|

市場調查報告書

商品編碼

1431633

鋰硫電池:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Lithium Sulfur Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

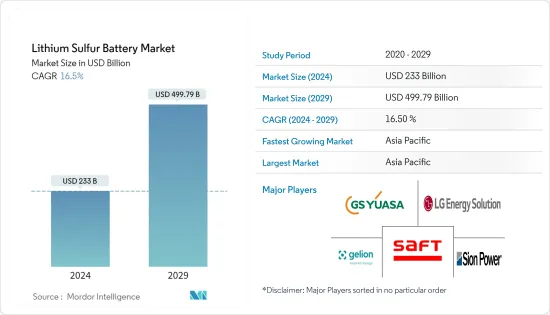

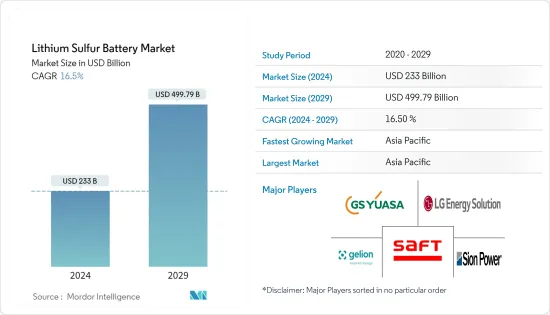

鋰硫電池市場規模預計到2024年為2,330億美元,預計2029年將達到4,997.9億美元,在預測期內(2024-2029年)複合年成長率為16.5%。

主要亮點

- 從中期來看,由於各國減少排放的支持政策和舉措,對電動車的需求增加,以及由於可再生能源的採用增加對儲能設備的需求增加,將推動預測期內的市場成長。

- 同時,鋰硫電池的高成本可能會限制預測期內的市場成長。

- 也就是說,電池技術的進步大大增加了整個最終用戶產業的需求。政府投資也在增加,以開發用於軍事和航空應用的高能量密度電池。因此,在預測期內調查的市場可能會出現巨大的機會。

- 預計亞太地區將成為預測期內最大、成長最快的市場,大部分需求來自中國、日本等國家。

鋰硫電池市場趨勢

航太領域佔市場主導地位

- 在航太領域,電池是關鍵零件,具有多種應用,包括衛星、高空飛機、太空船和無人機。航太領域使用的電池包括一次電池(一次性)和二次電池(可充電)。用於為飛機上或日常攜帶的設備供電的電池必須安全、能量密集、重量輕、可靠、需要最少的維護,並且可以在各種環境條件下運行,並且必須能夠高效運行。

- 由於需要更高能量密度的電池,鋰硫電池擴大安裝在航太領域。這可以實現更長的壽命和更強的能源儲存。航太部門也正朝向低排放源邁進。

- 美國電池新興企業Leiten 將電動飛機視為其高能量鋰硫電池的潛在市場。 2023年6月,該公司宣布已在矽谷運作一條鋰硫電池中試線。鋰硫電池試驗線計畫於 2023 年開始向國防、物流、汽車和衛星領域的早期採用者客戶提供者交付電池。

- 此外,配備此類電池的無人機的使用正在全球範圍內取得進展。無人機製造投資也大幅成長。

- 2023年7月,DroneShield從一家未具名的美國政府機構獲得了價值3,300萬美元的合約。該合約涵蓋了 DroneGun Mk4 等設備的供應,該設備可用於破壞多架無人機的控制和導航能力。

- 航空業的成長主要是由於機票價格下降、經濟狀況發展和可支配收入增加而導致全球航空乘客數量近期增加。

- 根據國際航空運輸協會 (IATA) 的數據,由於冠狀病毒大流行,商業航空公司 2022 年收益損失約 7,270 億美元。然而,到 2023年終,市場收益預計將達到 7,790 億美元。

- 上述因素可能會推動航太的成長,並在預測期內增加對鋰硫電池的需求。

亞太地區主導市場

- 預計亞太地區將主導全球鋰硫電池市場。中國、日本、韓國等該地區國家是主要支持國,為市場成長做出了貢獻。澳洲、印度和越南等國家也正在推進在預測期內在本國建立鋰電池製造設施的計畫。

- 該地區因努力提供無處不在的綠能並減少照明和行動電話充電需求對煤油和柴油等傳統燃料的依賴而聞名。鋰硫電池整合能源儲存方案由於其高能量密度和儲存容量等技術優勢,預計其採用率將會提高。

