|

市場調查報告書

商品編碼

1431057

全球化肥:市場佔有率分析、產業趨勢與統計、成長預測(2024-2030)Global Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

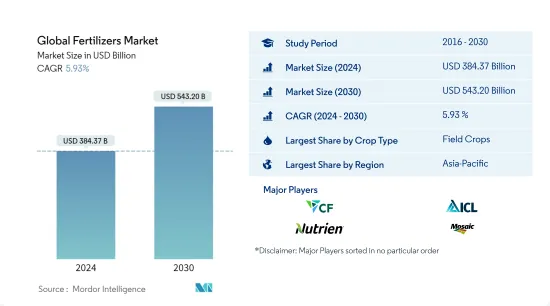

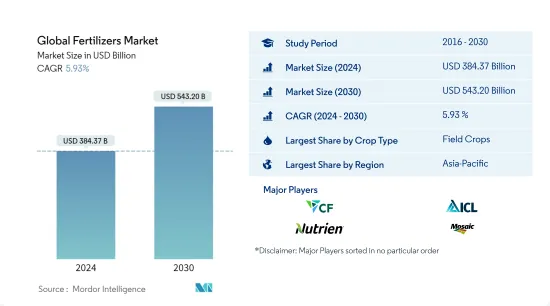

預計2024年全球肥料市場規模為3,843.7億美元,預計2030年將達5,432億美元,在預測期內(2024-2030年)複合年成長率為5.93%。

主要亮點

- 依產品分類成長最快的領域: 鐵:由於高 pH 值、鹼性土壤以及土壤健康和品質不佳而導致缺鐵,全球對產量作物生產的需求不斷增加。

- 依作物類型分類的最大區隔市場 -田間作物:田間作物在世界各地廣泛種植,並且是世界許多地區的主食。在大多數農業國家,田間作物種植面積比例最大。

- 成長最快的領域(依特種產品類型分類)- SRF:SRF 對土壤和環境是安全的,因為它可以在整個種植季節精確地將養分釋放到土壤中,並減少養分淋失。

- 最大的國家-中國:中國是世界上人口最多的國家。耕地面積大,每公頃施肥量高,可最大化作物產量。

化肥市場趨勢

依作物類型分類,田間作物是最大的部分

- 2021年,田間作物約佔全球化肥料市場的82.1%,金額約1,571.4億美元。田間作物生產在全球占主導地位,全球95.0%以上的農業用地用於田間作物種植。稻米、小麥和玉米是全球生產的主要田間作物,這三種作物約佔世界農業用地的38.0%。

- 園藝作物約佔全球肥料市場總量的12.7%。園藝作物生產在開發中國家,尤其是亞太地區占主導地位。亞太地區主導全球園藝肥料市場,主要是因為其約佔全球園藝種植面積的73.0%(約13,766萬公頃)。

- 草坪和觀賞植物領域是最小的化肥市場,其次是園藝作物。 2021年,草坪和觀賞植物領域約佔全球肥料市場的4.9%,市場規模約95.6億美元。草坪和觀賞肥料市場是一個高度分散的市場。然而,與亞太和南美相比,北美和歐洲等新興市場所佔佔有率更大。

- 亞太地區在大田和園藝作物種植方面佔據世界主導地位。亞太地區化肥市場正快速成長。歐洲地區是第二大化肥市場,其次是亞太地區。許多地區都市化的加速和農業總面積的減少正在增加對化肥的需求,預計將在預測期內推動化肥市場的發展。

依地區分類,亞太地區最大

- 研究期間,全球化肥市場呈現穩定成長態勢,2021年達1,911.3億美元。 2021年亞太地區將佔最大佔有率,達到40.5%,其次是歐洲和南美洲。

- 據美國農業部稱,中國是該地區乃至全球最大的化肥生產國和出口國,佔全球化肥產量的 25%。印度是世界第二大化肥消費國,2021年消費量量為7,000萬噸。儘管是世界第三大化肥生產國,印度仍依賴進口。印度是化肥使用量成長最快的國家,預計將持續大幅成長。

- 法國是歐洲最大的化肥消費國之一,預計到2022年終將佔總量的20.1%。預計2022年終市場規模將達到90億美元,與前一年同期比較成長率為5.8%。先進栽培方法的採用也增加了專用肥料的使用。

