|

市場調查報告書

商品編碼

1433757

類比積體電路(IC):市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Analog Integrated Circuit (IC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

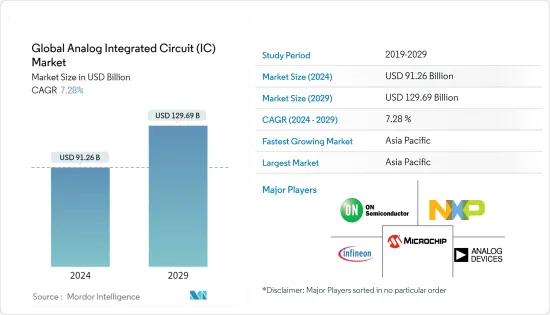

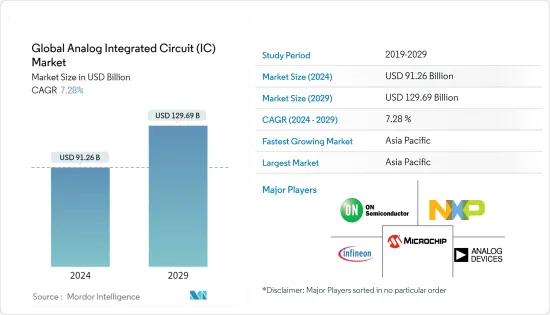

全球類比積體電路(IC)市場規模將在2024年達到912.6億美元,並在2024-2029年預測期內以7.28%的複合年成長率成長,到2029年將達到1296.9億美元。預計這一目標將會實現。

主要亮點

- 類比積體電路 (IC) 是在單一半導體材料晶圓上製造的互連組件網路。這些組件在連續的輸入訊號範圍內運行,而數位組件則僅使用兩個輸入和輸出電壓位準。這些電路在設備運作期間處理、接收和產生多個能量輸出等級。使用振盪器、直流放大器、多諧振盪器和音訊放大器等組件的電子設備利用類比電路來保持相同的輸出和輸入電平。

- 由於類比 IC 在相當多的即時連接設備和應用中具有明顯的優勢,因此物聯網 (IoT) 等新興技術的引入和採用預計將推動市場成長。由於高速連接的可用性不斷提高、雲端的採用率不斷提高以及資料處理和分析的使用不斷增加,物聯網 (IoT) 的採用率正在穩步成長。例如,愛立信預計,2022 年全球蜂巢式物聯網連接數將達到 19 億,預計到 2027 年將增至 55 億,期間複合年成長率為 19%。

- 此外,由於智慧型手機、消費性電器產品、電腦和儲存設備的普及,近年來類比IC的採用激增。智慧型手機中使用的各種IC包括充電IC、顯示PMIC、SoC PMIC、相機PMIC等。蘋果、高通、英特爾和三星S.LSI等主要企業主導了這個市場。因此,由於配備先進技術的智慧型手機的產量和銷售增加,以及 5G 和 6G 的整合度不斷提高,類比IC市場預計將在全球範圍內獲得巨大的吸引力。

- 然而,由於通膨上升、消費者支出下降以及消費者前景疲軟,預計 2023 年全球智慧型手機需求將較 2022 年下降。這種下降預計將暫時阻礙類比IC市場。儘管如此,由於對 5G 智慧型手機的需求不斷成長以及全球 5G 網路連接的擴大,特別是由於 5G 和折疊式智慧型手機的普及不斷提高,預計市場將在 2024 會計年度略有復甦。例如,根據 GSMA 的數據,到 2025 年,5G 網路將覆蓋全球三分之一的人口。

- 在很大程度上取決於業內熟練的類比晶片設計工程師的可用性。然而,半導體產業需要這樣的技能。英特爾人力資源、人才規劃和收購總監 Cindi Harper 表示,業界人才供不應求。同樣,西門子 EDA 區域經理 Ruchir Dixit 表示,他預計未來五年美國將短缺 25 萬名半導體工程師。中國大陸和台灣預計分別短缺30萬名和5萬名工程師。這種趨勢阻礙了市場的成長。