- 由於能源儲存系統和電動車在併網和離網應用中的採用,預計該地區對這些電池的需求將快速成長。此外,可再生能源發電設施的安裝不斷增加也推動了對這些電池的需求。

- 此外,中國政府正在全國投資建設充電站,以促進電動車的銷售。例如,2022年1月,中國政府宣布計畫在2025年為2,000萬輛電動車建造充電站。

- 充電基礎設施的發展正在支持電動車在該國的普及。截至2022年5月,中國電動車充電基礎設施促進會(EVCIPA)在全國安裝了約142個充電站,其中交流充電站806個,直流充電站61.3萬個,直流-交流混合充電站485個,我們已確認擁有10,000個充電站。充電站。

- 日本的目標是製定一項名為「從井到輪零排放」的政策,以與全球零排放努力保持一致,以在2050 年之前改善能源供應和汽車創新。透過專注於用電動車取代所有車輛,我們的目標是減少每輛車的溫室氣體排放量減少約 80%,其中每輛小客車的溫室氣體排放量減少約 90%。此類政府措施可能會增加對電動車的需求,進而預計也增加對鋰硫電池的需求。

- 同樣,2023年4月,韓國政府與三大電池公司(LG能源解決方案有限公司、三星SDI和SK On)合作,到2030年開發包括固態電池的先進電池技術。宣布計劃共同投資美國151億美元。

- 這項措施將使韓國能夠領先全球競爭對手開始固態電池的商業化生產。參與的電池公司將在韓國建立試點生產工廠,作為產品開發和製造創新的基地。這些設施將用於測試和製造包括固態電池在內的先進產品,然後在海外生產基地開始大規模生產。作為該計畫的一部分,LG Energy Solutions 的目標是到 2027 年實現鋰硫電池生產的商業化,首先主要為航太領域生產鋰硫電池。

- 因此,由於上述因素,預計亞太地區將在預測期內主導鋰硫電池市場。

鋰硫電池產業概況

鋰硫電池市場較為分散。市場的主要企業包括(排名不分先後)GS Yuasa Corporation、LG Energy Solutions Ltd、Saft Groupe SA、Gelion PLC 和 Sion Power Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的普及

- 對能源儲存系統(ESS)的需求增加

- 抑制因素

- 有限的循環壽命和耐用性

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按最終用戶

- 航太

- 電子產品

- 車

- 電力部門

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

- 北美洲

第6章 競爭形勢

- 合併、收購、合資、合夥和協議

- 主要企業策略

- 公司簡介

- GS Yuasa Corporation

- Sion Power Corporation

- LG Energy Solutions Ltd

- Li-S Energy Limited

- Polyplus Battery Co.

- Saft Groupe SA

- Gelion PLC

- LYTEN Batteries Inc.

第7章 市場機會及未來趨勢

- 電池技術的進步

簡介目錄

Product Code: 50000866

The Lithium Sulfur Battery Market size is estimated at USD 233 billion in 2024, and is expected to reach USD 499.79 billion by 2029, growing at a CAGR of 16.5% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles due to the various countries' supportive government policies and initiatives to reduce emissions and the increasing demand for energy storage devices amid increasing renewable energy installation drive growth in the market during the forecast period.

- On the other hand, the high cost of lithium-sulfur batteries is likely to restrain the market growth during the forecast period.

- Nevertheless, advancements in battery technology have dramatically increased the demand across end-user industries. Also, the government's investment is increasing to develop high-energy-density batteries for the military and aviation sectors. This will likely create immense opportunities for the market studied during the forecast period.

- The Asia-Pacific is expected to be the largest and fastest-growing market during the forecast period, with most of the demand coming from countries like China, Japan, and other countries.

Lithium Sulfur Battery Market Trends

Aerospace Segment to Dominate the Market

- In the aerospace sector, batteries are a vital component and have multiple applications in satellites, high-altitude aircraft, outer space vehicles, and unmanned aerial vehicles. Batteries in aerospace can be either primary (single-use) or secondary (rechargeable). Any battery designated for use as a power source in aircraft-installed or regularly carried equipment must be secure, have a high energy density, be lightweight, dependable, require minimal maintenance, and efficiently function in various environmental conditions.

- The installation of lithium-sulfur batteries is increasing across the aerospace sector as this sector requires batteries with higher energy density. Therefore, it can provide longer-lasting and more powerful energy storage. The aerospace sector is also moving toward lower emission sources.

