|

市場調查報告書

商品編碼

1432369

數位資產管理:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Digital Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

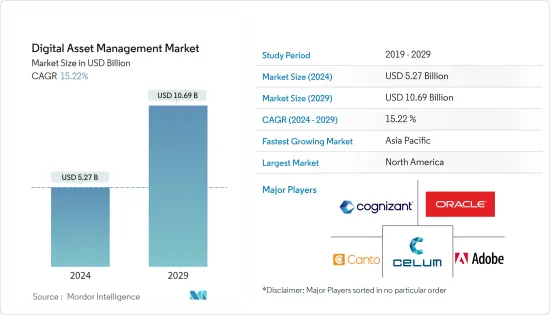

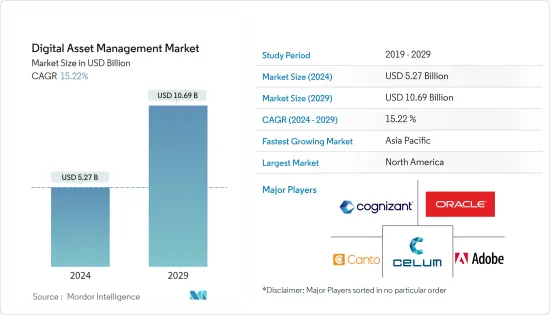

數位資產管理(DAM)市場規模預計 2024 年為 52.7 億美元,預計 2029 年將達到 106.9 億美元,預測期內(2024-2029 年)複合年成長率為 15.22%。

數位內容的創建和普及極大地推動了數位參與度的成長。根據 2021 年 Bynder 對 1,600 名行銷和創新專業人士進行的調查,數位轉型工作在疫情期間獲得了關注,產生了更多的數位內容和創新輸出、實施新的數位體驗技術以及投資於客戶資料和分析是行銷部門。預計這將對市場產生積極影響。

主要亮點

- 所有行業創建和消費的數位內容數量正在迅速增加。組織生產大量數位內容,從照片和影片到文章和創新資產。如此大量的內容正在推動對 DAM 解決方案的需求。我的猜測是,組織需要強大的系統來有效管理、組織和分發其數量不斷成長的數位資產。借助 DAM 系統提供的集中式平台來儲存、編目和搜尋數位資產,組織可以有效地管理內容庫並簡化內容工作流程。隨著企業尋求簡化內容管理程序並提高協作和生產力,對 DAM 解決方案的需求預計將會成長。

- 雲端運算因其擴充性、彈性和成本效益而在許多行業中變得普及。市場促進因素包括雲端基礎的DAM 解決方案的成長。雲端基礎的DAM 服務使組織能夠隨時隨地在任何裝置上安全地儲存和存取其數位資產。這種可訪問性和可用性促進了地理上分散的團隊和外部相關人員之間的協作。其他雲端基礎的工具和服務,例如內容管理系統、行銷自動化平台和社交媒體管理工具,可以與雲端基礎的DAM 無縫整合。雲端基礎的DAM 系統的擴充性和經濟性正在擴大市場,使其成為各種規模企業的理想選擇。

- 隨著組織產生越來越多的數位資產,DAM 系統需要可擴充性以滿足不斷成長的需求。然而,一些 DAM 平台在有效管理大量資產和處理同時上線用戶存取方面可能面臨挑戰。如果您的 DAM 基礎架構的設計無法跟上您的內容規模和使用者需求,您可能會遇到效能問題,例如資產搜尋緩慢和系統延遲。這些限制會影響生產力和使用者滿意度。

- 此次疫情也凸顯了雲端基礎的解決方案的重要性,這些解決方案支援遠端存取、協作和擴充性。我們相信,越來越多的公司正在轉向雲端基礎的DAM 解決方案,以便在可從任何地方存取的集中位置安全地儲存和管理其數位資產。雲端基礎的DAM 平台提供遠端工作環境所需的彈性和擴充性,使團隊能夠有效協作並遠端存取資產。對雲端基礎的DAM 解決方案的需求推動了疫情期間的市場成長。還有俄羅斯和烏克蘭戰爭對整個包裝生態系統的影響。