- 在南美洲,主要作物的收穫面積持續增加。田間作物在南美化肥市場佔據主導地位,2021年將佔95%的市場佔有率。南美洲種植的三大作物是大豆、玉米和甘蔗,過去20年來產量大幅增加。

- 美國約佔北美農地總面積的73.6%,是該地區最大的市場,2021年約佔化肥市場總量的82.1%。

- 由於田間作物種植面積的增加以及肥料需求的相應增加,預計市場在預測期內將成長。

化肥業概況

全球化肥市場較為分散,前五名企業佔27.63%。市場的主要企業包括(依字母順序排列)CF Industries、Israel Chemicals Ltd、Nutrien Limited、The Mosaic Company 和 Yara International。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章執行摘要和主要發現

第2章 檢舉要約

第3章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 平均養分施用量

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 類型

- 複合型

- 直的

- 微量營養素

- 硼

- 銅

- 鐵

- 錳

- 鉬

- 鋅

- 其他

- 氮

- 硝酸銨

- 無水氨

- 尿素

- 其他

- 磷酸

- DAP

- MAP

- SSP

- TSP

- 其他

- 磷酸鹽

- MoP

- SoP

- 其他

- 次要營養素

- 鈣

- 鎂

- 硫

- 型態

- 傳統的

- 特別的

- CRF

- 液體肥料

- SRF

- 水溶性

- 施肥方式

- 施肥

- 葉面噴布

- 土壤

- 作物類型

- 田間作物

- 園藝作物

- 用於草坪/裝飾用途

- 地區

- 亞太地區

- 澳洲

- 孟加拉

- 中國

- 印度

- 印尼

- 日本

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 中東/非洲

- 奈及利亞

- 沙烏地阿拉伯

- 南非

- 土耳其

- 其他中東和非洲

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章 競爭形勢

- 重大策略舉措

- 市場佔有率分析

- 公司形勢

- 公司簡介

- CF Industries

- Compo Expert

- Coromandel International Ltd.

- Haifa Group

- IFFCO

- Israel Chemicals Ltd

- Nutrien Limited

- Sociedad Quimica y Minera(SQM)

- The Mosaic Company

- Yara International

第7章 CEO 面臨的關鍵策略問題

第8章附錄

- 世界概況

- 概述

- 五力分析框架

- 世界價值鏈分析

- 市場動態(DRO)

- 資訊來源和參考文獻

- 圖表列表

- 重要見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92580

The Global Fertilizers Market size is estimated at USD 384.37 billion in 2024, and is expected to reach USD 543.20 billion by 2030, growing at a CAGR of 5.93% during the forecast period (2024-2030).

Key Highlights

- Fastest growing segment by Product - Iron : The alkaline soils with high pH and degrading health and quality of soils are making them deficient in Iron thus increasing the demand globally for high-yield crop production.

- Largest Segment by Crop Type - Field Crops : Field crops are widely cultivated worldwide and are a staple food in many parts of the world. They account for a maximum share by area in most agricultural countries.

- Fastest growing by Speciality Type - SRF : SRFs are safe for the soil and environment as they precisely release nutrients into the soil throughout the cropping season and reduce the leaching of nutrients.

- Largest segment by Country - China : China is the most populous country in the world. It has a large cultivable land with a high fertilizer application rate per hectare in order to maximize crop yields.

Fertilizer Market Trends

Field Crops is the largest segment by Crop Type.

- In 2021, field crops dominated the global fertilizers market, accounting for about 82.1% of the market value of the global fertilizer market, at about USD 157.14 billion. Field crop production is dominant worldwide, and more than 95.0% of the agricultural land in the world is under field crop cultivation. Rice, wheat, and corn are the major field crops produced globally, and these three crops account for about 38.0% of the global agricultural land.

- Horticultural crops account for about 12.7% of the total fertilizer market value worldwide. Horticultural crop production is dominant in developing countries, particularly in the Asia-Pacific region. The Asia-Pacific region's dominance in the global horticultural fertilizer market is primarily due to the presence of about 73.0% of the global horticultural cultivation area, which is about 137.66 million hectares of land under horticulture cultivation.

- The turf and ornamentals segment is the smallest fertilizer market, followed by horticultural crops. In 2021, the turf and ornamentals segment accounted for about 4.9% of the market value of the global fertilizer market, at about USD 9.56 billion. The turf and ornamental fertilizer market is a fragmented market. However, developed regions like North America and Europe occupy a major market share compared to Asia-Pacific and South America.

