|

市場調查報告書

商品編碼

1433524

數位流程自動化:市場佔有率分析、產業趨勢與成長預測(2024-2029)Digital Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

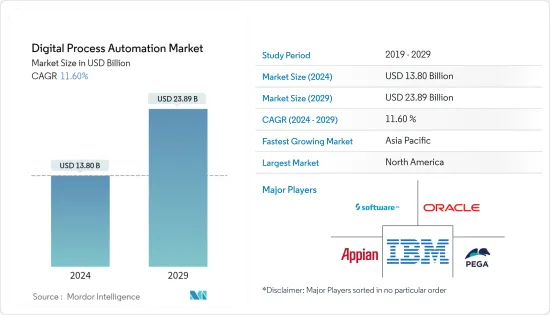

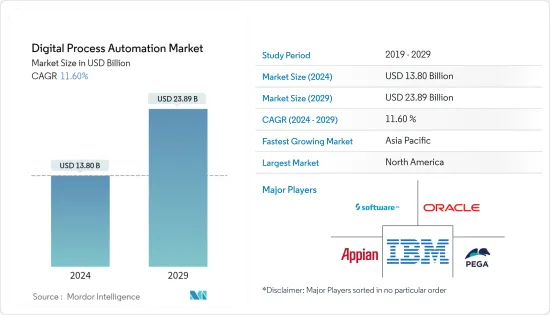

數位流程自動化市場規模預計到 2024 年為 138 億美元,預計到 2029 年將達到 238.9 億美元,在預測期內(2024-2029 年)複合年成長率為 11.60%。

隨著新技術的發展和加速,虛擬世界和實體世界的融合正在創造新的經營模式。製造商正在引入新的經營模式來銷售數位服務和產品,例如數位雙胞胎。

主要亮點

- 提高業務效率和簡化業務流程是所有行業組織的首要任務。由此推斷,對效率的重視正在推動對 DPA 解決方案的需求。透過自動化和最佳化手動和重複性任務,公司可以減少錯誤、消除瓶頸並提高流程效率。公司可以實現工作流程自動化和流程標準化,以縮短交付時間、提高生產力並降低成本。隨著公司尋求改善客戶體驗、推動卓越營運並在不斷變化的市場中保持競爭力,對 DPA 解決方案的需求預計將會增加。

- DPA 解決方案的另一個關鍵市場促進因素是企業的持續數位轉型。我們的理由是,企業正在迅速採用數位技術來轉變業務、改善消費者體驗並獲得競爭優勢。 DPA 使組織數位化和自動化,從而在這一轉變中發揮關鍵作用。 DPA 解決方案透過自動化手動任務、連接系統和應用程式以及提供流程效能的即時可見性,實現端到端流程自動化和敏捷性。對 DPA 的需求是由組織需要利用數位技術並實現其營運的數位成熟度所驅動的。

- 舊有系統和複雜的 IT 環境可能是採用 DPA 解決方案的主要障礙。我們的理由是,許多組織現有的系統、應用程式和技術並非旨在輕鬆與 DPA 平台整合。這些舊有系統缺乏與 DPA 解決方案無縫連接所需的 API(應用程式介面)和現代架構,這使得整合變得困難且耗時。此外,一些組織使用高度客製化的專有軟體,可能與商用 DPA 工具不相容。

- 雖然疫情促使許多部門更多地採用 DPA 解決方案,但它也造成了預算限制並改變了一些組織的優先事項。由此推斷,受到疫情嚴重打擊的企業可能已將資源轉移到應對眼前的挑戰,例如削減成本措施或專注於基本業務。因此,DPA 解決方案的實施可能會被推遲或計劃計劃被推遲。此外,遇到財務困難的組織可能用於投資新技術(包括 DPA)的預算有限。還有俄羅斯和烏克蘭戰爭對整個包裝生態系統的影響。

數位流程自動化市場趨勢

擴大採用業務流程管理 (BPM) 預計將加快小型企業的成長速度

- 採用 BPM 解決方案可協助組織更了解其現有業務流程並確定需要改進的領域。由此推斷,隨著組織採用 BPM舉措,他們將更加意識到流程自動化和最佳化的好處。隨著組織意識到需要自動化流程以提高效率、生產力和敏捷性,這種意識催生了對 DPA 解決方案的需求。

- BPM 解決方案通常作為數位轉型舉措的基石,幫助公司跨多個部門和平台整合和簡化業務。由此推斷,隨著公司採用 BPM,他們會更意識到完整流程協作和自動化的好處。這種洞察力推動了對 DPA 系統的需求,這些系統可以輕鬆地與 BPM 平台連接,擴展自動化功能並讓公司能夠存取整個自動化生態系統。

