|

市場調查報告書

商品編碼

1432944

紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

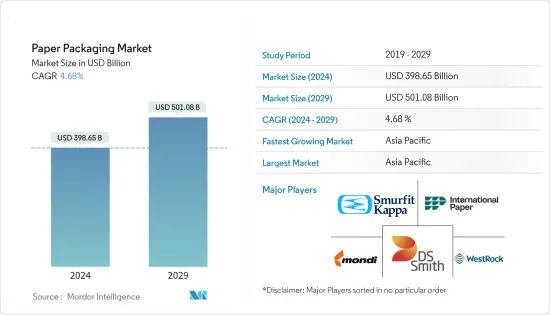

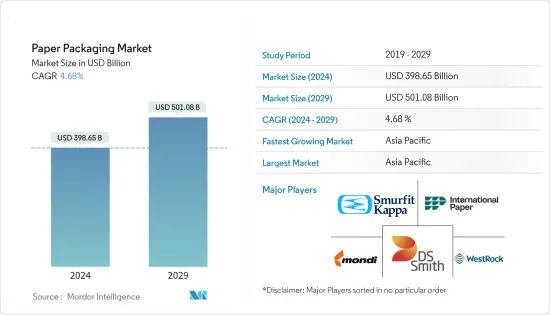

紙包裝市場規模預計到2024年為3,986.5億美元,預計到2029年將達到5,010.8億美元,在預測期內(2024-2029年)複合年成長率為4.68%。

主要亮點

- 紙包裝是保護、保存和運輸各種產品的多功能且經濟高效的方式。此外,它還可以進行客製化以滿足客戶和產品的特定需求。重量輕、生物分解性、可回收等特點是紙包裝的優勢,使其成為包裝中必不可少的元素。

- 世界各地的消費者越來越意識到包裝的環境風險,並正在將他們的購買習慣轉向更環保的選擇。消費者、政府和媒體正在向製造商施加壓力,要求其產品、包裝和工藝更加環保。人們願意為環保包裝付出金額的錢。由於這些趨勢,紙板包裝行業預計將成長。

- 電子商務銷售的擴大和折疊式紙盒包裝需求的增加正在推動市場的發展。然而,高性能替代品的可用性可能會限制市場成長。紙板包裝是最受歡迎的環保包裝選擇之一。與笨重的包裝解決方案相比,這種包裝型態可以生產各種尺寸且佔地面積小,使其適合幾乎所有最終用戶領域。

- 紙包裝市場面臨的一個主要挑戰是需要紙張來包裝非常重的材料,導致該行業被聚合物和金屬包裝行業取代。此外,為取得原料而砍伐森林以及造紙過程中戴奧辛的釋放也造成了環境問題。這些因素都阻礙了紙包裝市場的成長。

- 由於 COVID-19 大流行,包裝行業面臨一些重大挑戰,包括全國範圍內封鎖的影響、公司轉向從中國採購,以及重新考慮包裝中使用的材料。儘管紙包裝的供應端受到顯著影響,但部分應用領域終端用戶需求的大幅增加,使得紙包裝的範圍明顯擴大。

- 據 Packaging Gateway 稱,自 2022 年 5 月 3 日衝突爆發以來,已有 560 萬人離開烏克蘭。衝突已導致300多家西方大型公司撤離該國,並關閉了俄羅斯和烏克蘭的眾多生產和包裝設施。一些公司最初對暫停、縮減或關閉業務猶豫不決,因為他們尚不確定疫情何時結束。 4月初,在俄羅斯經營超過30年的芬蘭食品包裝公司Huhtamaki和愛爾蘭紙包裝公司Smurfit Kappa兩家公司加入了離開俄羅斯的公司名單。

紙包裝市場趨勢

食品和飲料預計將佔據很大的市場佔有率

- 紙和紙板是最常見的食品包裝材料。紙張是包裝的環保選擇,也是食品的理想選擇。主要用於與食品直接接觸的包裝以及運輸和儲存初級包裝。紙和紙板也用於製造微波爐爆米花袋、烘焙紙和速食容器。預計這些將推動全球紙包裝的成長。紙包裝市場的成長預計將受到消費者對包裝食品,尤其是包裝食品宅配的高度認知的推動。

