|

市場調查報告書

商品編碼

1433013

倉庫燻蒸劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Warehouse Fumigants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

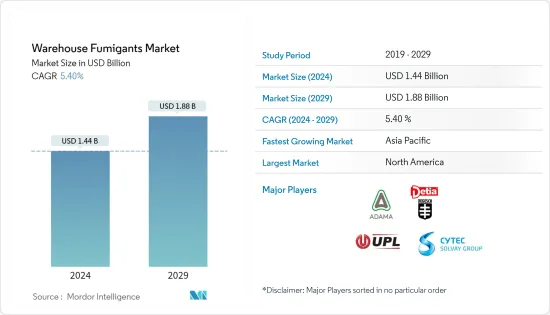

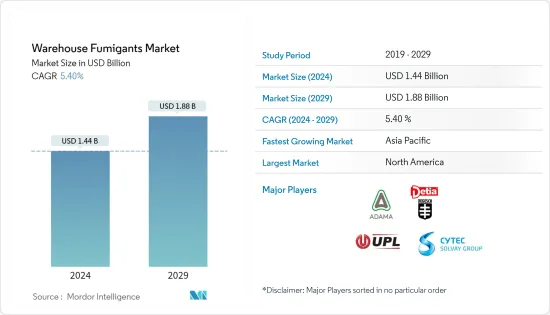

倉庫燻蒸劑市場規模預計2024年為14.4億美元,預計到2029年將達到18.8億美元,預測期內(2024-2029年)複合年成長率為5,預計將以40%的速度成長。

2018年,北美是受訪市場最大的區域部分,約佔全球市佔率的33.8%。按類型分類,磷化氫燻蒸劑產品領域在 2018 年佔據了最大的市場佔有率,為 26.3%,預計在預測期內仍將是成長最快的領域。

亞太地區被認為是倉庫燻蒸劑市場尚未開發潛力最大的地區。該市場受到多種因素的推動,包括該行業技術的快速進步、對收穫後損失的日益擔憂以及先進農業實踐的轉變導致產量增加。在植物中引入燻蒸劑將有助於使疾病遠離根部並提高產量。

倉庫燻蒸劑市場趨勢

害蟲防治的需求日益增加

在害蟲防治產業中,對糧食安全儲存和分配的最大自然威脅是蟲害。然而,燻蒸等工具對於害蟲防治來說比建築物和倉庫燻蒸更有效且更有效。由於氣候變化,包括氣溫上升,預計未來昆蟲數量將會增加,從而導致對燻蒸劑使用的依賴增加。燻蒸是消除家庭用品和出口材料中害蟲的常用方法,在新興經濟體廣泛採用。在全球範圍內,磷化氫和溴甲烷是兩種常用的用於保護儲存產品的燻蒸劑。

北美主導世界市場

2018年,北美地區對全球倉庫燻蒸劑消費量貢獻巨大,佔有率為33.8%,其中美國和加拿大約佔該地區市場的80%。北美是農業燻蒸劑的主要市場,有超過250種許可產品在主要國家銷售:美國和加拿大。在該地區倉庫和土壤中使用燻蒸劑的主要作物包括玉米、水稻、大麥、馬鈴薯、番茄、小麥、草莓和捲心菜。由於古巴、多明尼加共和國、哥斯達黎加和牙買加等國家的出口和儲存能力非常低,在監管禁令或對倉庫燻蒸劑使用的嚴格規定生效之前,成長率和市場佔有率預計將保持不變。完成了。

倉庫燻蒸劑產業概況

自2016年以來,全球倉庫燻蒸劑市場已變得碎片化,而且這個過程很可能會持續下去。收購、聯盟和擴張佔領先企業所採取策略的一半以上。如此活躍的併購活動背後的主要原因是為了整合兩家公司的新技術,為市場開發技術先進且易於使用的燻蒸劑。重大收購和產業聯盟旨在進行前向和後向整合,以加深市場滲透和定位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

市場區隔

- 類型

- 溴甲烷

- 硫醯氟

- 膦

- 磷酸鎂

- 磷化鋁

- 其他

- 目的

- 產品儲存保護

- 形狀

- 固體的

- 液體

- 氣體

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 荷蘭

- 波蘭

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- ADAMA Agricultural Solutions Ltd

- UPL Group

- Cytec Solvay Group

- Degesch America Inc.

