|

市場調查報告書

商品編碼

1433507

自動送貨機器人(ADR)的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Autonomous Delivery Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

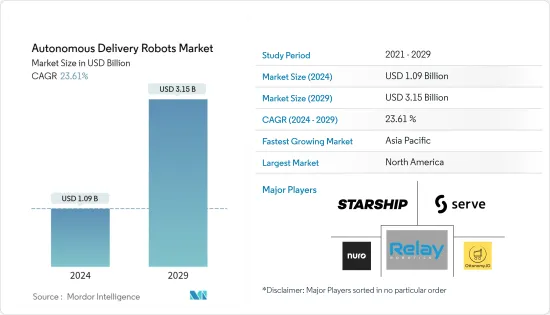

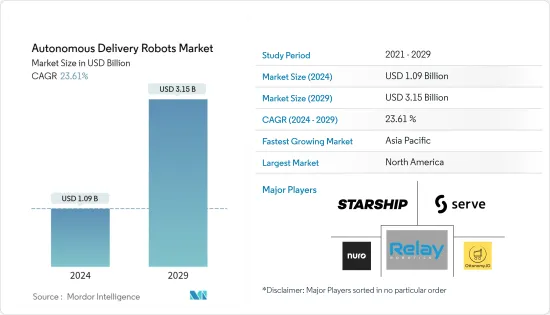

2024 年全球自動送貨機器人 (ADR) 市場規模估計為 10.9 億美元,預計到 2029 年將達到 31.5 億美元,在預測期間(2024~2029 年)以 23.61% 的複合年增長率增長。

由於效率較高,自動送貨車輛的使用不斷增加,這是推動市場成長的一個主要因素。 2022 年 1 月,Ottonomy 推出了 Ottobots,這是一組完全自主的送貨機器人,適用於餐廳和零售店的室外和室內環境。這場大流行為 Ottobots 提供了催化劑,促成了一系列合作夥伴關係,使該公司能夠推出路邊、室內和最後一英里交付的全自動送貨服務。

主要亮點

- 自主配送機器人 (ADR) 正在徹底改變配送程序,提供更便宜、更有效率的配送方式。送貨機器人過去並不是很普及,但由於其許多優點,預計未來將會成長。 ADR 的採用不斷增加,主要是由於基礎設施中的輕型機器人種類不斷增加、可承受性和投資收益不斷提高,以及對靈活高效的自動化履約的持續需求。例如,2022 年 1 月,領先的自動送貨機器人公司 Starship Technologies 從歐盟投資部門獲得了 5,000 萬歐元,用於擴大其自動送貨機器人團隊。

- 人工智慧和機器學習也為食品加工產業、食品飲料店、餐廳和自助餐廳帶來了巨大的好處。除此之外,這些技術加快了供應鏈流程並增強了食品配送服務。

- 此外,最後一哩交付一直是處理供應鏈的主要問題之一。隨著電子商務的持續成長以及消費者對更快、更定期送貨的高期望,導致交通堵塞和碳污染加劇,都市區的最後一哩送貨變得越來越複雜。根據世界經濟論壇預測,到 2030 年,全球整體最後一哩的配送需求預計將增加 78%。

- 根據美國零售聯合會 (NRF) 統計,運輸事故造成約 3.33 億美元的損失。這些運輸課題促使消費者和零售商尋求更好、更有效率的運輸方式。

- 此外,許多零售商發現出色的最後一哩體驗可以吸引並留住消費者。但同時,滿足客戶的交付期望並不能提高報酬率,因為當今的零售商承擔了最後一哩交付的部分成本。因此,ADR正在幫助這些公司實現高效的最後一英里交付。

- 此外,物流部門消耗多種自然資源來維持各種業務,例如貨物交付。它還透過向大氣中排放大量溫室氣體而導致全球暖化。自主輸送系統有望透過減少向大氣中排放的二氧化碳來抵消這種反環境影響。

- 正在頒布幾項法律來遏制全球暖化和保護環境。這些政府措施有助於增加市場對 ADR 的需求。例如,歐盟委員會設定了 2050 年實現脫碳的目標,並為 2020 年和 2030 年制定了多個近期目標。

