合,預期的營運改善被證明是困難的。例如,自動化僅佔印度製造業 GDP 的 1%,而已開發國家這一比例約為 5%。這是由於可採用的合適技術存在差距。此外,根據 GSMA 的數據,到 2025 年,北美消費者和工業物聯網 (IoT) 連接總數預計將成長到 54 億。

鑑於 5G 在工業環境中所承諾的優勢,它引起了人們的極大興趣。自3GPP Release 16以來,企業5G的關鍵特性(99.999%的網路可用性和可靠性、低於10毫秒的延遲、對時間敏感網路的網路支援等)已經數位化,吸引了產業相關人員人士正在尋找它。

例如,ABB和愛立信合作實現泰國的工業4.0雄心,並透過自動化系統和無線通訊促進未來的彈性生產。重點領域包括ABB的機器人和離散式自動化、工業自動化和運動業務領域以及ABBability TM 平台服務。此次合作涵蓋了五個支援 G 的擴增實境鏡頭,用於在製造環境中進行遠端試運行,以及透過愛立信通訊服務供應商商合作夥伴及其物聯網加速器平台支援 G 的全球 NB-IoT 連接馬達和驅動器。

北美地區佔比最大

北美是最重要的市場成長地區之一。美國貢獻了該地區的大部分市場佔有率。對物聯網、M2M通訊、行動寬頻和其他新興應用的需求正在推動這一成長。

根據GSMA行動智庫的2020年北美行動經濟報告,5G連線將佔北美所有行動連線的一半以上。到 2025 年,該地區 4.26 億行動連線中的 51% 將使用 5G 網路。報告稱,到2025年,該地區行動電話用戶數量預計將達到3.4億。

此外,根據思科年度網路報告,到 2023 年,美國智慧型手機的平均連線速度預計將達到 81.1 Mbps,比 2018 年的 19.2 Mbps 成長 4.2 倍(複合年成長率為 33%)。在推出 5G 的同時,通訊業者也在推行雄心勃勃的網路轉型策略。此外,全球 18 家通訊和消費性設備製造商已與美國公司合作開發 5G 晶片組。

5G 增強的吞吐量、可靠性、可用性和減少的延遲將支援新的以安全為中心的應用程式,統稱為 V2X 或車輛到一切。為了促進都市區、郊區和高速公路駕駛情況下不同應用程式的整合,5G 蜂窩 V2X (C-V2X) 提供了通用無線網路。

5G晶片產業概況

5G 晶片組市場由許多地區和全球參與者適度整合。創新推動產品供應市場,每個供應商都投資創新。

2022年8月,中國著名晶片廠商紫光展銳的第二代5G晶片預計將於2022年底或2023年初發表。我們使用極紫外線(EUV)技術,這是切割的關鍵製程。 -在邊緣晶片製造方面,紫光展銳已開始量產6nm 5G元件。憑藉市場上三種不同類型的 5G 晶片,紫光展銳將在消費性電器產品、物聯網、電動車電子、智慧顯示器和元宇宙展開競爭。

2022 年 5 月,下一代 5G 智慧型手機將搭載聯發科技的 Dimensity1050系統晶片[SoC],這是該公司首款毫米波5G 晶片組,具有無縫連接、顯示、遊戲和功效。這是一個時間表。 Dimensity930 和 HelioG99 是作為該公司 5G 和遊戲晶片組系列擴展的一部分而推出的另外兩款晶片組。 Dimensity1050 採用八核心CPU 和台積電 6nm 製造製程打造,結合了毫米波 5G 和 sub-6GHz,有助於網路頻譜遷移。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 合作公寓 合作公寓 市場

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 宏觀經濟走勢對產業的影響

第5章市場動態

- 市場促進因素

- 對高速網際網路和廣泛網路覆蓋範圍的需求不斷成長,同時減少延遲和功耗

- 增加機器對機器/物聯網連接

- 行動資訊服務需求增加

- 市場限制因素

- 精細的頻譜分配

第6章市場區隔

- 按晶片組類型

- 專用積體電路 (ASIC)

- 無線電頻率積體電路(RFIC)

- 毫米波技術晶片

- FPGA(現場可程式化閘陣列)

- 按運作頻率

- 小於6GHz

- 26~39 GHz

- 39 GHz 或更高

- 按最終用戶

- 消費性電子產品

- 工業自動化

- 汽車和交通

- 能源和公共產業

- 衛生保健

- 零售

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Xilinx Inc.

