|

市場調查報告書

商品編碼

1432832

雲端遷移:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cloud Migration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

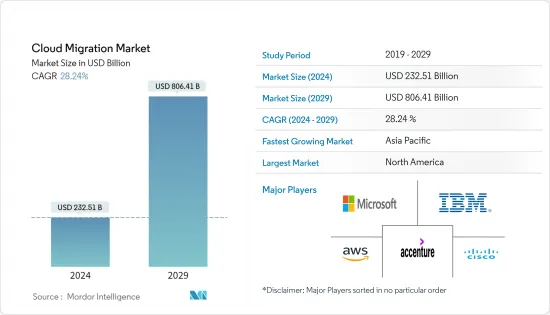

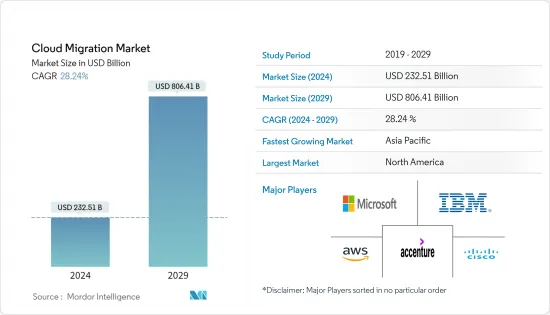

雲端遷移市場規模預計到 2024 年為 2,325.1 億美元,預計到 2029 年將達到 8,064.1 億美元,在預測期內(2024-2029 年)複合年成長率為 28.24%。

在過去的十年中,由於中小企業投資的增加,雲端處理的採用有所增加。在全球範圍內,許多公司正在轉向雲端平台並利用其優勢。近年來,雲端採用已成為 IT 成本降低策略的關鍵考量。

主要亮點

- 遷移到雲端的主要原因是擴充性、提高效率、快速部署、敏捷性和災難復原。許多公司為其客戶提供雲端災難復原功能,以協助他們發展業務。遷移到雲端因其即時體驗、業務元素和對本地資料的可訪問性而越來越受歡迎。這項技術還有助於在最短的時間內啟動多個業務部門。

- 雲端和工業化服務的成長以及傳統資料中心外包 (DCO) 的衰落標誌著向混合基礎設施服務的重大轉變。雖然傳統的 DCO 市場正在萎縮,但主機代管和託管以及基礎設施和公用事業服務的支出卻在激增。預計這將導致向雲端 IaaS 和託管的轉變。近年來,向 PaaS、IaaS 和 SaaS 的遷移已變得最為重要。此外,隨著企業採用 DevOps 功能和自動化,這些功能越來越被認為對於實現雲端採用的技術和業務優勢至關重要。

- 可擴充性、彈性、遠端協作、任務自動化、增強的行動性和強大的資料保護推動了對雲端遷移服務不斷成長的需求。此外,不斷成長的連接設備網路正在產生大量資料。因此,對低成本資料儲存解決方案的需求預計將會增加,雲端遷移服務的使用也會增加。

- 與其他雲端服務相比,混合雲遷移近年來整體顯著成長。混合雲允許企業擴展其運算資源,而無需大量資金來滿足短期需求高峰。許多雲端供應商能夠快速提升您在世界各地不同地點的基礎設施,使您能夠將業務快速擴展到新的地區。

- 資料安全問題和應用程式互通性問題預計將阻礙雲端遷移市場的成長。網路連線和數位化的增強為提供雲端遷移服務的公司提供了機會。

- 然而,全球範圍內持續爆發的 COVID-19 疫情為在本地 IT 系統上營運的企業帶來了巨大的限制。因此,許多公司正在迅速轉向雲端。疫情期間遠距工作的增加擴大了雲端遷移市場。此外,Accenture指出,COVID-19創造了一個新的曲折點,要求所有企業大幅加速雲端遷移,為端到端數位轉型奠定基礎,所有企業都需要成為雲端企業。