- 此外,德里政府最近共用了一項提案草案,要求到 2030 年計程車聚合商、食品配送公司和電子商務平台必須強制使用電動車。據政府相關人員稱,政府的目標是到 2024 年將電動車在汽車總銷量中的佔有率提高到 25%。此類活動可能會進一步阻礙宅配機器人市場的成長。

- COVID-19大流行讓全球專注於非接觸式包裹投遞的投遞機器人,強勁的市場需求促使投遞機器人開發商在美國多個城市展開大規模部署,並開始開展業務。交付機器人技術的部署和採用預計將在預測期內加強交付機器人市場。全球物流和醫療保健支出的成長可能會進一步推動市場成長。據世界衛生組織稱,目前全球衛生支出佔GDP的比重預計在2023年至2028年期間將增加0.2個百分點,到2028年達到10.81%。

自主配送機器人市場趨勢

醫療保健產業預計將錄得顯著成長

- 醫療保健應用是一種相當先進的自主交付機器人型態。與戶外送貨機器人不同,部署在醫療保健應用中的自主送貨機器人必須考慮其他幾個參數,例如低噪音馬達、衛生參數以及與常規送貨相比的平穩運行。

- 傳統上,機器人被安裝在一些醫療設施中用於治療兒童。但現在它甚至被用來協助醫務人員依需訂購所需的資源。例如,以美國知名機器人製造公司 Aethon 為例,Aethon 為醫療應用提供 TUG 機器人。

- 此外,巴達洛納市醫院和巴塞隆納診所醫院也安裝了TIAGo外送機器人和TIAGo輸送機機器人。在巴達洛納醫院,創新計劃部的 Sergio García Redondo 認為,測試的兩個使用案例具有很大潛力,肯定會改善醫院的後勤工作。它還使醫院能夠顯著減少不會為患者付加價值的重複性任務。這使得醫護人員能夠直接關注病人。

- 這些機器人也被歐馬哈退伍軍人醫療中心用來根據需要檢索和卸載醫療用品。機器人還透過運送一些物流用品和實驗室樣本來支持該設施。此外,Sheba 醫療中心最近與以色列新興企業Seamless Vision 合作,建立創新的自主物流基礎設施。未來幾年,該公司計劃開始自動向患者提供藥物,以減輕醫院工作人員的負擔。

- 根據美國勞工統計局 (BLS) 的數據,到 2024 年,美國對護理人員的需求預計將增加 16%,達到 3.2 毫米。成長的大部分將由需要更多護理的老齡化嬰兒潮一代推動。此外,醫療保健應用的支出日益增加,這表明自主配送機器人的採用。例如,根據 IBEF 的數據,2022 年印度的醫療保健支出達到 3,720 億美元,高於前一年的 1,940 億美元。

- Aster DM Healthcare還計劃在未來三年投資90億印度盧比(1.2097億印度盧比)擴大在印度的業務,以期到2025年將收益佔有率提高到40%。宣布計劃進行資本投資支出以美元為單位。此外,在2023-24年聯邦預算中,政府已向衛生與家庭福利部(MoHFW)撥款107.6億美元。各個地區醫療保健產業的這種擴張可能會進一步推動對所研究市場的需求。

北美市場正在經歷顯著成長

- 北美是自主配送機器人的重要市場。幾個重要的市場經銷商都位於該地區。該地區也是許多致力於發展自主送貨機器人技術的新興企業和製造商的所在地。

- 同時,與世界其他地區相比,該地區一些最終用戶的自主送貨機器人的豐富程度相對較高。飯店、物流和零售業對這些機器人的需求龐大。許多零售和餐旅服務業供應商與製造商合作,親身體驗原型。例如,Google最近投資了 Nuro,這是一家專注於使用機器人自動駕駛車輛運送貨物的公司。該公司在老虎環球基金主導的一輪資金籌措中籌集了總計 6 億美元的資金。

- 根據電子商務基金會的數據,北美擁有全球最高的社交網路普及,並引領電子商務產業。除了降低人事費用外,送貨機器人的引入還將幫助您在社交網路上獲得知名度並提高RevPAR。這些活動預計將維持飯店業對自動送貨機器人的穩定需求。

