|

市場調查報告書

商品編碼

1431243

建築幕牆墊片:市場佔有率分析、產業趨勢、成長預測(2024-2029)Facade Gasket - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

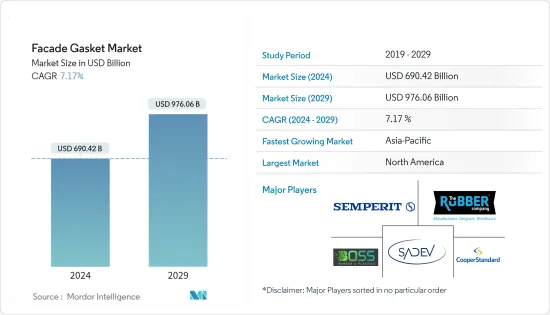

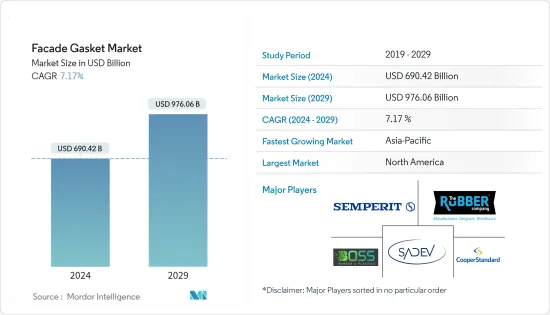

建築幕牆墊片市場規模預計到2024年為6,904.2億美元,預計到2029年將達到9,760.6億美元,在預測期內(2024-2029年)複合年成長率為7.17%。

主要亮點

- COVID-19 對建設產業產生了重大影響,限制措施導致計劃延誤,建築工作因勞動力短缺而停止。隨後,監管放鬆後,該行業復甦,主要是由於住宅和商業領域計劃的增加。這種成長進一步推動了建築幕牆墊片製造的需求。

- 此外,為了實現永續性目標,大多數開發商都選擇太陽能建築幕牆作為其建築外牆。例如,2022年8月,澳洲Kenon公司在墨爾本規劃了一個名為「550 Spencer」的新計劃。這座八層辦公大樓採用由 1,182 塊太陽能板組成的最先進的太陽能建築幕牆,可產生超出其需求的電力。因此,隨著計劃數量的增加,需要大量的墊片產品來保持建築幕牆指定並穩定,以承受高壓和極端氣候。

- 此外,建築幕牆墊片不僅廣泛應用於現代建築中,而且還廣泛應用於舊建築的修復。此外,大多數國家的結構老化,建築幕牆密封件和墊圈也過時。這些舊的密封件和墊片可以替換為由更高效的材料製成的新產品,這些新產品可以承受當今高層建築的惡劣天氣條件。三元乙丙橡膠、矽膠、橡膠和熱可塑性橡膠是世界各地用於墊片製造的主要材料。

建築幕牆墊片市場趨勢

亞太地區成長顯著

亞太地區住宅和商業領域的建築計劃正在顯著成長。這種成長進一步鼓勵了該地區建築幕牆的安裝,建築幕牆牆主要用於解決能源效率、美觀和溫度控制因素。因此,建築幕牆安裝的增加進一步增強了對建築幕牆墊圈和密封件的需求,以支持建築幕牆承受各種因素和氣候的能力。

此外,由於住宅和商業領域的開發活動不斷增加,建築幕牆裝置在該地區的新興國家中越來越受歡迎。例如,2022年9月,丹麥工作室Schmidt Hammer Lassen Architects設計了一個具有玻璃建築幕牆的上海圖書館東館。圖書館佔地115,000平方公尺,共有七層。此外,2022 年 2 月,Innovators 建築幕牆 Systems訂單了在印度設計、供應、製造和建造建築幕牆的訂單。

同時,亞太地區的辦公空間建設呈現良好成長動能。儘管存在在家工作的文化,但辦公室計劃仍在不斷增加,且沒有中斷。印度、韓國、日本、澳洲等辦公大樓計劃數量不少。例如,在韓國,西面辦公大樓開發計劃於2022年第二季啟動,計劃投資超過7.1億美元。同樣在澳大利亞,滑鐵盧地鐵區開發案和 360 Queen Street 辦公大樓計劃也已啟動。此外,到2022年,海得拉巴、班加羅爾、深圳和上海等城市預計將引領該地區的甲級辦公室供應。因此,該地區建設活動的擴展為建築幕牆墊片製造商提供了機會。

