|

市場調查報告書

商品編碼

1432820

穿戴式溫度感測器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Wearable Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

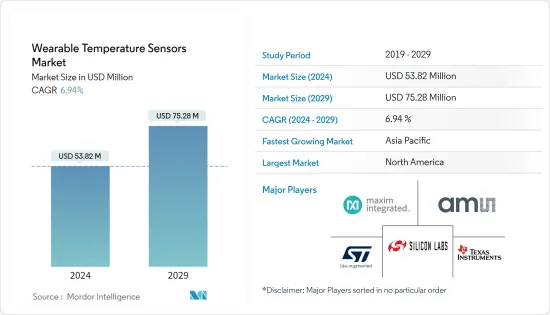

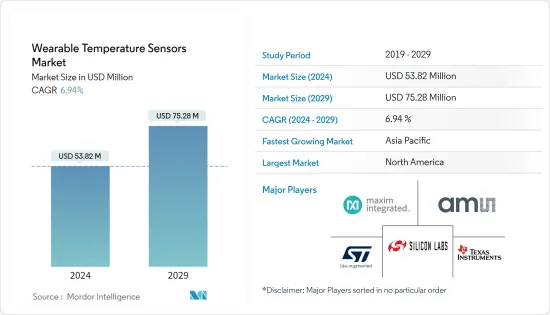

穿戴式溫度感測器市場規模預計到 2024 年為 5,382 萬美元,預計到 2029 年將達到 7,528 萬美元,在預測期內(2024-2029 年)複合年成長率為 6.94%。

智慧型穿戴裝置普及的提高、物聯網和擴增實境平台的普及提高、小型化趨勢的增強以及連網型設備的普及是研究期間推動穿戴式溫度感測器市場成長的關鍵因素。

主要亮點

- 智慧生活的快速發展和連網型設備數量的增加預計將推動穿戴式溫度感測器市場的成長。這些穿戴式溫度感測器可以持續監測各種健康狀況,例如心率、體溫和脈搏率。

- 隨著蘋果、三星、微軟等大公司進入穿戴式科技市場,消費性電子產業對穿戴式感測器技術的需求也因強勁的客戶需求而快速成長。

- ICT 與醫療領域的整合反映了無縫連接的感測器和設備的出現,這些感測器和設備可改善醫療保健服務。隨著支援先進醫療設備的高需求,感測器與醫療保健領域使用的穿戴式設備的整合不斷增加,從而提高了感測器在醫療保健領域的重要性。

- 此外,各年齡層人群健身和健康意識的提高正在推動穿戴式溫度感測器的成長。遠端護理和監控的趨勢正在推動對穿戴式裝置溫度感測器的需求。幾家新興企業透過直接或間接製造溫度感測器並將其涵蓋其解決方案中,獲得了大量資金。

- 穿戴式感測器在醫療保健和診斷行業中廣受歡迎,其中血壓、心率和體溫等多個參數至關重要。預計在整個預測期內,老年人口的增加和穿戴式裝置在醫療保健領域的好處不斷增加將加速市場的開拓。

穿戴式溫度感測器市場趨勢

手錶類穿戴裝置成長顯著

- 智慧型手錶因其舒適、方便、安全和健康監測功能而風靡全球。因此,能夠輕鬆與人體互動,例如監測心率、手腕脈搏、運動、血壓、眼壓和其他健康狀況的智慧型手錶越來越受到關注。

- 即時監測體溫對於識別心臟病等突發不利事件也至關重要。此外,當體力活動與其成績直接相關時,溫度監測至關重要。因此,智慧腕式穿戴裝置滿足了所有這些要求,並有助於創建腕式穿戴式裝置市場。

- 隨著德州儀器(德克薩斯) 等感測器製造商支援在智慧型手錶和健身追蹤器中使用溫度感測器功能,這些感測器的使用預計將進一步增加。例如,LMT70 穿戴式設計使用適合智慧型手錶或健身追蹤器的小型電氣系統,在 20°C 至 42°C 人體溫度範圍內測量人體皮膚溫度和室溫,精度為 0.1°C。兩者都。