- 此外,紙張是最容易取得且最便宜的資源之一。它廣泛用於食品和飲料行業的包裝以及紙張生產。這些材料可以回收利用,為包裝應用和其他含有飲料的接觸物品(如杯子、袋子和液體包裝)製作出色的模製品。這場大流行凸顯了健康和保健的重要現實以及消費者飲食和生活方式決定的重要性。根據英敏特全球 COVID-19 追蹤報告,消費者最重視健康飲食。

- 大多數消費者都過著忙碌的生活方式。因此,消費者不斷尋求更容易拿起、處理、食用和運輸的食品。品牌正在努力透過使食品包裝更加攜帶來滿足這一需求。包裝製造商依賴紙質包裝來包裝食品,因為它極其輕巧且易於運輸。此外,近年來食品包裝變得更加環保。為了尋求環保的解決方案,大公司已經放棄使用一次性塑膠,轉而生物分解性、可回收或可重複使用的包裝。

- 此外,食品工業的成長推動了對折疊紙盒、瓦楞紙箱和液體紙板箱的需求,而已調理食品、冷凍食品和包裝商品的需求不斷成長,也推動了食品工業的成長。例如,根據美國人口普查局的數據,2022年美國零售食品和飲料商店銷售額將達到每年約9,470億美元,比前一年穩步成長,並增加了過去五年中記錄的金額,因此,增幅食品和飲料銷售的成長將影響紙包裝市場的成長。

- 此外,全國飲料包裝模式的快速轉變是產業擴張的主要因素之一。創新包裝解決方案的使用顯著增加。創建能夠與產品及其周圍環境相互作用的新型活性系統、提高客戶接受度、食品安全和各種飲料的保存期限是飲料包裝最新發展的主要領域。

亞太地區預計將佔據主要市場佔有率

- 亞太地區預計將出現顯著成長。這是由於全部區域生產設施數量不斷增加、消費者意識不斷增強以及亞太地區運輸包裝產業的擴張。由於中國和印度開發中國家對紙漿和紙張的需求不斷成長,預計該地區的擴張速度最快。在中國,運輸包裝市場隨著消費的成長而不斷成長,紙包裝的需求量迅速增加。

- 城市人口的增加、電子商務包裝行業的發展、紙漿價格的下降以及公眾對環保包裝意識的增強預計將推動中國紙包裝市場的發展。此外,該行業的主要趨勢和發展包括折疊式紙板消費量的增加、箱板紙產能的增加以及技術突破。

- 此外,中國等開發中國家對紙漿的需求正在增加,中國的人均紙張使用量成長最快。中國紙包裝產業的成長進一步受到蓬勃發展的零售和電子商務產業以及該地區對環保包裝產品不斷成長的需求的主導。此外,網路購物平台和線上消費者的顯著增加、消費者對永續包裝態度的改變以及政府優惠政策的實施增加了對紙和紙板包裝產品的需求。

- 由於印度食品和飲料、化妝品等行業的快速成長,該行業正在迅速擴張。此外,政府限制塑膠廢棄物的多項措施正在影響市場成長。因此,印度消費者意識的提高和有組織食品產業的興起正在推動市場成長。

- 此外,對優質快速消費品、藥品、紡織品、有組織零售、蓬勃發展的電子商務和其他行業的持續需求將進一步推動印度紙和紙板包裝的成長。此外,果肉、果汁和其他濃縮物、醬汁和番茄醬瓶正在推動印度對紙和紙板包裝的需求不斷成長。印度工業已經沿著永續性曲線前進,技術更加先進。

- 在日本,許多紙基產品用於多種行業,包括報紙、包裝、印刷/通訊、衛生產品和其他雜項應用。在包裝領域,由於消費者對永續包裝的認知、對森林砍伐的擔憂以及原料的可用性等因素,最近出現了向紙張的轉變。

- 這些方面都在迫使企業適應環保包裝。日本雀巢公司正在為各種品牌和產品探索新的包裝選擇。該公司還積極研究材料,以進一步減少對環境的影響,每天銷售約 400 萬件產品。

紙包裝產業概況

紙包裝市場分散。這是一個競爭激烈的市場,有多家公司進入該市場,包括國際紙業、Mondi 和 Smurfit Kappa。沒有玩家壟斷市場。公司不斷創新並結成策略夥伴關係以維持市場佔有率。

