|

市場調查報告書

商品編碼

1433772

威脅情報 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Threat Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

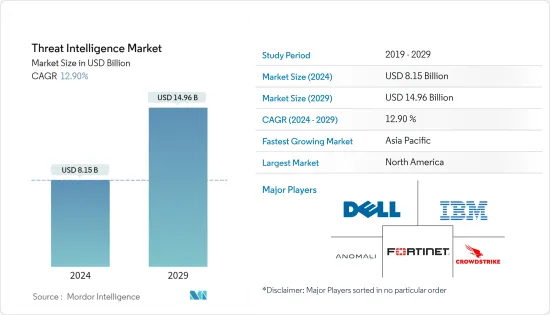

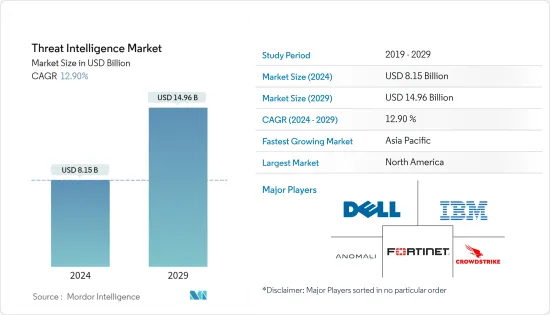

威脅情報市場規模預計到2024年為 81.5 億美元,預計到2029年將達到 149.6 億美元,在預測期內(2024-2029年)CAGR為 12.90%。

在過去的幾年中,攻擊源、目標、目標攻擊概況和不同類型的技術之間發生了範式轉移。雖然攻擊類型和目標可以揭示,但攻擊源仍然存在問題,因為很難為特定攻擊分配歸因。

主要亮點

- 網路攻擊和資料外洩的數量不斷增加,已將組織的重點轉移到各種網路安全解決方案。由於攻擊者和防禦者之間的網路軍備競賽不斷升級,越來越多的組織開始關注網路情報。因此,威脅情報使防禦者能夠做出更快、更明智的安全決策,並將其在應對違規行為中的行為從被動轉變為主動。

- 大多數組織將其情報工作重點放在更基本的用例(取決於現有的案例研究和攻擊)上,例如將情報來源與當前的IPS、防火牆和SIEM 整合,而沒有充分利用它們可以提供的情報見解。

- 威脅情報市場主要是由攻擊技術日益獨特而導致資料易受攻擊所驅動。不同企業產生的資料量不斷增加是推動市場的關鍵因素。

- 透過整合雲端和威脅情報,組織可以阻止網路威脅並利用全球威脅社群來識別未知威脅並最終在威脅出現之前阻止它們,瞄準攻擊面。因此,威脅情報解決方案的採用顯著增加。

- 過去幾年,網路犯罪增加,而且沒有放緩的跡象。隨著疫情的持續發展,遠距辦公不斷成長,網路攻擊的發生率也隨之增加。企業採用遠距工作模式,引發了人們對企業安全的擔憂,這些因素進一步推動了威脅情報市場的發展。

- COVID-19 大流行對市場的成長產生了積極影響,世界各地的政府機構製定新的策略實施,以幫助支持組織提出的網路問題。網路漏洞數量的增加推動威脅情報市場的成長。

威脅情報市場趨勢

BFSI 細分市場預計將佔據重要佔有率

- BFSI 產業是面臨多次資料外洩和網路攻擊的關鍵基礎設施領域之一,因為該產業服務的客戶群龐大且財務資訊受到威脅。作為一種利潤豐厚的營運模式,具有驚人的回報,並具有相對較低的風險和可檢測性,網路犯罪分子最佳化許多邪惡的網路攻擊,以癱瘓金融部門。這些攻擊的威脅範圍從木馬、惡意軟體、ATM 惡意軟體、勒索軟體和行動銀行惡意軟體到資料外洩、機構入侵、資料竊取、財務外洩等。

- 例如,根據 Orange Cyberdefense 的資料,惡意軟體是2021年 10月至2022年 9月期間金融和保險組織中最常見的網路攻擊類型。全球約 40%的組織成為攻擊媒介的目標。網路和應用程式異常位居第二,23%的組織經歷過此類網路攻擊,其次是系統異常(20%)。

