|

市場調查報告書

商品編碼

1432984

共乘:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Ridesharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

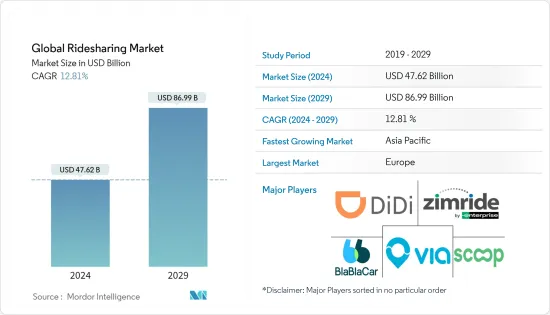

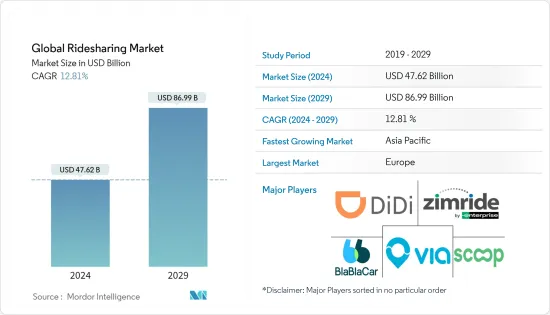

預計 2024 年全球共乘市場規模為 476.2 億美元,預計到 2029 年將達到 869.9 億美元,在預測期內(2024-2029 年)成長至 128.1 億美元,複合年成長率預計為 % 。

主要亮點

- 人們認為,對經濟高效且省時的交通選擇的需求不斷成長,推動了共乘市場的發展。汽車擁有成本的不斷上升、出於環境原因而需要最大限度地減少交通流量以及鼓勵共乘服務的政府法規都是推動全球普及共乘服務的重要因素。

- Waze、Carma、eRideShare、CarpoolWorld 等美國新興企業相信數位網路和智慧型手機將推動共乘市場。在歐洲,共乘等趨勢正在興起。法國的 BlaBlaCar 在全球擁有 4,000 萬用戶。英國有超過 50 萬人使用 Liftshare。推動共乘服務需求的另一個因素是交通。例如,在洛杉磯,平均通勤時間為 53.68 分鐘。在歐洲,英國的通勤時間長達 45 分鐘。因此,許多政府正在推廣共乘系統。舊金山灣區捷運系統 (BART) 推出了一項鼓勵共乘的新計畫。

- 在亞太地區和拉丁美洲,糟糕的大眾交通工具、不斷成長的人口和商業營運正在顯著增加對負擔得起且有效的出行的需求。在東南亞,共乘市場在過去兩三年急劇成長。許多全球供應商正在利用該地區共乘服務日益普及的機會,擴大在該地區的業務。

- 這些因素正在推動共乘應用程式的成長,這些應用程式正迅速成為該地區智慧交通的基石。根據 Dalia 的研究,該地區擁有智慧型手機的城市人口中有 45% 使用過共乘應用程式或網站,其中墨西哥以 58% 的比例領先。

- 最近的 COVID-19 大流行和世界各地的國家封鎖也影響了共乘產業。市場上的大多數供應商都已調整或暫停營業,以阻止冠狀病毒的傳播。在最近的封鎖期間,許多地區對共乘的需求有所下降,以至於目前不需要這些服務。 COVID-19 的爆發已將客戶關注點從叫車服務轉移到租車和擁有汽車。預計這將促使其中一些客戶轉向共乘服務,他們將主要看到促進因素。因此,長期車輛訂購和豪華汽車租賃的供應商正在成長。例如,印度自動駕駛汽車租賃公司 ZoomCar 預計,封鎖後個人出行需求將大幅成長,需求預計將增加三到四倍。這些趨勢可能會促使用戶從共乘車服務轉向共乘服務。

