|

市場調查報告書

商品編碼

1431725

藥品倉儲:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

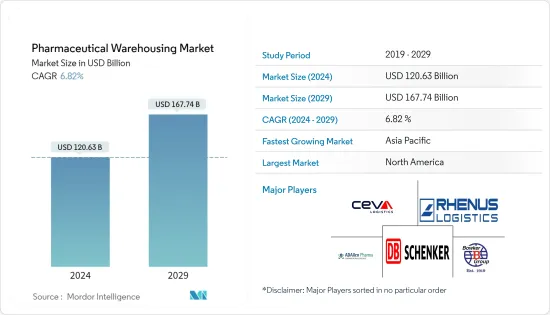

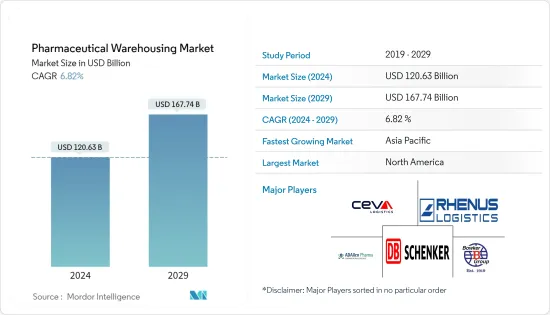

藥品倉儲市場的市場規模預計到2024年為1206.3億美元,預計到2029年將達到1677.4億美元,在預測期內(2024-2029年)複合年成長率為6.82%,預計將會成長。

市場開拓取決於多種因素,包括增加藥品倉儲服務的外包、製藥業對品質和產品敏感度的日益重視,以及提高生產力和準確性的倉庫級自動化。隨著世界各地的製藥商擴大產能和擴大業務,零售商和經銷商之間儲存原料和成品的物流需求不斷增加。外包醫藥倉儲服務可降低物流成本12%,庫存成本降低8%,物流固定資產成本降低20%。

藥品供應鏈管理 (SCM) 面臨的課題包括影響訂單準確性、可靠性、庫存管理和合規性的即時可見性和技術障礙。由於製藥公司的SCM越來越複雜,一些SCM功能被外包給倉儲服務提供者。包裝後高壓加工和非熱巴氏殺菌等去除微生物的服務需求量大。

此外,對 VMS(維生素、礦物質和補充品)藥物、感冒藥、止咳藥、胃腸道藥物和皮膚科藥物等非處方 (OTC) 藥物的需求不斷增加也推動了市場的成長。醫療保健領域及時援助的重要性日益增加,也推動了藥品倉儲市場的發展。

醫藥倉儲市場趨勢

技術創新驅動市場

- 持續的技術創新促進製藥公司之間的無縫溝通,連接製造商、倉庫、批發商和其他供應鏈相關人員。這簡化了路線規劃,並減少了因天氣、延誤、風險和法規造成的干擾。使用 RFID(無線射頻識別)標籤的遠端物流追蹤可提高藥品安全性並防止假藥進入市場。

- 在低溫運輸產品領域,高性能冷卻技術和先進的設計功能(例如墊圈和隔熱材料)在維持藥品儲存期間所需的溫度方面發揮關鍵作用。

- 該監控系統全天候(24/7)運作,允許醫院和醫護人員追蹤內部儲存溫度、外部環境條件、GPS 定位和設備健康狀況。基於網路的介面(B Connected、視聽警報、RTMD 等)可實現即時門操作,從而允許醫療專業人員快速回應。

人口成長推動市場

- 根據聯合國最新預測,世界人口預計到2050年將達到高峰約103億,然後到2080年減少約12億。預計這一人口水準將在 21 世紀剩餘時間內保持穩定。

- 由於持續的低出生率以及某些情況下移民的增加,預計未來 30 年將有 61 個國家和地區的人口將減少至少 1%。最近的疫情對人口結構產生了進一步影響,2021年全球平均壽命從前一年的72.9歲降至71歲。疫情可能導致某些地區的懷孕和出生率短期下降。