- 透過保護 IT 流程和系統、保護關鍵客戶資料以及遵守政府法規的策略,公共和私人銀行機構致力於實施最新技術來防止網路攻擊。此外,不斷提高的客戶期望、技術進步和監管要求要求銀行機構採取積極主動的安全措施。隨著網路銀行、手機銀行等科技和數位管道的日益普及,網路銀行已成為客戶銀行服務的首選。銀行必須使用高階身份驗證和存取控制流程,包括威脅情報策略。

- 例如,2022年 2月,司法部(DoJ)和菲律賓銀行家協會(BAP)簽署了一份合作備忘錄(MoU),以提高菲律賓的網路安全意識並打擊網路犯罪。 BAP 目的是加強銀行業的網路彈性,並與司法部建立合作夥伴關係,在該國網路犯罪事件不斷增加後,透過資訊共享和協作實現協調、集體和策略性的網路回應。

- 2022年 1月,美國聯邦銀行監管機構發布了一項網路安全規則,要求及時通知違規行為。擬議的規則目的是儘早向各機構發出重大電腦安全事件的警告。銀行企業確定發生事件後,需要盡快提供資訊,並在36小時內提供資訊。此類法規可以控制美國銀行業的網路攻擊。

北美將佔據最大市場佔有率

- 美國的 BFSI 磁區儲存的資料超過 1 艾位元組。這些資料是從各種來源產生的,例如信用卡/金融卡歷史記錄、客戶銀行存取記錄、銀行交易量、通話記錄、帳戶交易和網路互動。

- 由於基礎設施的高可用性,許多全球金融機構增加了物聯網設備的採用,網路使用者預計將推動北美地區威脅情報解決方案的成長。

- 各地區的政府實體和私人企業投資研發以引進先進的威脅情報解決方案。美國國土安全部(DHS)網路安全和基礎設施安全局(CISA)提到,他們經歷了使用以COVID-19 為主題的誘餌、註冊包含與冠狀病毒或COVID 相關措辭的新域名的網路釣魚和惡意軟體傳播大幅增加-19,以及針對新部署的快速部署的遠端存取和遠端辦公基礎設施的攻擊。

- 此外,組織也致力於測試安全策略和實踐。例如,根據Accenture2022年 2月進行的一項調查,其網路威脅情報和事件回應團隊調查了幾起涉嫌網路間諜和出於經濟動機的目標案件。在這些調查過程中,威脅情報和事件回應分析師獲得了一些最老練的網路攻擊者所採用的策略、技術和程序(TTP)的第一手資料。調查顯示,2021年勒索軟體和勒索造成的入侵高達 35%,其中 30%是惡意軟體威脅。

- 對威脅情報解決方案的投資對於加強國家的安全態勢非常重要。實施威脅情報解決方案將有助於組織在整個北美地區提供平穩、安全的營運。

威脅情報產業概覽

威脅情報市場由幾家主要參與者主導,並推出了更安全的軟體解決方案。 Dell Inc.、IBM Corporation、Anomali Inc.、Fortinet Inc. 和 CrowdStrike Inc. 是提供威脅情報專用解決方案的市場主要參與者。

- 2022年 2月 - IBM 宣布收購美國雲端服務顧問公司 Neudesic。此次收購將進一步幫助公司大幅擴展其混合多雲端服務組合,並增強其混合雲和人工智慧策略解決方案。

- 2022年 3月 - Fortinet 宣布與五家新服務供應商建立合作夥伴關係 - Etihad Atheeb Telecom Company 'GO'、Microland、Radius Telecoms Inc.、Spectrotel 和 TIME dotcom。這種合作夥伴關係可以提供具有增強安全性的簡化網路架構,全部由單一作業系統提供支持,以在從資料中心到多雲環境再到 SaaS 位置的任何地方實現營運效率。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對市場的影響評估

第5章 市場動態

- 市場促進因素

- 安全漏洞和網路犯罪事件不斷增加

- 下一代安全解決方案的演變

- 市場挑戰/限制

- 資料安全預算低,解決方案安裝成本高

第6章 市場細分

- 依類型

- 解決方案

- 服務

- 依部署

- 本地部署

- 雲端

- 依最終用戶產業

- BFSI

- 資訊科技和電信

- 零售

- 製造業

- 衛生保健

- 其他最終用戶產業

- 按地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 墨西哥

- 巴西

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 中東和非洲其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Juniper Networks Inc.

