|

市場調查報告書

商品編碼

1432806

活性與智慧包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Active and Intelligent Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

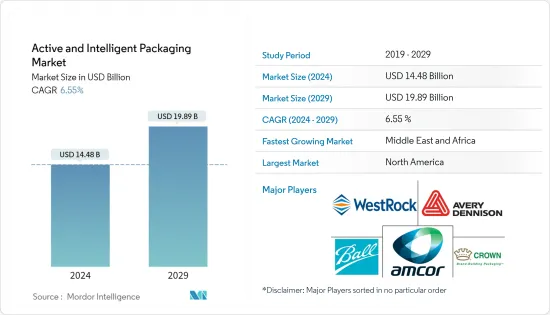

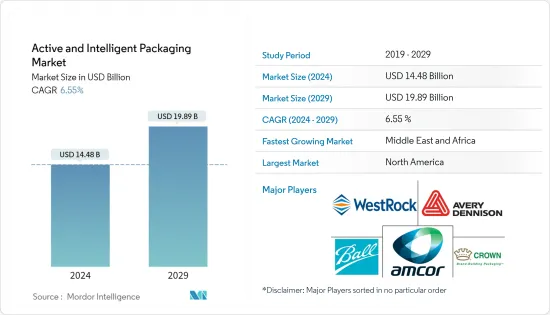

活性和智慧包裝市場規模預計2024年為144.8億美元,預計2029年將達到198.9億美元,預測期內(2024-2029年)複合年成長率為6.55%,預計還會成長。

主要亮點

- 活性包裝系統的開發是為了延長食品的保存期限並延長食品的高品質時間。活性包裝使包裝能夠與食品和環境相互作用,在食品保鮮中發揮重要作用。食品加工公司正在推動整個供應鏈對活性包裝的需求,以延長食品保鮮時間,減少食品廢棄物,並為消費者推廣更方便的包裝。

- 根據聯合國環境規劃署的數據,全球每年生產的所有食品中約有 13 億噸(14.3 億噸)被損失或浪費。據估計,美國每年浪費 1,330 億磅(約 1,610 億美元)食品。創新的活性包裝解決方案可以減少食品浪費。未來,旨在減少食品浪費和提高食品安全的活性包裝的需求可能會成長。

- 對安全和追蹤解決方案的需求不斷成長將推動主動和智慧包裝市場的成長。例如,RFID 標籤提供識別、控制和管理食品供應鏈的能力。這些標籤比傳統的食品追溯條碼標籤更先進、更可靠、更有效率。用於監控產品溫度、相對濕度、壓力、pH 值和光照的 RFID 標籤已投入商用,有助於提高食品品質和安全性。

- 主動智慧包裝的第一個優勢在於其能夠與封裝的產品相互作用並在其保存過程中發揮動態作用。該過程追蹤整個供應鏈中的標記資訊。活性包裝可以改變食品的成分或有機特性,前提是這種變化符合食品法規。但這也引發了污染問題,因為塑膠滲透到食品中可能會導致健康併發症。

- 此外,由於人們對電子商務平台上的安全和可追溯食品的偏好增加,以及公眾對健康和安全的整體意識增強,COVID-19 大流行的出現導致了可觀察到的行為變化。 IBM 研究表明,約 71% 的消費者願意為產品提供完全透明度和可追溯性的公司支付平均約 37% 的溢價。

主動化、智慧化包裝市場趨勢

對持久永續包裝產品的需求不斷增加

- 傳統包裝可保護食品在穿過供應鏈並到達最終客戶手中時免受環境危害。然而,它不會為其內容增加價值,因此它是惰性的。但科學正在改變這一現狀,讓包裝能夠與食品溝通。隨著供應鏈變得數位化,技術變得越來越重要。此外,數位化有利於監管合規並滿足市場對透明度的需求。這一趨勢也是由顧客對環保包裝產品的期望不斷變化所推動的。