- 到 2050 年,預計有八個國家將對全球人口成長做出重大貢獻:剛果民主共和國、埃及、衣索比亞、印度、奈及利亞、巴基斯坦、菲律賓和坦尚尼亞。聯合國劉振民警告說,人口快速成長給消除貧困、減少飢餓和營養不良以及擴大健康和教育覆蓋帶來了課題。

- 鑑於全球暖化的日益惡化以及新細菌和病毒擴散的可能性,可以預期疫苗的開發將會增加,以應對這些不斷變化的威脅。因此,預計藥品倉庫的增加將適應疫苗生產的擴大。

醫藥倉儲行業概況

市場成長的主要驅動力之一是對藥品倉儲外包服務的需求不斷成長。然而,新興市場需要更有效的物流支援等因素可能會限制市場成長。主要營運商包括 CEVA Logistics、Rhenus SE and Co 和 DB Schenker AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場考量與動態

- 市場概況(市場和經濟的當前市場情勢)

- 政府法規和舉措

- 科技趨勢

- COVID-19 對市場的影響

- 市場動態

- 市場促進因素

- 人口成長

- 增加倉儲服務

- 市場限制因素/問題

- 缺乏技術純熟勞工

- 市場機會

- 創新

- 市場促進因素

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依類型

- 低溫運輸倉庫

- 非低溫運輸倉庫

- 依用途

- 藥廠

- 藥局

- 醫院

- 其他用途

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 西班牙

- 比利時

- 英國

- 俄羅斯

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 越南

- 泰國

- 亞太地區其他國家

- GCC

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 海灣合作理事會休息

- 南美洲

- 阿根廷

- 巴西

- 智利

- 南美洲其他地區

- 非洲

- 南非

- 埃及

- 其他非洲

- 世界其他地區

- 北美洲

第6章 競爭形勢

第7章市場概況(市場集中度及主要企業)

第8章 公司簡介

- Alloga

- Bio Pharma Logistics

- CEVA Logistics

- Rhenus SE and Co.

- ADAllen Pharma

- WH BOWKER LTD

- Pulleyn Transport Ltd

- TIBA

- DB Schenker AG

- DACHSER Group SE*

第9章市場機會與未來性

第10章附錄

第11章 附錄 免責聲明

The Pharmaceutical Warehousing Market size is estimated at USD 120.63 billion in 2024, and is expected to reach USD 167.74 billion by 2029, growing at a CAGR of 6.82% during the forecast period (2024-2029).

The market's development hinges on several factors, including increased outsourcing of pharma warehousing services, heightened emphasis on quality and product sensitivity in the pharmaceutical sector, and warehouse-level automation for improved productivity and accuracy. Pharmaceutical manufacturers worldwide are expanding their production capacity and operations, leading to a heightened need for logistics between retailers and distributors for storing raw materials and finished goods. Outsourcing pharmaceutical warehousing services can reduce logistics costs by 12%, inventory costs by 8%, and logistics fixed asset costs by 20%.

Challenges faced by pharmaceutical supply chain management (SCM) include real-time visibility and technology barriers that affect order accuracy, dependability, inventory management, and compliance. Due to the growing complexity of SCM for pharmaceutical companies, certain SCM functions are outsourced to warehousing and storage service providers. Services like high-pressure processing after packaging and nonthermal pasteurization for micro-organism elimination are in high demand.

The market growth is also propelled by the rising demand for over-the-counter (OTC) medications such as VMS (vitamin, mineral, and supplement) medicines, common cold and cough medicines, gastrointestinal drugs, and dermatology treatments. The increasing importance of fast-track aid in the healthcare sector is another driving force in the pharmaceutical warehousing market.

