|

市場調查報告書

商品編碼

1432789

分散式控制系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Distributed Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

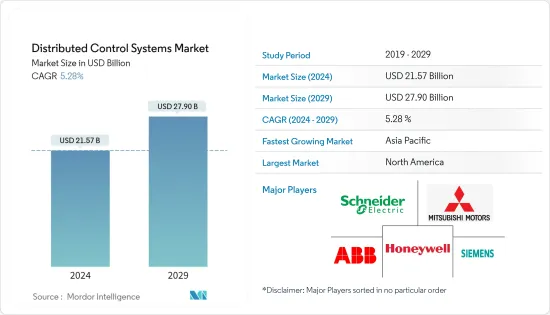

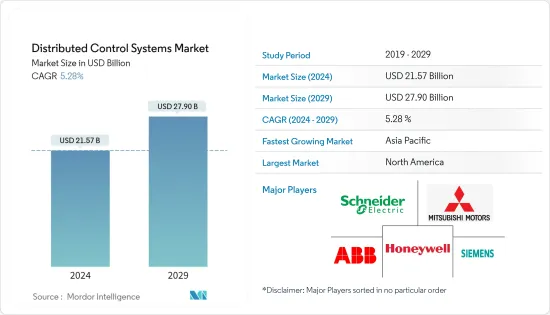

2024年分散式控制系統市場規模估計為215.7億美元,預計到2029年將達到279億美元,在預測期間(2024~2029年)以5.28%的複合年增長率增長。

預計未來分散式控制系統市場將受到製程工業製造商實施最佳自動化技術以在當前競爭環境中獲得競爭優勢的趨勢的推動。

智慧應用和物聯網技術的日益採用是市場的主要促進因素。隨著智慧型設備的日益普及,對具有減少時間延遲和提高性能的多功能微電子裝置的需求不斷增加。

現今,製程工業的運作環境高度複雜,對其控制技術的要求也相應更高。控制技術是製程工業競爭力的重要手段,特別是如果它能夠應對當今和未來的巨大課題。最新版本的DCS系統在安全性、與現代技術的兼容性和操作員效率方面比以前的系統帶來了顯著改進,推動了分散式控制系統市場的發展。

COVID-19 對世界各地的每個行業都產生了重大影響。由於快速成長,世界各國政府對工廠和辦公室的運作採取了更強力的措施,導致封鎖增加。由於商業和工業部門的電力需求大幅下降,封鎖對電力部門產生了重大影響。對於世界各地的大多數企業來說,從疫情造成的嚴重損失中恢復的階段已基本完成。

Wind Europe可再生,許多新的風發電工程預計會出現延誤,開發商錯過了引入競標系統的最後期限,並因COVID-19而面臨罰款。該機構表示,儘管大流行威脅著全球供應鏈:在電力產業,向二氧化碳淨零排放的轉變是不可阻擋的。此次疫情也表明,製造自動化對於現代工業的運作有多麼重要。其中一些是由社交距離驅動的,一些是由網路威脅驅動的。隨著製造商重組其業務以更多地依賴機器人技術,社交距離措施產生了更大的影響。

然而,最新版本的DCS系統在安全性、與現代技術的兼容性和操作員效率方面比以前的系統顯示出顯著的改進,這些都是分散式控制系統的市場驅動力。現代 DCS 包括資產診斷、性能監控、車隊管理、故障警報處理、訊息優先順序以及發生故障時的簡化操作等新功能。新 DCS 的目的是在發電廠的整個生命週期中發揮作用。 DCS可以線上更新,安裝更新和安全補丁,並且可以在不關閉工廠的情況下添加新功能。

此外,DCS 通常用於大量或連續操作,例如石油精製、發電、有機化合物生產、製程、食品和飲料生產、製藥生產和水泥。 DCS 可以控制各種類型的設備,例如變速驅動器、品管系統、馬達控制中心 (MCC)、窯爐、製造設備和採礦設備。

DCS 系統的主要優勢之一是分散式控制、工作站和其他計算元件之間的數位通訊遵循P2P存取原則。為了在石化、核能、石油和天然氣工業等製程工業中實現更高的精度和控制,對能夠在特定設定點附近提供指定製程公差的控制器的需求不斷成長。

這些要求推動了 DCS 的採用。這些系統降低了操作複雜性和計劃風險,並提供了諸如在要求苛刻的應用中實現敏捷製造的彈性等功能。 DCS可以整合PLC、渦輪機械控制、安全系統、第三方控制以及熱交換器、給水加熱器和水質等各種工廠製程控制,進一步促進DCS在能源領域的採用。