- 共乘業共乘越來越多的罷工要求提高薪資水平和監管、對非專業服務商進行刑事起訴、傳統交通服務的抵制以及複雜的交通規則都可能阻礙共乘市場的成長。

乘車共享市場的趨勢

COVID-19 對市場構成嚴重威脅

- 由於最近爆發的新冠肺炎 (COVID-19) 疫情,叫車和共乘服務的需求大幅下降。然而,隨著許多人現在轉向私家車,許多人相信共乘市場可能會再次崛起。

- 這一因素可能會促使固定乘車共享和企業乘車共享等乘車共享服務的增加。 Cars.com 於 2020 年 3 月中旬進行的一項全球調查顯示,超過 40% 的受訪者已停止使用共乘或叫車服務,以減少感染傳染性病毒的機會。超過 90% 的受訪者表示他們已經開始使用汽車,20% 的受訪者已經開始考慮投資購買新車。

- 許多政府也削減共乘和叫車服務,以控制污染程度。根據哈佛大學公共衛生學院 TH Chan 的研究,空氣污染水平較高 (PM 2.5) 的城市更容易感染 COVID-19 疾病。同樣,根據歐洲公共衛生聯盟 (EPHA) 的說法,空氣污染會增加 COVID-19 的影響。

- 2020 年 4 月,美國疾病管制與預防中心發布了針對共乘司機和其他駕駛職業(計程車、豪華轎車等)的新指南。 CarGurus 最近的 COVID-19 情緒調查顯示,從長遠來看,汽車銷售不太可能受到疫情的影響。約79%的受訪者因疫情延後了購車。同時,39% 的人表示他們計劃減少使用叫車服務或完全停止使用這些服務。

- 然而,毫無疑問,在未來幾個月內,COVID-19 大流行將改變交通運輸業,特別是在中國和印度等人口稠密的國家。汽車銷售的波動以及對 Uber 等叫車服務的信任度下降可能會為其他共乘和共乘服務創造空間。

- 在 COVID-19 大流行期間,許多市場供應商也在改變他們的產品,這有望建立他們的品牌形象並贏得客戶的信任。 例如,在德國,Berliner Verkerhsbetriebe (BVG) 提供一種名為 BerlKonig 的拼車服務。 在 COVID-19 大流行期間,他們暫停了正常運營。 取而代之的是,該公司在晚間和夜間時段為醫務人員提供免費乘車服務。

歐洲佔主要市場佔有率

- 都市化往往強調城市交通系統並影響人們的生活品質。出行選擇減少、交通基礎設施不足、擁擠加劇、污染和道路安全問題是需要採取系統方法的一些重要問題。

- 法國是主要的旅遊目的地之一,最美麗的城市是巴黎,是埃菲爾鐵塔、盧浮宮和迪士尼樂園的所在地。 巴黎市推出了世界上第一個全電動汽車共享服務Autolib,以促進電動汽車的共用文化,旨在通過電動汽車共用和電動汽車購買激勵措施來鼓勵可持續交通。 此外還構建了 Navigo 支付系統,通過提供易於使用的網路並允許客戶支付公共交通、汽車共用和自行車共用計劃來保證高客戶滿意度。 這些計劃可能會刺激拼車市場的擴張。

- 2000 年至 2019 年間,歐盟 28 國地區的汽車保有量顯著增加,從每 1,000 名居民 411 輛增加到超過 516 輛。然而,該產業現在預計將根據《巴黎協定》減少碳排放。例如,許多歐洲城市都採用了低排放區。

- 此外,MaaS(行動即服務)旨在創建一個簡化且獨特的市場,其中透過單一應用程式或等效應用程式提供許多行動服務。根據最近的一項調查,59% 的歐洲人對使用 MaaS 類型的應用程式感興趣。

- 在歐洲,共乘霸主地位的競爭對手包括美國公司和誕生於歐洲大陸的公司,每家公司都有自己的語言、行為和法律特徵,並且在不同的國家運作。 2021年2月,中國叫車巨頭滴滴出行科技有限公司計畫進軍西歐。總部位於北京的滴滴出遊正考慮今年上半年在英國、法國和德國等市場推出共乘服務。

- 此外,由於大流行,許多公司已開始提供新的支援服務。例如,2020 年 8 月,法國共乘公司 BlaBlaCar 宣布已將其用戶轉變為臨時志工網路。促銷者提出透過下載 BlaBlaHelp 向有需要的人提供所需的物品,以換取收取乘車費用。在此困難時期提供的技術快捷方式和幫助引起了用戶的共鳴,平台在 72 小時內就有超過 20,000 人註冊,自上線以來已有數千人關注。

