|

市場調查報告書

商品編碼

1432945

CMOS影像感測器:市場佔有率分析、產業趨勢、成長預測(2024-2029)CMOS Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

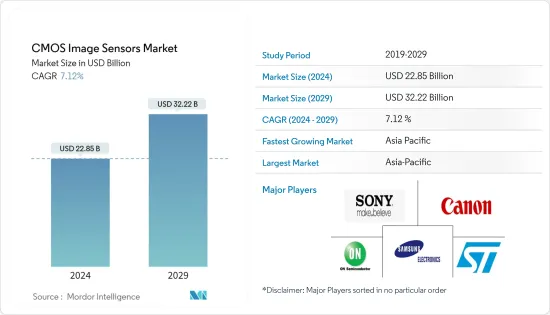

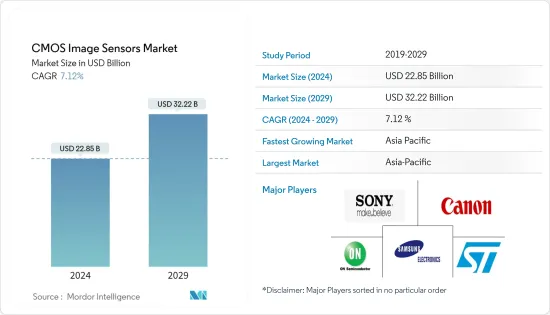

預計 2024 年 CMOS 影像感測器市場規模為 228.5 億美元,預計到 2029 年將達到 322.2 億美元,預測期內(2024-2029 年)複合年成長率為 7.12%。

主要亮點

- 各行業對高解析度影像擷取設備的需求不斷成長,推動了 CMOS(互補型金屬氧化物半導體)技術的廣泛採用。該技術不僅可以實現百葉窗速度,還可以確保高品質的影像。

- 全球CMOS影像感測器市場正在經歷顯著成長,這主要是由於智慧型手機需求的不斷成長。智慧型手機中帶有影像感測器的相機的普及尤其有利於消費性電子產業。智慧型手機製造商正在透過在單一設備中整合多達五個攝影機來應對行動電話攝影的日益普及。這些 CMOS 影像感測器無所不在,不僅存在於智慧型手機中,還存在於筆記型電腦和數位單鏡反光 (DSLR) 相機中。

- 隨著智慧型手機普及的提高,相機與智慧型手機的整合大大增強了影像捕捉能力。這些因素將推動影像感測器市場向前發展。

- 同時,創新正在呈指數級成長對智慧型手機相機產生最高品質影像和 CMOS 技術的需求。此外,機器視覺系統的採用、自動駕駛汽車和高級駕駛輔助系統 (ADAS) 的出現進一步增加了對 CMOS 感測器的需求。

- 儘管 CCD(電荷耦合元件)感測器因其成熟度和高品質而在許多工業應用中變得普及,但對 CMOS 感測器的需求仍然存在。 CCD感測器以其高影像品質、高解析度影像和出色的感光度與CMOS感測器競爭。這種競爭預計將限制市場成長。

- 由於全球供應鏈停工和中斷,電子和半導體產業在 COVID-19 大感染疾病期間面臨重大挫折。儘管如此,由於消費性電器產品和汽車產業的需求不斷成長,預計全球 CMOS 影像感測器市場仍將出現強勁成長。

CMOS影像感測器市場趨勢

汽車和交通運輸行業將成為成長最快的最終用戶

- 各類車輛擴大採用先進駕駛輔助系統 (ADAS),這使得汽車和交通運輸領域對 CMOS 影像感測器的需求迅速增加。將高性能保護功能整合到汽車系統中正在影響攝影機感測器系統的廣泛採用,特別是在全球即將推出的無人駕駛和自動駕駛汽車的背景下。自動駕駛和聯網汽車的持續發展正在為新的市場機會鋪平道路。

- 例如,聯邦運輸管理局(FTA)最近宣布了示範計劃的重大機會。這將提供高達 650 萬美元的資金,其中包括 500 萬美元用於公車 ADAS 以及另外 150 萬美元用於自動化公車維護的初始階段。和堆場作業。此外,2023 年 4 月,英國宣布核准福特先進駕駛輔助系統 (ADAS) BlueCruise 的免持駕駛技術,該技術將在該國高速公路上發揮引領作用。