數位資產管理市場趨勢

雲端部署可望推動數位資產管理市場

- Adobe 於 2022 年 4 月宣布,它將透過 After Effects 和 Premiere Pro 的更新,為數百萬創新 Cloud 客戶帶來 Frame.Io 業界領先的視訊協作平台,包括 After Effects Did 中的原生 M1 支援。引入 Frame 後,影像編輯者和關鍵計劃相關人員(例如製作人、代理商和客戶)現在可以在雲端上進行協作。

- 透過雲端數位資產管理 (DAM),您的組織內的數位媒體管理和分發變得更加容易。 Cloud DAM 不僅為維護品牌形象提供單一事實來源,而且還承諾降低營運成本並提高生產力。前端體驗也會受到雲端DAM的影響。 Bynder 宣布與著名的雲端基礎的社交媒體管理系統 Hootsuite Inc. 進行整合。這種整合將 Bynder 的數位資產連結到 Hootsuite 的儀表板,使社群媒體負責人能夠快速輕鬆地存取創新內容,而無需下載、調整大小或重新上傳單一文件。

- 隨著人工智慧、巨量資料分析等各種技術的引入,雲端基礎的DAM正在廣泛應用。 DAM 使用人工智慧 (AI) 技術掃描內容並建立元資料標籤。 DAM 的人工智慧使用案例包括光學字元辨識、語音辨識和臉部辨識。

- 資料產生的快速成長也導致儲存需求的增加。借助人工智慧(AI)和機器學習功能可以更快地完成資料收集、處理和分析,並且業務資料和應用程式可以遷移到各種公有和私有雲端。由於 Cognizant Technology Solutions、Media Beacon 和 Binder 等眾多公司,數位資產管理市場正在迅速擴張。

- 此外,企業逐漸從本地部署轉向基於 SaaS 的解決方案,提供行動可存取性和其他直覺的服務。該模型的可承受性透過針對各種規模的企業來滿足特定的數位資產需求。此外,這些解決方案通常提供更低的成本選項和更快的服務部署。

亞太地區在預測期內成長率最快

- 由於複雜的內容、語言和其他區域要求,印度被認為是娛樂和媒體提供者非常難以管理的國家。因此,數位資產管理被廣泛採用來解決這種複雜性。

- 2021年10月,哈佛大學的一位設計師創造了一家擁有內容行銷平台的獨角獸。連接設計師和企業的特贊 (Tezign) 宣布完成主導的首輪 D 輪融資,估值升至超過 10 億美元。新加坡國營投資公司和其他支持者出資約4000萬美元。

- 根據中小企業廳的報告,日本 99.7% 的行業屬於中小企業,是該地區數位資產管理解決方案的理想國家。此外,由於預算要求和IT基礎設施不足,中小型企業更喜歡中低成本的解決方案,例如數位存取管理軟體,而不是ERP解決方案。 2021 年 3 月,NRI 宣布與提供數位資產管理服務的 Komainu Holdings Co., Ltd. 合作進行投資。此次合作將使 NRI 和 Komainu 能夠結合各自的技術,並將其產品擴展到該地區的數位資產市場。

- 此外,BFSI 部門也擴大採用 DAM 技術來儲存和管理國家財富。 2021年5月,中國國有亞太投資銀行(APIB)的完全子公司亞洲數位銀行(ADB)宣布計畫透過產業夥伴關係建立自籌資金的定序生態系統。火幣資管成為第二家獲得證監會批准發行100%虛擬資產基金的基金管理人。

- 亞太地區正在成為數位資產管理行業成長最快的地區之一。隨著全球品牌向亞太地區擴張並加大對視覺內容策略的投入,DAM致力於解決在與全球團隊、新領域和大量內容打交道時出現的常見問題,它正在成為一種解決方案。

