|

市場調查報告書

商品編碼

1431013

全球標籤:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

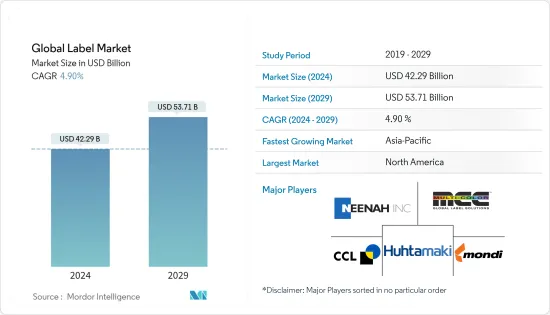

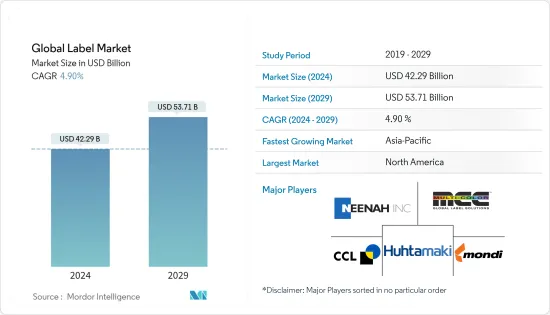

預計 2024 年全球標籤市場規模為 422.9 億美元,預計 2029 年將達到 537.1 億美元,在預測期內(2024-2029 年)複合年成長率為 4.90%。

主要亮點

- 標籤對顧客的購買決策影響很大,在目前市場上各種產品的品牌行銷中扮演重要角色。標籤通常由紙、塑膠、布或其他材料製成並貼在產品上。標籤包含一般產品資訊。

- 標籤透過提供產品識別、成分資訊、警告標籤和預防措施等功能品質,有助於食品和消費品的包裝。由於其美學方面,標籤也是品牌推廣的重要貢獻者。

- 電子商務的興起推動了對更環保、更有效的包裝的需求。因此,客戶正在尋求更環保、更有吸引力的選擇,例如可回收黏合劑、無襯墊標籤和透明基材上的透明薄膜標籤。

- 食品和飲料和製藥企業等主要最終用途行業對標籤的需求不斷成長,預計將增加標籤需求。製藥業務日益系列化,標籤是製藥業的巨大競爭優勢。

- 相對穩定的標籤市場是由於COVID-19期間對食品和藥品包裝的需求增加。同時,COVID-19 的爆發導致食品和飲料、醫療保健和製造業等各個最終用戶行業的供應鏈中斷。

標籤市場趨勢

食品和飲料最終用戶領域預計將推動標籤成長

- 標籤預計將在食品和飲料食品和飲料中獲得最大程度的普及,因為該行業強調包裝的美學價值。包裝可以延長產品的保存期限並吸引新客戶。

- 食品標籤提供有關產品的有用資訊。提供產品名稱及描述、淨重、日期標記、成分清單、營養資訊面板、過敏警告或過敏原聲明、名稱及地址、原產國等資訊。

- 由於食品和飲料行業的興起,自粘標籤是一種備受讚賞的標籤型態。套模標籤直接貼在容器模具上,減少了實體標籤建置的需要。由於其耐用性、經濟性、3D裝飾潛力和可回收性,此類標籤預計將在已開發國家最為發達。

- 在許多成長地區,隨著全球經濟的改善,提供更多冷凍食品選擇的超級市場和便利商店等現代零售店越來越普及。根據經濟合作暨發展組織(OECD)的數據,冷凍食品和食品的成長食品顯著。在德國,客製化包裝食品的銷量與前一年同期比較成長56%。

- 根據 Label Insight 和食品行銷研究所的數據,86% 的客戶對透明度感興趣。同時,雜貨購物者可能會更加信任提供全面且易於理解的成分資訊的食品製造商和零售商。

亞太地區可望成為快速成長的市場

- 亞太地區是世界上人口最多的地區。隨著消費者包裝意識的增強,食品和飲料行業對包裝的需求不斷增加,對快速、高品質標籤解決方案的需求也隨之增加。由於工業和製造業的成長,中國和印度的標籤市場預計也會成長。

- 許多亞洲公司都在當地位置工廠,並將機械出貨到世界各地,為這些地區的市場利潤的增加做出了貢獻。例如,AH Industries 在印度、孟加拉、埃及、菲律賓和敘利亞的製藥業運作1,000 多台機器。該公司的各種機器,包括濕式不乾膠貼標機,廣泛用於製藥機械貼標,並在製藥行業中有應用。

- 在亞太地區,中國和印度尤其主導市場。在整個全部區域,COVID-19 的影響因國家而異。包裝和標籤產業的製造和生產僅在包裝對 GDP 貢獻顯著的某些國家進行。

- 此外,還有印度工商會聯合會(FICCI)、全印度食品加工商協會和美美國戰略合作夥伴論壇(USISPF)等三大區域產業協會,以及百事可樂、可口可樂等主要飲料製造商。雀巢、億滋等公司認為食品和飲料製造是一項“基本服務”,並要求政府免除他們的禁閉限制以繼續生產。

標籤行業概況

全球標籤市場分散,供應商之間的競爭日益加劇。市場上不斷有新進入者進入標籤市場。這些新進入者迫使現有企業專注於產品創新,以獲得競爭優勢。此外,公司正在推出新產品以開拓客戶群。