- 此外,俄羅斯和烏克蘭之間的衝突預計將對電子產業等多個產業產生重大影響。這場衝突已經影響該行業一段時間,加劇了半導體供應鏈問題和晶片短缺。此次中斷導致鎳、鈀、銅、矽、鍺、砷化鎵磷化物、鈦、鋁和鐵礦石等關鍵原料價格波動和材料短缺。此外,根據SEMI的數據,俄羅斯是全球45-50%鈀金的供應國。它用於形成半導體接合線、引線框架、電極、電鍍、塗層等。因此,隨著各國關閉與俄羅斯的貿易,半導體製造商越來越注重供應替代原料,進一步推遲了市場所需半導體的生產。

類比積體電路(IC)市場趨勢

行動電話在通訊領域佔有很大佔有率

- 該部分包括為行動電話和多功能(語音/網路/電子郵件)手持設備設計和使用的專用類比 IC,其中語音通訊仍然是主要功能。這些手機專為2G、3G和Wimax等廣域蜂巢式網路而設計,並採用CDMA、GSM及其升級版本等全面的傳輸格式。

- 智慧型手機普及的上升,尤其是在開發中國家,是由這些地區的人口成長和都市化加快推動的。例如,愛立信預測,到2022年,全球行動用戶數將達到約84億,呈現持續上升趨勢。

- 隨著5G技術的出現,5G智慧型手機的普及正在加速。根據2022年11月愛立信移動報告,預計年終5G行動用戶數將達50億。特別是,5G網路預計將覆蓋85%的人口並處理約70%的行動流量。

- 許多產業參與者推出專為 5G 智慧型手機客製化的晶片組,為市場成長做出了重大貢獻。例如,Google在 2022 年宣布推出 Pixel 6a、Pixel 7 和 Pixel 7 Pro,以支援印度的 5G 網路。 Pixel 6a支援19個5G頻段,而Pixel 7和7 Pro則支援22個5G頻段。

- 美國消費者科技協會 (CTA) 和美國人口普查局的一份報告預測,美國智慧型手機銷售額將從 2021 年的 730 億美元增至 2022 年的 747 億美元。此外,GSMA 預測北美智慧型手機用戶數量將會增加。到2025年,這一數字將增加至3.28億人,行動電話用戶(86%)和網路用戶(80%)的普及也將增加。

- 愛立信行動報告顯示,到 2024 年,中東和非洲 (MEA) 地區可能將有 6,000 萬 5G 服務用戶,約佔所有行動用戶的 3%。 GSMA 估計,中東和北非地區約有 5,000 萬個 5G 連接,到 2025 年,光是阿拉伯國家就有可能達到 2,000 萬個連接。這些統計數據證實了行動應用的快速發展推動了所研究的市場。

中國預計將成為亞太地區成長最快的市場

- 由於領先的半導體製造商的存在、快速的工業化和龐大的消費性電器產品市場,中國預計將成為模擬IC市場的主導者。該地區以其半導體的大規模生產以及類比 IC 在消費性電器產品、汽車和通訊等多個行業的採用而聞名。這些因素預計將推動所研究的國內市場的成長,從而為市場相關人員創造利潤豐厚的機會。

- 此外,該國的 IT 和資料中心產業蓬勃發展,這可歸因於每年產生的資料量不斷增加。中國作為世界科技領域主導力量的驚人崛起主要得益於其蓬勃發展的資料中心生態系統。中國的網際網路資料中心市場是全球技術最先進的市場之一,有許多組織透過數位平台運作。

- 此外,資料中心投資的增加和網際網路普及的提高將要求許多此類設備整合與物理世界互動的感測器,從而需要模擬處理來進行類比數位轉換。這些功能與數位技術相結合,形成了經濟高效、低功耗且高度可靠的解決方案。因此,預計這些因素將在預測期內推動全球類比IC市場的成長。

