|

市場調查報告書

商品編碼

1431742

專屬式電廠:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Captive Power Plant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

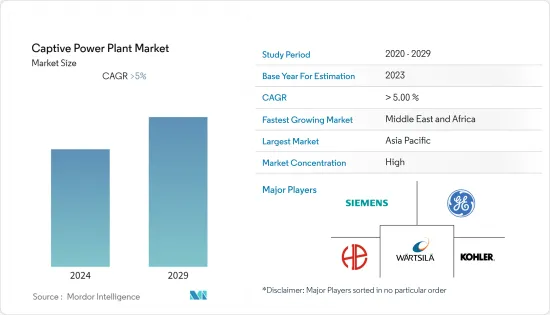

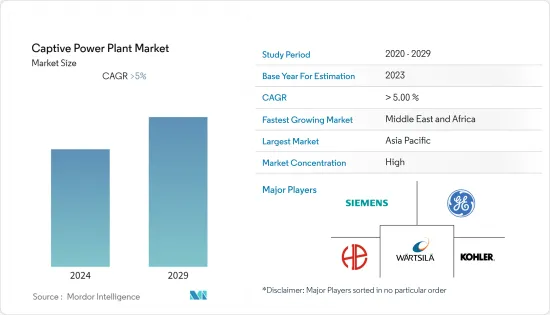

Equal-6.41的專屬式電廠市場規模預計將從2024年的2,141.2億美元成長到2029年的2,921.4億美元,在預測期間(2024-2029年)複合年成長率為6.41%。

主要亮點

- 從中期來看,大多數國家的發電業已相當成熟,但電力公司每天24小時向工業用戶提供優質電力的能力有限,因此工業界將繼續發展自備電廠。我別無選擇,只能建立它。此外,其中一些行業的地理位置偏遠和電力供應不可靠(特別開發中國家和不已開發國家)是鼓勵安裝自備發電廠的因素。

- 另一方面,高昂的資本支出和營運成本限制了全球低度開發地區專屬式電廠的成長。

- 儘管如此,奈及利亞、安哥拉和加納等非洲國家能源密集型產業的擴張預計將在不久的將來為專屬式設備製造商和開發商提供重大機會。

- 亞太地區主導專屬式電廠市場,大部分需求來自中國、印度和日本。

專屬式電廠市場趨勢

鋼鐵業佔有較大市場佔有率

- 在運作大型鋼廠時,確保可靠的電源極為重要。由於負載的性質及其大小,鋼廠的配電系統與其他工廠的配電系統有所不同。眾所周知,大型綜合鋼廠由各種加工廠、非加工廠、服務和公用設施組成。

- 由於鋼廠是連續流程工廠,需要較高的資本支出,因此電網設計必須妥善處理各種突發事件,例如由於電能品質差而停電、電力設備故障以及內部電力系統故障等。批判性觀點。設備和配件的選擇和尺寸限制可能會因生產損失和經濟損失而導致重大資本損失。

- 此外,現代生活的很大一部分是由鋼鐵製成的。從基礎設施、建築物、機械、電氣設備、汽車、烹調器具都需要大量鋼材。預計到2050年鋼鐵需求將增加五倍。

- 世界在現代化過程中建立了龐大的鋼鐵產能。根據世界鋼鐵協會統計,2022年鋼鐵產量約18.85億噸(MT),較2012年成長約20.6%。

- 在各種政策的推動下,透過擴大製造基地、透過多邊合作進程共用專有技術、產品開發和技術轉讓,促進了國內生產。

- 例如,2022年10月,安賽樂米塔爾公司AMNS India宣布對印度Hazira鋼廠投資76.2億美元。這項投資預計將使該工廠的產能從目前的900萬噸增加到1500萬噸。此外,這項投資還包括引進新的煉鋼技術、安裝新時代的機械以及擴大我們的產品範圍。

- 2022年7月,印尼Krakatau鋼鐵公司與韓國POSCO控股公司同意投資35億美元擴大印尼鋼鐵產能。該協議將使Krakatoa POSCO的上下游產品產能擴大至每年1,000萬噸。 2023 年起的擴建也將包括電動車用汽車鋼的生產。

- 考慮到該地區鋼鐵業的發展和投資,預計在預測期內對容量電廠的需求將大幅成長。

亞太地區主導市場

- 預計亞太地區將在 2022 年主導專屬式電廠市場,並有望在未來幾年保持其主導地位。人口成長、快速都市化和工業化等因素正在推動該地區的電力需求,為產能擴張創造了重大機會。