共乘產業概述

由於主要參與者之間的激烈競爭,全球共乘市場高度分散。這個市場正在蓬勃發展,越來越多的新進業者進入市場,並以不同的獨特方法加劇競爭。大公司正試圖透過提供多種乘車共享應用程式的優惠來擴大用戶群。

- 2021 年 11 月 - Mahindra Logistics Ltd. (MLL) 收購了共乘公司 Meru Cabs。 Meru 加入 MLL 品牌將進一步加強 MLL 的行動業務。 MLL 已經成為企業行動服務 (ETMS) 業務的領導者,以「Alyte」品牌經營。透過此次收購,MLL 加強了其行動解決方案範圍,策略重點是企業客戶和電動車。

- 2021 年 9 月 - UCR 與 Commute with Enterprise 合作,為附近的通勤者提供共乘服務,使他們能夠共乘往返 UCR 校園的乘車服務。共乘有助於省錢、減少私家車磨損、縮短通勤時間、保持空氣清潔、減少溫室氣體排放、減少交通和停車堵塞。

- 2021年7月-Lyft、Argo AI和福特馬達公司在美國推出自動駕駛乘車共享服務,並合作將配備Argo自動駕駛系統的福特自動駕駛汽車引入Lyft的乘車共享網路,兌現了承諾。作為 Lyft 與其合作夥伴合作的一部分,該服務的首次亮相標誌著自動駕駛汽車首次在邁阿密提供共乘服務。這種獨特的合作關係提供了永續的自動駕駛叫車服務所需的一切,包括支援可擴展業務和提供卓越乘客體驗所需的自動駕駛技術、車隊和運輸網路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 成本優勢和共乘/企業共乘服務可用性的提高

- 法國等主要市場政府提供的獎勵和回扣

- 不斷上升的汽車持有成本和環境效益

- 市場課題

- 對最後一哩連線、產業動態以及叫車供應商雲端遷移的擔憂成為課題

- 市場機會

第6章市場區隔

- 依會員類型

- 固定共乘

- 動態共享出行

- 企業共乘

- 依服務類型

- 基於網路的

- 基於應用程式

- 基於網路/應用程式

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Zimride Inc.

- Kangaride Canada Co.

- CarpoolWorld(Datasphere Corporation)

- Via Transportation Inc.

- SPLT(Bosch)

- Scoop Technologies Inc.

- BlaBlaCar(Comuto SA)

- KINTO Join Limited

- GoMore

- Klaxit SAS(formerly Wayzup)

- Flinc GmbH(Daimler Mobility Services)

- Wunder Mobility Solutions GmbH

- Didi Chuxing Technology Co.

- HyreCar Inc

- Vride Inc(Acquired by Enterprise Holdings Inc)

第8章投資分析

第9章市場的未來

The Global Ridesharing Market size is estimated at USD 47.62 billion in 2024, and is expected to reach USD 86.99 billion by 2029, growing at a CAGR of 12.81% during the forecast period (2024-2029).

Key Highlights

- The Ridesharing market will be driven by increased demand for cost-effective and time-saving transportation. The rising expense of car ownership, the need to minimize traffic for environmental reasons, and government rules encouraging ridesharing services are all significant factors driving the global adoption of ridesharing services.

- Waze, Carma, eRideShare, and CarpoolWorld are some American startups that believe digital networks and smartphones will drive the ridesharing market. Trends such as carpooling are growing on in Europe; French BlaBlaCar already boasts 40 million users globally. Over 500,000 people in the UK use Liftshare. Another factor that will drive the need for ridesharing services is traffic. In Los Angeles, for example, the average commute time is 53.68 minutes. In Europe, Britons face the longest commute of up to 45 minutes. As a result, many governments are pushing ridesharing systems. San Francisco's (BART) Bay Area Rapid Transit system launched a new program to encourage carpooling.

- Due to bad public transportation systems and growing populations and business operations in Asia-Pacific and Latin America, the demand for affordable and effective mobility is developing significantly. Southeast Asia has seen a dramatic ridesharing market increase in the last 2-3 years. Many global vendors have taken advantage of the region's growth in popularity of ridesharing services and are growing their presence in the region.