Pharmaceutical Warehousing Market Trends

Technological Innovation is driving the market

- Constant technological advancements facilitate seamless communication among pharmaceutical companies, connecting manufacturers, warehouses, wholesalers, and other supply chain stakeholders. This streamlines route planning, mitigating disruptions caused by weather, delays, risks, and regulations. Employing radio-frequency identification (RFID) tags for remote logistics tracking enhances pharmaceutical safety, ensuring counterfeit drugs do not infiltrate the market.

- In the realm of cold chain products, high-performance cooling technologies and advanced design features like gaskets and insulations play a crucial role in maintaining desired temperatures while storing medicines.

- Monitoring systems operate 24x7, allowing hospital and healthcare staff to track internal storage temperatures, external ambient conditions, GPS positioning, and device health. Real-time door operations facilitated by web-based interfaces (such as B Connected, Audio-Visual Alarms, and RTMDs) enable swift responses by healthcare professionals.

Increase in Population is driving the market

- The United Nations' latest projections suggest a peak global population of around 10.3 billion people by 2050, followed by an anticipated decrease of approximately 1.2 billion individuals by 2080. This population level is expected to stabilize throughout the remainder of the 21st century.

- In 61 countries or regions, a projected population decline of at least one percent over the next 30 years is foreseen due to persistently low fertility rates and, in some cases, increased emigration rates. The recent pandemic has further impacted population dynamics, reducing global life expectancy at birth to 71 years in 2021, down from the previous year's 72.9. The pandemic likely led to short-term declines in pregnancy and childbirth in certain regions.

- By 2050, eight countries-namely the DR Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and Tanzania-are anticipated to contribute significantly to global population growth. Liu Zhenmin of the United Nations has cautioned that rapid population growth poses challenges to eradicating poverty, reducing hunger and malnutrition, and expanding health and education coverage.

- Considering the escalating effects of global warming and the potential rise in new bacteria and viruses, there's a forecast for increased development of vaccines to combat these evolving threats. Consequently, this development will likely lead to a rise in pharmaceutical warehousing to accommodate the expanded vaccine production.

Pharmaceutical Warehousing Industry Overview

One of the main drivers of the market growth is the increasing demand for pharmaceutical warehousing outsourced services. However, factors such as the need for more effective logistics support in developing countries may limit the growth of the market. Some of the major players operating players are CEVA Logistics, Rhenus SE and Co. and DB Schenker AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Market Scenario of Market and Economy)

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends

- 4.4 Impact of Covid-19 on the market

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Rise In Population

- 4.5.1.2 Increase in Warehousing Services

- 4.5.2 Market Restraints/ Challenges

- 4.5.2.1 Shortage of Skilled Labor

- 4.5.3 Market Opportunities

- 4.5.3.1 Technological Innovations

- 4.5.1 Market Drivers

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Powers of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 BY Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 USA

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 Belgium

- 5.3.2.3 United Kingdom

- 5.3.2.4 Russia

- 5.3.2.5 Germany

- 5.3.2.6 France

- 5.3.2.7 Italy

- 5.3.2.8 Rest-of-Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Australia

- 5.3.3.2 China

- 5.3.3.3 India

- 5.3.3.4 Indonesia

- 5.3.3.5 Japan

- 5.3.3.6 Malaysia

- 5.3.3.7 Vietnam

- 5.3.3.8 Thailand

- 5.3.3.9 Rest-of-APAC

- 5.3.4 GCC

- 5.3.4.1 UAE

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Qatar

- 5.3.4.4 Rest-of GCC

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.7 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

7 Overview (Market Concentration and Major Players)

8 Company Profiles

- 8.1 Alloga

- 8.2 Bio Pharma Logistics

- 8.3 CEVA Logistics

- 8.4 Rhenus SE and Co.

- 8.5 ADAllen Pharma

- 8.6 WH BOWKER LTD

- 8.7 Pulleyn Transport Ltd

- 8.8 TIBA

- 8.9 DB Schenker AG

- 8.10 DACHSER Group SE*