- 此外,5G網路能力的增強預計將為模擬IC模組創造巨大需求。由於5G基地台的廣泛部署,中國已成為5G領域的重要參與者。工信部公佈的資料顯示,截至年終,我國5G基地台已達231萬個。中國對基礎設施的巨額投資和雄心勃勃的部署策略使得實現5G廣泛覆蓋成為可能。專家預測,到2024年,中國5G基地台將超過600萬個。

- 此外,根據中國資訊通訊研究院(CAICT)的數據,2022年7月中國5G智慧型手機出貨量達1,470萬部,佔智慧型手機總出貨的73%以上。此外,5G智慧型手機佔當月中國行動電話總出貨的74%。年初至今,2022年5G智慧型手機累計出貨已達1.24億支。此外,中國在同年推出了121款新的5G行動電話型號。隨著5G智慧型手機的日益普及,對類比IC的需求預計將增加。

- 據ITA稱,中國在年銷量和產量方面繼續領先全球汽車市場。預計2025年國內產量將達3,500萬台。此外,今年中國汽車工業加大了對全球市場的拓展力度,出口量大幅成長,達到176萬輛,與前一年同期比較成長81%。根據中國工業協會(CAAM)揭露的資料,2023年前5個月。汽車製造中的這一重要特徵預計將在所研究的工業市場中對現代汽車的廣泛應用產生巨大的需求。

類比積體電路(IC)產業概覽

類比積體電路 (IC) 市場預測顯示半整合形勢。製造商透過產品創新和技術差異化展開激烈競爭。許多公司正在策略性投資模擬 IC 開發,以確保先發優勢並保持競爭優勢。該領域的知名廠商包括 Analog Devices Inc.、Infineon Technologies AG、Microchip Technology Inc.、NXP Semiconductors NV 和 ON Semiconductor。

2023 年 2 月,Analog Devices Inc. 和 Marvell Technology Inc. 宣布推出一款具有整合開放式 RAN 支援的最先進的 5G 大規模 MIMO (mMIMO) 參考設計平台。這個開創性平台將 ADI 的尖端 RadioVerse 收發器 SoC 與 Marvell 的 OCTEON 10 Fusion 5G基頻相結合,為 5G 提供業界領先的 5 nm 數位波束成形解決方案。透過利用這項先進技術,該平台顯著縮短了先進 mMIMO 無線電單元和 O-RAN 支援的上市時間,從而實現能耗降低高達 40%、尺寸更小、重量更輕。

2023 年 1 月,Microchip Technology 宣布推出其抗輻射產品組合的最新產品:MIC69303RT 3A 低壓差 (LDO) 穩壓器。這款商用現貨 (COTS) 功率元件代表了 Microchip 在擴展其輻射硬化技術範圍方面的重大進步。此次推出 COTS 抗輻射電源管理解決方案旨在為 Microchip 類比電源和介面業務部門的空間開拓新的設計機會。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 供應鏈分析

- 宏觀經濟因素和 COVID-19 的影響

第5章市場動態

- 市場促進因素

- 智慧型手機、功能手機和平板電腦的普及不斷提高

- 市場挑戰

- 類比積體電路 (IC) 設計的複雜度不斷增加

第6章市場區隔

- 按類型

- 通用IC

- 介面

- 能源管理

- 訊號轉換

- 放大器/比較器(訊號調節)

- 應用 - 特定IC

- 消費者

- 音訊視訊

- 數位相機/攝影機

- 其他消費者

- 車

- 資訊娛樂

- 其他資訊娛樂

- 通訊設備

- 行動電話

- 基礎設施

- 有線通訊

- 近場通訊

- 其他無線通訊

- 電腦

- 電腦系統顯示

- 電腦周邊設備

- 貯存

- 其他電腦

- 工業/其他

- 通用IC

- 按地區

- 美洲

- 歐洲

- 日本

- 中國

- 其他地區

第7章供應商市場佔有率分析

第8章 競爭形勢

- 公司簡介

- Analog Devices Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor

- Richtek Technology Corporation(MediaTek Inc.)