- Lyten, a US-based battery startup company, is looking toward electric aircraft as a potential market for its energy-dense lithium-sulfur batteries. In June 2023, the company announced the commissioning of its lithium-sulfur battery pilot line in Silicon Valley. The lithium-sulfur pilot line is expected to start delivering commercial battery cells in 2023 to early adopting customers within the defense, logistics, automotive, and satellite sectors.

- Furthermore, the utilization of drones for various purposes is increasing worldwide, which can be equipped with such batteries. The investment in manufacturing drones is growing significantly.

- In July 2023, DroneShield was awarded a USD 33 million contract with an unnamed U.S. government agency. The contract covers the supply of equipment such as DroneGun Mk4, which can be used to disrupt the control and navigation capabilities of multiple drones.

- The growth in the aviation sector is mainly driven by the increasing number of air passengers globally because of the cheaper airfare in recent times, developing economic conditions, and rising disposable income.

- Due to the coronavirus pandemic, According to the International Air Transport Association (IATA), commercial airlines generated about USD 727 billion in revenue in 2022. However, the market's revenue was estimated to reach USD 779 billion by the end of 2023.

- The abovementioned factors will likely drive growth in the aerospace sector, boosting the demand for lithium-sulfur batteries during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global lithium-sulfur battery market. Countries in the region, such as China, Japan, and South Korea, are the leading supporters and are contributing to the growth of the market studied. Countries like Australia, India, and Vietnam are also following plans to set up lithium-based battery manufacturing facilities in their countries during the forecast period.

- The region is significantly making efforts to supply clean electricity to every corner and reduce dependency on conventional fuels, such as kerosene and diesel, for their lighting and mobile phone charging needs. Lithium-sulfur battery integrated energy storage solutions will likely witness an increasing adoption rate due to their technical benefits, such as high energy density and storage capacity.

- The demand for these batteries in the region is expected to grow rapidly, owing to the adoption of energy storage systems and electric vehicles for on-grid and off-grid applications. Further, the increasing installation of renewable energy generation facilities also boosts the demand for such batteries.

- Furthermore, the Chinese government is investing in building charging stations nationwide to promote electric vehicle sales. For instance, in January 2022, the Chinese government announced plans to build enough charging stations for 20 million electric vehicles by 2025.

- The development of charging infrastructure is propelling EV adoption in the country. As of May 2022, China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA) confirmed that there were nearly 1.42 million charging stations across the country, including 806 AC charging stations, 613 thousand DC charging stations, and 485 DC-AC combined charging stations.

- Japan aims to establish a policy named 'Well-to-Wheel Zero Emission,' in line with the global efforts to eliminate emissions, focusing on energy supply and vehicle innovation by 2050 and replacing all vehicles with EVs to reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle. Such government initiatives are likely to increase the demand for electronic vehicles, which, in turn, is expected to increase the demand for lithium-sulfur batteries.

- Similarly, in April 2023, the South Korean government, in partnership with the three leading battery companies (LG Energy Solution Ltd, Samsung SDI Co., Ltd and SK on Co., Ltd.), announced plans to jointly invest USD 15.1 billion by 2030 to develop advanced battery technologies, including solid-state batteries.

- The initiative will enable South Korea to begin commercial production of solid-state batteries ahead of global competitors. The participating battery firms will establish pilot production plants in South Korea, serving as centers for product development and manufacturing innovation. These facilities will be used to test and manufacture advanced products, including solid-state batteries, before initiating mass production at overseas production sites. As a part of this effort, LG Energy Solutions set out a target for commercializing the production of lithium-sulfur batteries by 2027, primarily for the aerospace sector to start with.

- Therefore, based on the above factors, the Asia-Pacific is expected to dominate the lithium-sulfur battery market during the forecast period.

Lithium Sulfur Battery Industry Overview

The lithium-sulfur battery market is fragmented. Some of the major players in the market include (in no particular order) GS Yuasa Corporation, LG Energy Solutions Ltd, Saft Groupe SA, Gelion PLC, and Sion Power Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Increasing Demand for Energy Storage Systems (ESS)

- 4.5.2 Restraints

- 4.5.2.1 Limited Cycle Life and Durability

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Aerospace

- 5.1.2 Electronics

- 5.1.3 Automotive

- 5.1.4 Power Sector

- 5.1.5 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Sion Power Corporation

- 6.3.3 LG Energy Solutions Ltd

- 6.3.4 Li-S Energy Limited

- 6.3.5 Polyplus Battery Co.

- 6.3.6 Saft Groupe SA

- 6.3.7 Gelion PLC

- 6.3.8 LYTEN Batteries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219