- Nokia Corporation

- Broadcom Inc.

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Renesas Electronics Corporation

- Anokiwave Inc.

- Qorvo Inc.

- NXP Semiconductors NV

- Cavium Inc.

- Analog Devices Inc.

- Texas Instruments Inc.

第8章投資分析

第9章市場的未來

The Global 5G Chipset Market size is estimated at USD 44.37 billion in 2024, and is expected to reach USD 109.97 billion by 2029, growing at a CAGR of 19.90% during the forecast period (2024-2029).

The 5G modem chipsets, in combination with service providers, largely serve and enhance the capabilities of three major applications - enhanced mobile broadband, ultra-reliable and low latency communications, and massive machine-type communications. The applications of this technology are expected to drive the demand for 5G chipsets during the forecast period.

The 5G chipsets are expected to be a critical component of 5G networks, which will soon be rolled out at a massive scale for smartphone OEMs and telecom players. In order to provide ultra-high network speeds and data rates, major telecom service providers across the globe are upgrading their networks to 5G.

The emergence of 5G is expected to expedite the use of connected devices in industries that are already pushing toward the fourth industrial revolution (Industry 4.0). Industry 4.0 is aiding cellular connectivity throughout the industry; the rise of IoT and machine-to-machine connections is also instrumental in driving market traction. Several smart city projects and initiatives are underway around the world, and it is expected that by 2025, there will be around 30 global smart cities, with half of these located in North America and Europe. These steps are supported by global investments, which, according to the OECD, are expected to total USD 1.8 trillion in urban infrastructure projects between 2010 and 2030. This is one of the major factors driving demand for 5G chipsets, owing primarily to their use in smart city connectivity applications.

Multiple telecom operators are acquiring spectrums to increase their 5G connection coverage. For instance, in August 2022, In India's first 5G spectrum auction, Airtel paid Rs 43,084 crore for 19,800 MHz spectrum. In the past 20 years, spectrum bands 900 MHz, 2100 MHz, 1800 MHz, 3300 MHz, and 26 GHz have been acquired through auctions. It obtained a pan-India footprint in the 3.5 GHz and 26 GHz bands. According to the company, this is the ideal spectrum bank for the best 5G experience, with 100x capacity enhancement done strategically at the lowest cost.

During the pandemic, the WFH setting was prepared for the extra technological benefits of 5G: in the Global Workplace Analytics (2020) survey, more than 80% of respondents stated that they had the technical skills and knowledge required for WFH, as well as easy and reliable access to company networks (presumably by both fixed-line and mobile means).

3GPP has specified that 5G should offer voice or video communication services based on the IMS, i.e., the IMS must be deployed for 5G-to-3G SRVCC in 3GPP Release 16 or VoNR, EPS FB, VoeLTE, and RAT FB in 3GPP Release 15. Hence such upgrades are expected to increase the infrastructure cost, thereby challenging the market's growth. While every architecture has specific challenges, all of them need network readiness of the IP Multimedia Subsystem (IMS) within the carrier's network.

5G Chipset Market Trends

Industrial Automation to Account for a Significant Share

According to Capgemini, three out of every ten automotive plants have become smart in the last 18-24 months. Furthermore, 80% of automakers believe 5G will be critical to their digital transformation over the next five years. For instance, Ericsson and Audi are conducting field trials, such as wirelessly connected production robots building a car body at the latter company's production lab in Gaimersheim, Germany, using simulated processes similar to those used at its headquarters in Ingolstadt.

The emphasis on smart manufacturing practices is a significant trend influencing the market. According to IBEF data, the Government of India has set an ambitious target of increasing manufacturing output contribution to GDP to 25% by 2025, up from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to raise awareness of Industry 4.0 in the Indian manufacturing industry and assist stakeholders in addressing smart manufacturing challenges.

The Industry 4.0 revolution, or industrial internet of things (IIOT) is making a dent in the automotive, manufacturing, warehousing, and logistics sectors by leveraging smart machines and real-time analytics on data produced by dumb machines. However, automation created several challenges in these sectors. Expected operational improvements proved hard to match due to a lack of integration with the required hardware. For instance, automation contributes to just 1% of manufacturing GDP in India, compared to around 5% in developed countries. This stems from a gap in suitable technology available for adoption. Further, According to GSMA By 2025 the total number of consumer and industrial Internet of Things (IoT) connections in North America is forecast to grow to 5.4 billion

5G has garnered significant interest considering the promised benefits within industrial environments. Since 3GPP's Release 16, key capabilities for enterprise 5G (such as 99.999% network availability and reliability, sub-10 milliseconds latencies, and Internet support for time-sensitive networking) has attracted ,industrial players for digitization in the context of Industry 4.0.