集散控制系統市場趨勢

服務佔重要市場佔有率

在研究範圍內的其他組成部分中,DCS 產業服務市場是所有收益相關人員中最令人感興趣的。由於 DCS 在維護、安裝、警報管理、升級服務、工廠資產管理、生命週期服務、諮詢服務、遷移服務、模擬和培訓服務方面的廣泛適用性,服務業對 DCS 的需求也在成長。因此,在預測期內,不斷成長的能源需求和重大技術進步預計將推動需求,特別是服務業的需求。

此外,市場領先的供應商繼續專注於擴大計劃以及營運和維護服務能力,以實現市場的持續擴張。市場報告涵蓋的服務範圍的各個組成部分包括計劃管理服務、非合約維護、維修和升級。

由於產業內分散式天線系統服務供應商數量顯著增加,目前佔據DCS市場重要部分的服務市場預計將在預測期內以最快的速度發展。

隨著意識的不斷增強,產業相關人員開始專注於部署和執行 IIoT 策略以增強 DCS 網路服務。隨著感測器和邊緣設備變得更加強大並且具有類似於 PC 的處理和通訊能力,這種關係已經發生了變化。每個設備都可以作為對等方執行更多功能,而不是扮演被動監聽和回應的角色。

此外,主要自動化承包商(MAC)的概念在計劃服務中變得越來越重要,其中供應商負責計劃的所有自動化相關系統。

這種趨勢在大多數大型 DCS計劃中都在增加。服務市場封裝了金字塔的底層實體,即備件和維修,它們有助於系統生產力、降低成本,並透過減少生產單元的運作來延長產品生命週期和系統。它已被證明是有幫助的。高效率地實現營運績效。

北美佔據主要市場佔有率

北美快速成長的頁岩氣產業預計將成為該地區分散式控制系統市場的主要推動力。

根據美國能源局,到 2035 年,頁岩氣的佔有率預計將達到近 45%,從而促使緊密整合,這可能會促使 DCS 市場的平行成長。

此外,儘管該市場目前面臨全球油價下跌的課題,但預計未來將成為一個大產業。頁岩氣開採需要大量的水,為水處理設施中的 DCS 系統創造了市場,從而顯著增加了整體市場。

此外,北美化工產業也受惠於可靠性的提高、遠端監控的簡化以及安裝成本的降低。此外,化學產業的一些公司正在從過時的 DCS 系統轉向更先進的 DCS 系統,以提高生產、效率、安全性並減少人為錯誤。

北美石油和天然氣產業是流程主導的,具有連續運作和複雜的監控方法。操作員很難監控和調節該領域使用的機器的運作。北美的許多公司已經引入了 HMI 和控制器 (DCS) 的使用,允許操作員管理操作。這些系統會自動執行警報管理系統等安全程序,並執行設備維護和維修任務。

事實證明,分散式控制系統對於核能發電廠的管理至關重要,它可以進一步支援美國核能發電廠市場,並不斷增加核能發電廠的容量和數量。

分散式控制系統產業概況

在競爭激烈的分散式控制系統市場上有幾個重要的競爭對手。目前,就市場佔有率而言,很少有大型競爭對手能夠控制大部分市場。擁有重要市場佔有率的大公司都致力於擴大其國際消費群。許多公司依靠策略合作計劃來增加市場佔有率和盈利。

2022 年 12 月,霍尼韋爾宣布印度 Regreen Excel EPC 已在印度 40 家工廠部署霍尼韋爾 PlantCruise by Experion 分散式控制系統 (DCS) 解決方案、模組化系統和現場儀表 (FI)。 Regreen Excel EPC India Pvt. Ltd. 是一家釀酒廠、糖廠、汽電共生、生質燃料、零液體排放系統和可再生能源公司。此技術可協助使用者增加生產運作,提高安全性、可靠性和效率,並降低投資和運作成本。

2022 年 5 月,ABB 對阿拉伯聯合大公國的製程控制系統和水泥研磨設備進行了現代化改造,以提高多個站點的運作和一致性。 ABB 正在為阿拉伯聯合大公國 Star Super Cement 的水泥研磨作業建造最先進的分散式控制系統 (DCS) 自動化技術。憑藉新的增強型系統和多個線性化和破碎裝置的全站點同質性,Star Cement 受益於操作員可視性的提高、維護的簡單性和停機時間的減少。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 價值鏈分析

- 市場促進因素

- 主要新興國家能源需求擴大

- 更多採用智慧應用和物聯網技術

- 現有 DCS 解決方案的現代化有助於服務業的成長

- 市場限制因素

- 擴大製程自動化領域替代技術的使用

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依成分

- 硬體

- 軟體

- 依服務

- 依行業分類

- 發電

- 油和氣

- 化學

- 精製

- 礦業/金屬

- 紙漿

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- UAE

- 南非

- 其他中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- ABB Ltd.