- 例如,根據《2021年全球綠色採購報告》,54%的客戶在選擇產品時考慮永續包裝。 44 歲以下的消費者正在推動這項運動。 83% 的消費者表示,他們願意為採用永續方法生產的產品支付更多費用。

- 在進一步的永續性計畫中,2021 年 7 月,Flipkart 和 Myntra 與非營利組織座艙罩合作收購了永續包裝。 Flipkart Group 加入了座艙罩的 Pack4Good 和 CanopyStyle 計劃,以加強其對永續性的承諾並促進永續材料採購和包裝。

- 2022 年 7 月,經過四年的研究開發更有效、更持久的保存方法,AIMPLAS主導的NEMOSINE計劃結束。該計劃成功生產了一種創新、持久的包裝,有助於減少膠片、電影和照片檔案傳統儲存方法的能源消耗和成本。

- 2022 年 1 月,羅格斯大學食品科學教授與軟包裝和材料科學公司 ProAmpac 合作。與 Proanpack 材料科學創新團隊建立了新的合作關係,以幫助該公司兌現生產活性智慧食品包裝的承諾。這種合作有可能推動永續和持久包裝產品的創新。

北美佔有很大佔有率

- 由於有利的監管條件、對永續性的日益重視以及各個最終用戶領域(特別是食品和醫療保健行業)對活性和智慧包裝的需求不斷增加,美國活性和智慧包裝市場正在成長。年。

- 根據美國糧食及農業組織估計,美國每年浪費 1,330 億磅(1,610 億美元)食品。減少食品浪費的努力是多方面的,包括增加將食品轉移到食物銀行、教育和外展工作以及標準化食品標籤上的日期標籤的努力。此外,透過主動智慧 (A&I) 包裝減少食品廢棄物在美國正受到廣泛關注。

- 此外,智慧包裝在食品產業的成長不僅有助於減少食品廢棄物、確保食品安全,而且智慧包裝還可以追蹤食品的位置和狀況,使政府更容易做到這一點,這很大程度上歸功於例如,美國國防部(DOD)和食品藥品協會(FDA)正在鼓勵使用RFID技術進行供應鏈管理以及對需要主動智慧包裝的產品進行追蹤和追蹤。

- 加拿大在北美佔有第二大市場佔有率,大部分趨勢與美國相似。對更健康、更少加工的食品、有效包裝以確保安全、免受污染和延長保存期限的追求,顯示了該國消費者的偏好。

- 此外,加拿大印刷電子工業協會還與包裝聯盟PAC 合作,成立了 IntelliPACK 領導委員會,以加速採用新的智慧包裝產品和應用。 IntelliPACK 聯合計畫於 2017 年啟動,旨在推動可印刷、軟性或透過有機電子 (PE) 實現的智慧包裝的開發和採用。

活性智慧包裝產業概況

活躍的智慧包裝市場是分散的,許多參與者在同一空間競爭。品牌形像在市場消費者決策中發揮重要作用,因為強大的品牌是性能和品質的代名詞。整體而言,競爭企業之間的競爭程度為中等。公司尋求透過簽訂長期供應合約、利用成本效益並將其傳遞給供應鏈來創造雙贏的局面。

- 2022 年5 月- 艾利丹尼森透過整合atma.io 以及Wiliot 標籤的開發、設計和製造來擴展物聯網,以開發和提供數位ID 技術,幫助實現智慧且完全連接的物聯網。宣布與Wiliot 公司建立策略聯盟。

- 2022 年 4 月 - Amcor PLC 投資了位於愛爾蘭斯萊戈的醫療保健包裝工廠,以建立新的醫療包裝熱成型產能。這項數百萬美元的投資增強了 Amcor 不斷發展的無菌包裝產業,並為歐洲和北美客戶提供全面的醫療保健解決方案奠定了基礎。