數位資產管理行業概況

數位資產管理領域的主要企業包括 Cognizant Technology Solutions Corp、Oracle Corporation、CELUM GmbH、Adobe Systems Incorporated、Cloudinary Ltd 和 IBM Corporation。這些公司正在採取擴張、協議、新產品發布、合資、收購和合作等策略來擴大他們在這個市場的足跡。

- 2022 年 3 月 內容營運平台 GatherContent 被數位資產管理 (DAM) 軟體供應商 Bynder 收購。這為 Bynder 的 DAM 服務提供了內容開發的工作流程和編輯流程。透過 GatherContent,Bynder 希望負責人能夠存取整個內容生成生命週期,從文字創建到準備分發的結構化材料。

- 2022 年 1 月 DAM 軟體供應商 PhotoShelter 最近宣布收購英國DAM 服務 Third Light。 PhotoShelter 擁有 1,300 多個客戶,包括企業、品牌、運動聯盟和大學。 Third Light 在全球擁有超過 300 家客戶。透過此次收購,PhotoShelter 現在將提供 Third Light 的旗艦應用程式 Chorus。這些 Third Light 用戶現在可以使用 PhotoShelter 的尖端功能和業務安全性,自 15 年前 PhotoShelter 首次為攝影師提供雲端存檔以來,這些功能和業務安全性已經在 DAM 中得到了發展。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- -市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 數位資產數量增加

- 市場挑戰

- 缺乏解決方案意識且成本高

- 任天堂

- 直播影片管理

- 創新工具整合

- 資產分析

- 網頁內容整合

- 紀伊國屋書店品牌門戶

- 歸檔資產和元資料

- 生命週期和版權管理

第6章市場區隔

- 按發展

- 本地

- 雲(SaaS)

- -按組織規模

- SME(中小企業)

- 主要企業

- 按最終用戶

- 媒體娛樂

- 衛生保健

- 零售

- 製造業

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太地區其他地區

- 其他地區(拉丁美洲、中東和非洲)

- 北美洲

第7章 競爭形勢

- 公司簡介

- Adobe Systems Incorporated(Adobe Experience Manager Assets)

- Canto Inc.(Canto Digital Asset Management)

- CELUM GmbH(CELUM Digital Asset Management)

- Cognizant Technology Solutions Corp.(assetServ)

- Oracle Corporation(Oracle WebCenter Content)

- Cloudinary Ltd(Digital Asset Management)

- OpenText Corporation(Media Management, MediaBin)

- Aprimo LLC(ADAM Software)

- Bynder(Webdam Inc.)

- MediaBeacon Inc.(R3volution)

- IBM Corporation

- Nuxeo(Nuxeo Platform)

- Widen(Digital Asset Management)

- Extensis(Celartem Inc.)

- Digizuite A/S

第8章投資分析

第9章市場展望

The Digital Asset Management Market size is estimated at USD 5.27 billion in 2024, and is expected to reach USD 10.69 billion by 2029, growing at a CAGR of 15.22% during the forecast period (2024-2029).

The growing push for digital engagement has increased significantly due to the creation and dissemination of digital content. According to a study of 1,600 marketing and creative professionals by Bynder in 2021, the digital transformation initiatives have gained traction during the pandemic, and owing to this, generating more digital content and creative output, implementing new digital experience technologies, and investing in customer data and analytics are the focal points of marketing departments. This is expected to have a positive impact on the market.

Key Highlights

- Across all industries, the amount of digital content being produced and consumed is increasing quickly. Organisations produce enormous amounts of digital content, ranging from photos and videos to papers and creative assets. This abundance of content propels the demand for DAM solutions. Inference implies that organisations need solid systems to manage, organise, and distribute digital assets efficiently while their volume keeps growing. Organisations can effectively manage their content libraries and streamline content workflows thanks to DAM systems, which offer a centralized platform for storing, cataloging, and retrieving digital assets. As businesses look to streamline their content management procedures and improve collaboration and productivity, the need for DAM solutions is anticipated to grow.