- 以GDP計算,中國是世界第二大經濟體。 2022年,該國GDP成長約0.8%,達到17.96兆美元。隨著人口老化和經濟從製造業轉向服務業、從外需轉向內需、從投資轉向消費的再平衡,國家成長逐漸下滑。

- 由於化學、石油和天然氣、金屬加工和其他行業的顯著成長,中國預計將成為專屬式電廠最大、成長最快的市場之一。此外,專屬式電廠在這些產業中發揮重要作用,因此預計在預測期內也將出現類似的成長。

- 鋼鐵業是專屬式電廠的重要市場。根據世界鋼鐵協會預測,2022年中國鋼鐵產量約10.18億噸,約佔全球鋼鐵產量的54%。

- 此外,石化產業對中國經濟貢獻顯著,也是支撐製造業高品質發展的主要領域。近年來,中國石化產業取得了長足發展。例如,2023年3月,阿美公司與合資夥伴岩金新城工業集團和北方工業集團宣布計畫在中國東北地區開始興建大型精製石化綜合廠。該綜合設施將包括一座日產30萬桶的煉油廠和一座石化廠,每年將生產165萬噸乙烯和200萬噸對二甲苯。計劃獲得行政批准後,預計將於 2023 年第二季開工。計劃於 2026 年全面運作。

- 韓國也在投資石化產品,專屬式電廠的需求預計將增加。 2022年11月,沙烏地阿美公司宣布計畫向其韓國子公司位於港口城市蔚山的工廠投資約70億美元,以生產更高價值的石化產品。該公司表示,Shaheen計劃是沙烏地阿拉伯在亞洲國家最大的投資,旨在開發全球最大的精製石化蒸汽裂解裝置之一。

- 因此,由於鋼鐵、石化產業的這些趨勢,預計在預測期內對專屬式電廠的需求將大幅增加。

專屬式電廠產業概況

專屬式電廠市場正在整合。該市場的主要企業(排名不分先後)包括科勒公司、通用電氣公司、Wartsila Oyj Abp、Bharat Heavy Electricals Limited、西門子股份公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 工業部門對電力的需求不斷增加

- 多個行業的位置偏遠且供電不可靠

- 抑制因素

- 資本投資和營運成本高

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 燃料來源

- 煤炭

- 氣體

- 柴油引擎

- 可再生

- 其他燃料

- 產業

- 水泥

- 鋼

- 金屬/礦物

- 石油化學

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Kohler Co.

- General Electric Company

- Wartsila Oyj Abp

- Siemens AG

- Bharat Heavy Electricals Limited

- Tata Power Renewable Energy

- AMP Solar Group Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 47683

The Captive Power Plant Market size in terms of Equal-6.41 is expected to grow from USD 214.12 billion in 2024 to USD 292.14 billion by 2029, at a CAGR of 6.41% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, though the power generation industry is well-established in most countries, the limitations that the utilities have to provide high-quality power round the clock to the industrial users force the industries to establish captive power plants. Moreover, the remote location of some of these industries and the unreliability of the power supply (especially in developing and underdeveloped countries) are the factors promoting the installation of captive power plants.

- On the other hand, high capital and operational expenditures are limiting the growth of captive power plants in underdeveloped regions across the world.

- Nevertheless, the expansion of energy-intensive industries in African countries such as Nigeria, Angola, and Ghana is expected to provide a significant opportunity for captive power plant equipment manufacturers and developers in the near future.

- Asia-Pacific has dominated the captive power plant market, with the majority of the demand coming from China, India, and Japan.

Captive Power Plant Market Trends

Steel Industry to Have Significant Share in the Market

- It is very important to have a reliable power source when operating a large-scale steel plant. The distribution system for power in a steel plant is different from that of any other industrial plant because of the nature of the load and its magnitude. It is common knowledge that large-scale integrated steel plants consist of a variety of processing plants, nonprocessing plants, services, and utilities.

- Since steel plants are continuous process plants requiring high capital expenditure, power network design should be viewed from a criticality perspective to ensure that any eventuality such as grid power failure, power equipment failure and internal power system disturbances due to poor power quality is adequately addressed. A constraint in selection and sizing of equipment and accessories cannot result in a massive capital damage associated with financial loss as a result of lost production, resulting in huge capital damage.

- Further, a large portion of modern life is comprised of steel. Infrastructure, buildings, machinery, electrical equipment, automobiles, and various products, from cookware to furniture, require large amounts of iron and steel. It is estimated that the steel demand will increase by five times by 2050.