- 2022 年 3 月 - Graphic Packaging 擴大了其針對飲料行業的永續包裝解決方案的範圍。根據我們對支持循環經濟的持續產品創新的承諾,我們推出了 EnviroClip,這是一種材料最少的紙板替代品,可替代標準飲料罐中的塑膠環和收縮膜。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 研究範圍

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 更長的保存期限和消費者生活方式的改變

- 對永續包裝產品的需求

- 對安全性和追蹤解決方案的需求不斷成長

- 市場挑戰/限制

- 包裝材料對人體影響的相關問題

- 初始資本投資和安裝成本高

第5章 COVID-19 對市場的影響

第6章全球主動智慧包裝市場:依功能分類

- 供應鏈管理

- 產品新鮮度

- 消費者便利性

- 品牌保護

- 產品資訊

第7章智慧包裝市場展望

- 活性包裝

- 智慧包裝

- 調氣包裝

第8章市場區隔

- 活性包裝市場

- 按類型

- 氣體清除劑/脫模劑

- 水分清除劑

- 微波基座

- 其他活性封裝技術

- 按最終用戶產業

- 食品

- 飲料

- 其他最終用戶產業

- 按類型

- 智慧包裝

- 按類型

- 編碼和標記

- 天線(RFID 和 NFC)

- 感測器和輸出設備

- 其他智慧包裝技術

- 按最終用戶產業

- 食品

- 飲料

- 藥品

- 工業

- 後勤

- 其他最終用戶產業

- 按類型

- 按地區(活性包裝和智慧包裝)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第9章 競爭形勢

- 公司簡介

- Amcor PLC

- Avery Dennison

- Ball Corporation

- Coveris Holding SA

- Crown Holdings, Inc.

- Desiccare Inc

- Graphic Packaging International LLC

- Honeywell International Inc.

- Sealed Air Corp.

- Timestrip UK Ltd

- WestRock Company

第10章 市場未來展望

The Active and Intelligent Packaging Market size is estimated at USD 14.48 billion in 2024, and is expected to reach USD 19.89 billion by 2029, growing at a CAGR of 6.55% during the forecast period (2024-2029).

Key Highlights

- Active packaging systems are being developed to extend the shelf life of foods and increase the period that the food is of high quality. Active packaging allows packages to interact with food and the environment and plays an important role in food preservation. Food processing companies drive active packaging demand to keep food fresh for extended periods and throughout the supply chain to reduce food waste and promote more convenient packaging for consumers.

- According to the UN environment program, approximately 1.3 billion metric tons (1.43 billion tons) of all food produced globally is lost or wasted every year. In the United States, an estimated 133 billion pounds of food are wasted yearly, valued at USD 161 billion. Innovative active packaging solutions can be implemented to reduce food wastage. In the future, the demand for active packaging may grow as they are intended to reduce food waste and improve food safety.

- Increasing demand for security and tracking solutions drives growth in the active and intelligent packaging market. For instance, RFID tags provide the ability to identify, control, and manage the food supply chain. These are more advanced, reliable, and efficient than conventional barcode tags for food traceability. RFID tags for monitoring the products' temperature, relative humidity, pressure, pH, and light exposure are already available on the market, aiding in enhancing food quality and safety.

- The primary advantage of active and intelligent packaging lies in its ability to interact with the enclosed product, playing a dynamic role in its preservation. The process keeps track of tagged information throughout the supply chain. Active packaging may change food composition and organoleptic characteristics, provided the changes are consistent with the food provisions. However, it also raises contamination issues, as plastic seepage into foods may lead to health complications.

- Furthermore, the emergence of the COVID-19 pandemic has led to an increase in visible behavioral changes due to a higher inclination toward safe and traceable food on e-commerce platforms and raised public consciousness of health and safety in general. According to an IBM study, approximately 71% of consumers were willing to pay an additional average premium of around 37% for companies providing full transparency and traceability of their products.

