|

市場調查報告書

商品編碼

1433488

產品資訊管理:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Product Information Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

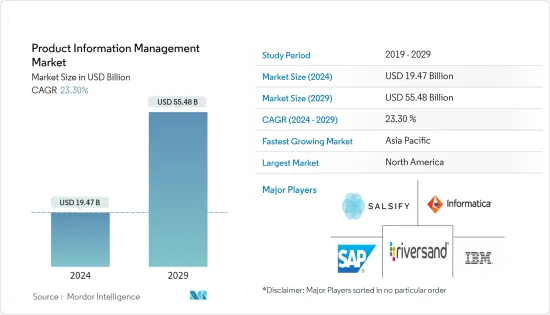

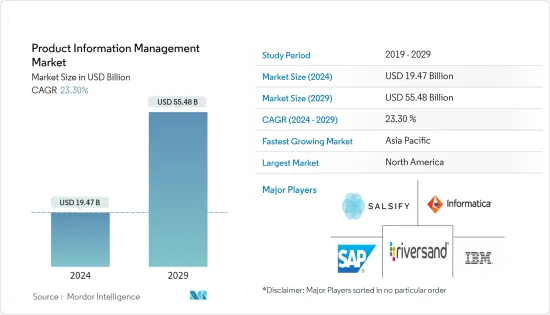

產品資訊管理市場規模預計到2024年為194.7億美元,預計到2029年將達到554.8億美元,在預測期內(2024-2029年)成長23.30%,預計複合年成長率為

產品資訊管理 (PIM) 解決方案是整合和管理公司產品資訊的流程和工具,以確保產品資料的單一、準確視圖。 PIM 提供了一個集中平台,可以經濟高效地收集有關公司產品和服務的資料。 PIM 有助於為所有客戶維護一致、高品質的產品資料和資訊。

主要亮點

- PIM 系統被各種組織用來收集核心產品資料(產品名稱、標題、描述)、產品屬性(SKU、成本、定價)、產品規格(尺寸、保固、包裝資訊等)、產品相關指標、全方位用於整合從多個資訊來源收集的各種產品訊息,如通路產品資訊(如手機文案)、擴展通路資訊(如Google/Amazon/Shopify)、商店特定資訊(POS收銀機和產品目錄)。 。

- 隨著資料生成的顯著增加,資料和資訊已成為組織和企業的支柱。近年來,由於對更好的客戶體驗的需求不斷成長,越來越多的專業人士開始關注產品資訊管理(PIM)系統。

- PIM軟體因其在零售和電子商務行業的不斷擴大的應用而受到廣泛關注。我們幫助線下零售商在數位領域發展,並支持 Amazon Go 等利用客戶資料來建立產品的新概念。隨著零售和電子商務業務的擴展以及必須管理的產品資料量的增加,PIM 系統被擴大引入。

- 最近,對SaaS(軟體即服務)版本的業務應用程式的需求顯著增加。雲端基礎的PIM 在那些喜歡輕鬆部署和協作、經濟實惠和可擴展性的組織中越來越受歡迎。

- 在COVID-19期間,以前透過實體店嚴格控制零售市場並依賴電子商務合作夥伴進行銷售的垂直整合品牌和製造商發現自己突然失去了對零售體驗的洞察力。我看到了親眼所見。與實體店相比,您沒有相同程度的可見度或控制力。為了避免在電子商務巨頭亞馬遜上進行零售,品牌商正在專注於 Shopify 等電子商務平台,這些平台允許製造商直接向消費者銷售產品,同時維護品牌和客戶資料。

產品資訊管理市場趨勢

零售業預計將推動市場成長

- 由於零售和電子商務領域越來越注重改善客戶體驗以及引入人工智慧和零售分析工具,預計零售和電子商務行業的產品資訊管理 (PIM) 採用率最高。

- 數位化使客戶能夠從各種來源獲取產品資訊。隨著電子商務的顯著成長,客戶的偏好和行為發生了巨大的變化。行動性和人工智慧的世界與智慧資料分析相結合,使世界各地的零售商能夠體驗有助於其業務的準確分析。