- 2022 年 12 月 - WestRock 宣布以 9.7 億美元加承擔債務的價格收購了 Grupo Gonzi 的剩餘權益。 Grupo Gondi 的收購包括墨西哥各地的四家造紙廠、九家瓦楞紙工廠和六家高圖形工廠。這些工廠為各地區的終端市場生產永續包裝。此次收購鞏固了該公司在拉丁美洲不斷擴大的瓦楞紙、消費品、紙板和紙板市場中的領先地位。

- 2022 年 7 月 - Mondi 與義大利初級加工和包裝公司 Fiorini International 合作,成功為義大利優質義式麵食品牌開發並推出了新型可回收紙包裝。新型義式麵食袋在填充設備上還具有出色的運作性能,能夠有效傳達品牌和產品相關訊息。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 阻隔塗層紙板產品的開發

- 消費者對紙包裝的認知不斷增強

- 市場限制因素

- 森林砍伐對紙包裝的影響

- 營運成本增加

第6章世界廢紙產量統計

- 廢紙產量

- 廢紙進口額/金額

- 廢紙出口額/出口量

- 主要國家廢紙產量

第7章 紙箱板進出口場景

- 紙箱板出口:金額/數量

- 紙板原紙進口:金額及數量

第8章市場區隔

- 按年級

- 紙箱板

- 固體漂白硫酸鹽 (SBS)

- 未漂白固態硫酸鹽 (SUS)

- 折疊式紙板 (FBB)

- 塗佈再生紙板 (CRB)

- 未上漆的再生紙板 (URB)

- 其他等級

- 貨櫃板

- 白色頂工藝內襯

- 其他工藝襯墊

- 白色頂部測試襯墊

- 其他測試襯墊

- 半化學瓦楞

- 再生瓦楞紙

- 紙箱板

- 依產品

- 折疊式紙盒

- 瓦楞紙箱

- 其他類型

- 按最終用戶產業

- 食品

- 飲料

- 衛生保健

- 個人護理

- 家庭用品

- 電器

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第9章 競爭形勢

- 公司簡介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- Eastern Pak Limited

- WestRock Company

- Packaging Corporation of America

- Cascades Inc.

- Nippon Paper Industries Ltd.

- Sonoco Products Company

第10章投資分析

第11章市場的未來

簡介目錄

Product Code: 56225

The Paper Packaging Market size is estimated at USD 398.65 billion in 2024, and is expected to reach USD 501.08 billion by 2029, growing at a CAGR of 4.68% during the forecast period (2024-2029).

Key Highlights

- Paper packaging is a versatile and cost-efficient method to protect, preserve, and transport a wide range of products. In addition, it can be customized to meet the customers' or product-specific needs. The attributes like lightweight, biodegradability, and recyclability are the advantages of paper packaging that make it an essential component for packaging.

- Consumers worldwide are becoming more conscious of the environmental hazards of packaging and are moving their purchasing habits to more environmentally friendly options. Consumers, the government, and the media pressure manufacturers to make their products, packaging, and processes more environmentally friendly. People are willing to pay more for environmentally friendly packaging. The paperboard packaging industry is expected to grow due to these trends.

- The expansion of e-commerce sales and the rising demand for folded carton packaging are driving the market. However, the availability of high-performance substitutes will likely restrain the market's growth. Paperboard packaging is one of the most popular eco-friendly packaging options. Compared to bulkier packaging solutions, this packaging format can be created in various sizes with a small footprint, making it suitable for use in almost all end-user sectors.

- The major challenge faced by the paper packaging market is the need for paper to package very heavy materials, resulting in the industry being overpowered by the polymers and metal packaging industries. Furthermore, deforestation to acquire raw materials and release dioxins during paper production cause environmental concerns. These factors, in turn, are hindering the growth of the paper packaging market.

- The packaging industry witnessed some major issues due to the COVID-19 pandemic, including the effects of the nationwide lockdown, companies moving to source away from China, and reconsidering materials used in packaging. Although the supply side of paper packaging witnessed a significant impact, a drastic increase in the end-user demand in some applications significantly expanded the scope of paper packaging.

- According to Packaging Gateway, 5.6 million people left Ukraine since the conflict started on May 3, 2022. Over 300 significant Western corporations left the country due to the conflict, and numerous production and packaging facilities in Russia and Ukraine were shut down. Some businesses initially hesitated to halt, reduce, or shut down operations as they were still determining when it would finish. Early in April, two more companies operating in Russia for over 30 years, Finnish food packaging provider Huhtamakiand Irish paper packaging company Smurfit Kappa, joined the expanding list of enterprises leaving the country.