- BPM舉措通常涉及擴展和調整流程,以滿足不斷變化的小型企業需求和市場動態。由此推斷,企業正在認知到可擴展且靈活的自動化解決方案對於支援其 BPM 計劃的重要性。 DPA 解決方案提供自動化各種流程(從簡單到複雜)所需的可擴展擴充性和彈性,以滿足不斷變化的業務需求。 BPM 的採用增加了對擴充性且適應性強的 DPA 解決方案的需求,以滿足組織不斷成長的自動化需求。

- BPM 培養持續流程改善的文化,並鼓勵組織定期評估和增強其流程。由此推斷,當組織採用 BPM 時,他們將尋求支援持續改善工作的自動化解決方案。 DPA 解決方案可實現自動化流程監控、分析和最佳化,進而提高效率和長期效能改進。 BPM 的採用將推動對 DPA 解決方案的需求,這些解決方案有助於持續改善流程,並為資料主導的決策提供分析和見解。

- 在冠狀病毒 (COVID-19) 爆發期間,全球展覽公司取消了 2020 年和 2021 年的一些現場活動,轉而探索數位形式。根據 2021 年 6 月進行的一項研究,全球 80% 的展覽場館正在整合數位服務和產品,以補充其現有展品。同時,45% 的服務供應商質疑將內部程序和工作流程轉換為數位流程。

北美佔有很大的市場佔有率

- 由於該地區存在大型數位流程自動化供應商,預計北美將為市場擴張做出重大貢獻。推動該地區數位流程自動化市場成長的主要趨勢包括多樣化的封裝,這增加了對先進感測技術的需求,這直接影響了自動化產品的成長。

- 由於技術進步和全球供應鏈/物流的簡化,美國正在經歷顯著成長。這些國際物流網路的出現意味著美國製造商現在可以有效地將成品和原料運送到世界任何地方。

- 為了充分利用這一潛力,該地區的聯盟、併購活動正在激增。這些投資的根本驅動力是新技術和部署選項的持續成長。

- 2022 年 8 月,技術諮詢和軟體開發公司 Sigma Solve 將為客戶提供數位化、收入成長、系統整合和業務流程自動化願景的指導,將整合的數位能力和創新交付給北美各地的企業。與Liferay DXP 建立了策略合作夥伴關係,Liferay DXP 提供了一個功能豐富的平台來交付Sigma Solve 的數位轉型方法與 Liferay 的 DXP 平台完美整合。

- 這一趨勢大大增加了美國製造商及其國際競爭對手的經濟機會。機器人流程自動化(RPA)是使公司能夠應對所有業務領域快速變化的關鍵技術之一。 RPA 提供虛擬代理,可自動執行複雜的工作任務、流程和工作流程。

數位流程自動化產業概述

數位過程自動化市場是分散的。重點關注新產品發布和持續創新是主要企業採取的一些策略。主要參與者包括 IBM 公司、Pegasystems Inc.、Appian Corporation 和 Oracle Corporation。近期市場開拓如下。

- 2023 年3 月- 埃及領先的網路供應商埃及電信(TE) 與IBM 合作,將智慧自動化技術整合到行動、固定和核心網路的所有營運支援系統(OSS) 中。宣布將為埃及電信提供統一的解決方案該計劃是利用在 RedHat OpenShift 上運作的IBM Cloud Pak for Watson AIOps 並實施 TE 的 IBM 機器人流程自動化 (RPA) 解決方案。創建此解決方案的目的是讓 TE整體情況整個IT基礎設施,幫助您更快地創新、降低營運成本並減少排除故障和解決網路相關事件所需的時間。

- 2022 年 2 月 - 諾基亞和 Atos 開始全球合作,為企業提供業界領先的 4/5G 專用無線網路解決方案和相關數位服務,並合作創建新的尖端服務。透過促進新的工作方式,兩家公司之間的合作將幫助公司提高業務效率。該整合產品託管在 Atos 或諾基亞伺服器上,結合了邊緣運算和雲端運算領域兩個行業領導者的優勢,支援企業向 4.0 工業革命過渡。此次合作得益於 Atos 收購的人工智慧先驅 Ipsotek 及其無與倫比的 IP 和軟體能力,包括 Atos AI 電腦視覺平台和工業級專用無線連接和應用平台 Nokia Digital,該平台利用自動化雲端 (DAC)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 市場促進因素

- 對高效能後端流程的業務流程自動化的需求不斷成長

- 更多地採用低程式碼自動化以提高可訪問性

- 市場限制因素

- 缺乏技術純熟勞工

第5章市場區隔

- 按成分

- 解決方案

- 按服務

- 按配置

- 一經請求

- 本地

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶

- 銀行、金融服務和保險 (BFSI)

- 製造業

- 資訊科技/通訊

- 航太/國防

- 衛生保健

- 零售/消費品

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- IBM Corporation

- Bizagi Group Limited

- Pegasystems Inc.