- 例如,印度品牌資產基金會 (IBEF) 表示,印度政府的「數位印度」計畫旨在到 2025 年推動印度成為價值數兆美元的線上經濟。這導致成立了一個新的指導小組來審查和分析政府電子商務平台的發展。

- IBEF 預計,到 2024 年,線上零售普及預計將達到 10.7%,高於 2019 年的 4.7%。同樣,到2025年,印度的網路買家數量預計將達到2.2億。根據 Payoneer 的報告,印度電子商務產業的跨國成長在全球排名第九。印度的電子商務預計將從 2020 年佔食品、雜貨、時尚和消費性電子產品總銷售額的 4% 成長到 2025 年的 8%。預計此類發展將推動研究市場。

- 因此,客戶轉換是零售商面臨的關鍵挑戰。他們競相透過提供獲取產品資訊的綜合解決方案來吸引有能力的消費者,從而加強資訊供應鏈。產品資訊管理解決方案管理這些資訊並為公司提供競爭優勢。 PIM 也用於管理由於行銷管道數量不斷增加而從各種來源產生的資料。

北美獲得主要收益佔有率

由於擴大採用先進技術來減少該地區企業的體力勞動和簡化工作流程,北美已成為一個重要的 PIM 市場。電子商務的成長也促進了市場的成長。該地區擁有強大的產品資訊管理 (PIM) 供應商立足點,推動了整體市場的成長。其中包括 IBM Corporation、Oracle Corporation、Riversand Technologies Inc. 和 Informatica LLC。

美國的電子商務銷售額也在成長。根據美國商務部統計數據的 Digital Commerce 360 分析,北美電子商務零售總額將在 2022 年成長,達到 1.3 兆美元。

網路購物銷售額的激增與新冠肺炎 (COVID-19) 有關,該病毒導致數百萬人出於健康和安全原因留在家裡,避免在商店購物。隨著零售和電子商務業務的擴展及其管理的產品資料量的增加,該地區擴大採用 PIM 解決方案。

Orgill Inc. 是全球最大的獨立分銷商之一,為美國和 60 多個國家的零售商提供超過 75,000 種產品和行業領先的零售服務。

Orgill 實施了 PIM 解決方案來管理公司的所有產品資訊並建立各種產品目錄、目錄和行銷材料。產品資訊也用於推廣公司的線上產品目錄。 PIM 解決方案支持 Orgill 的使命,即提供無與倫比的零售商支援和服務。

過去,加拿大領先的戶外和體育用品零售商 SAIL 選擇 inRiver PIM 來組織、管理和行銷其跨所有管道的廣泛產品系列。該公司選擇 PIM 來減少手動資料輸入、強大地存儲大量供應商資料並加快產品上市時間。

產品資訊管理產業概況

由於區域和國際參與者的存在,產品資訊管理市場競爭非常激烈。市場集中度適度,在激烈的競爭中,企業紛紛採取併購、產品創新等策略來維持市場地位。市場的最新發展包括:

- 2023 年 2 月:Lumavate 推出產品資訊管理 (PIM) 解決方案。負責人可以使用 Lumavate 的 PIM 在中央位置輕鬆建立和管理產品資料和數位資產。

- 2022 年 10 月:Agilis 和 SpecialChem 宣佈建立合作夥伴關係,將專為化學產業設計的雲端基礎的PIM 系統推向市場。 ionicPIM 是一款新產品,旨在幫助化學品製造商和分銷商維護所有產品資料和文件的單一來源。 ionicPIM 針對化學品進行了預先配置,使其易於實施和使用。生產商和經銷商還可以連結PIM以共用產品資訊。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產品資訊管理市場的影響

- 市場促進因素

- 改善客戶服務的需求不斷增加

- 對集中式資料管理工具的需求不斷成長

- 市場限制因素

- 資料外洩案例增加

第5章市場區隔

- 部署

- 雲

- 本地

- 奉獻

- 解決方案

- 服務

- 最終用戶產業

- BFSI

- 媒體娛樂

- 零售

- 能源/公共產業

- 衛生保健

- 資訊科技/通訊

- 運輸/物流

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- SAP SE

- Salsify Inc.