Active & Intelligent Packaging Market Trends

Increasing Demand For Longer-lasting And Sustainable Packaging Products

- Traditional packaging protects food from environmental hazards as it travels through the supply chain to the final customer. Nevertheless, it is inert because it does not enhance the value of the contents. However, science is altering this by allowing packaging to communicate with food. As the supply chain becomes digitalized, technology is becoming more important as it offers operational advantages that enable businesses to respond to changing market conditions. Additionally, digitizing makes it easier to comply with regulations and satisfies the market's demand for transparency. This trend is driven by shifting customer expectations for environmentally friendly packaging products.

- For example, the 2021 Global Buying Green Report found that 54% of customers considered sustainable packaging when selecting a product. Within that demography, consumers under the age of 44 are driving this movement. 83% of the consumers said they would be prepared to pay more for goods made with sustainable practices.

- In July 2021, in an effort for further sustainability, Flipkart and Myntra teamed up with the non-profit canopy to acquire sustainable packaging. The Flipkart group joined Canopy's Pack4Good and CanopyStyle programs to strengthen their commitment to sustainability and advance sustainable material sourcing and packaging.

- In July 2022, after four years of investigation to develop a more effective and long-lasting storage option, the NEMOSINE Project, led by AIMPLAS, ended. The project successfully produced innovative, long-lasting packaging that aids in lowering the energy usage and expenses of conventional storage methods for film, cinematographic, and photographic archives.

- In January 2022, a Department of Food Science professor at Rutgers University teamed with ProAmpac, a flexible packaging, and material science player. A new partnership with ProAmpac's Material Science and Innovation team has been formed to help the company fulfill its promise of producing active and intelligent food packaging. Such collaborations may drive innovations toward sustainable and long-lasting packaging products

North America Accounts for a Significant Share

- The US active and intelligent packaging market has been witnessing significant growth over the past few years, owing to the favorable regulatory landscape, growing emphasis on sustainability, and increasing demand for active and intelligent packaging across various end-user segments, especially the food and healthcare industry.

- According to the Food and Agriculture Organization of the United States, in the United States, an estimated 133 billion pounds of food, at a value of USD 161 billion, is wasted yearly. Efforts to reduce food waste are multifaceted and include increased diversion of food to food banks, education and outreach, and efforts to standardize date markings on food labels. Furthermore, reducing food waste through active and intelligent (A&I) packaging is gaining significant traction in the United States.

- Moreover, the growth of intelligent packaging in the food industry is significantly attributed to government efforts, as beyond reducing food waste or helping to ensure food safety, intelligent packaging also can track the location and condition of food. For instance, the US Department of Defense (DOD) and the Food and Drugs Association (FDA) encouraged using RFID technology for supply chain management and tracking and tracing products requiring active and intelligent packaging.

- Canada occupies the second largest market share in the North American region, with the majority of trends similar to the United States. The move toward healthier, less processed food, which has been packaged efficiently to ensure safety from contamination and increase the longevity of the shelf-life, is indicative of consumer preferences in the country.

- In addition, the Canadian Printable Electronics Industry Association has formed the IntelliPACK Leadership Council, in partnership with PAC, Packaging Consortium, to speed up the adoption of new intelligent packaging products and applications. The joint IntelliPACK program was launched in 2017 to drive the development and adoption of intelligent packaging enabled with printable, flexible, or organic electronics (PE).

Active & Intelligent Packaging Industry Overview

The active and intelligent packaging market is fragmented, with many players competing in the same space. Brand identity plays a major role in shaping consumer decisions in the market, as strong brands are synonymous with high performance and quality. Overall, the intensity of competitive rivalry is moderately high. Companies try to enter into long-term supply contracts to create a win-win situation by utilizing cost benefits and passing on the supply chain.

- May 2022- Avery Dennison announced its strategic partnership with Wiliot, a developer and provider of digital ID technologies to scale the IoT through the integration of atma.io and the development, design, and manufacturing of Wiliot tags, which will help to create an intelligent and fully connected IoT.

