|

市場調查報告書

商品編碼

1432422

財務分析:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Financial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

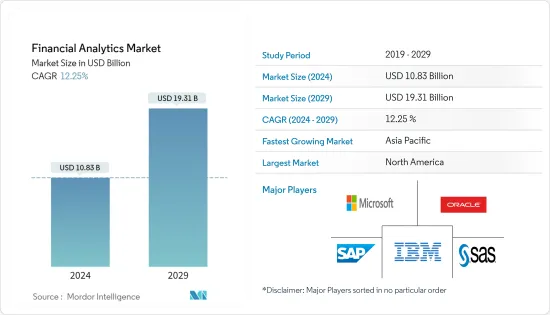

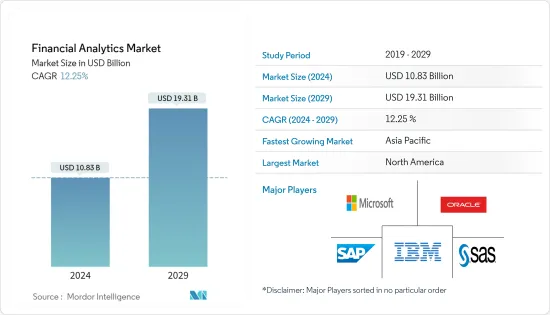

金融分析市場規模預計到 2024 年為 108.3 億美元,預計到 2029 年將達到 193.1 億美元,在預測期內(2024-2029 年)複合年成長率為 12.25%。

持續的技術進步、對雲端基礎的服務不斷成長的需求以及各個組織和行業對金融分析解決方案不斷成長的需求預計將推動全球金融分析市場的發展。

主要亮點

- 在波動性、不確定性和風險增加的經濟環境中,財務規劃、管理和預測解決方案為使用者提供速度、敏捷性和業務遠見,幫助他們在市場中競爭。財務分析解決方案使客戶能夠更好地整合資訊、發現市場趨勢並提供見解以改善整個企業的決策。

- 隨著各種最終用戶公司越來越關注資料主導的財務決策以及大量資料的出現,需要解決方案來處理大量資料並提供有價值的見解。此外,業務分析和商業智慧領域增強技術的發展以及對資料透明度的日益重視正在增加各個行業對這些解決方案的需求。

- 財務分析解決方案擴大應用於各個行業,以增強業務營運。例如,BFSI 是一個資料主導的行業,處理透過 ATM 交易、現金交易、開戶、網上銀行業務、網路購物等產生的大量資料。提供以客戶為中心的客製化服務和提案正在推動 BFSI 行業對分析的需求。此外,BI 還為銀行和其他金融機構提供靈活、透明的方法來做出更好的財務決策和業務。

- 人工智慧主導的商業情報軟體為銀行和投資公司等金融機構帶來價值的兩種主要方式是報告和預測分析。例如,SAS Visual Analytics 結合使用預測分析和自然語言處理來幫助銀行向關鍵員工提供自助分析和互動式報告。此類軟體應用程式可以幫助 BFSI 機構制定獲取客戶或尋找違約機率較低的客戶的策略。

- 此外,隨著市場的顯著成長,新興企業正在獲得大量投資,並利用這一機會來增強其產品供應和市場佔有率。例如,Sigmoid 是新興企業幫助英國、美國和歐洲的企業探索資料並從中獲得更好見解的新創公司,在經歷了一年的強勁成長後,於 2022 年 9 月籌集了 1,200 萬美元。消費品和金融服務領域的公司是 Sigmoid 的一些最大客戶。

- 然而,資料外洩和網路攻擊的風險是阻礙所研究市場成長的主要課題之一。特別是在新興市場,消費者意識低落也是市場成長的限制因素。

- 隨著 COVID-19 的爆發,這種對決策的支持變得比以往任何時候都更加重要。在新冠肺炎 (COVID-19) 大流行期間,金融分析服務在新環境中迅速發展並改變了數位經營模式。此外,消費者和企業對數位技術的認知也在不斷提高,預計這將為所研究市場的成長創造有利的未來。

金融分析市場的趨勢

雲端基礎的解決方案有望引領潮流

- 全球對雲端基礎的金融分析解決方案的需求預計將在預測期內顯著成長。採用雲端基礎的財務分析解決方案的關鍵因素包括部署速度、易於擴充性、敏捷性和 24/7 可用性。此外,雲端基礎的財務分析解決方案可讓您跨任何管道從任何來源獲取資料,並以巨量資料規模運行它。