- The world has built an enormous capacity for iron and steel during its modernization process. According to World Steel Association, in 2022, the steel production was around 1,885 million tons (MT), with an increase of around 20.6% from 2012.

- As a result of various policy, indigenous manufacturing will be encouraged by widening the manufacturing base, sharing know-how, product development, and technological transfer through a multilateral collaboration process.

- For instance, in October 2022, AMNS India, an arm of ArcelorMittal, announced an investment of USD 7.62 billion in its Hazira steel plant in India. This investment is expected to increase the plant's capacity to 15 million tons, which is currently 9 million tons. Additionally, the investment will include the installation of new steel-making technologies, the setting up of new-age machinery, and the expansion of product offerings.

- In July 2022, Indonesia's Krakatau Steel and South Korea's POSCO Holdings agreed to invest USD 3.5 billion in expanding their steel production capacity in Indonesia. KRAKATAU POSCO's production capacity for upstream and downstream products will be increased to 10 million tonnes per year under the agreement. Starting in 2023, the expansion includes manufacturing automotive steel for electric vehicles.

- Considering the developments and investments in the steel and iron industry in the region, the demand for capative power plants is expected to witness significant growth during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominat the captive power plant market in 2022, and is expected to continue its dominance in the coming years as well. Factors such as growing population, rapid urbanization, and industrialization are driving the power demand in the region, creating significant opportunities for capacity expansion.

- In terms of GDP, China is the second-largest economy in the world. In 2022, the country's GDP grew by about 0.8%, reaching USD 17.96 trillion. The growth in the country is gradually diminishing as the aging population, manufacturing to services, and external to internal demand, and the economy is rebalancing from investment to consumption.

- China is expected to be one of the largest and fastest-growing markets for captive power plants, owing to the significant growth in its chemical, oil & gas, metals processing, and other sectors. Further, it is expected to continue to witness similar growth during the forecast period, as captive power plants play a crucial role in these industries.

- The iron and Steel industry is a significant market for captive power plants. According to World Steel Association, in 2022, the steel production in China was approximately 1,018 million tons, around 54% of the global steel production.

- Further, the petrochemical industry is a significant contributor to China's economy and a key field for supporting the high-quality development of the manufacturing sector. Recently, China is witnessing developments in the petrochemical sector. For instance, in March 2023, Aramco and joint venture partners Panjin Xincheng Industrial Group and NORINCO Group announced plans to start the construction of a significant integrated refinery and petrochemical complex in northeast China. The complex is going to have combination of a 300,000 barrels per day refinery and a petrochemical plant with an annual production capacity of 1.65 million tons of ethylene and 2 million metric tons of paraxylene. Construction is expected to start in the second quarter of 2023 after the project has secured administrative approvals. It is expected to be fully operational by 2026.

- South Korea is also investing in its petrochemical business which is anticipated to create a rising demand for captive power plants. In November 2022, Saudi Aramco announced investment plans for about USD 7 billion at a South Korean affiliate's factory in the port city of Ulsan to produce more high-value petrochemical products. According to the company, the Shaheen project is Saudi's biggest investment in the Asian nation to develop one of the world's largest refinery-integrated petrochemical steam crackers.

- Hence, with these trends from the steel, and petrochemical industries, the demand for captive power plants is anticipated to increase significantly during the forecast period.

Captive Power Plant Industry Overview

The captive power plant market is consolidated. Some of key players in this market (not in particular order) include Kohler Co., General Electric Company, Wartsila Oyj Abp, Bharat Heavy Electricals Limited, and Siemens AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Power Demand across Industrial Sector

- 4.5.1.2 Remote Location of Several Industries and the Unreliability of the Power Supply

- 4.5.2 Restraints

- 4.5.2.1 High Capital and Operational Expenditures

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Source

- 5.1.1 Coal

- 5.1.2 Gas

- 5.1.3 Diesel

- 5.1.4 Renewable

- 5.1.5 Other Fuel Sources

- 5.2 Industry

- 5.2.1 Cement

- 5.2.2 Steel

- 5.2.3 Metal & Minerals

- 5.2.4 Petrochemicals

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kohler Co.

- 6.3.2 General Electric Company

- 6.3.3 Wartsila Oyj Abp

- 6.3.4 Siemens AG

- 6.3.5 Bharat Heavy Electricals Limited

- 6.3.6 Tata Power Renewable Energy

- 6.3.7 AMP Solar Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Energy Intensive Industries in African Countries such as Nigeria, Angola, And Ghana

02-2729-4219

+886-2-2729-4219