For example, ABB and Ericsson collaborated to realize Thailand's Industry 4.0 ambition and facilitate future flexible production with automation systems and wireless communications. The focus areas include ABB's Robotics & Discrete Automation, Industrial Automation, and Motion business areas and ABB Ability TM Platform Services. The collaboration would cover 5 G-enabled andAugmented Reality Lenses for remote commissioning in manufacturing environments G-enabledand global NB-IoT connected motors and drives through Ericsson Communication Service Provider partners and its IoT-Accelerator platform.

North America to Account for the Largest Share

North America is one of the most important market growth regions. The United States has contributed the majority of the region's market share. The demand for IoT, M2M communications, mobile broadband, and other emerging applications is driving the increase.

In North America, 5G connections will represent more than half of all mobile connections, according to GSMA Intelligence's 'Mobile Economy North America 2020' report. By 2025, 51% of the region's 426 million mobile connections will be on 5G networks. According to the report, the region will have 340 million mobile subscribers by 2025.

Furthermore, according to Cisco Annual Internet Report, the average smartphone connection speed in the United States will be 81.1 Mbps by 2023, up from 19.2 Mbps in 2018, 4.2-fold growth (33% CAGR). Alongside 5G rollouts, operators are also pursuing ambitious network transformation strategies. Moreover, 18 global telecom and consumer device makers partnered with US-based Qualcomm for their 5G chipset.

New safety-sensitive applications, collectively known as V2X or Vehicle-to-Everything, will be made possible by 5G's enhanced throughput, dependability, availability, and decreased latency. To facilitate the convergence of various apps for urban, suburban, and highway driving circumstances, 5G Cellular V2X (C-V2X) offers a common wireless network.

5G Chipset Industry Overview

The 5G chipset market is moderately consolidated, with many regional and global players. Innovation drives the market in product offerings, and each vendor invests in innovation.

In August 2022, a second-generation 5G chip will be released by UNISOC, a well-known Chinese chip manufacturer, in the latter part of 2022 or the first half of 2023. Using extreme ultraviolet (EUV) technology, a crucial process for cutting-edge chipmaking, UNISOC had already started mass-producing 6nm 5G devices. UNISOC, which has three distinct types of 5G chips available on the market, will compete to establish itself in consumer electronics, IoT, EV electronics, smart displays, and the metaverse.

In May 2022, the next generation of 5G smartphones will be powered by MediaTek's Dimensity1050 system-on-chip [SoC], the company's first mm-Wave 5G chipset, featuring seamless connection, displays, gaming, and power efficiency. Dimensity930 and HelioG99 are two more chipsets introduced as part of the company's 5G and gaming chipset families expansion. The Dimensity1050, constructed using an octa-core CPU and the TSMC 6nm fabrication process, combines mm-Wave 5G with sub-6GHz to aid network spectrum migration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for High-speed Internet and Broad Network Coverage with Reduced Latency and Power Consumption

- 5.1.2 Growing Machine-to-machine/IoT Connections

- 5.1.3 Increase in Demand for Mobile Data Services

- 5.2 Market Restraints

- 5.2.1 Fragmented Spectrum Allocation

6 MARKET SEGMENTATION

- 6.1 By Chipset Type

- 6.1.1 Application-specific Integrated Circuits (ASIC)

- 6.1.2 Radio Frequency Integrated Circuit (RFIC)

- 6.1.3 Millimeter Wave Technology Chips

- 6.1.4 Field-programmable Gate Array (FPGA)

- 6.2 By Operational Frequency

- 6.2.1 Sub-6 GHz

- 6.2.2 Between 26 and 39 GHz

- 6.2.3 Above 39 GHz

- 6.3 By End User

- 6.3.1 Consumer Electronics

- 6.3.2 Industrial Automation

- 6.3.3 Automotive and Transportation

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Retail

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 MediaTek Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Xilinx Inc.

- 7.1.5 Nokia Corporation

- 7.1.6 Broadcom Inc.

- 7.1.7 Infineon Technologies AG

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 Anokiwave Inc.

- 7.1.11 Qorvo Inc.

- 7.1.12 NXP Semiconductors NV

- 7.1.13 Cavium Inc.

- 7.1.14 Analog Devices Inc.

- 7.1.15 Texas Instruments Inc.