- Syndigo LLC

- Informatica LLC

- inRiver AB

- Stibo Systems Inc.

- EnterWorks Acquisition Inc.(Winshuttle Software)

- Agility Multichannel Limited

- IBM Corporation

- Pimcore USA

- Akeneo SAS

- Plytix Limited

- Riversand Technologies Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Product Information Management Market size is estimated at USD 19.47 billion in 2024, and is expected to reach USD 55.48 billion by 2029, growing at a CAGR of 23.30% during the forecast period (2024-2029).

Product information management (PIM) solutions are processes and tools that unify and manage a business' product information to secure a single, accurate view of product data. PIM offers a centralized platform to collect data on a business's products and services cost-effectively. PIM promotes the maintenance of consistent and quality product data and information for all customers.

Key Highlights

- A PIM system helps various organizations integrate various product information collected from multiple information sources, like core product data (product name, title, and description), product attributes (SKU, cost, and pricing), product specifications (e.g., dimensions, warranty, and packaging info), product-related metrics, omnichannel product information (e.g., mobile copy), extended channel information (Google/Amazon/Shopify/etc.), and store-specific information (POS registers and product catalogs).

- With the massive growth in data generation, data and information have become the backbone of organizations and businesses. Recently, more professionals have begun to pay attention to product information management (PIM) systems due to the growing demand for a better customer experience.

- The PIM software gained strong traction due to its growing application in the retail and e-commerce industries. It is helping offline retail outlets grow in digital spaces and assisting new concepts, like Amazon Go, leveraging customer data to build their product. With the expansion of retail and e-commerce businesses and the growing amount of product data to be managed, the adoption of PIM systems is on the rise.

- The demand for software-as-a-service (SaaS) versions of business applications has recently increased dramatically. Cloud-based PIM is becoming more popular among organizations that prefer the ease of deployment and collaboration, affordability, and the ability to scale.

- Amid COVID-19, vertically integrated brands and manufacturers that previously exercised tight control over the retail market with their brick-and-mortar stores witnessed a sudden loss of insight into the retail experience as they depended on e-commerce partners for sales. They do not have the same levels of visibility and control as they are used to when compared to a brick-and-mortar store. To avoid retailing on the e-commerce giant Amazon, brands have been focusing on e-commerce platforms, such as Shopify, which allow manufacturers to sell direct-to-consumer while maintaining their brand and customer data.

Product Information Management Market Trends

Retail Industry is Expected to Drive Market Growth

- The adoption of product information management (PIM) is expected to be the highest in the retail and e-commerce industry due to the growing focus on enhancing customer experience and the adoption of artificial intelligence and retail analytics tools in the retail and e-commerce sector.

- Due to digitization, customers can access product information through various sources. With the massive growth in e-commerce, customer preferences and behaviors have changed drastically. As the world of mobility and artificial intelligence combines intelligent data analytics, retailers worldwide can experience accurate analytics that is useful for their business.

- For instance, according to the India Brand Equity Foundation (IBEF), the Indian government's Digital India effort aims to drive it into an online economy worth trillions by 2025. It has led to the formation of a new steering group to review and analyze the development of an e-commerce platform for the government.

- According to IBEF, by 2024, online retail penetration will reach 10.7%, up from 4.7% in 2019. Likewise, by 2025, India's internet buyers will number 220 million. According to a Payoneer report, India's e-commerce sector is ranked 9th in the world for cross-border growth. E-commerce in India is expected to grow from 4% of total food and groceries, fashion, and consumer electronics retail sales in 2020 to 8% by 2025. Such developments are expected to drive the studied market.