- AlienVault Inc.

- Farsight Security Inc.

- Trend Micro Incorporated

- LogRhythm Inc.

- F-Secure Corporation

- Check Point Software Technologies Ltd

- Dell Inc.

- IBM Corporation

- Webroot Inc.

- Fortinet Inc.

- Broadcom Inc.(Symantec Corporation)

- McAfee LLC

- LookingGlass Cyber Solutions Inc.

- FireEye Inc.

第8章 投資分析

第9章 市場的未來

The Threat Intelligence Market size is estimated at USD 8.15 billion in 2024, and is expected to reach USD 14.96 billion by 2029, growing at a CAGR of 12.90% during the forecast period (2024-2029).

In the past few years, there has been a paradigm shift between attack sources, targets, destination attack profiles, and different types of technologies. While the attack types and targets can be revealing, attack sources remain problematic because of the difficulties in assigning attribution for a specific attack.

Key Highlights

- The growing number of cyberattacks and data breaches has shifted organizations' focus to various cybersecurity solutions. More organizations are focusing on cyber intelligence because of the escalating cyber arms race between attackers and defenders. As a result, threat intelligence has enabled defenders to make faster, more informed security decisions and shift their behavior in the fight against breaches from reactive to proactive.

- Most organizations are focusing their intelligence efforts on more basic use cases (that depend on existing case studies and attacks), such as integrating intelligence feeds with current IPS, firewalls, and SIEMs, without taking full advantage of the intelligence insights they can offer.

- The threat intelligence market is primarily driven by increasing uniqueness in the attacking techniques leaving the data vulnerable. The rising volumes of data generated by different enterprises are the key factor driving the market.

- By integrating cloud and threat intelligence, organizations can block cyber threats and leverage the global threat community to identify unknown threats and ultimately stop them before they emerge, thus, targeting the attack surface. Therefore, the adoption of threat intelligence solutions has increased significantly.

- Cybercrime has increased over the last few years, and there are no signs of a slowdown. With the ongoing pandemic, telecommuting has grown, increasing the rate of cyberattacks. Enterprises have adopted a remote working model, which raises concerns about corporate security, and these factors further drive the threat intelligence market.

- The COVID-19 pandemic has positively impacted the market's growth, and government bodies across the world are coming up with new strategy implementation to help support the cyber concerns organizations raise. The increasing number of cyber vulnerabilities is driving the growth of the threat intelligence market.

Threat Intelligence Market Trends

BFSI Segment is Expected to Occupy a Significant Share

- The BFSI industry is one of the critical infrastructure segments that face multiple data breaches and cyber-attacks, owing to the massive customer base that the sector serves and the financial information that is at stake. Being a highly lucrative operation model with phenomenal returns and the added upside of relatively low risk and detectability, cybercriminals are optimizing many diabolical cyberattacks to immobilize the financial sector. These attacks' threat landscape ranges from Trojans, malware, ATM malware, ransomware, and mobile banking malware to data breaches, institutional invasion, data thefts, fiscal breaches, etc.

- For instance, according to Orange Cyberdefense, malware was the most common type of cyber attack in financial and insurance organizations between October 2021 and September 2022. Around 40% of organizations worldwide were targeted by the attack vector. Network and application anomalies came in second, with 23% of organizations experiencing such cyber attacks, followed by system anomalies (20%).

- With a strategy of protecting IT processes and systems, protecting critical customer data, and complying with government regulations, public and private banking institutions are focused on implementing the latest technologies to prevent cyberattacks. In addition, rising customer expectations, technological advances, and regulatory requirements require banking institutions to take a proactive approach to security. With the increasing penetration of technology and digital channels, such as internet banking and mobile banking, online banking has become a favorite choice for customers of banking services. Banks must use advanced authentication and access control processes, including threat intelligence strategies.