- Honeywell International Corporation

- Siemens AG

- Schneider Electric

- Mitsubishi Motors Corporation

- Rockwell Automation

- Emerson Electric Company

- Metso(Valmet Oyj)

- Omron Corporation

- Novatech Llc(Weir Group)

- Azbil Corporation

- Toshiba International

- Yokogawa Electric Co.

第7章 投資分析

第8章 未來趨勢

The Distributed Control Systems Market size is estimated at USD 21.57 billion in 2024, and is expected to reach USD 27.90 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

The distributed control system market will be driven in the future by the tendency for manufacturers in the process industry to implement the best automation technologies to obtain a competitive edge in the current competitive environment.

The growing adoption of smart applications and IoT technologies are the key drivers for the market. With the increased adoption of smart devices, there is an increase in the demand for multifunctional microelectronics with reduced time delays and improved performance.

The process industry currently operates in a very complex environment, and the requirements for its control technology are correspondingly demanding. Control technology is a key lever for gaining a competitive edge in the process industry, all the more so if it can meet the tremendous challenges of both today and tomorrow. The latest iterations of DCS systems provide marked improvements over their predecessors regarding security, compatibility with the latest technology, and operator effectiveness, which drives the distributed control systems market.

COVID-19 had a significant impact on all industries worldwide. Because of the rapid growth, governments worldwide took stronger measures for functioning industrial plants and offices, resulting in stricter lockdowns. The lockdown significantly influenced the power sector as power demand from commercial and industrial sectors reduced significantly. For most businesses worldwide, the recovery phase following large losses during the pandemic was nearly completed.

According to Wind Europe, delays were expected in many new wind farm projects, causing developers to miss the deployment deadlines in the auction systems and face financial penalties due to COVID-19, The International Renewable Energy Agency stated that despite the pandemic threatening global supply chains in the power sector, it would not stop the industry from transitioning to net-zero CO2 emissions. The pandemic also showed how essential manufacturing automation was to modern industry functioning, with some fueled by social distancing and some by cyber threats. Social distancing measures had a greater impact as they led the manufacturers to restructure their operations to rely more on robotics.

However, the latest iterations of DCS systems provide marked improvements over their predecessors regarding security, compatibility with the newest technology, and operator effectiveness, a market driver for distributed control systems. Modern DCSs include new capabilities, such as asset diagnostics, performance monitoring, fleet management, alarm handling during the fault, prioritizing messages, and simplifying actions to be taken in the event of a failure. The purpose of the newer DCSs is to serve the entire lifetime of the power plant. The DCSs can be updated online, where updates and security patches are installed, and new features can be added without shutting down the plant.

Moreover, DCS is often employed in batch-oriented or continuous method operations, such as oil purification, power generation, organic compound manufacturing, craft, food and drink manufacturing, pharmaceutical production, and cement. DCSs can control various instrumentality types, including variable speed drives, quality control systems, motor control centers (MCC), kilns, manufacturing equipment, and mining equipment.

One of the significant benefits of DCS systems is that the digital communication between distributed controllers, workstations, and other computing elements follows the peer-to-peer access principle. To achieve greater precision and control in process industries, like the petrochemical, nuclear, and oil and gas industries, there is an increasing demand for controllers which offer specified process tolerance around an identified set point.

These requirements have driven the adoption of DCS, as these systems provide lower operational complexity, project risk, and functionalities, like flexibility for agile manufacturing in highly demanding applications. The ability of DCS to integrate PLCs, turbomachinery controls, safety systems, third-party controls, and various other plant process controls for heat exchangers, feedwater heaters, and water quality, among others, further drives the adoption of DCS in the energy sector.

Distributed Control Systems Market Trends

Services Constitute a Considerable Market Share

The services market in the DCS industry is the most intriguing of all the revenue stakeholders among the other components included in the report's scope. Due to its widespread applicability in maintenance, installation, alarm management, upgrade services, plant asset management, lifecycle services, consulting services, migration services, simulation, and training services, the service segment is also expanding demand for DCS. As a result, rising energy demand and considerable technological advancements will drive demand for the services segment, among others, during the projection period.

Moreover, the top market suppliers continue to emphasize expanding capabilities for projects and operations and maintenance services for continuous market expansion. The different components in the scope of services covered in the market report include project management services, non-contract maintenance, retrofits, and upgrades.