雲端遷移市場趨勢

BFSI預計將大幅成長

- 由於雲端解決方案具有彈性、敏捷性以及與新興技術和金融科技生態系統的整合等優勢,銀行和金融機構正在加速向雲端解決方案過渡。雲端解決方案透過顯著降低基礎設施成本來幫助銀行節省資金。

- 此類案例不僅推動了 BFSI 行業,而且還推動了其他最終用戶行業採用雲端服務,市場供應商獲得了巨大的吸引力。例如,根據 Zscaler資料,2021 年,發現實例暴露總數的 50% 歸因於 AWS公共雲端平台。微軟 Azure 以 35% 的佔有率位居第二,谷歌雲端以 13% 的佔有率位居第二。

- 許多供應商提供針對 BFSI 部門的 IaaS 和 PaaS 應用程式,消除了管理、託管、維護、更新和擴展服務營運的需要。銀行廣泛認知到雲端基礎設施可以幫助推動基本的舉措計劃,包括人工智慧、區塊鏈和軟體容器支援的營運和客戶導向的計劃。

- 銀行也透過與雲端服務供應商的策略合作夥伴關係來採用雲端遷移技術。例如,2022年5月,傑富瑞金融集團將與亞馬遜合作,將其資訊科技服務遷移到雲端。這是一家剛開始朝著雲端基礎的軟體和資料分析領域發展的金融企業邁出的最新一步。根據一項為期四年的協議,Jefferies 將把其關鍵業務流程、內部和麵向客戶的應用程式、IT 資源和資料移轉到 Amazon Web Services。

- 為了向客戶提供數位銀行業務體驗,銀行組織正在採用雲端遷移技術。例如,2021 年 5 月,亞馬遜網路服務 (AWS) 宣布菲律賓聯合銀行將於 2022 年將其IT基礎設施從本地遷移到雲端。此舉旨在加速銀行的數位轉型,改善客戶的數位銀行業務體驗,並透過將金融服務擴展到該國偏遠地區來擴大菲律賓的金融包容性。

預計北美將佔據最大的市場佔有率

- 北美是雲端遷移的主要創新者和先驅,佔據了很大的市場佔有率。該地區還擁有強大的雲端遷移供應商,這正在推動市場的成長。 IBM Corporation、Microsoft Corporation、Amazon Web Services Inc.、Cisco Systems Inc.、Cognizant Technology Solutions Corporation、Google Inc. 等。

- 將資料和應用程式等資訊遷移到雲端的好處正在推動該地區的許多組織採用雲端遷移服務,從而對市場成長產生積極影響。

- 2021 年 12 月,納斯達克宣布與亞馬遜網路服務建立合作關係,以轉型北美資本市場。透過這種混合架構,納斯達克提供對本地系統的低延遲訪問,以實現高頻交易功能,同時讓客戶能夠存取雲端基礎的功能,例如虛擬連接服務、市場分析和機器學習。

- 此外,2022 年 8 月,多倫多自動化雲端遷移公司 Next Pathway 宣布與 Microsoft 合作,加速遺留資料倉儲和資料湖向 Microsoft Azure 的遷移。班次分析器提供對來源遺留應用程式工作負載的全面審查,以識別現有的程式碼類型和物件。 Shift Translator 可加速複雜工作負載(例如 SQL、預存程序、ETL 管道/工作流程以及各種其他程式碼類型)的轉換、測試和遷移。此外,Next Pathway 的技術可以輕鬆且有效率地將工作負載從其他雲端平台或資料資料倉儲遷移到 Azure。

雲端遷移產業概況

雲端遷移市場適度整合,由多個主要企業組成。從市場佔有率來看,目前少數大公司佔據市場主導地位。這些市場佔有率較高的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作計劃來提高市場佔有率和盈利。

- 2023 年 1 月 數位解決方案公司 LTIMindtree 宣布,它已與智慧解決方案供應商 Duck Creek Technologies 和 Microsoft 合作建立了一個解決方案,使保險公司能夠快速且有效率地將其本地任務關鍵型系統遷移到雲端。

- 2022 年 2 月:IBM 公司宣布與 SAP 合作,提供技術和諮詢技能,協助採用混合雲策略並將關鍵任務工作負載從 SAP 解決方案轉移到雲端。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 為組織增加雲端優勢