- Douglas Products and Packaging Products LLC

- BASF SE

- Corteva Agriscience

- Reddick Fumigants, LLC

- Ikeda Kogyo Co., Ltd.

- Industrial Fumigation Company LLC

- Lanxess

- Nippon Chemical Industrial Co. Ltd

- Vietnam Fumigation Joint Stock Company

- Fumigation Services Pvt. Ltd

第7章 市場機會及未來趨勢

The Warehouse Fumigants Market size is estimated at USD 1.44 billion in 2024, and is expected to reach USD 1.88 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

In 2018, North America was the largest geographical segment of the market studied and accounted for a share of around 33.8% of the global market.By type, the phosphine-based fumigant product segment had the largest market share of 26.3% in 2018 and is expected to remain the fastest-growing segment during the forecast period.

Asia-Pacific has been identified as the region, which is yet to reach its maximum potential in the warehouse fumigant market. The market is driven by several factors, like rapid technological advancement in the sector, growing concerns over the post-harvest loss, and the shift in advance farming practices that led to increased yield. The introduction of fumigants to plants helps them keep the diseases away from their roots and to produce a better yield.

Warehouse Fumigants Market Trends

Increased Need for Pest Control

The largest natural threat to the safe storage and distribution of grains is insect infestation in the pest control industry. However, tools like fumigation are more effective in controlling pest infestations and are more effective, as compared to structural and warehouse fumigation. It is anticipated that due to climate changes, like an increase in temperature, the insect population is going to increase in the future, leading to increased dependence on the usage of fumigants. In order to control insects in commodities and export materials, fumigation is one of the general methods, which is adopted widely across emerging countries. Globally, phosphine and methyl bromide are the two common fumigants, which are used for stored product protection.

North America Dominates the Global Market

North America contributes a significant share of global warehouse fumigant consumption with a 33.8% share in 2018, with the United States and Canada accounting for around 80% of the regional market. North America is a major market for agriculture fumigants, with over 250 authorized products available in the main countries of the United States and Canada. The major commodities using fumigants for both warehouse and soil applications in the region are, corn, rice, barley, potato, tomato, wheat, strawberry, cabbage, etc. Due to very low export and storage capacities of countries like including Cuba, the Dominican Republic, Costa Rica, Jamaica and others, the growth rate, and market share are expected to remain constant until regulatory ban or stringent regulations on the usage of warehouse fumigants are brought into effect.

Warehouse Fumigants Industry Overview

The global warehouse fumigantsmarket has been getting into a fragmented shape since 2016, and this process is likely to continue in the future as well. Acquisitions, partnerships, and expansions account for more than half of the share among the strategies adopted by leading players. The main reason behind such intensive M&A activities, is the collaboration of new technology of the two companies, in order to develop technologically advanced and user-friendly fumigants for the market. The major acquisitions and industrial collaborations taking place are targeted toward forward and backward integration for deeper penetration and positioning in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Methyl Bromide

- 5.1.2 Sulfuryl Fluoride

- 5.1.3 Phosphine

- 5.1.4 Magnesium Phosphide

- 5.1.5 Aluminium Phosphide

- 5.1.6 Others

- 5.2 Application

- 5.2.1 Structural Fumigation

- 5.2.2 Commodity Storage Protection

- 5.3 Form

- 5.3.1 Solid

- 5.3.2 Liquid

- 5.3.3 Gas

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Italy

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 ADAMA Agricultural Solutions Ltd

- 6.3.2 UPL Group

- 6.3.3 Cytec Solvay Group

- 6.3.4 Degesch America Inc.

- 6.3.5 Douglas Products and Packaging Products LLC

- 6.3.6 BASF SE

- 6.3.7 Corteva Agriscience

- 6.3.8 Reddick Fumigants, LLC

- 6.3.9 Ikeda Kogyo Co., Ltd.

- 6.3.10 Industrial Fumigation Company LLC

- 6.3.11 Lanxess

- 6.3.12 Nippon Chemical Industrial Co. Ltd

- 6.3.13 Vietnam Fumigation Joint Stock Company

- 6.3.14 Fumigation Services Pvt. Ltd