商業部門的成長推動市場

大多數國家都致力於發展節能商業建築和辦公空間。此外,建築商也致力於讓建築物看起來更好、包裹外牆並消耗更少的能源。這些因素推動了建築幕牆墊片的使用。此外,維修老化辦公大樓的支出增加將推動世界各地對建築幕牆安裝的需求。

此外,北美的商業計劃正在顯著增加,其中最著名的辦公大樓開發項目,從高層建築到廣闊的校園,預計將於 2022 年竣工。此外,據行業專家稱,超過 20 個最大的辦公計劃正計劃進行重建。同時,2022年第二季度,多個大型辦公室計劃在美國和加拿大啟動。例如,八辦公大樓計劃將於 2022 年第二季破土動工,總預算為 4.7 億美元,將包括勞倫斯街 1900 號辦公大樓、北港綜合用途開發專案、埃爾塞貢多總部大樓和培訓設施。其他人也緊跟在後。

同時,歐洲也湧現大量商業計劃。根據業內專家預測,2022年將有超過570萬平方公尺的辦公室計劃竣工,另外510萬平方公尺的辦公項目計劃在2023年開發。此外,美國駐義大利米蘭總領事館綜合計劃於2022年第二季開工,總預算達3.5億美元。然而,2022年第一季,跨國房地產交易有所增加。歐洲、中東和非洲地區(包括歐洲、中東和非洲)的跨國交易額最高,達 364 億美元。因此,全球不斷成長的商業部門可能為建築幕牆墊片製造商提供巨大的機會。

建築幕牆墊片產業概況

本報告重點介紹了在建築幕牆墊片市場營運的主要企業。該市場競爭激烈且分散,沒有一家公司佔據較大佔有率。為了保持競爭力,我們不斷努力增強我們的產品供應。市場上的主要企業包括 Sadev、The Rubber Company、Boss Polymer P/L、Semperit AG Holding 和 Cooper Standard。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 當前市場概況

- 市場動態

- 市場促進因素

- 市場限制因素

- 市場機會

- 建築幕牆墊片產業供應鏈/價值鏈分析見解

- 洞察政府對市場的監管

- 市場技術進步的見解

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按用途

- 住宅

- 商業的

- 其他用途

- 按類型

- E墊片

- 楔形墊片

- 氣泡墊片

- 其他類型

- 按材質

- 矽膠

- 橡皮

- 其他材料

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 其他亞太地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- SADEV

- THE RUBBER COMPANY

- Boss Polymer P/L.

- Semperit AG Holding

- Conta Flexible Products

- Silicone Engineering Ltd.

- Cooper Standard

- Vip Rubber and Plastic Company

- LOPO International Limited

- Polecex SL*

第7章 市場展望

第8章附錄

The Facade Gasket Market size is estimated at USD 690.42 billion in 2024, and is expected to reach USD 976.06 billion by 2029, growing at a CAGR of 7.17% during the forecast period (2024-2029).

Key Highlights

- COVID-19 created a huge impact on the construction industry, and the restrictions resulted in project delays and construction work being halted due to a scarcity of labor. Later, after easing restrictions, the industry recovered, largely driven by increasing projects in the residential and commercial sectors. This growth further fuels the demand for facade gasket manufacturing.

- Also, facade installations are becoming more popular around the world because of how nice they look and how well they save energy.In addition, to meet the sustainability goals, most of the developers are choosing solar facades on the building's outer envelope. For instance, in August 2022, Australian firm Kennon planned a new project in Melbourne called 550 Spencer, the eight-story office building will produce more electricity than it requires using a cutting-edge solar facade made up of 1,182 solar panels. Thus, the increasing number of projects requires a huge amount of gasket products to install facades in place and make them stable to withstand high pressures and extreme climates.

- Furthermore, facade gaskets are heavily used in modern construction as well as the restoration of old buildings. In addition, most of the countries have aging structures that were fitted with older-style facade seals and gaskets. These older seals and gaskets can be replaced by new products made of more efficient materials that can withstand today's extreme weather conditions in high-rise buildings. Ethylene propylene diene monomer, silicone, rubber, thermoplastic elastomer, etc. are some of the major materials utilized in gasket manufacturing across the globe.