- Hence, customer conversion is a significant challenge for retailers. They are competing to engage the empowered consumer by providing a comprehensive solution for accessing product information, thereby enhancing the information supply chain. Product information management solutions maintain a tab on this information and offer enterprises a competitive advantage. PIM is also used for managing data generated from various sources, owing to the increasing number of marketing channels.

North America to Acquire Major Revenue Share

North America is a prominent PIM market due to the growing adoption of advanced technologies to reduce manual tasks and streamline workflows among the region's enterprises. The growth in e-commerce also contributes to the market's growth. The region has a strong foothold on product information management (PIM) vendors, which drives the overall market's growth. Some include IBM Corporation, Oracle Corporation, Riversand Technologies Inc., and Informatica LLC.

E-commerce sales in the United States are also increasing. According to a Digital Commerce 360 analysis of US Department of Commerce figures, total e-commerce retail sales in North America climbed in 2022, reaching USD 1.03 trillion.

The surge in online shopping sales is related to COVID-19, which has caused millions of people to stay home for health and safety reasons and avoid in-store purchases. With the expansion of the retail and e-commerce businesses and the increasing amount of product data to be managed, the PIM solution's adoption is on the rise in the region.

Orgill Inc. is one of the world's largest independently owned hardlines distributors, providing retailers across the United States and over 60 countries with access to over 75,000 products and industry-leading retail services.

Orgill implemented the PIM solution to manage all the company's product information and produce its various product catalogs, directories, and marketing materials. The product information is also used to drive the company's online product catalog. PIM solution supports Orgill's mission to provide unparalleled retailer support and service.

In the past, SAIL, a large outdoor and sporting goods retailer based in Canada, selected inRiver PIM to organize, manage, and market its extensive product range for all its channels. The company chose PIM to reduce manual data entry, contain large quantities of supplier data powerfully, and cut down the time-to-market for their products.

Product Information Management Industry Overview

The product information management market is highly competitive due to the presence of regional and international players. The market appears to be moderately concentrated, with players adopting strategies like mergers and acquisitions and product innovations to maintain their position in the market, which holds an intense rivalry among the competitors. Some of the recent developments in the market are:

- February 2023: Lumavate launched its product information management (PIM) solution. Marketers can easily create and manage their product data and digital assets in a centralized location using Lumavate's PIM.

- October 2022: Agilis and SpecialChem announced a collaboration to bring a cloud-based PIM system designed specifically for the chemical industry to market. ionicPIM is a new product designed for chemical producers and distributors to help them maintain a single source for all product data and documents. Because ionicPIM is preconfigured for chemicals, it is simple to implement and use. It also enables producers and distributors to link their PIMs in order to share product information.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Product Information Management Market

- 4.4 Market Drivers

- 4.4.1 Growing Demand for Better Customer Service

- 4.4.2 Growing Demand for Centralized Data Management Tools

- 4.5 Market Restraints

- 4.5.1 Increasing Data Breaching Cases

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 Offering

- 5.2.1 Solution

- 5.2.2 Services

- 5.3 End-user industry

- 5.3.1 BFSI

- 5.3.2 Media and Entertainment

- 5.3.3 Retail

- 5.3.4 Energy and Utilities

- 5.3.5 Healthcare

- 5.3.6 IT and Telecommunications

- 5.3.7 Transportation and Logistics

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Salsify Inc.

- 6.1.3 Syndigo LLC

- 6.1.4 Informatica LLC

- 6.1.5 inRiver AB

- 6.1.6 Stibo Systems Inc.

- 6.1.7 EnterWorks Acquisition Inc. ((Winshuttle Software)

- 6.1.8 Agility Multichannel Limited

- 6.1.9 IBM Corporation

- 6.1.10 Pimcore USA

- 6.1.11 Akeneo SAS

- 6.1.12 Plytix Limited

- 6.1.13 Riversand Technologies Inc.