Due to an enormous increase in the number of distributed antenna systems service providers in the industry, the services market, which currently holds a significant part of the DCS market, is anticipated to develop at the fastest rate over the projection period.

With the rising awareness, industry players are focusing on deploying and executing IIoT strategies to enhance the DCS network services. The relationship has changed because sensors and edge devices are far more capable, with some processing and communications abilities similar to a PC. Instead of acting in a passive listen-and-respond role, each device can perform more as a peer.

In addition, the main automation contractor (MAC) concept is increasingly becoming important in project services, where the supplier is responsible for all automation-related systems of the project.

The trend is growing in the majority of the large DCS projects. The services market encapsulates entities from the bottom of the pyramid, i.e., the spare parts and repairs, which prove to be helpful in system productivity, cost curtailment, and extension of the product life cycle and systems by reducing the uptime of production units, thus, efficiently delivering operational excellence.

North America Holds Significant Market Share

The rapidly growing shale gas industry in North America is expected to be a major driver of the Distributed Control Systems market in the region.

According to the Department of Energy, in the United States, The shale gas percentage is expected to reach nearly 45% by 2035, which is likely to result in a parallel growth of the tightly integrated DCS market, which provides sustainability of the process through redundant controls in high-risk environments.

In addition, this market is currently challenged by reducing oil prices globally but can be relied upon to be a sizeable industry in the future. The requirement for a large amount of water in Shale gas extraction has created a market for DCS systems in water treatment facilities, resulting in a significant rise in the overall market.

Moreover, the chemicals sector in North America is benefiting from improved dependability, simplified remote monitoring, and lower installation costs. Additionally, several businesses in the chemicals sector are switching from outdated DCS systems to more advanced ones to improve production, efficiency, and safety and decrease human error.

The oil and gas industry in North America is process-driven, with ongoing operations and intricate monitoring methods. It is challenging for operators to keep an eye on and regulate the operation of the machinery used in the sector. Many North American businesses are implementing the usage of an HMI and a controller, or DCS, which enables operators to manage operations. These systems automate safety procedures, including alarm management systems, and perform equipment maintenance and repair tasks.

Distributed control systems have proven vital in managing nuclear power plants, further helping their market in the United States and continuously increasing its nuclear power plant capacity and numbers.

Distributed Control Systems Industry Overview

There are several significant competitors in the competitive distributed control system market. Few of the big competitors now control most of the market in terms of market share. Major firms with a sizable market share are concentrating on growing their consumer base internationally. Many businesses rely on strategic collaboration projects to improve their market share and profitability.

In December 2022, Honeywell announced that Regreen Excel EPC, India, has deployed Honeywell's PlantCruise by Experion Distributed Control Systems (DCS) solution, modular systems, and field instruments (FI) across its 40 plants in India. Regreen Excel EPC India Pvt. Ltd. is a distillery, sugar and cogeneration, biofuels, zero liquid discharge systems, and renewable energy company. The technology assists users in increasing production uptime, improving safety, dependability, and efficiency, and lowering investments and running costs.

In May 2022, ABB modernizes process control systems and cement grinding equipment in the UAE to improve uptime and consistency across several sites. ABB builds a cutting-edge distributed control system (DCS) automation technology at Star Super Cement cement grinding operations in the United Arab Emirates. With the new enhanced systems and homogeneity throughout the multiple linearization and grinding unit sites, Star Cement will benefit from greater operator visibility, easier maintenance, and little downtime.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Growing Energy Demand from Major Emerging Economies

- 4.3.2 Growing Adoption for Smart Applications and Iot Technologies

- 4.3.3 Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector

- 4.4 Market Restraints

- 4.4.1 Growing Availability of Alternative Technologies in the Field of Process Automation

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End-User Vertical

- 5.2.1 Power Generation

- 5.2.2 Oil & Gas

- 5.2.3 Chemicals

- 5.2.4 Refining

- 5.2.5 Mining & Metals

- 5.2.6 Paper and Pulp

- 5.2.7 Other End-User Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 UAE

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Honeywell International Corporation

- 6.1.3 Siemens AG

- 6.1.4 Schneider Electric

- 6.1.5 Mitsubishi Motors Corporation

- 6.1.6 Rockwell Automation

- 6.1.7 Emerson Electric Company

- 6.1.8 Metso (Valmet Oyj)

- 6.1.9 Omron Corporation

- 6.1.10 Novatech Llc (Weir Group)

- 6.1.11 Azbil Corporation

- 6.1.12 Toshiba International

- 6.1.13 Yokogawa Electric Co.