- Due to its scalability, flexibility, and cost-effectiveness, cloud computing has spread throughout many industries. Inference suggests that a key market driver is the growth of cloud-based DAM solutions. Organizations may securely store and access digital assets using cloud-based DAM services from any location, at any time, and on any device. Collaboration between geographically distant teams and outside stakeholders is facilitated by this accessibility and usability. Other cloud-based tools and services, like content management systems, marketing automation platforms, and social media management tools, can be seamlessly integrated with cloud-based DAM. The market is expanding as a result of the scalability and affordability of cloud-based DAM systems, which make them a desirable option for businesses of all sizes.

- As organizations generate increasing volumes of digital assets, DAM systems need to be scalable to handle the growing demands. However, some DAM platforms may face challenges in effectively managing large quantities of assets or handling concurrent user access. Performance issues, such as slow asset retrieval or system lag, can arise when the DAM infrastructure is not designed to handle the scale of content and user requirements. These limitations can impact productivity and user satisfaction.

- The pandemic has also highlighted the importance of cloud-based solutions that enable remote access, collaboration, and scalability. Inference suggests that organizations have increasingly turned to cloud-based DAM solutions to store and manage their digital assets securely in a centralized location accessible from anywhere. Cloud-based DAM platforms provide the flexibility and scalability required in a remote work environment, allowing teams to collaborate effectively and access assets remotely. This demand for cloud-based DAM solutions has driven the growth of the market during the pandemic. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Digital Asset Management Market Trends

Cloud Deployment is Expected to Drive the Digital Asset Management Market

- Adobe announced in April 2022 that it would bring Frame. Io's industry-significant video collaboration platform to its millions of creative cloud customers and updates to After Effects and Premiere Pro, including native M1 support for After Effects. Video editors and key project stakeholders such as producers, agencies, and clients can now collaborate in the cloud thanks to the introduction of Frame.

- Digital media management and delivery within an organisation are made more accessible via cloud digital asset management (DAM). Along with delivering a single source of truth to retain brand identification, cloud DAM also promises to lower operational costs and boost productivity. Front-end experiences are impacted by cloud DAM as well. Bynder unveiled its integration with Hootsuite Inc., a well-known cloud-based social media management system. Through the integration, digital assets from Bynder are linked to Hootsuite dashboards, making it possible for social media marketers to access creative content quickly and easily without having to download, resize, and re-upload individual files.

- With the increasing adoption of various technologies like Artificial Intelligence and Big Data Analytics, cloud-based DAMs are widely used. DAM uses Artificial Intelligence(AI) technology to scan content and create metadata tags. The AI use cases for DAM include optical character recognition, speech recognition, and facial recognition.

- The rapid increase in data generation also contributes to the rising demand for storage. Data collection, processing, and analysis can be done more quickly thanks to artificial intelligence (AI) and machine learning capabilities, and business data and apps can be moved to various public-private clouds. The market for digital asset management is expanding quickly thanks to a number of businesses like Cognizant Technology Solutions, MediaBeacon, and Bynder because most end users prefer cloud-based products.

- Further, companies are gradually moving from on-premises to SaaS-based solutions, which offer mobile accessibility and other intuitive services. The model's affordability caters to specific digital asset needs by targeting companies of all sizes. Moreover, these solutions usually offer low-cost options and rapid deployment of services.

Asia Pacific to Witness the Fastest Growth Rate Over the Forecast Period

- India is considered a very demanding country to manage for the entertainment and media providers due to complexities related to the content, language, and other regional requirements. Therefore, digital asset management was widely adopted to cater to such complexities.

- In China, there is a clear trend toward the digital transformation of businesses.In October 2021, a Harvard University-educated designer created a unicorn with his content marketing platform, aided by investors who see enterprise software as the next big opportunity in China's tech industry. Tezign, which connects designers with businesses, announced the completion of the first tranche of its Series D round led by Temasek Holdings, raising its valuation to more than USD1 billion. The Singaporean state investment firm and other backers contributed approximately USD 40 million.