- These factors fuel the ridesharing app's growth, rapidly becoming the foundation for smart transportation in the region. According to the Dalia survey, 45% of the region's smartphone-owning urban population has used a ridesharing app or site, with Mexico leading the way at 58%.

- The recent COVID-19 pandemic and nationwide lockdown across the world have impacted the ridesharing industry, too. Most of the market vendors have modified or suspended their businesses in an attempt to help stop the spread of coronavirus. In many regions during the recent lockdown, the demand for ridesharing has dropped to the point that these services aren't needed right now. The COVID-19 outbreak has turned customer attention away from ride-hailing services to car rental and owning a car. This is projected to drive some of these customers to ridesharing services, where the customer primarily verifies the driver. As a result, suppliers of longer-term vehicle subscriptions and rentals for premium cars are seeing growth. For example, ZoomCar, an Indian self-drive car rental company, anticipates a huge increase in demand for personal mobility post-lockdown and expects a 3-4 times increase in demand. These trends can also shift users away from ride-hailing services toward ridesharing services.

- Rising carpool operator strikes demanding better and regulated pay rates, criminal charges for nonprofessional drivers, resistance from traditional transportation services, and complex transportation rules may all hamper the growth of the ridesharing market.

Ridesharing Market Trends

COVID-19 Has Posed Significant Threat to the Market

- Due to the recent COVID -19 outbreak, ride-hailing and ridesharing have witnessed massive declines in demand. However, many believe the ridesharing market can emerge again, as many people are now shifting to personal cars.

- This factor may boost ridesharing services, like fixed ridesharing and corporate ridesharing. According to the recent global survey by Cars.com in mid-March 2020, over 40 % of the respondents had stopped using ridesharing and hailing services to reduce the odds of catching the contagious virus. Over 90% said that they had started using their cars, and 20 % of the respondents had already started looking at investing in buying a new vehicle.

- Many governments are also declining ridesharing and hailing services to control pollution levels. According to a study by Harvard University's T. H . Chan School of Public Health, cities with higher air pollution levels (PM 2.5) are more susceptible to COVID-19. Similarly, as per the European Public Health Alliance (EPHA), air pollution can increase the impact of COVID-19.

- In April 2020, the Centers for Disease Control and Prevention issued new guidelines for rideshare drivers and other driving occupations (taxis, limousines, etc.). CarGurus's recent COVID -19 sentiment study shows that car sales are unlikely to be affected by the pandemic in the long term. Around 79% of respondents delayed their car purchases due to the pandemic. Meanwhile, 39% said they would reduce their ride-hailing service consumption or stop using them entirely.

- However, in the coming months, the COVID-19 pandemic will undoubtedly change the transport sector, especially in population-dense countries, like China and India. The fluctuating vehicle sales and reduced trust in ride-hailing services like Uber may develop a space for other carpooling and ridesharing services.

- Many market vendors are also changing their offerings amid the COVID-19 pandemic, which is expected to create a brand image and help them gain customers' trust. For instance, in Germany, Berliner Verkerhsbetriebe (BVG) offers BerlKonig, a rideshare service. It suspended its regular operations during the COVID-19 outbreak. Instead, the company offers free lifts to medical staff during evening and nighttime hours.

Europe to Account for Significant Market Share

- Urbanization has stressed the urban transportation systems that tend to affect the population's quality of life. The reduced mobility options, inadequate transportation infrastructure, increasing congestion, pollution, and traffic safety problems, are a few crucial problems that need a systematic approach to be resolved.

- France is one of the most prominent tourist spots, the most beautiful city is Paris with Eiffel Tower, Louvre museum, and Disneyland. Paris intends to encourage sustainable transport through electric carsharing and EV purchase incentives and has launched the world's first fully electric carshare service, Autolib, to inculcate sharing culture. Furthermore, it has created a Navigo payment system that ensures great customer satisfaction by providing an easy-to-use network and allowing customers to pay for public transportation, car sharing, and bike-sharing programs. These plans are likely to stimulate the expansion of the ridesharing market.

- Car ownership in the EU-28 area increased considerably between 2000 and 2019, growing from 411 cars per thousand inhabitants to more than 516. However, the industry is now expected to reduce its carbon emissions in line with the Paris Agreement. Many European cities, for example, have adopted low-emission zones.