- 此外,隨著大多數企業尋求提高財務績效,雲端基礎的解決方案對於降低營運、維護和實施成本至關重要。此外,最終用戶行業不斷成長的數位化未來幾年雲端基礎的金融分析解決方案的成長提供了廣闊的前景。

- 此外,對於大多數沒有這些雲端基礎的解決方案的組織來說,從所有內部應用程式、社交網路、裝置和資料訂閱收集資料將相對昂貴。此外,最近各行業對雲端處理的接受度被認為會對金融分析市場產生正面影響。

- 此外,BFSI 產業正在轉向這些雲端基礎的解決方案,進一步推動對雲端基礎的分析解決方案的需求。供應商也宣布推出雲端基礎的數位付款解決方案,推動市場研究。例如,2022 年 12 月,彙報、分析和績效管理解決方案供應商 InsightSoftware 發布了 Jet Analytics Cloud。此託管服務旨在簡化財務和業務報告,同時增加資料的價值。

- 此外,隨著組織迅速轉向雲端解決方案,對雲端基礎的財務分析的需求預計在預測期內將會增加。例如,根據泰雷茲2022年資料威脅報告,全球組織中儲存在雲端的企業資料佔有率將從2015年的30%增加到2022年的60%。

亞太地區在預測期內將經歷顯著成長

- 預計亞太市場在預測期內將出現高成長率,因為它與該地區快速成長的最終用戶產業的成長有關。此外,隨著更複雜和更實惠的技術的出現,企業開始認知到對分析功能的需求,從而推動他們探索的市場。

- 亞太地區目前的財務分析趨勢正在幫助組織提高分析能力和成熟度,從缺乏正式流程和協作的初級或發展中國家轉變為具有整合規劃流程、即時協作規劃和輕鬆多維的先進或領先地位情勢分析。

- 此外,在中國等國家,巨量資料技術在各個最終用戶產業的部署預計將推動該地區的分析服務市場,其中金融服務業處於領先地位。此外,印度金融分析市場仍處於發展早期階段,具有巨大的成長潛力。此外,該地區最終用戶行業的雲端採用正在加速,對雲端基礎的分析的需求預計將進一步增加。隨著市場預計將加速發展,對分析服務的需求預計將繼續成長。

- 此外,近年來,透過整合人工智慧 (AI) 等先進技術,分析解決方案得到了增強。該地區的組織正在迅速採用人工智慧來自動化日益重複的任務,使下一代財務和會計高管能夠為員工提供更有效率的工具。這些發展進一步豐富了市場產品並支持市場成長。

- 此外,該地區的市場參與者正在利用成長機會並不斷創新其市場產品。例如,2022年9月,阿里巴巴集團的數位科技和智力骨幹阿里雲宣布推出一整套金融服務的阿里雲解決方案。這些解決方案由 70 多種產品組成,旨在幫助銀行、金融科技、保險和證券等各種規模的金融機構實現業務數位化。

金融分析產業概述

金融分析市場有許多公司,因此市場競爭適度。市場相對集中,主要企業採取的主要策略是產品創新和合作。該市場的主要企業包括IBM公司、微軟公司和甲骨文公司。

- 2023 年 3 月 Epicor 收購了 DSPanel,DSPanel 是一家雲端基礎的財務規劃和分析 (FP&A) 解決方案的全球供應商,也是 Epicor 現有的 ISV 合作夥伴。此次收購擴展了 Epicor 的財務管理解決方案組合,使世界各地的製造商、分銷商和搬運商能夠簡化預算、預測、規劃、場景建模和財務報告。

- 2022 年 9 月,微軟宣布,在中東、非洲和亞洲 16 個國家經營零售品牌家樂福的 Majid Al Futtaim Retail 將利用可靠、智慧且多功能的 Microsoft Azure 數據平台的力量,宣布已轉變了其財務規劃和分析(FP&A) 職能。 Majid Al Futtaim Retail 的財務團隊利用 Azure 分析平台完全自動化財務和業務彙報,並為決策者創建單一事實來源。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- BI 和業務分析工具的進步

- 最終主導越來越關注資料驅動的財務決策

- 市場課題

- 網路攻擊與資料外洩風險

第6章市場區隔

- 依安裝類型

- 本地

- 雲

- 依解決方案類型

- 資料庫管理與規劃

- 分析報告

- 其他

- 依行業分類

- BFSI

- 衛生保健

- 製造業

- 政府機關

- 資訊科技和電信

- 其他行業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 新加坡

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- FICO

- Hitachi Vantara

- SAS Institute

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Teradata Corporation.