- 此外,根據 IEA資料,電動車已成為道路交通脫碳的關鍵技術,因為該產業佔全球能源相關排放的 15% 以上。近年來,由於續航里程的進步、車型的廣泛可用性和性能的提高,電動車銷量迅速成長。搭乘用電動車發展勢頭強勁,IEA 預測 2023 年售出的新車中 18% 將是電動車,其中歐洲、中國和美國將引領電動車市場。

- 國家安全委員會預測,到2026年,約71%的註冊車輛將配備後置鏡頭,60%將配備後停車感應器。 ADAS 的廣泛採用預計將顯著推動市場成長。

- 根據世界經濟論壇預測,到2035年,預計每年將售出1,200萬輛全自動駕駛汽車,佔全球汽車市場的25%。聯網汽車和電動車的需求激增推動了 CMOS 影像感測器市場的創新和產品開發。主要市場供應商都專注於產品創新,以滿足不斷成長的消費者需求。

美洲預計將出現顯著成長

- 由於行動相機模組和其他行動裝置使用率較高的消費性電器產品市場的存在,CMOS 影像感測器在美國得到越來越多的採用。在消費性電器產品,智慧型手機已成為主要的拍照設備,壓倒了相機和數位單眼相機。智慧型手機領域的激烈競爭促使製造商提供更好的相機來擊敗競爭對手,從而導致該領域的技術創新投入大量資金。

- 美國人口普查局估計 2022 年至 2023 年智慧型手機銷售額為 747 億美元。成長放緩是美國智慧型手機出貨下降的結果。在經濟挑戰、高通膨和季節性需求疲軟的背景下,低階智慧型手機銷量下降是導致經濟下滑的最大因素。然而,這種情況預計將在未來幾年內結束。這些銷售趨勢預計將對消費電子領域 CMOS 影像感測器的成長產生重大影響,該領域不僅包括智慧型手機,還包括個人電腦、筆記型電腦、平板電腦等。

- 除此之外,機器人攝影機已成為各行業的革命力量,改變了我們拍攝、監控以及與周圍環境互動的方式。這些先進的設備配備了尖端技術,具有許多優點,使其成為從監控和安全到製造和娛樂等應用的寶貴資產。因此,CMOS 感測器在產生數位影像方面更有效率,並且比 CCD 消耗更少的功率。它們可以比 CCD 更大,從而可以提供更高解析度的圖像,並且與 CCD 相比製造起來更經濟,從而增加了區域市場的需求。

- 由於車輛駕駛員輔助系統擴大使用生物識別、醫療和膠片相機等影像感測器設備,安全和監控設備預計將在未來成為一個巨大的市場。此外,在美國等國家,無人機被廣泛用於進行勘察,製造商一直在尋找能夠從高空捕捉影像的相機。具有高百萬像素解析度和小感測器尺寸的相機可能會受到影像衍射效應的影響。

- 這影響了對 CMOS 影像感測器的需求,該感測器擴大用於汽車應用。例如,根據 OICA 的數據,到 2022 年,墨西哥將以 3,509,800 輛的銷量成為拉丁美洲地區領先的汽車製造商,其次是巴西(2,369.77 輛)、阿根廷(536.9 輛)和哥倫比亞(51.46 輛)。

CMOS影像感測器產業概況

CMOS 影像感測器市場高度分散,主要企業包括意法半導體、索尼集團公司、三星電子、安森美半導體公司和佳能公司。這些公司利用合作夥伴關係和收購等策略來加強產品系列建立持久的競爭優勢。邊緣。

2023年9月,Sony Semiconductor Solutions Corporation發表了IMX735,這是一款汽車攝影機的尖端CMOS影像感測器,有效像素數達到業界領先,達到1,742萬像素。這項創新產品將加強具有先進感測和識別能力的汽車攝影機系統的開發,並將為促進安全可靠的自動駕駛做出巨大貢獻。

此外,2023 年 1 月,三星電子發布了最新的 2000 萬像素 (MP) 影像感測器 ISOCELL HP2。該感測器採用增強的像素技術和增強的全井容量,可為高階智慧型手機提供令人驚嘆的行動影像。 ISOCELL HP2 具有 2 億個 1/1.3 吋光學格式的 0.6微米(μm) 像素,這種感光元件尺寸廣泛用於領先的 108MP 智慧型手機相機,讓消費者可以輕鬆使用他們最新的高階智慧型手機。體驗更高的解析度。相機的突出部分變大了。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 擴大CMOS影像感測器在消費性電子領域的引入

- 4K像素技術在安防監控領域的出現

- 市場限制因素

- 與CCD感測器的競爭

第 6 章 技術概覽

- 依通訊類型

- 有線

- 無線的

第7章市場區隔

- 按最終用戶產業

- 消費性電子產品

- 衛生保健

- 產業

- 安全/監控

- 汽車與運輸

- 航太/國防

- 計算

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章 競爭形勢

- 公司簡介

- STMicroelectronics NV

- Sony Corporation

- Samsung Electronics Co. Ltd

- ON Semiconductor Corporation

- Canon Inc.