- April 2022 - Amcor PLC invested in establishing new thermoforming capabilities for medical packaging in its Sligo, Ireland, healthcare packaging facility. The multi-million-dollar investment would strengthen Amcor's growth industry for sterile packaging, offering customers in Europe and North America another site with comprehensive healthcare solutions.

- March 2022 - Graphic Packaging extended a range of sustainable packaging solutions for the beverage industry. In line with its commitment to ongoing product innovation in support of a more circular economy, the business launched EnviroClip, a minimal material, paperboard alternative to plastic rings and shrink film for standard beverage cans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 SCOPE OF THE REPORT

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Longer Shelf Life and Changing Consumer Lifestyle

- 4.4.2 Demand For Longer-lasting and Sustainable Packaging Products

- 4.4.3 Increasing Demand For Security and Tracking Solutions

- 4.5 Market Challenges/restraints

- 4.5.1 Issues With the Effects of Packaging Materials on the Human Body

- 4.5.2 High Initial Capital Investment and Installation Costs

5 IMPACT OF COVID-19 ON THE MARKET

6 GLOBAL ACTIVE AND INTELLIGENT PACKAGING MARKET - BY FUNCTION

- 6.1 Supply Chain Management

- 6.2 Product Freshness

- 6.3 Consumer Convenience

- 6.4 Brand Protection

- 6.5 Product Information

7 SMART PACKAGING MARKET LANDSCAPE

- 7.1 Active Packaging

- 7.2 Intelligent Packaging

- 7.3 Modified Atmosphere Packaging

8 MARKET SEGMENTATION

- 8.1 Active Packaging Market

- 8.1.1 By Type

- 8.1.1.1 Gas Scavengers/emitters

- 8.1.1.2 Moisture Scavengers

- 8.1.1.3 Microwave Susceptors

- 8.1.1.4 Other Active Packaging Technologies

- 8.1.2 By End-user Industry

- 8.1.2.1 Food

- 8.1.2.2 Beverages

- 8.1.2.3 Other End-user Industries

- 8.1.1 By Type

- 8.2 Intelligent Packaging

- 8.2.1 By Type

- 8.2.1.1 Coding And Markings

- 8.2.1.2 Antenna (RFID & NFC)

- 8.2.1.3 Sensors and Output Devices

- 8.2.1.4 Other Intelligent Packaging Technologies

- 8.2.2 By End-user Industry

- 8.2.2.1 Food

- 8.2.2.2 Beverages

- 8.2.2.3 Pharmaceuticals

- 8.2.2.4 Industrial

- 8.2.2.5 Logistics

- 8.2.2.6 Other End-user Industries

- 8.2.1 By Type

- 8.3 By Geography (Active and Intelligent Packaging)

- 8.3.1 North America

- 8.3.1.1 United States

- 8.3.1.2 Canada

- 8.3.2 Europe

- 8.3.2.1 United Kingdom

- 8.3.2.2 Germany

- 8.3.2.3 France

- 8.3.2.4 Italy

- 8.3.2.5 Rest of Europe

- 8.3.3 Asia-Pacific

- 8.3.3.1 China

- 8.3.3.2 India

- 8.3.3.3 Japan

- 8.3.3.4 Rest of Asia-Pacific

- 8.3.4 Latin America

- 8.3.5 Middle-East and Africa

- 8.3.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Amcor PLC

- 9.1.2 Avery Dennison

- 9.1.3 Ball Corporation

- 9.1.4 Coveris Holding SA

- 9.1.5 Crown Holdings, Inc.

- 9.1.6 Desiccare Inc

- 9.1.7 Graphic Packaging International LLC

- 9.1.8 Honeywell International Inc.

- 9.1.9 Sealed Air Corp.

- 9.1.10 Timestrip UK Ltd

- 9.1.11 WestRock Company