- SAP SE

第8章投資分析

第9章 市場機會及未來趨勢

The Financial Analytics Market size is estimated at USD 10.83 billion in 2024, and is expected to reach USD 19.31 billion by 2029, growing at a CAGR of 12.25% during the forecast period (2024-2029).

The ongoing technological advancements, the increasing need for cloud-based services, and the increasing demand for financial analytics solutions in various organizations and verticals are expected to boost the global financial analytics market.

Key Highlights

- In this economic environment of rising volatility, growing uncertainty, and risk, financial planning, managing, and forecasting solutions provide the user with speed, agility, and foresight about the business to compete in the market better. Using financial analytics solutions, clients can better synthesize information, uncover market trends, and deliver insights to improve decision-making throughout the enterprise, which is driving growth in the global financial analytics market.

- The growing focus on data-driven financial decisions in various end-user verticals and the emergence of significant data demands solutions that tackle large amounts of data and provide valuable insights. Further, the development of enhanced technologies in business analytics and business intelligence domain and the extended focus on data transparency drive the demand for these solutions across various industries.

- Financial analytics solutions are increasingly being utilized by several industries for enhancing business operations. For instance, BFSI is a data-driven industry with massive volumes of data generated through ATM transactions, cash transactions, account opening, internet banking, online shopping, etc. The need to deliver customized and customer-centric services and offers drive the demand for analytics in the BFSI industry. Moreover, BI offers banking and other financial institutions a flexible and transparent approach to making better financial decisions and operations.

- The two predominant ways that AI-driven business intelligence software could bring value to financial institutions such as banks, investment firms, etc., are report generation and predictive analytics. For instance, SAS Visual Analytics claims to help banks provide self-service analytics and interactive reports to their lead staff using a combination of predictive analytics and natural language processing. Such software applications can help BFSI institutions develop strategies to gain customers or find customers who are less likely to default on loans.

- Further, with the significant growth in the market, emerging players are capitalizing on the opportunities by gaining substantial investment to enhance their product offerings and market presence. For instance, in September 2022, Sigmoid, a startup helping firms in the U.K., U.S., and Europe go through their data and derive better insights from it, raised USD 12 million following a strong year of growth. Firms operating in consumer goods and financial services categories are some of Sigmoid's largest customers.

- However, the risk of data breaches and cyberattacks are among the primary factor challenging the growth of the studied market. A lower consumer awareness, especially across the developing regions, also restraints the growth of the market.

- With the outbreak of COVID-19, this support for decision-making became more critical than ever. During the COVID-19 pandemic, financial analytics services rapidly evolved and transformed digital business models with new circumstances. Furthermore, the awareness regarding digital technologies also increased among consumers and businesses, which is expected to create a future favorable to the growth of the studied market.

Financial Analytics Market Trends

Cloud Based Solutions are Expected to Gain Significant Traction

- The global demand for cloud-based financial analytics solutions is anticipated to witness significant growth over the forecast period. Speed of deployment, ease of scalability, agility, and 24x7 availability are some key drivers for adopting cloud-based financial analytics solutions. Further, it allows organizations to incorporate data from all sources across all channels and do it at a big-data scale.

- Further, as the majority of businesses aim to improve financial performance, cloud-based solutions are vital due to lower operational, maintenance, and installation costs. Moreover, the growing digitization across end-user industries offers a prominent future for the growth of the cloud-based financial analytics solution in the coming years.

- Moreover, data collection from all internal applications, social networks, devices, and data subscriptions would be comparatively expensive for most organizations without these cloud-based solutions. Further, cloud computing acceptance across various industries in the recent past is assumed to have a positive effect on the financial analytics market.