- SK Hynix Inc.

- Omnivision Technologies Inc.

- Hamamatsu Photonics KK

- Panasonic Corporation

- Teledyne Technologies Inc.

- GalaxyCore Shanghai Limited Corporation

- 供應商市場佔有率分析

第9章投資分析

第10章市場機會與未來趨勢

The CMOS Image Sensors Market size is estimated at USD 22.85 billion in 2024, and is expected to reach USD 32.22 billion by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

Key Highlights

- The rising demand for high-definition image-capturing devices in various industries has spurred a significant adoption of CMOS (Complementary Metal-Oxide-Semiconductor) technology. This technology not only provides faster shutter speeds but also ensures high-quality images.

- Primarily driven by the increasing demand for smartphones, the global CMOS image sensors market has seen substantial growth. The widespread use of cameras with image sensors in smartphones has particularly benefited the consumer electronics industry. Smartphone producers are responding to the surge in popularity of cell phone photography by incorporating up to five cameras into a single device. These CMOS image sensors are omnipresent, found not only in smartphones but also in laptops and digital single-lens reflex (DSLR) cameras.

- Integration of cameras into smartphones has significantly augmented image capturing, aligning with the expanding smartphone penetration rate. These factors are poised to propel the image sensor market forward.

- Simultaneously, the demand for producing top-quality images in smartphone cameras and for CMOS technology is exponentially increasing due to innovations. Moreover, the adoption of machine vision systems and the emergence of self-driving cars and advanced driver assistance systems (ADAS) further drive the demand for CMOS sensors.

- Despite the prevalence of CCD (Charge-Coupled Device) sensors in many industrial applications due to their maturity and higher quality, the demand for CMOS sensors persists. CCD sensors excel in high-quality, high-resolution images and excellent light sensitivity, providing competition to CMOS sensors. This competition is expected to limit the market's growth.

- The electronics and semiconductor industries faced significant setbacks during the COVID-19 pandemic due to closures and disruptions in the global supply chain. Despite this, the anticipated growth of the global CMOS image sensors market remains strong, driven by increased demand from the consumer electronics and automotive sectors.

CMOS Image Sensors Market Trends

Automotive and Transportation Industry to be the Fastest Growing End User

- The demand for CMOS image sensors in the automotive and transportation sectors is rapidly expanding due to the increasing adoption of advanced driver-assistance systems (ADAS) across various categories of vehicles. The integration of high-performance protective functions into automotive systems has influenced the widespread adoption of camera sensor systems, particularly in the context of upcoming driverless autonomous vehicles worldwide. The ongoing development of autonomous and connected vehicles is paving the way for new market opportunities.

- For instance, the Federal Transit Administration (FTA) recently announced a substantial opportunity for demonstration projects, offering up to USD 6.5 million, including USD 5 million for ADAS in Transit Buses and an additional USD 1.5 million for the initial phase of Automated Transit Bus Maintenance and Yard Operations. Additionally, in April 2023, the UK announced the approval of hands-free driving technology through Ford's advanced driver-assistance system (ADAS), BlueCruise, set to lead the way on the country's motorways.

- Moreover, electric vehicles have emerged as a pivotal technology for decarbonizing road transport, given that this sector contributes over 15% of global energy-related emissions, as per IEA data. Recent years have witnessed exponential growth in EV sales, with advancements in range, broader model availability, and enhanced performance. Passenger electric cars are gaining traction, and the IEA estimates that 18% of new cars sold in 2023 will be electric, with Europe, China, and the US leading the electric vehicle markets.

- The National Safety Council projects that by 2026, approximately 71% of registered vehicles will feature rear cameras, while 60% will be equipped with rear parking sensors. This widespread adoption of ADAS is expected to fuel the market's growth significantly.

- According to the World Economic Forum, an estimated 12 million fully autonomous cars are projected to be sold annually by 2035, encompassing 25% of the global automotive market. This surge in demand for connected and electric vehicles has spurred innovation and product development in the CMOS image sensor market. Key market vendors are concentrating on product innovation to meet the escalating consumer demand.