- 然而,測量和監測體溫已成為穿戴式裝置的重要問題,部分原因是持續的 COVID-19 大流行。體溫過高(高於 37.8°C)是呼吸道疾病的常見症狀。穿戴式溫度感測器的此類應用,加上智慧型手錶需求的不斷成長,預計將有助於穿戴式溫度感測器市場的全球成長。

亞太地區將成長最快

- 由於中國和印度等人口大國的存在,亞太地區預計將錄得最快的成長。在這兩個國家,可支配收入的增加預計將對穿戴式溫度感測器市場的成長起到補充作用。

- 保誠集團和《經濟學人》的《2020 年亞洲健康晴雨表》報告匯集了亞洲 13 個國家的調查回复,根據該報告,78.5% 的受訪者使用某種形式的個人健康技術。

- 此外,技術進步激勵穿戴式裝置製造商進行創新,將感測器整合到智慧型手錶中並使用 Android 或 iOS 應用程式監控變化。

- 此外,COVID-19 加速了亞太地區穿戴式裝置對溫度感測器的需求,許多供應商推出了產品來滿足這項需求。

- 2021年4月,Timex在印度推出Fit健康監測智慧型手錶。這款穿戴式裝置配備了眾多健康和健身功能,包括遠端醫療、監測體溫的溫度感測器和 SpO2 監測儀。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 提高各年齡層的健康意識

- 智慧型設備中高性能感測器的增加

- 市場挑戰

- 產品成本高

第6章市場區隔

- 應用

- 身體穿著

- 眼鏡產品

- 鞋類

- 手腕佩戴

- 其他用途

- 按行業分類的最終用戶

- 衛生保健

- 運動/健身

- 工業的

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Silicon Laboratories Inc.

- Maxim Integrated Products Inc.

- STMicroelectronics NV

- Texas Instruments Inc.

- AMS AG

- Melexis

- Analog Devices Inc.

- GreenTEG

- TE Connectivity Ltd

- Sensirion AG

第8章投資分析

第9章市場的未來

The Wearable Temperature Sensors Market size is estimated at USD 53.82 million in 2024, and is expected to reach USD 75.28 million by 2029, growing at a CAGR of 6.94% during the forecast period (2024-2029).

The expanding reach of smart wearable devices, increased penetration of IoT and AR platforms, the rising trend of miniaturization, and the popularity of connected devices are some of the major factors that are expected to drive the market growth of wearable temperature sensors during the study period.

Key Highlights

- The rapidly increasing trend of smart living and the increasing number of connected devices is anticipated to enhance the wearable temperature sensors market growth. These wearable temperature sensors are able to continuously monitor various health aspects, such as heart rate, body temperature, and pulse rate.

- With the entrance of big players, such as Apple, Samsung, and Microsoft, into the wearable technology market, the demand for wearable sensor technology in the consumer electronics industry has also multiplied rapidly, owing to the strong demand from its customers.

- The convergence between ICT and medical fields reflects the emergence of seamlessly connected sensors and devices that can improve healthcare services. The integration of sensors in wearables used for the healthcare sector increases with a high demand to support advanced medical equipment, thereby making it significant in the healthcare sector.

- Moreover, enhanced awareness regarding fitness and health in people of all age groups has been driving the growth of wearable temperature sensors. The trend toward remote care monitoring is driving the demand for temperature sensors equipped with wearable devices. Several startups are gaining significant funding which directly manufactures temperature sensors or indirectly incorporates them into their solution.

- Wearable sensors have gained significant popularity in the healthcare and diagnosis industry, where several parameters are of vital importance, namely blood pressure, heart rate, and body temperature. The growing geriatric population and the increasing number of advantages of wearable devices in the healthcare segment are projected to accelerate the development of the market throughout the forecast period.