- 各個終端用戶產業正在採用自主機器人,顯著擴大了該地區 ADR 市場的範圍。 2022 年 8 月,Ottonomy Inc. 完成了 330 萬美元的種子輪資金籌措,並宣布 Ottobot 2.0 為其自動送貨機器人的最新版本。此外,該公司還打算擴大 Ottobots 在機場、零售店和餐廳的部署。

- 此外,北美國家已成為推動該地區物流市場成長的關鍵力量之一。由於該地區國家貿易量不斷擴大,該地區的產品需求激增。 2022年,該地區物流市場與前一年同期比較成長5.31%。此外,在電子商務成長的推動下,2022年商業倉庫總面積與前一年同期比較%。在預測期內,對低溫運輸設施的需求可能會穩定成長。該地區物流業的這種擴張可能會進一步推動預測期內所研究市場的成長。

- 2022年10月,美國運輸部投資約3,100萬美元擴大貨運基礎設施和加強供應鏈。美國政府已宣佈在 2022 年提供 14 億美元資金籌措,用於鐵路基礎設施的現代化和升級。墨西哥政府在《國家私營部門基礎設施投資協議》框架下推出了2020-2024年440億美元的計劃,重點關注交通基礎設施。加拿大政府也向國家貿易走廊基金投資超過23億美元,以加強貨運。

自主配送機器人產業概況

由於多個區域公司的存在,自動送貨機器人市場競爭非常激烈。本公司採用合作夥伴關係、合併、收購和產品創新等策略來擴大其地理影響力並獲得相對於競爭對手的優勢。市場的重要參與者包括 Starship Technologies、Ottonomy.IO、Nuro Inc.、Relay Robotics 和 Serve Robotics Inc.。

2022 年 5 月,Uber Eats 與人行道機器人送貨新興企業Saab Robotics 和自動駕駛汽車技術公司 Motional 合作,在洛杉磯推出了兩個自動送貨試點計畫。

2022 年 3 月,英偉達向 Uber 衍生公司 Serve Robotics 投資 1,000 萬美元,這是一家人行道機器人送貨公司。英偉達的這項投資可能會推動所研究的市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 技術簡介

- 評估宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 最後一公里配送管理需求

- 物流行業自動化的進步

- 市場課題

- 天氣和安全問題

第6章市場區隔

- 依最終用戶

- 衛生保健

- 款待

- 零售/物流

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

第7章 競爭形勢

- 公司簡介

- Starship Technologies

- Relay Robotics, Inc.

- Ottonomy.IO

- Nuro Inc.

- Serve Robotics Inc

- Eliport

- TeleRetail(Aitonomi AG)

- Aethon Inc.

- Kiwibot

- Postmates Inc.

- Segway Robotics Inc.

- Neolix

第8章投資分析

第9章市場的未來

The Autonomous Delivery Robots Market size is estimated at USD 1.09 billion in 2024, and is expected to reach USD 3.15 billion by 2029, growing at a CAGR of 23.61% during the forecast period (2024-2029).

The increasing use of autonomous delivery automobiles due to their efficiency is the primary element contributing to the Market's growth. In January 2022, Ottonomy launched Ottobots, a fleet of fully autonomous delivery robots for restaurant and retail industries for outdoor and indoor environments. The pandemic provided Ottobots with a catalyst enabling a series of partnerships that allowed it to launch fully autonomous delivery for curbside, indoor, and last-mile deliveries.

Key Highlights

- Autonomous delivery robots (ADR) have revolutionized delivery procedures, providing a cheaper and more efficient way of delivery. Though delivery robots did not experience high adoption in the past, they are expected to notice increased growth in the future, owing to numerous advantages. The increasing adoption of ADR is mainly driven by the growing affordability and return on investment of a rising variety of infrastructure light robots, along with continuing needs for flexible and efficient automated fulfillment. For instance, in January 2022, Starship Technologies, a significant player in autonomous delivery robots, picked up EUR 50M from the European Union (EU) investment arm to extend its fleet of autonomous delivery robots.

- AI and ML have also greatly benefited the food processing industry, eateries, restaurants, and diners. These technologies, among other things, have sped up the supply chain process and enhanced food delivery services.