- In addition, the BFSI industry is moving towards these cloud-based solutions, further driving the demand for cloud-based analytics solutions. Vendors are also launching cloud-based digital payment solutions, which boosts the market studied. For instance, in December 2022, insightsoftware, a provider of reporting, analytics, and performance management solutions, released Jet Analytics Cloud. This managed services offering is designed to simplify financial and operational reporting while augmenting the value of the user's data.

- Further, with organizations rapidly moving towards cloud solutions, the demand for cloud-based financial analytics is expected to increase over the forecast period. For instance, according to the 2022 Thales Data Threat Report, the share of corporate data stored in the cloud in organizations worldwide increased from 30% in 2015 to 60% in 2022.

Asia-Pacific to Witness a Significant Growth Over the Forecast Period

- The Asia Pacific region is expected to witness a high growth rate during the forecast period as the market in this region correlates with the growth in the end-user industries in the region, which are growing rapidly. Further, with more sophisticated and affordable technology available, organizations recognize the need for analytics capabilities, boosting the studied market.

- Current financial analytics trends in the Asia-pacific region are helping organizations to improve their analytical capabilities and maturity level, taking them from a primary or developing state where there are few formal processes and little collaboration to an advanced or leading state with integrated planning processes, real-time collaborative planning, and easy multi-dimensional scenario analysis.

- Moreover, in countries, like China, the deployment of big data technology across various end-user industries is expected to drive the analytics services market in this region, with the financial services sector leading the way. Additionally, India's financial analytics market is still in its early stage of development with tremendous growth potential. Also, as cloud adoption is gaining pace in the region's end-user industries, the demand for cloud-based analytics is further expected to increase. As the market is expected to acquire speed, the need for analytics services is expected to increase in the future.

- Further, in recent years the capabilities of analytics solutions have been enhanced by integrating advanced technologies such as artificial intelligence (AI). Organizations across the region are rapidly incorporating AI to automate an increasing volume of repetitive work, enabling the next generation of finance and accounting executives to provide their workforce with more efficient tools. Such developments will further enrich the market offerings, thus boosting the market's growth.

- Additionally, market players in the region are capitalizing on growth opportunities and continuously innovating their market offerings. For instance, in September 2022, Alibaba Cloud, the digital technology and intellectual backbone of Alibaba Group launched a comprehensive suite of Alibaba Cloud for Financial Services solutions. Comprising over 70 products, these solutions are designed to help financial services institutions of all sizes across banking, FinTech, insurance, and securities, digitalize their operations.

Financial Analytics Industry Overview

The financial analytics market is moderately competitive owing to the presence of many players in the financial analytics market. The market appears to be relatively concentrated, and the key strategies adopted by the major players are product innovation and partnerships. Some major players in the market are IBM Corporation, Microsoft Corporation, and Oracle Corporation, among others.

- March 2023 - Epicor acquired DSPanel, a global provider of cloud-based Financial Planning and Analysis (FP&A) solutions, and an existing Epicor ISV partner. The acquisition extends the company's portfolio of financial management solutions, helping makers, sellers, and movers worldwide streamline and simplify budgeting, forecasting, planning, scenario modeling, and financial reporting.

- September 2022 - Microsoft announced that Majid Al Futtaim, Retail operator of the Carrefour retail brand across 16 countries in the Middle East, Africa, and Asia - has transformed its financial planning and analysis (FP&A) capabilities through the power of the trusted, intelligent, versatile Microsoft Azure Data Platform. Majid Al Futtaim Retail's finance team leveraged the Azure Analytics Platform to fully automate financial and operational reporting and create a single source of truth for decision-makers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancement in BI and Business Analytics Tools

- 5.1.2 Growing Focus on Data Driven Financial Decisions in End Users

- 5.2 Market Challenges

- 5.2.1 Cyberattacks and Data Breach Risk

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Solution Type

- 6.2.1 Database Management and Planning

- 6.2.2 Analysis and Reporting

- 6.2.3 Other Type

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government

- 6.3.5 IT and Telecom

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 Singapore

- 6.4.3.4 India

- 6.4.3.5 South Korea

- 6.4.3.6 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 FICO

- 7.1.2 Hitachi Vantara

- 7.1.3 SAS Institute

- 7.1.4 IBM Corporation

- 7.1.5 Microsoft Corporation

- 7.1.6 Oracle Corporation

- 7.1.7 Teradata Corporation.

- 7.1.8 SAP SE