- Japan is the ideal country for digital asset management solutions in this region, as 99.7% of industries fall under the small and medium enterprise segment, as reported by the Small and Medium Enterprise Agency of Japan. Furthermore, due to their budgetary requirements and inadequate IT infrastructure, SMEs have preferred low to medium-cost solutions, like digital access management software, over ERP solutions. In March 2021, NRI announced an investment in collaboration with Komainu Holdings Limited, a digital asset management service provider. The partnership enables NRI and Komainu to combine their technologies to expand their offerings into the digital asset market in the region.

- Further, The BFSI sector has witnessed increased adoption of DAM tech to store and manage wealth across countries. In May 2021, Asia Digital Bank Ltd (ADB), a wholly-owned subsidiary of Chinese state-owned Asia Pacific Investment Bank (APIB), announced plans to construct a self-financing servicing ecosystem through industrial alliances. Huobi Asset Management became the second fund manager to receive approval from the Securities and Futures Commission to issue 100% virtual asset funds.

- The Asia-Pacific region is becoming one of the fastest-growing regions in the digital asset management industry. As global brands expand their reach into the Asia Pacific and increase their investments in visual content strategies, DAM is emerging as the solution to help them tackle common difficulties that arise when dealing with global teams, new expansion regions, and an influx in content.

Digital Asset Management Industry Overview

The major digital asset management players are Cognizant Technology Solutions Corp, Oracle Corporation, CELUM GmbH, Adobe Systems Incorporated, Cloudinary Ltd, and IBM Corporation, among others. They have adopted strategies such as expansions, agreements, new product launches, joint ventures, acquisitions, partnerships, and others to expand their footprints in this market.

- March 2022 - The content operations platform GatherContent had been purchased by Bynder, a provider of digital asset management (DAM) software. With this change, Bynder's DAM service gains workflow and editorial processes for content development. With GatherContent, Bynder hopes to give marketers access to the entire lifecycle of content generation, from text creation to structured material that is ready for dissemination.

- January 2022 - PhotoShelter, a provider of DAM software, recently announced the acquisition of Third Light, a DAM service based in the UK. Over 1,300 clients are listed by PhotoShelter, including businesses, brands, sports leagues, and colleges. Third Light has more than 300 clients worldwide. With the acquisition, PhotoShelter will now provide Chorus, the flagship application of Third Light. These Third Light users will gain access to PhotoShelter's cutting-edge features and business security, which have advanced DAM since PhotoShelter initially offered a cloud archive for photographers 15 years ago.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Digital Assets

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Higher Costs of the Solutions

- 5.3 Key Product Features

- 5.3.1 Video Management

- 5.3.2 Creative Tool Integration

- 5.3.3 Asset Analytics

- 5.3.4 Web Content Integration

- 5.3.5 Brand Portals

- 5.3.6 Asset and Metadata Archiving

- 5.3.7 Lifecycle and Rights Management

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud (SaaS)

- 6.2 By Organization Size

- 6.2.1 SMEs (Small and Medium Enterprises)

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 Media and Entertainment

- 6.3.2 BFSI

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Manufacturing

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World (Latin America, Middle East and Africa)

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe Systems Incorporated (Adobe Experience Manager Assets)

- 7.1.2 Canto Inc. (Canto Digital Asset Management)

- 7.1.3 CELUM GmbH (CELUM Digital Asset Management)

- 7.1.4 Cognizant Technology Solutions Corp. (assetServ)

- 7.1.5 Oracle Corporation (Oracle WebCenter Content)

- 7.1.6 Cloudinary Ltd (Digital Asset Management)

- 7.1.7 OpenText Corporation (Media Management, MediaBin)

- 7.1.8 Aprimo LLC (ADAM Software)

- 7.1.9 Bynder(Webdam Inc.)

- 7.1.10 MediaBeacon Inc. (R3volution)

- 7.1.11 IBM Corporation

- 7.1.12 Nuxeo (Nuxeo Platform)

- 7.1.13 Widen (Digital Asset Management)

- 7.1.14 Extensis (Celartem Inc.)

- 7.1.15 Digizuite A/S

![數字資產管理市場:趨勢、機遇和競爭分析 [2023-2028]](/sample/img/cover/42/1284986.png)