- Appian Corporation

- Oracle Corporation

- Software AG

- DST Systems Inc.

- OpenText Corporation

- Newgen Software Technologies Ltd.

- TIBCO Software Inc.

第7章 投資分析

第8章市場的未來

The Digital Process Automation Market size is estimated at USD 13.80 billion in 2024, and is expected to reach USD 23.89 billion by 2029, growing at a CAGR of 11.60% during the forecast period (2024-2029).

As new technologies are trending and accelerating, merging the virtual and physical worlds creates new business models. Manufacturers are introducing new business models under which they sell digital services and products, such as digital twins.

Key Highlights

- Improving operational effectiveness and simplifying business processes are top priorities for organizations across all industries. According to inference, this emphasis on efficiency drives the demand for DPA solutions. By automating and optimizing manual and repetitive tasks, firms may lower errors, get rid of bottlenecks, and boost process efficiency. Organizations can achieve faster turn-around times, increased productivity, and cost savings by automating workflows and standardizing processes. The need for DPA solutions is anticipated to increase as companies look to enhance client experiences, drive operational excellence, and maintain their competitiveness in a changing market.

- Another significant market driver for DPA solutions is organizations' continual digital transformation path. According to inference, businesses are embracing digital technology at a faster rate to revolutionize their operations, improve consumer experiences, and gain a competitive advantage. By enabling organizations to digitize and automate their fundamental business activities, DPA plays a crucial part in this shift. DPA solutions enable organizations to achieve end-to-end process automation and agility by automating manual operations, linking systems and applications, and offering real-time visibility into process performance. The need for DPA is fueled by organizations' need to utilize digital technology and attain operational digital maturity.

- Legacy systems and complex IT environments can pose a significant restraint on the adoption of DPA solutions. Inference suggests that many organizations have existing systems, applications, and technologies in place that are not designed to easily integrate with DPA platforms. These legacy systems may lack the necessary APIs (Application Programming Interfaces) or modern architecture to seamlessly connect with DPA solutions, making integration challenging and time-consuming. Additionally, organizations may have heavily customized or proprietary software that is not easily compatible with off-the-shelf DPA tools.

- While the pandemic drove increased adoption of DPA solutions in many sectors, it also introduced budget constraints and shifting priorities for some organizations. Inference suggests that businesses heavily impacted by the pandemic may have diverted resources to address immediate challenges, such as cost-cutting measures or focusing on essential operations. This could have slowed down the adoption of DPA solutions or led to delays in planned projects. In addition, organizations that experienced financial difficulties may have limited budgets for investing in new technologies, including DPA. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Digital Process Automation Market Trends

Small Enterprises are expected to grow at a higher pace on back of growing adoption of Business Process Management (BPM)

- The adoption of BPM solutions helps organizations gain a better understanding of their existing business processes and identifies areas for improvement. Inference suggests that as organizations implement BPM initiatives, they become more aware of the benefits of process automation and optimization. This awareness creates a demand for DPA solutions as organizations recognize the need to automate their processes to achieve greater efficiency, productivity, and agility.

- BPM solutions frequently act as the cornerstone for digital transformation initiatives, helping businesses to integrate and streamline their operations across many divisions and platforms. Inference implies that when businesses embrace BPM, they become more aware of the benefits of complete process orchestration and automation. This insight increases demand for DPA systems that can easily link with BPM platforms, extending automation capabilities and giving businesses access to a whole automation ecosystem.

- BPM initiatives often involve scaling and adapting processes to meet changing small business needs and market dynamics. Inference suggests that organizations recognize the importance of scalable and flexible automation solutions to support their BPM efforts. DPA solutions offer the scalability and flexibility required to automate a wide range of processes, from simple to complex, and accommodate evolving business requirements. The adoption of BPM drives the demand for DPA solutions that can scale and adapt to support the organization's growing automation needs.