- Furthermore, last-mile delivery has been one of the primary problems in handling the supply chain. Last-mile deliveries are getting increasingly complicated in cities, as continued growth in e-commerce and high consumer expectations for faster and regular deliveries are causing traffic congestion and increased carbon pollution. According to the World Economic Forum, the need for last-mile delivery is predicted to grow by 78% globally by 2030

- Losses of about USD 333m incurred due to shipping mishaps, according to the National Retail Federation (NRF). Due to such delivery issues, various consumers and retailers have been looking for better and more efficient delivery methods.

- Also, many retailers have discovered that a superior last-mile experience engages and retains consumers. However, at the same time, meeting customers' delivery expectations does not assist in increasing profit margins, as today's retailers are soaking a part of the cost of last-mile delivery. Therefore, ADR is helping these companies in achieving efficient last-mile delivery.

- Moreover, the logistics sector consumes several natural resources to sustain different operations, such as the delivery of goods. This has also contributed to global warming by disposing of large amounts of greenhouse gases into the atmosphere. Autonomous delivery systems are anticipated to counter such anti-environmental effects by reducing CO2 emissions in the atmosphere.

- Multiple laws are being put in place to control global warming and protect the environment; such initiatives undertaken by governments contribute to the demand growth of ADRs in the Market. For instance, the European Commission has set an objective of decarbonization by 2050, with a few immediate goals in 2020 and 2030.

- Moreover, the government of Delhi recently shared a draft that mandates EVs to cab aggregators, food delivery firms, and E-commerce platforms by 2030. As per officials, the government aims to increase the EV share in overall vehicle sales to 25% by the year 2024. Such activities may further hamper the growth of delivery robots in the Market.

- The COVID-19 pandemic focused attention on delivery robots for contactless package deliveries worldwide, and strong market demand has pushed delivery robot developers to launch large-scale operations in several US cities. The deployment and adoption of delivery robot technology are anticipated to strengthen the Market for delivery robots in the forecasted period. Increasing logistic and healthcare spending worldwide may further drive market growth. According to WHO, the global current health expenditure as a share of the GDP is forecasted to increase between 2023 and 2028 by 0.2% points, and the share is estimated to amount to 10.81% in 2028.

Autonomous Delivery Robots Market Trends

Healthcare Segment is Expected to Register a Significant Growth

- Healthcare applications are one of the considerably advanced forms of autonomous delivery robots. Unlike outdoor delivery robots, autonomous delivery robots deployed in healthcare applications need to consider several other parameters, such as low noise motors, sanitation parameters, and smoother travel compared to regular deliveries.

- Traditionally, robots were installed in several medical establishments for therapeutic use for kids. But now, they are even used to assist the medical staff in fetching the required resources on demand. For example, consider the case of Aethon, a prominent robotics manufacturer based in the US, which offers TUG Robots for medical applications.

- In addition, the TIAGo Delivery and TIAGo Conveyor robots were deployed at the Hospital Municipal of Badalona and Hospital Clinic Barcelona. At the Hospital of Badalona, Sergio Garcia Redondo of the Innovation and Projects Department believes that based on the two use cases they have tested, it's seen a lot of potential, and they will undoubtedly improve the hospital's logistics. And also, the hospital would drastically be able to reduce the necessity to do repetitive tasks with no added value for the patient. Therefore the healthcare staff could concentrate directly on the patient.

- Also, these robots are being utilized at Omaha VA Medical Center to fetch and drop medical supplies on demand. They also sustain the facility by delivering several logistical things and lab samples. In addition, Sheba Medical Center recently partnered with Seamless Vision, an Israeli startup, to create an innovative Autonomous Logistics Infrastructure. The firm plans to launch autonomous medication delivery to patients to ease the pressure on hospital staff in the coming years.

- According to the Bureau of Labor Statistics (BLS), the requirement for nurses is expected to increase by 16%, reaching 3.2mm in 2024 the United States. The aging baby boomers who require additional care will propel much of the growth. Moreover, the spending on healthcare applications is increasing daily, implying the adoption of autonomous delivery robots. For instance, according to IBEF, expenditure on healthcare in India amounted to USD 372 billion in 2022, an increase from the previous year, which was recorded to USD 194 billion.

- Additionally, Aster DM Healthcare declared that it is planning INR 900 crores (USD 120.97 million) capital expenditure over the next three years to enhance its presence in India as it looks at increasing the share of the revenue from the country to 40% of the total earnings by 2025. In addition, in the Union Budget 2023-24, the government allocated USD 10.76 billion to the Ministry of Health and Family Welfare (MoHFW). Such expansion in the healthcare sector in various regions may further propel the studied market demand.