Paper Packaging Market Trends

Food and Beverage Expected to Hold Significant Market Share

- Paper and paperboard are among the most common materials for packaging food. Paper is an eco-friendly option in packaging, making it an ideal choice for food. It is predominantly used for packaging in direct contact with food and transporting and storing primary packages. Also, paper and paperboard are used in making microwave popcorn bags, baking paper, and fast-food containers. All this is expected to promote growth for paper packaging worldwide. The market growth in paper packaging is anticipated to be driven by high consumer awareness of packaged food, particularly packaged food delivery.

- In addition, paper is one of the readily available, inexpensive resources. It is used extensively in the packaging of the food and beverage sector and the creation of papers. These materials can be recycled to create excellent molded products for packaging applications and other beverage-containing contact items like cups, pouches, and liquid cartons. The pandemic highlighted important health and wellness realities and the significance of consumers' dietary and lifestyle decisions. According to Mintel's Global Covid-19 tracker, consumers value eating and drinking healthily the most.

- Most consumers lead on-the-go lifestyles. As a result, they are continuously seeking simpler foods to pick up, handle, eat, or carry. Brands are working harder to make food packaging portable to address this need. Packaging manufacturers depend on paper packaging for food products because it is extremely lightweight and easy to carry. Moreover, food packaging became more environmentally friendly in recent years. Big firms abandoned single-use plastics in favor of biodegradable, recyclable, or reusable packaging due to the desire for eco-friendly solutions.

- Further, the growth of the food industry, which in turn is driving demand for folding cartons, corrugated boxes, and liquid paperboard boxes, is propelled by the increased need for ready-to-eat, frozen, and packaged goods. For instance, according to US Census Bureau, Retail food and beverage store sales in the United States reached an annual value of approximately USD 947 billion in 2022, a steady increase from the previous year and forward increasing the amount recorded from the last 5 years, thus increasing sales of food and beverage impact the growth of the paper packaging market.

- Moreover, the quick shifts in beverage packaging patterns nationwide are one of the main drivers of industry expansion. The use of innovative packaging solutions grew significantly. Creating new active systems that can interact with the product or its surroundings, customer acceptability, food security, and enhancing the preservation of various beverages are the primary areas of recent developments in beverage packaging.

Asia-Pacific Expected To Include Significant Market Share

- The Asia-Pacific is expected to include significant growth. The market is expanding due to the increasing number of production facilities throughout the area, rising consumerism, and the transit packaging industry in the APAC region. The region is expected to expand the fastest due to the rising demand for paper pulp in developing nations like China and India. In China, the transportation packaging market is growing along with consumption, fueling a rapidly rising demand for paper packaging.

- The growing urban population, evolving e-commerce package industry, dropping pulp prices, and improving population awareness about environmentally friendly packaging are expected to propel China's paper packaging market. Furthermore, the industry's key trends and developments are increased folding boxboard consumption, increased containerboard capacity, and technological breakthroughs.

- Moreover, the demand for paper pulp is increasing in developing countries like China, the fastest-growing paper per capita user. The increase in the paper packaging sector in China is further governed by the booming retail and e-commerce industry and a boost in demand for environmentally friendly packaging products in the region. Furthermore, significant growth in online shopping platforms and online shoppers, changing consumer attitudes regarding sustainable packaging, and implementing favorable government policies increased the demand for paper and paperboard packaging products.

- Since India's food and beverage, cosmetics, and other industries are rising faster, this industry is rapidly expanding. Furthermore, several government measures to limit plastic waste influence the market's growth. As a result, rising consumer awareness and the rise of India's organized food sector are driving market growth.

- Moreover, India's paper and paperboard packaging growth is further driven by continued demand for quality FMCG products, pharmaceuticals, textiles, organized retail, booming e-commerce, and other segments. Additionally, Fruit pulp, juices, other concentrates, sauces, and ketchup bottles are driving the growing demand for paper and paperboard packaging in India. The industry in India went up the sustainability curve and became far more technologically advanced.

- Japan significantly uses paper-based products in various industries, including newspapers, packaging, printing and communication, sanitary products, and other miscellaneous uses. There is a recent movement in the packaging sector to utilize paper because of consumer awareness about sustainable packaging, worries about deforestation, and raw material availability, among other factors.