- Moreover, MaaS (Mobility as a Service) aims to create a simplified and unique marketplace where many mobility services will be offered through a single app or equivalent. According to a recent survey, 59% of Europeans are interested in using a MaaS-type app.

- In Europe, the contenders for ridesharing supremacy include American companies and those born on the continent, operating in various countries, all with their own linguistic, behavioral, and legal particularities. In February 2021, Chinese ride-hailing giant Didi Chuxing Technology Co. planned to make its debut in Western Europe. Beijing-based Didi is considering rolling out ridesharing services in markets that could include the UK, France, and Germany by the first half of this year.

- Furthermore, due to the pandemic, many companies have begun to offer new services to assist. For instance, in August 2020, the French ridesharing company BlaBlaCar announced that it had turned its users into a makeshift volunteer network. Instead of being paid for the rides, drivers offered to deliver the essential items to people who needed them by downloading BlaBlaHelp. This tech shortcut and the help in these difficult times struck a chord within the users, as more than 20,000 people registered on the platform within 72 hours, and thousands have followed since the launch.

Ridesharing Industry Overview

The Global Ridesharing Market is quite fragmented, as there is high competition in the market among major players. Since this market is booming, more new entrants are entering the market, creating more competition with their various unique approaches. And the major players are trying to increase their user base by providing multiple offers where they could utilize the ridesharing apps.

- November 2021 - Mahindra Logistics Ltd. (MLL) acquired Meru Cabs, a ridesharing company. Adding Meru under the MLL brand will further strengthen MLL's mobility business. MLL is already a leader in its Enterprise Mobility Service (ETMS) business, which operates under the 'Alyte' brand. With this acquisition, MLL will enhance its range of mobility solutions with a strategic focus on enterprise customers and electric mobility.

- September 2021 - UCR Partners with Commute with Enterprise to provide vanpool services to commuters living within close proximity of each other and allows them to share the ride to and from the UCR campus. Vanpooling can save their money, reduce wear and tear on their personal vehicle, reduce commute time, help keep the air-breathing cleaner, lower greenhouse gas emissions, and reduce both traffic and parking congestion.

- July 2021 - Lyft, Argo AI, and Ford Motor Company have launched autonomous ridesharing services in Miami, United States, fulfilling a joint commitment to deploy Ford's autonomous vehicles, powered by the Argo Self-Driving System on Lyft's ridesharing network. As part of the collaboration between Lyft and its partners, the debut of this service marks the first time autonomous vehicles are available for ridesharing in Miami. The unique partnership will bring together all components required to build a sustainable autonomous ride-hailing service, including the self-driving technology, vehicle fleet, and transportation network needed to support a scalable business and provide an amazing rider experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services

- 5.1.2 Incentives and Rebates Provided by Governments in Major Markets, such as France

- 5.1.3 Increasing Cost of Vehicle Ownership and Environmental Benefits

- 5.2 Market Challenges

- 5.2.1 Last-mile Connectivity Concerns and Dynamic Nature of the Industry and Increasing Cloud of Ride-hailing Vendors to Pose a Challenge

- 5.3 Market Opportunties

6 MARKET SEGMENTATION

- 6.1 By Membership Type

- 6.1.1 Fixed Ridesharing

- 6.1.2 Dynamic Ridesharing

- 6.1.3 Corporate Ridesharing

- 6.2 By Service Type

- 6.2.1 Web Based

- 6.2.2 App Based

- 6.2.3 Web and App Based

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zimride Inc.

- 7.1.2 Kangaride Canada Co.

- 7.1.3 CarpoolWorld (Datasphere Corporation)

- 7.1.4 Via Transportation Inc.

- 7.1.5 SPLT (Bosch)

- 7.1.6 Scoop Technologies Inc.

- 7.1.7 BlaBlaCar (Comuto SA)

- 7.1.8 KINTO Join Limited

- 7.1.9 GoMore

- 7.1.10 Klaxit SAS (formerly Wayzup)

- 7.1.11 Flinc GmbH (Daimler Mobility Services)

- 7.1.12 Wunder Mobility Solutions GmbH

- 7.1.13 Didi Chuxing Technology Co.

- 7.1.14 HyreCar Inc

- 7.1.15 Vride Inc (Acquired by Enterprise Holdings Inc)