North America to Experience Significant Market Growth

- North America is a substantial market for autonomous delivery robots. Multiple of the significant market dealers are based out in the region. The region also has many start-ups and manufacturers working toward the growth of autonomous delivery robotic technology.

- Along with this, the enhancement of autonomous delivery robots across several end users in the region is relatively high compared to other parts of the world. The requirement for these robots is enormous in the hospitality, logistics, and retail sectors. Many retail and hospitality vendors collaborate with manufacturers to experience the prototypes first-hand. For instance, Google recently invested in Nuro, which is focused on delivering goods using robotic autonomous vehicles. Overall, the company raised USD 600 million in the fundraising round led by Tiger Global Management.

- According to the E-commerce Foundation, North America has the world's highest social network penetration rate, driving its e-commerce industry. Despite reducing labor costs, installing delivery robots also helps hospitality establishments gain popularity on social networks, helping them improve their RevPAR. These activities are expected to keep a steady need for autonomous delivery robots from the hospitality sector.

- Various end-user industries are adopting autonomous robots, significantly expanding the ADR market's scope in the region. In August 2022, Ottonomy Inc. closed its USD 3.3 million seed funding round and declared Ottobot 2.0 the latest version of its autonomous delivery robot. In addition, the company intends to scale up its deployments of Ottobot in airports, retail stores, and restaurants.

- Furthermore, North American countries act as one of the significant forces catalyzing the growth of the logistics market in the region. As a result of extending trade volumes in the countries across the region, the need for goods in the region noticed a steep rise. In 2022, the region's logistics market grew by 5.31% on a YoY basis. In addition, the total commercial warehousing space witnessed a YoY increase of 9.77% in 2022, driven by growth in e-commerce and other factors. The need for cold chain facilities will witness robust growth during the forecast period. Such expansion in the region's logistic sector may further propel the studied market growth in the forecasted period.

- In October 2022, the US Department of Transportation invested around USD 31 million to expand cargo infrastructure and strengthen the supply chain. To modernize and upgrade rail infrastructure, the US government announced a funding amount of USD 1.4 billion in 2022. The Government of Mexico initiated a USD-44-billion plan for 2020-2024, focusing on transportation infrastructure under the National Private Sector Infrastructure Investment Agreement framework. The Government of Canada also invested over USD 2.3 billion in the National Trade Corridors Fund to enhance freight transportation.

Autonomous Delivery Robots Industry Overview

The Autonomous Delivery Robots Market is favorably competitive due to the presence of multiple regional players. The players are adopting strategies like partnerships, mergers, acquisitions, and product innovation to expand their geographic presence and stay ahead of the competitors. Some of the significant players in the Market are Starship Technologies, Ottonomy.IO, Nuro Inc., Relay Robotics, and Serve Robotics Inc., among others.

In May 2022, Uber Eats launched two autonomous delivery pilots in Los Angeles in collaboration with Serve Robotics, a robotic sidewalk delivery startup, and Motional, an autonomous car technology company.

In March 2022, Nvidia invested USD 10 million in Uber spinout Serve Robotics, a sidewalk robot delivery company. This investment by Nvidia will drive the studied Market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment Of Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Manage Last-mile Deliveries

- 5.1.2 Growing Automation in the Logistics Industry

- 5.2 Market Challenges

- 5.2.1 Weather Conditions and Security Issues

6 MARKET SEGMENTATION

- 6.1 By End Users

- 6.1.1 Healthcare

- 6.1.2 Hospitality

- 6.1.3 Retail & Logistics

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Starship Technologies

- 7.1.2 Relay Robotics, Inc.

- 7.1.3 Ottonomy.IO

- 7.1.4 Nuro Inc.

- 7.1.5 Serve Robotics Inc

- 7.1.6 Eliport

- 7.1.7 TeleRetail (Aitonomi AG)

- 7.1.8 Aethon Inc.

- 7.1.9 Kiwibot

- 7.1.10 Postmates Inc.

- 7.1.11 Segway Robotics Inc.

- 7.1.12 Neolix