Americas is Expected to Witness Significant Growth

- The growing adoption of CMOS image sensors across the United States is due to the strong presence of the consumer electronics market, which is fueling the usage of mobile camera modules and other portable devices at a high rate. In consumer electronics, the smartphone has become the primary camera device, dominating cameras and DSLRs. Heavy competition in the smartphone segment has driven manufacturers to provide better cameras to have the edge over the competition, resulting in high investments in technology innovations in this field.

- The US Census Bureau estimated the smartphone sales value at USD 74.7 Billion in 2022-2023. This sluggish growth is an outcome of declined shipments of smartphones in the US. Low-end smartphone sale declines were the biggest contributing factor to the downturn amid economic challenges, high inflation, and poor seasonal demand; however, this is expected to end in the upcoming years. These sales trends are expected to have a significant impact on the growth of CMOS image sensors in the consumer electronics segment, which not only includes smartphones but also PCs, laptops, and tablets.

- In addition to this, robotic cameras have become a revolutionary force in various industries, transforming the way of capturing, monitoring, and interacting with surroundings. These sophisticated devices, equipped with cutting-edge technology, offer a plethora of advantages, making them invaluable assets in applications ranging from surveillance and security to manufacturing and entertainment. Thus, CMOS sensors are more efficient in generating a digital image and consume less power than a CCD. They can be larger than a CCD, enabling high-resolution images, and their manufacture is more economical when compared to a CCD, thus driving the demand in the regional market.

- With the increase in the use of image sensor devices in biometrics, medical, and film cameras by vehicle driver assistance systems, security, and surveillance devices are expected to have a substantial market in the future. Moreover, drones are widely used in countries such as the United States to conduct surveys, and manufacturers are constantly looking for cameras that can capture images from altitude. Cameras with high megapixel resolution and small sensor sizes can be subject to image diffraction effects.

- This is impacting the demand for CMOS image sensors as they are increasingly being used in automotive applications. For instance, according to OICA, in 2022, Mexico was the leading motor vehicle manufacturer in the Latin American region, with 3,509.8 thousand vehicles, followed by Brazil (2,369.77), Argentina (536.9), and Colombia (51.46).

CMOS Image Sensors Industry Overview

The CMOS image sensor market exhibits high fragmentation, with major players such as STMicroelectronics NV, Sony Group Corporation, Samsung Electronics Co. Ltd, ON Semiconductor Corporation, and Canon Inc. These entities are leveraging strategies like partnerships and acquisitions to enrich their product portfolios and establish enduring competitive edges.

In September 2023, Sony Semiconductor Solutions Corporation unveiled the IMX735, a cutting-edge CMOS image sensor designed for automotive cameras, boasting an industry-leading pixel count of 17.42 effective megapixels. This innovative product is poised to bolster the development of automotive camera systems capable of sophisticated sensing and recognition, contributing significantly to the advancement of safe and secure automated driving.

Additionally, in January 2023, Samsung Electronics introduced its latest 200-megapixel (MP) image sensor, the ISOCELL HP2. This sensor incorporates enhanced pixel technology and increased full-well capacity, delivering stunning mobile images for premium smartphones. Packed with 200 million 0.6-micrometer (μm) pixels within a 1/1.3" optical format, a sensor size widely used in 108MP primary smartphone cameras, the ISOCELL HP2 enables consumers to experience even higher resolutions in the latest high-end smartphones without larger camera protrusions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Implementation of CMOS Image Sensors in the Consumer Electronics Segment

- 5.1.2 Emergence of 4K Pixel Technology in the Security and Surveillance Sector

- 5.2 Market Restraints

- 5.2.1 Competition from CCD Sensor

6 TECHNOLOGY SNAPSHOT

- 6.1 By Communication Type

- 6.1.1 Wired

- 6.1.2 Wireless

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 Consumer Electronics

- 7.1.2 Healthcare

- 7.1.3 Industrial

- 7.1.4 Security and Surveillance

- 7.1.5 Automotive and Transportation

- 7.1.6 Aerospace and Defense

- 7.1.7 Computing

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 STMicroelectronics NV

- 8.1.2 Sony Corporation

- 8.1.3 Samsung Electronics Co. Ltd

- 8.1.4 ON Semiconductor Corporation

- 8.1.5 Canon Inc.

- 8.1.6 SK Hynix Inc.

- 8.1.7 Omnivision Technologies Inc.

- 8.1.8 Hamamatsu Photonics KK

- 8.1.9 Panasonic Corporation

- 8.1.10 Teledyne Technologies Inc.

- 8.1.11 GalaxyCore Shanghai Limited Corporation

- 8.2 Vendor Market Share Analysis