- Skyworks Solutions Inc.

- STMicroelectronics NV

- Renesas Electronics Corporation

- Texas Instruments Inc.

- Qorvo Inc.

第9章 類比積體電路(IC)市場價格分析

第10章投資分析

第11章市場的未來

The Global Analog Integrated Circuit Market size is estimated at USD 91.26 billion in 2024, and is expected to reach USD 129.69 billion by 2029, growing at a CAGR of 7.28% during the forecast period (2024-2029).

Key Highlights

- An analog integrated circuit (IC) is a network of interconnected components manufactured on a single wafer of semiconducting material. These components operate across a continuous range of input signals, contrasting with their digital counterparts, which utilize only two input and output voltage levels. These circuits process, receive, and generate multiple energy output levels during device operation. Electronic devices employing components such as oscillators, DC amplifiers, multi-vibrators, and audio amplifiers utilize analog circuits, which maintain equal output and input levels.

- The introduction and adoption of emerging technologies such as the Internet of Things (IoT) are expected to propel the market growth owing to the evident benefits of analog ICs across a considerable range of real-time connected devices and applications. Owing to the increasing availability of high-speed connectivity, rising cloud adoption, and increasing use of data processing and analytics, the adoption of the Internet of Things (IoT) is growing steadily. For instance, as per Ericsson, there were 1.9 billion cellular IoT connections in the world in 2022, which is expected to grow to 5.5 billion in 2027, registering a CAGR of 19% over the period.

- Furthermore, the adoption of analog ICs has surged in recent years due to the proliferation of smartphones, consumer electronics, computers, and storage devices, as well as the increased sales of electric vehicles. Various ICs used in smartphones include charge ICs, display PMICs, SoC PMICs, and Camera PMICs. Key players such as Apple, Qualcomm, Intel, and Samsung S.LSI dominate this market. Consequently, with the growing production and sales of smartphones featuring advanced technologies and the increasing integration of 5G and 6G, the analog IC market is anticipated to gain substantial traction globally.

- However, global smartphone demand is projected to decline in 2023 compared to 2022 due to ongoing inflation, reduced consumer spending, and a weaker consumer outlook. This decline is expected to temporarily hamper the Analog IC market. Nevertheless, the market is predicted to recover slightly in FY 2024 owing to heightened demand for 5G smartphones and the expanding 5G network connectivity worldwide, particularly driven by the increased proliferation of 5G and foldable smartphones. For instance, as per GSMA, by 2025, 5G networks will likely cover one-third of the world's population.

- There is a significant dependency on the availability of skilled analog chip design engineers in the industry. However, there is a need for such skills within the semiconductor industry. According to Cindi Harper, Human Resources, Talent Planning, and Acquisition at Intel, the demand for talent in the industry surpasses the supply. Similarly, Ruchir Dixit, country manager at Siemens EDA, has stated that the US expects a shortage of 250,000 semiconductor engineers over the next five years. China and Taiwan anticipate shortages of 300,000 and 50,000 engineers, respectively. Such trends hinder the market's growth.

- Moreover, the conflict between Russia and Ukraine is expected to significantly impact several industries like the electronics industry. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have impacted the industry for some time. The disruption caused volatile pricing for critical raw materials like nickel, palladium, copper, silicon, Germanium, Indium Gallium Arsenide Phosphide, titanium, aluminum, and iron ore, resulting in material shortages. Further, according to SEMI, Russia is a global supplier of 45-50% of palladium. The material is used to form bonding wires, lead frames, electrodes, plating, and coating for semiconductor packaging. Therefore, with every country shutting doors for trading with Russia, the semiconductor manufacturers' focus is increasing on alternative raw material supplies, further delaying the production of semiconductors required in the market.