- For instance, in February 2022, the Department of Justice (DoJ) and Bankers Association of the Philippines (BAP) signed a memorandum of understanding (MoU) to raise cybersecurity awareness and combat cybercrime in the Philippines. The BAP aims to strengthen the banking industry's cyber-resilience and develop a collaborative partnership with the Justice Department to achieve a coordinated, collective, and strategic cyber response through information sharing and collaboration in the wake of rising cybercrime incidents in the country.

- In January 2022, the federal banking regulators of the United States issued a cybersecurity rule requiring prompt notification of a breach. The proposed rule is poised to warn the agencies early of considerable computer security incidents. It would need information as soon as possible and by 36 hours after a banking enterprise determines that an incident has occurred. Such regulations could control cyber attacks in the banking sector of the United States.

North America to Hold the Largest Market Share

- The BFSI sector in the United States has more than 1 exabyte of stored data. These data are generated from various sources, such as credit/debit card histories, customer bank visits, banking volumes, call logs, account transactions, and web interactions.

- Due to the high availability of adequate infrastructure, numerous global financial institutions increased the adoption of IoT devices, and internet users are expected to drive the growth of threat intelligence solutions in the North American region.

- Government entities and private players across regions invest in R&D to introduce advanced threat intelligence solutions. The US Department of Homeland Security (DHS) Cybersecurity and the Infrastructure Security Agency (CISA) mentioned that they experienced a massive rise in phishing and malware distribution using COVID-19-themed lures, registration of new domain names containing wording related to coronavirus or COVID-19, and attacks against newly and rapidly deployed remote access and teleworking infrastructure.

- Additionally, organizations are focusing on testing security strategies and practices. For instance, according to a survey conducted by Accenture in February 2022, its cyber threat intelligence and incident response team has investigated several suspected cyber-spy and financially motivated targeting cases. During these investigations, threat intelligence and incident response analysts gained first-hand insight into the tactics, techniques, and procedures (TTP) employed by some of the most sophisticated cyber attackers. The survey revealed that intrusions made by ransomware and extortion were up to 35%, and 30% were malware threats in 2021.

- Investments in threat intelligence solutions are essential for strengthening the security posture of a country. Implementing threat intelligence solutions will help organizations provide smooth and secure operations across North America.

Threat Intelligence Industry Overview

The threat intelligence market is dominated by a few major players, with more secure software solutions being launched. Dell Inc., IBM Corporation, Anomali Inc., Fortinet Inc., and CrowdStrike Inc. are key players in the market that offer dedicated solutions for threat intelligence.

- February 2022 - IBM announced the acquisition of Neudesic, a US cloud services consultancy. This acquisition will further help the company significantly expand its hybrid multi-cloud services portfolio and enhance its hybrid cloud and AI strategy solutions.

- March 2022 - Fortinet announced a partnership with five new service providers - Etihad Atheeb Telecom Company 'GO,' Microland, Radius Telecoms Inc., Spectrotel, and TIME dotcom. This partnership may deliver a simplified network architecture with enhanced security, all powered by a single operating system to achieve operational effectiveness everywhere, from the data center to multi-cloud environments to SaaS locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Incidences of Security Breaches and Cyber Crime

- 5.1.2 Evolution of Next-generation Security Solutions

- 5.2 Market Challenges/restraints

- 5.2.1 Low Data Security Budget and High Installation Cost of Solution

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunications

- 6.3.3 Retail

- 6.3.4 Manufacturing

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Juniper Networks Inc.

- 7.1.2 AlienVault Inc.

- 7.1.3 Farsight Security Inc.

- 7.1.4 Trend Micro Incorporated

- 7.1.5 LogRhythm Inc.

- 7.1.6 F-Secure Corporation

- 7.1.7 Check Point Software Technologies Ltd

- 7.1.8 Dell Inc.

- 7.1.9 IBM Corporation

- 7.1.10 Webroot Inc.

- 7.1.11 Fortinet Inc.

- 7.1.12 Broadcom Inc. (Symantec Corporation)

- 7.1.13 McAfee LLC

- 7.1.14 LookingGlass Cyber Solutions Inc.

- 7.1.15 FireEye Inc.