Facade Gasket Market Trends

Asia Pacific is Witnessing Significant Growth

Asia Pacific is witnessing significant growth in construction projects across residential and commercial sectors. This growth further fuels the facade installations in the region, and facade envelopes are primarily adopted to cater to growing energy efficiency, external beautification, and temperature control factors. Thus, the growing facade installations further bolster the demand for facade gaskets and seals, which support the facades ability to withstand various elements and climates.

Moreover, facade installations are gaining traction across developing countries in the region due to increasing development activities across the residential and commercial sectors. For instance, in September 2022, Danish studio Schmidt Hammer Lassen Architects designed Shanghai Library East with glass facades. The library is spread across 115,000 square meters and is 7 stories high. In addition, in February 2022, Innovators Facade Systems was awarded a contract to design, supply, fabricate, and install facade work in India.

Meanwhile, office space construction is experiencing lucrative growth in Asia Pacific. Despite the work-from-home culture, office projects are increasing without disruption. India, Korea, Japan, Australia, etc. are witnessing a significant number of office projects. For instance, in Q2 2022, the Seomyeon Office Building Development project commenced in South Korea, and more than USD 710 million was invested in this project. Also in Australia, the Waterloo Metro Quarter Development and 360 Queen Street Office Tower projects have commenced. Moreover, in 2022, Hyderabad, Bengaluru, Shenzhen, Shanghai, etc., will be leading in Grade A office supply in the region. Thus, the growing construction activities in the region are creating opportunities for facade gasket manufacturers.

Growing Commercial Sector is Driving the Market

Most countries are focusing on developing commercial buildings and office spaces that are energy efficient. In addition, builders are focusing on making buildings look better, wrapping the outside walls, and making them use less energy. These factors are driving the utilization of facade gaskets. Also, the increased spending on the renovation of aging office buildings would increase demand for facade installations across the globe.

Moreover, North America is experiencing a significant number of commercial projects, and from supertall skyscrapers to sprawling campuses, the most prominent office developments will be completed in 2022. In addition, as per industry experts, more than 20 of the largest office projects are planned for redevelopment. Meanwhile, in Q2 2022, some of the major office projects commenced across the United States and Canada. For example, The Eight Office Tower project construction began in Q2 2022 with a total budget of USD 470 million.Followed by the 1900 Lawrence Street Office Tower, the North Harbour Mixed-Use Development, El Segundo Headquarters, the Training Facility, etc.

On the other hand, Europe also experienced a huge number of commercial projects. In 2022, as per industry experts, more than 5.7 million square meters of office projects were completed, and a further 5.1 million square meters of development is planned for 2023. In addition, in Q2 2022, construction on the Milan US Consulate General Complex project was started in Italy, with an overall budget of USD 350 million. However, in Q1 2022, cross-border real estate transactions increased. In addition, the EMEA region, consisting of Europe, the Middle East, and Africa, received the largest volume of cross-border transactions, amounting to USD 36.4 billion. Thus, the growing commercial sector across the globe will create a huge opportunity for facade gasket manufacturers.

Facade Gasket Industry Overview

The report covers prominent players operating in the facade gasket market. The market is highly competitive and fragmented, with no players occupying a significant share. To remain competitive, the major players are constantly working to enhance their product offerings to meet the changing needs of the facade gasket market. Some of the major players in the market include Sadev, The Rubber Company, Boss Polymer P/L, Semperit AG Holding, Cooper Standard, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.2.3 Market Opportunities

- 4.3 Insights into Supply Chain/Value Chain Analysis of the Facade Gasket Industry

- 4.4 Insights on Government Regulations in the Market

- 4.5 Insights on Technological Advancements in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Other Applications

- 5.2 By Type

- 5.2.1 E Gaskets

- 5.2.2 Wedge Gaskets

- 5.2.3 Bubble Gaskets

- 5.2.4 Other Types

- 5.3 By Material

- 5.3.1 Silicone

- 5.3.2 Rubber

- 5.3.3 Other Materials

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 Latin America

- 5.4.5.1 Mexico

- 5.4.5.2 Brazil

- 5.4.5.3 Argentina

- 5.4.5.4 Rest of Latin America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 SADEV

- 6.2.2 THE RUBBER COMPANY

- 6.2.3 Boss Polymer P/L.

- 6.2.4 Semperit AG Holding

- 6.2.5 Conta Flexible Products

- 6.2.6 Silicone Engineering Ltd.

- 6.2.7 Cooper Standard

- 6.2.8 Vip Rubber and Plastic Company

- 6.2.9 LOPO International Limited

- 6.2.10 Polecex S.L.*