Analog Integrated Circuit (IC) Market Trends

Cell Phone within Communication Segment to Hold Major Share

- This segment encompasses application-specific analog ICs designed for and used in cellular phones and multifunction (voice/web/email) handheld devices, where voice communication remains a primary function. These phones are intended for wide-area cellular networks such as 2G, 3G, and Wimax, employing comprehensive transmission formats like CDMA, GSM, and their upgraded versions.

- The escalating rates of smartphone adoption, particularly in developing nations, are fueled by increasing population growth and urbanization in these regions. For instance, Ericsson forecasts predict that global mobile subscriptions are expected to reach approximately 8.4 billion by 2022, indicating a continuous upward trend.

- The advent of 5G technology is fostering a surge in 5G smartphone penetration. As per the November 2022 Ericsson Mobility Report, it's anticipated that 5G mobile subscriptions will reach 5 billion by the end of 2028. Notably, 5G networks are expected to cover 85% of the population and handle around 70% of mobile traffic.

- The introduction of chipsets tailored for 5G smartphones by numerous industry players is contributing significantly to the market's growth. For example, Google unveiled the Pixel 6a, Pixel 7, and Pixel 7 Pro in 2022 to support India's 5G network. The Pixel 6a supports 19 5G bands, while Pixel 7 and 7 Pro support 22.

- Reports from the Consumer Technology Association (CTA) and the US Census Bureau project an increase in smartphone sales value in the United States from USD 73 billion in 2021 to USD 74.7 billion in 2022. Additionally, GSMA estimates a rise in smartphone subscribers in North America to 328 million by 2025, along with increased penetration rates for mobile subscribers (86%) and Internet users (80%).

- The Ericsson Mobility Report suggests that the Middle East & Africa (MEA) region may have 60 million 5G service subscribers by 2024, accounting for approximately 3% of all mobile subscriptions. GSMA estimates around 50 million 5G connections across MENA, with potentially 20 million connections in the Arab States alone by 2025. These statistics underscore the swift pace of mobile adoption driving the studied market

China is Expected to be the Fastest Growing Market in the Asia Pacific Region

- China is anticipated to emerge as a dominant player in the analog IC market, owing to the presence of major semiconductor manufacturers, rapid industrialization, and a vast consumer electronics market. The region is renowned for its high-volume production of semiconductors and the adoption of analog IC across diverse industries, such as consumer electronics, automotive, and telecommunications. These factors are expected to fuel the growth of the studied market in the country, thereby presenting lucrative opportunities for market players.

- In addition, the country is experiencing a thriving IT and data center industry, which is attributed to the increasing volume of data generated annually. China's remarkable ascent as a dominant force in the global technology sector is primarily bolstered by its flourishing data center ecosystem. The Chinese market for Internet data centers stands out as one of the most technologically advanced markets worldwide, with numerous organizations operating through digital platforms.

- Furthermore, it is expected that the rising investments in data centers and the increasing internet penetration is expected to create the demand for many of these devices to incorporate sensors that interact with the physical world, requiring analog processing for analog to digital conversion. By combining these functions with digital technology, a cost-effective, low-power, and reliable solution is achieved. As a result, these factors are expected to drive the growth of the global analog IC market during the forecast period.

- Moreover, the increasing 5G networking capabilities are expected to create a massive demand for analog IC modules. China has emerged as a prominent player in the 5G arena with a substantial deployment of 5G base stations. As per the data released by MIIT, China had 2.31 million 5G base stations by the end of 2022. The country's massive investment in infrastructure and ambitious rollout strategies have enabled it to achieve extensive 5G coverage. Experts predict that the 5G base stations in China will surpass six million by 2024.

- Furthermore, according to China Academy of Information and Communications Technology (CAICT), In July 2022, the shipment volume of 5G smartphones in China amounted to 14.7 million units, representing over 73 % of the total smartphone shipments. Additionally, 5G smartphones accounted for 74 % of all mobile phone shipments in China during that month. The year-to-date total for 5G smartphone shipments in 2022 reached 124 million units. Furthermore, China released 121 new 5G mobile phone models in the same year. The rising 5G smartphone penetration will likely drive the demand for analog IC.