- Asia-Pacific dominates in growing both field and horticultural crops worldwide. The Asia-Pacific fertilizer market is growing at a fast rate. The European region is the second-largest fertilizer market, followed by the Asia-Pacific region. The increasing urbanization in many regions and the decreasing overall agricultural area are increasing the demand for fertilizers and are expected to drive the fertilizer market during the forecast period.

Asia-Pacific is the largest segment by Region.

- The global fertilizer market grew at a stable rate during the study period, registering a value of USD 191.13 billion in 2021. The Asia-Pacific region occupied the largest share of 40.5% in 2021, followed by Europe and South America.

- China is the largest producer and exporter of fertilizers in the region and the world, and it contributes to 25% of the global fertilizer production, as per the USDA. India is the world's second-largest consumer of fertilizers, with a consumption volume of 70 million metric tons in 2021. Despite being the third-largest producer of fertilizers globally, India is still import-dependent. India is the fastest-growing country in terms of fertilizer usage, and this is anticipated to grow significantly in the future.

- France is one of the largest fertilizer-consuming countries in Europe, with an expected overall share of 20.1% by the end of 2022. The market value is expected to reach USD 9 billion by the end of 2022, with a 5.8% Y-o-Y growth rate. The adoption of advanced cultivation methods will also increase the usage of specialty fertilizers.

- In South America, the area harvested for major food crops has been continuously increasing. Field crops dominated the South American fertilizers market by accounting for 95% of the market share in 2021. The top three crops grown in South America are soybean, corn, and sugarcane, which have increased significantly over the past two decades.

- The United States is the largest market in the region, accounting for about 82.1% of the total fertilizer market value in 2021, as it occupied about 73.6% of the total agricultural land in North America.

- With the increasing cultivation of field crops, along with a subsequently increased demand for fertilizers, the market is anticipated to grow during the forecast period.

Fertilizer Industry Overview

The Global Fertilizers Market is fragmented, with the top five companies occupying 27.63%. The major players in this market are CF Industries, Israel Chemicals Ltd, Nutrien Limited, The Mosaic Company and Yara International (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.2 Average Nutrient Application Rates

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Ammonium Nitrate

- 5.1.2.2.2 Anhydrous Ammonia

- 5.1.2.2.3 Urea

- 5.1.2.2.4 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 SSP

- 5.1.2.3.4 TSP

- 5.1.2.3.5 Others

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.4.3 Others

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Speciality

- 5.2.2.1 CRF

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 SRF

- 5.2.2.4 Water Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf & Ornamental

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.1.1 Australia

- 5.5.1.2 Bangladesh

- 5.5.1.3 China

- 5.5.1.4 India

- 5.5.1.5 Indonesia

- 5.5.1.6 Japan

- 5.5.1.7 Pakistan

- 5.5.1.8 Philippines

- 5.5.1.9 Thailand

- 5.5.1.10 Vietnam

- 5.5.1.11 Rest Of Asia-Pacific

- 5.5.2 Europe

- 5.5.2.1 France

- 5.5.2.2 Germany

- 5.5.2.3 Italy

- 5.5.2.4 Netherlands

- 5.5.2.5 Russia

- 5.5.2.6 Spain

- 5.5.2.7 Ukraine

- 5.5.2.8 United Kingdom

- 5.5.2.9 Rest Of Europe

- 5.5.3 Middle East & Africa

- 5.5.3.1 Nigeria

- 5.5.3.2 Saudi Arabia

- 5.5.3.3 South Africa

- 5.5.3.4 Turkey

- 5.5.3.5 Rest Of Middle East & Africa

- 5.5.4 North America

- 5.5.4.1 Canada

- 5.5.4.2 Mexico

- 5.5.4.3 United States

- 5.5.4.4 Rest Of North America

- 5.5.5 South America

- 5.5.5.1 Argentina

- 5.5.5.2 Brazil

- 5.5.5.3 Rest Of South America

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CF Industries

- 6.4.2 Compo Expert

- 6.4.3 Coromandel International Ltd.

- 6.4.4 Haifa Group

- 6.4.5 IFFCO

- 6.4.6 Israel Chemicals Ltd

- 6.4.7 Nutrien Limited

- 6.4.8 Sociedad Quimica y Minera (SQM)

- 6.4.9 The Mosaic Company

- 6.4.10 Yara International

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219