- BYOD 使用量增加

- 市場挑戰

- 資料安全和應用程式互通性問題

第6章市場區隔

- 安裝類型

- 公共雲端

- 私有雲端

- 混合雲端

- 公司規模

- 中小企業 (SME)

- 主要企業

- 服務類型

- PaaS

- IaaS

- SaaS

- 按最終用戶產業

- BFSI

- 衛生保健

- 零售

- 政府機關

- 資訊科技/通訊

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Accenture PLC

- Amazon Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corp

- DXC Technology

- Evolve IP LLC

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace Hosting Inc.

- Rightscale Inc.(Flexera)

- Tech Mahindra Ltd

- VMware Inc.

- WSM International LLC

第8章投資分析

第9章市場的未來

The Cloud Migration Market size is estimated at USD 232.51 billion in 2024, and is expected to reach USD 806.41 billion by 2029, growing at a CAGR of 28.24% during the forecast period (2024-2029).

Over the past decade, cloud computing adoption has risen owing to increasing investments from small and medium enterprises. Globally, many organizations have already switched to cloud platforms to take advantage of its benefits. In recent years, cloud adoption stands to be a significant consideration for IT cost reduction strategies.

Key Highlights

- The significant reasons for migrating to the cloud are scalability, increased effectiveness, faster implementation, mobility, and disaster recovery. Considerable companies are offering cloud disaster recovery features to their customers, aiding them in expanding their businesses. Cloud migration is gaining traction for its real-time experience, business elements, and accessibility to on-premise data. This technology also aids in setting up several business units in minimal time.

- The growth of cloud and industrialized services and the decline of traditional data center outsourcing (DCO) indicate a massive shift toward hybrid infrastructure services. While the conventional DCO market is shrinking, spending on colocation and hosting, along with infrastructure utility services, is increasing rapidly. This is expected to drive the shift toward cloud IaaS and hosting. Migration for PaaS, IaaS, and SaaS has been most important in recent years. Companies are also embracing DevOps capabilities and automation; hence, they are increasingly seen as critical to realizing cloud adoption's technical and business benefits.

- The growing demand for cloud migration services is attributed to increased scalability, flexibility, remote collaboration, task automation, improved mobility, and robust data protection. Furthermore, the growing network of connected devices has resulted in massive data growth. As a result, the growing need for a low-cost data storage solution is projected to increase the use of cloud migration services.

- The migration to the hybrid cloud has experienced significant overall growth in the past few years compared to other cloud services. Using a hybrid cloud allows companies to scale computing resources and helps eliminate the need for massive capital to handle short-term spikes in demand. Many cloud providers offer the ability to rapidly increase infrastructure in various worldwide locations, enabling a business to expand to new territories quickly.

- Data security issues and application interoperability issues are expected to hamper the growth of the cloud migration market. Increased internet connectivity and digitization provide opportunities to the cloud migration service offering companies.

- However, the ongoing outbreak of COVID-19 across the world has created massive restrictions on businesses operating with on-premise IT systems. Hence, many of these organizations have rapidly migrated to the cloud. The increase in remote working during the pandemic peopled the cloud migration market. Further, Accenture also states that COVID-19 has created a new inflection point that demands every company to significantly accelerate their cloud migration in order to create a foundation for end-to-end digital transformation, requiring that every business becomes a cloud business

Cloud Migration Market Trends

BFSI Expected to Witness Significant Growth

- Banking and financial organizations are accelerating the migration toward cloud solutions owing to benefits such as flexibility, agility, and integration of emerging technologies and the FinTech ecosystems. Cloud solutions are helping banks cut down expenses by significantly reducing infrastructure costs.

- Such instances have boosted the adoption of cloud services among the BFSI sector as well as other end-user industries, and market vendors are gaining significant traction. For instance, according to the data from Zscaler, In 2021, 50% of total found instance exposure was attributed to the AWS public cloud platform. Microsoft Azure took second place with 35% and Google Cloud 13%, respectively.