- China remains the leading global vehicle market in annual sales and manufacturing output, per ITA. The domestic production is projected to touch 35 million vehicles by 2025. Additionally, the automotive industry in China has intensified its global outreach in the current year, with exports witnessing a remarkable surge of 81% year-on-year to 1.76 million vehicles in the first five months of 2023, as per the data disclosed by the China Association of Automobile Manufacturers (CAAM). Such significant capabilities in manufacturing automobiles are expected to create a significant demand for the studied market in the industry for their wide range of applications in modern cars.

Analog Integrated Circuit (IC) Industry Overview

The forecast for the Analog Integrated Circuit (IC) Market indicates a semi-consolidated landscape. Manufacturers are engaged in fierce competition, leveraging product innovation and technological differentiation. Many companies are strategically investing in the development of analog ICs to secure a first-mover advantage and maintain competitiveness. Notable players in this arena include Analog Devices Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors NV, and ON Semiconductor.

In February 2023, Analog Devices Inc. and Marvell Technology Inc. introduced their cutting-edge 5G massive MIMO (mMIMO) reference design platform, integrating Open RAN support. This pioneering platform combines ADI's state-of-the-art RadioVerse Transceiver SoC with Marvell's OCTEON 10 Fusion 5G baseband processor, delivering an industry-leading 5 nm digital beamforming solution for 5G. By harnessing this advanced technology, the platform significantly accelerates the time-to-market for advanced mMIMO radio units and O-RAN support, achieving up to 40% lower energy consumption, reduced size, and lighter weight.

In January 2023, Microchip Technology unveiled its latest addition to the radiation-tolerant portfolio, the MIC69303RT 3A Low-Dropout (LDO) Voltage Regulator. This commercial-off-the-shelf (COTS) power device represents a significant stride for Microchip as it expands its range in radiation-tolerant technology. The introduction of this COTS rad-tolerant power management solution aims to unlock new design opportunities in space applications within Microchip's analog power and interface business unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Impact of Macroeconomic Factors and COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphones, Feature Phones, and Tablets

- 5.2 Market Challenges

- 5.2.1 Increasing Design Complexity of Analog IC

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General-Purpose IC

- 6.1.1.1 Interface

- 6.1.1.2 Power Management

- 6.1.1.3 Signal Conversion

- 6.1.1.4 Amplifiers/Comparators (Signal Conditioning)

- 6.1.2 Application-Specific IC

- 6.1.2.1 Consumer

- 6.1.2.1.1 Audio/Video

- 6.1.2.1.2 Digital Still Camera and Camcorder

- 6.1.2.1.3 Other Consumers

- 6.1.2.2 Automotive

- 6.1.2.2.1 Infotainment

- 6.1.2.2.2 Other Infotainment

- 6.1.2.3 Communication

- 6.1.2.3.1 Cell Phone

- 6.1.2.3.2 Infrastructure

- 6.1.2.3.3 Wired Communication

- 6.1.2.3.4 Short Range

- 6.1.2.3.5 Other Wireless

- 6.1.2.4 Computer

- 6.1.2.4.1 Computer System and Display

- 6.1.2.4.2 Computer Periphery

- 6.1.2.4.3 Storage

- 6.1.2.4.4 Other Computers

- 6.1.2.5 Industrial and Others

- 6.1.1 General-Purpose IC

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Rest of the World

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Analog Devices Inc.

- 8.1.2 Infineon Technologies AG

- 8.1.3 Microchip Technology Inc.

- 8.1.4 NXP Semiconductors NV

- 8.1.5 ON Semiconductor

- 8.1.6 Richtek Technology Corporation (MediaTek Inc.)

- 8.1.7 Skyworks Solutions Inc.

- 8.1.8 STMicroelectronics NV

- 8.1.9 Renesas Electronics Corporation

- 8.1.10 Texas Instruments Inc.

- 8.1.11 Qorvo Inc.