- Companies are forced to adapt to environmentally friendly packaging due to this aspect. Nestle, a Japanese company, is looking into new packaging options for various brands and goods. It is also aggressively researching materials to further lessen its environmental impact, as it sells approximately 4 million products daily.

Paper Packaging Industry Overview

The paper packaging market is fragmented. It is a highly competitive market with several players like International Paper, Mondi, Smurfit Kappa, and more in the market. There is no dominant player present in the market. The companies keep innovating and entering into strategic partnerships to retain their market share.

- December 2022 - WestRock Company announced that it had successfully acquired Grupo Gondi's remaining interest for USD 970 million plus debt assumption. The Grupo Gondi acquisition includes four paper mills, nine corrugated packaging facilities, and six high graphic facilities throughout Mexico. These facilities produce sustainable packaging for a variety of regional end markets. The company's dominant position in the expanding corrugated packaging, consumer goods, paperboard, and containerboard markets in Latin America will be strengthened by this acquisition.

- July 2022 - Mondi successfully developed and introduced a new recyclable paper packaging for a premium Italian pasta brand in collaboration with FioriniInternational, a primary converter and packaging company with headquarters in Italy. The brand and product-related information may be effectively communicated with the help of the new pasta bag, which also includes excellent runnability on filling equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of Barrier-coated Paperboard Products

- 5.1.2 Growing Consumer Awareness on Paper Packaging

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

- 5.2.2 Increasing Operational Costs

6 GLOBAL RECOVERED PAPER PRODUCTION STATISTICS

- 6.1 Recovered Paper, Production Quantity

- 6.2 Recovered Paper, Import Value, and Import Quantity

- 6.3 Recovered Paper, Export Value, and Export Quantity

- 6.4 Recovered Paper Production, by Leading Countries

7 CARTONBOARD EXIM SCENARIO

- 7.1 Cartonboard Exports By Value & Volume (USD Million, Million Tonnes)

- 7.2 Cartonboard Import By Value & Volume (USD Million, Million Tonnes)

8 MARKET SEGMENTATION

- 8.1 By Grade

- 8.1.1 Carton board

- 8.1.1.1 Solid bleached sulphate (SBS)

- 8.1.1.2 Solid unbleached sulphate (SUS)

- 8.1.1.3 Folding boxboard (FBB)

- 8.1.1.4 Coated Recycled Board (CRB)

- 8.1.1.5 Uncoated recycled board (URB)

- 8.1.1.6 Other Grades

- 8.1.2 Containerboard

- 8.1.2.1 White-top Kraftliner

- 8.1.2.2 Other Kraftliners

- 8.1.2.3 White top Testliner

- 8.1.2.4 Other Testliners

- 8.1.2.5 Semi Chemical Fluting

- 8.1.2.6 Recycled Fluting

- 8.1.1 Carton board

- 8.2 By Product

- 8.2.1 Folding Cartons

- 8.2.2 Corrugated Boxes

- 8.2.3 Other Types

- 8.3 By End User Industry

- 8.3.1 Food

- 8.3.2 Beverage

- 8.3.3 Healthcare

- 8.3.4 Personal Care

- 8.3.5 Household Care

- 8.3.6 Electrical Products

- 8.3.7 Other End User Industries

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 Italy

- 8.4.2.4 France

- 8.4.2.5 Rest of Europe

- 8.4.3 Asia-Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia Pacific

- 8.4.4 Latin America

- 8.4.4.1 Brazil

- 8.4.4.2 Mexico

- 8.4.4.3 Rest of Latin America

- 8.4.5 Middle East and Africa

- 8.4.5.1 United Arab Emirates

- 8.4.5.2 Saudi Arabia

- 8.4.5.3 South Africa

- 8.4.5.4 Rest of Middle East and Africa

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 International Paper Company

- 9.1.2 Mondi Group

- 9.1.3 Smurfit Kappa Group

- 9.1.4 DS Smith PLC

- 9.1.5 Eastern Pak Limited

- 9.1.6 WestRock Company

- 9.1.7 Packaging Corporation of America

- 9.1.8 Cascades Inc.

- 9.1.9 Nippon Paper Industries Ltd.

- 9.1.10 Sonoco Products Company

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219