- BPM fosters a culture of continuous process improvement, encouraging organizations to regularly evaluate and enhance their processes. Inference suggests that as organizations embrace BPM, they seek automation solutions that support their continuous improvement efforts. DPA solutions enable organizations to monitor, analyze, and optimize their automated processes, driving efficiency gains and performance improvements over time. The adoption of BPM fuels the demand for DPA solutions that facilitate ongoing process improvement and provide analytics and insights for data-driven decision-making.

- During the coronavirus (COVID-19) epidemic, exhibition companies globally stopped some in-person events in 2020 and 2021 in favor of exploring digital formats. According to research conducted in June 2021, 80 percent of global exhibition venues incorporated digital services or products to complement their existing displays. Meanwhile, 45 percent of service provider organizations questioned converting internal procedures and workflows into digital processes.

North America to Account for a Significant Market Share in the Market

- Due to the region's large digital process automation vendors, North America is expected to contribute significantly to market expansion. The major trends responsible for the growth of the digital process automation market in the region include the diverse packaging that increases demand for advanced sensing technology, which will directly impact the increase of automated products.

- The United States is significantly growing due to improved technology and streamlined global supply chains/logistics. This emergence of international logistics networks means that United States manufacturers can now efficiently and effectively deliver the finished products and raw materials anywhere around the world.

- The region has witnessed a surge of partnerships, mergers, and acquisitions to capitalize on these possibilities. The fundamental driver of these investments has been the continued growth of new technologies and deployment options.

- In August 2022, Sigma Solve, a technology consulting and software development company that guides clients' visions for digitization, sales growth, system integration, and business process automation, has formed a strategic partnership with Liferay DXP, which will provide a feature-rich platform that puts integrated digital capabilities and innovation in the hands of businesses across North America. Sigma Solve's digital transformation approach integrates perfectly with Liferay's DXP platform.

- This trend has massively increased the economic opportunities of US manufacturers and international competitors. Robotic process automation (RPA) is one key technology enabling companies to address the fast pace of change across all business areas. RPA provides virtual agents to automate tasks, processes, and workflows for complex work.

Digital Process Automation Industry Overview

The digital process automation market is fragmented. New product launches and focuses on continuous technology innovations are some strategies adopted by the major players. Key players are IBM Corporation, Pegasystems Inc., Appian Corporation, Oracle Corporation, etc. Recent developments in the market are

- March 2023 - Leading network provider in Egypt, Telecom Egypt (TE), announced that it is collaborating with IBM to integrate intelligent automation technologies to provide a unified solution for all of its operations support systems (OSS) across mobile, fixed, and core networks. The use of IBM Cloud Pak for Watson AIOps running on RedHat OpenShift and the implementation of IBM Robotic Process Automation (RPA) solutions by TE are both planned. The solution will be created to give TE a complete picture of its whole IT infrastructure and to assist them in fast innovating, lowering operational costs, and reducing the amount of time needed to troubleshoot and resolve network-related events.

- February 2022 - A global cooperation between Nokia and Atos was launched to offer enterprises industry-leading 4/5G private wireless networking solutions, along with related digital services, and to collaborate on the creation of new, cutting-edge services. By facilitating new working methods, our cooperation will assist businesses in achieving increased operational efficiency. The combined product, which is hosted on servers from Atos or Nokia, combines the strengths of the two industry leaders in edge and cloud computing to support businesses as they transition to the 4.0 industrial revolution. The partnership makes use of the Atos AI computer vision platform, which has recently been strengthened by Atos' acquisition of the AI pioneer Ipsotek and its unmatched IP and software capabilities, as well as the industrial-grade private wireless connectivity and application platform Nokia Digital Automation Cloud (DAC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increase Demand of Automating Business Process for Efficient Back-end process

- 4.4.2 Increase Adoption of Low Code Automation for Greater Accessibility

- 4.5 Market Restraints

- 4.5.1 Lack of Skilled Workforce

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-demand

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small- and Medium-sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End User

- 5.4.1 Banking, Financial Services, and Insurance (BFSI)

- 5.4.2 Manufacturing

- 5.4.3 IT and Telecommunication

- 5.4.4 Aerospace and Defense

- 5.4.5 Healthcare

- 5.4.6 Retail and Consumer Goods

- 5.4.7 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Bizagi Group Limited

- 6.1.3 Pegasystems Inc.

- 6.1.4 Appian Corporation

- 6.1.5 Oracle Corporation

- 6.1.6 Software AG

- 6.1.7 DST Systems Inc.

- 6.1.8 OpenText Corporation

- 6.1.9 Newgen Software Technologies Ltd.

- 6.1.10 TIBCO Software Inc.