Wearable Temperature Sensors Market Trends

Wrist Wearables To Have Significant Growth

- Smartwatches have taken the world by storm owing to the features such as human comfort, convenience, security, and monitoring health conditions offered by these watches. As a result, smartwatches are receiving greater attention because of their facile interaction with the human body, such as monitoring heart rate, wrist pulse, motion, blood pressure, intraocular pressure, and other health-related conditions.

- In addition, real-time monitoring of body temperature is crucial for recognizing sudden adverse occurrences, such as heart attacks. Furthermore, temperature monitoring is essential where physical activity is directly concerned with their accomplishment. And thus, smart wrist wearables fulfill all these requirements, which help in creating a market for wrist wearables.

- With sensor manufacturers, such as Texas Instruments, supporting the use of temperature sensor capabilities in smartwatches or fitness trackers, the use of these sensors is expected to increase further in the future. For instance, the LMT70 Wearable Design uses a small form factor electrical system that fits inside a smartwatch or fitness tracker that measures both human skin and room temperatures with an accuracy of 0.1°C in the human body temperature range of 20°C-42°C.

- However, measuring or monitoring body temperature is a topical subject for wearables in current times, mainly because of the ongoing COVID-19 pandemic. A high temperature (37.8C or greater) is one of the common symptoms of respiratory illness. Such applications of wearable temperature sensors, coupled with the increase in the demand for smartwatches, are expected to contribute to the growth of the Wearable Temperature Sensors Market globally.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is anticipated to register the fastest growth because of the presence of two highly populated countries such as China and India. In these two countries, the increase in disposable income will act as a supplement for the growth of the wearable temperature sensors market.

- According to the Health of Asia Barometer 2020 report by Prudential and the Economist, a collection of survey responses from 13 countries in Asia, 78.5% of respondents use some form of personal health technology.

- Moreover, advancements in technologies have encouraged wearable manufacturers to come up with innovative ideas to embed the sensors into smartwatches and monitor the changes using Android and iOS apps.

- Further, COVID-19 accelerated the demand for temperature sensors in wearable devices in Asia-Pacific, and many vendors are launching products to meet this demand.

- In April 2021, Timex launched its fit health monitoring smartwatch in India. The wearable comes with numerous health and fitness features, including telemedicine, a temperature sensor to monitor the body's temperature, and a SpO2 monitor.

Wearable Temperature Sensors Industry Overview

The wearable temperature sensors market is moderately fragmented. Some of the global key players in this market are Silicon Laboratories, Maxim Integrated Products Inc., Texas Instruments Inc., STMicroelectronics N.V., and AMS AG. Product launch, acquisition, and partnership are some of the key strategies adopted by market players operating in the wearable sensors industry. Some of the recent developments are:

- March 2022 - AMS OSRAM established a new research and development center in Bucharest, Romania. The new facility would focus on the research and development of integrated circuitry to deliver state-of-the-art solutions focusing on consumer applications, including sensor technology for wearable technology for fitness and exercise, smartphones, 3D authentication, and payment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Health Awareness Among all Age Groups

- 5.1.2 Increasing Growth of Advanced Functions Sensors in Smart Gadgets

- 5.2 Market Challenges

- 5.2.1 High Product Cost

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Body Wear

- 6.1.2 Eye Wear

- 6.1.3 Foot Wear

- 6.1.4 Wrist Wear

- 6.1.5 Other Applications

- 6.2 End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Sports/Fitness

- 6.2.3 Industrial

- 6.2.4 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silicon Laboratories Inc.

- 7.1.2 Maxim Integrated Products Inc.

- 7.1.3 STMicroelectronics NV

- 7.1.4 Texas Instruments Inc.

- 7.1.5 AMS AG

- 7.1.6 Melexis

- 7.1.7 Analog Devices Inc.

- 7.1.8 GreenTEG

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Sensirion AG