- Many vendors are providing IaaS and PaaS applications to eliminate the need to manage, host, maintain, update, and scale service operations targeted toward the BFSI sectors. Banks widely recognize that a cloud infrastructure can help them pursue sweeping modernization initiatives, including operational and customer-facing programs supported by AI, blockchain, and software containers.

- Banks are also adopting Cloud migration technology through strategic partnerships with cloud service-providing companies. For instance, in May 2022, Jefferies Financial Group Inc. is partnering with Amazon to move its information-technology services to the cloud. This is the latest step by a financial business that has just begun to grow into cloud-based software and data analytics. Jefferies is transferring its essential business processes, internal and customer-facing apps, IT resources, and data to Amazon Web Services under a four-year arrangement.

- To provide a digital banking experience to customers, banking organizations are adopting cloud migration technology. For instance, in May 2021, Amazon Web Services (AWS) announced that the Union Bank of the Philippines would transition its IT infrastructure from on-premises to the cloud by 2022. The move is designed to speed the bank's digital transformation, improve customers' digital banking experiences, and increase financial inclusion in the Philippines by providing financial services to distant areas of the nation.

North America Expected to Hold the Largest Market Share

- North America is among the leading innovators and pioneers in cloud migration and holds a significant share of the market. The region also has a strong foothold on cloud migration vendors, which adds to its growth. Some companies include IBM Corporation, Microsoft Corporation, Amazon Web Services Inc., Cisco Systems Inc., Cognizant Technology Solutions Corporation, and Google Inc.

- The benefits offered by moving data and applications, among other information, to the cloud are pushing many organizations in the region to adopt cloud migration services, thereby impacting the market's growth positively, and also the companies in the North American region are making strategic collaborations, business expansion to propel the cloud migration.

- In December 2021, Nasdaq announced a partnership with Amazon Web Services to transfer its North American capital market. This hybrid architecture would offer Nasdaq low-latency access to its on-premises systems, enabling high-frequency trading capabilities and allowing its customers access to cloud-based features such as virtual connection services, market analytics, and machine learning.

- Furthermore, in August 2022, Next Pathway Inc., the Automated Cloud Migration company in Toronto, announced a collaboration with Microsoft to accelerate the migration from legacy data warehouses and data lakes to Microsoft Azure. Shift Analyzer provides a comprehensive review of source legacy application workloads to review the code types and objects present. Shift Translator accelerates the translation, testing, and migration of complex workloads such as SQL, Stored Procedures, ETL pipelines/workflows, and various other code types. Furthermore, Next Pathway's technology can easily and efficiently transfer workloads from other cloud platforms and cloud data warehouses to Azure.

Cloud Migration Industry Overview

The cloud migration market is moderately consolidated and consists of several major players. In terms of market share, few major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- January 2023: Digital solutions firm LTIMindtree announced that it had partnered with Duck Creek Technologies, the intelligent solutions provider, and Microsoft to build a solution enabling insurers to migrate their on-premises core systems to the cloud quickly and efficiently.

- February 2022: IBM Corporation announced a collaboration with SAP to deliver technology and consulting skills to help clients embrace a hybrid cloud strategy and migrate mission-critical workloads from SAP solutions to the cloud in regulated and non-regulated sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Benefits Of Cloud To Organizations

- 5.1.2 Increasing Use of BYOD

- 5.2 Market Challenges

- 5.2.1 Data Security And Application Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 Type of Deployment

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 Type of Service

- 6.3.1 PaaS

- 6.3.2 IaaS

- 6.3.3 SaaS

- 6.4 End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Government

- 6.4.5 IT and Telecommunication

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Amazon Inc.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Cognizant Technology Solutions Corp

- 7.1.5 DXC Technology

- 7.1.6 Evolve IP LLC

- 7.1.7 Google LLC

- 7.1.8 IBM Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 Oracle Corporation

- 7.1.11 Rackspace Hosting Inc.

- 7.1.12 Rightscale Inc. (Flexera)

- 7.1.13 Tech Mahindra Ltd

- 7.1.14 VMware Inc.

- 7.1.15 WSM International LLC