- 2021 年 4 月 Neenah, Inc. 的耐用標籤解決方案系列中的九種生物基產品獲得美國農業部 (USDA) 認證。憑藉此第三方認證,各種 DISPERSA、ENDURA 和 PREVAIL 耐用標籤和紙板產品現在可以顯示獨特的 USDA 標籤,突出顯示其 68-99% 的生物基含量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 離型紙回收問題和實現直接數位印刷驅動需求的能力

- 能夠適應任何尺寸或形狀並提供所需的保護

- 市場課題

- 飲料業對立式袋的需求不斷成長以及整個回收過程的複雜性

第6章市場區隔

- 依類型

- 感壓標籤

- 依印刷過程

- 膠印

- 彈性凸版印刷

- 凹版印刷

- 其他模擬印刷過程

- 數位印刷

- 依產品類型

- 襯墊

- 無襯墊

- VIP

- 主要的

- 功能與安全

- 晉升

- 最終用戶產業

- 食品和飲料

- 藥品/醫療保健

- 其他最終用戶

- 依印刷過程

- 收縮和彈力套筒標籤

- 依類型

- 收縮套管

- 拉伸套

- 依材質

- PVC

- PET

- PE

- OPP &OPS

- 其他材料(PO、PLA等)

- 最終用戶產業

- 食品和飲料

- 藥品/醫療保健

- 其他最終用戶

- 依類型

- 套模標籤

- 濕膠標籤

- 熱轉印標籤

- 依材質

- 紙

- 聚酯纖維

- PP

- 其他材料

- 最終用戶產業

- 食品和飲料

- 藥品/醫療保健

- 其他最終用戶

- 環繞標籤

- 感壓標籤

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 中東/非洲

- 拉丁美洲

第7章 競爭形勢

- 公司簡介

- Neenah, Inc

- Multi-Color Corporation

- Mondi

- Huhtamaki Group

- CCL Industries, LLC

- Constantia Flexibles Group GmbH

- Avery Dennison

- UPM Raflatc

- Lintec

- Bemis Company

- Berry Global

- Klockner Pentaplast

- Taghleef Industries Inc.

- Fort Dearborn Company

- Fort Dearborn

- CPC Packaging

- Royal Sens Group

- 3M Company

- Lintec Corporation

- Fuji Seal International, Inc.

- WestRock Company

- Vintech Polymers Private Limited

- KRIS FLEXIPACKS PVT. LTD.

- GTPL

- Leading Edge labels & Packaging

第8章投資分析

第9章 未來趨勢

The Global Label Market size is estimated at USD 42.29 billion in 2024, and is expected to reach USD 53.71 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Key Highlights

- Labels have a considerable impact on customer purchasing decisions and play a vital part in brand marketing of the various products currently available on the market. Labels are often made of paper, plastic, cloth, or other material attached to a product. Labels contain general product information.

- Labels contribute to the packaging of food and consumer goods by giving functional qualities such as product identification, ingredient information, warning signs, and cautionary alerts, among other things. Labels are also important contributors to brand promotion because of their aesthetic aspect.

- With the rise of e-commerce, there is a greater demand for more environmentally friendly and effective packaging. This encourages customers to seek more environmentally friendly and appealing options, such as recyclable adhesives, liner-free labels, and clear film labels on clear substrates.

- The increased need for labels from major end-use industries such as food and beverages and the pharmaceutical business is projected to increase demand for labels. Pharmaceutical businesses are increasingly serializing, giving the label a significant competitive advantage in the pharmaceutical industry.

- The label market has remained relatively stable because of the growing need for food and pharmaceutical packaging during COVID-19. The COVID-19 epidemic, on the other hand, caused supply chain disruptions in a variety of end-user industries, including food and beverage, healthcare, and manufacturing.

Label Market Trends

Food and Beverage End-User Segment is Expected to Drive Growth of Labels

- Labeling is expected to exhibit maximum adoption in the food and beverage industry due to the importance of the aesthetic value of packaging in the food and beverage sector. Packaging extends the product's shelf life and attracts new customers.

- Food label carries useful information about a product. It provides information like the name and description of the product, Net weight, Date mark, Ingredient list, Nutrition information panel, Allergy warning or Allergen declaration, Name and address, and Country of origin.

- Glue-applied labels are the highly rated form of label due to the rise of the food and beverage industry. In-mold labeling is carried out directly on the container's mold, reducing the need for a physical label structure. Because of its durability, affordability, 3D decorating potential, and recycling, this kind is predicted to develop the most in developed countries.

- In numerous growing regions, modern retail trade outlets such as supermarkets and convenience shops that sell a more significant choice of frozen food goods are becoming more prevalent as global economies improve. Frozen and packaged food items, in particular, have expanded considerably, according to the Organisation for Economic Co-operation and Development (OECD). In Germany 56% increase in customized packaged food sales year over year.

- According to Label Insight and the Food Marketing Institute, 86 percent of customers are concerned about transparency. At the same time, grocery shopping would place more faith in food producers and retailers that give comprehensive, easy-to-understand ingredient information.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia-Pacific region has the largest population in the world. As consumer awareness of packaging grows, so does the demand for packaging in the food and beverage industry and the need for fast and high-quality labeling solutions. Increased growth in the industrial and manufacturing sectors is expected to lead to positive growth in China and India's label market.

- Many Asian companies are located locally, shipping their machines to other parts of the world, helping to increase market profits in these parts of the world. For example, A.H. Industries operates more than 1000 machines in the pharmaceutical industry in India, Bangladesh, Egypt, the Philippines, and Syria. Their wide range of machines, such as wet adhesive labeling machines, are widely used to label pharmaceutical machines and have applications in the pharmaceutical industry.

- In the Asia-Pacific region, China and India, in particular, dominate the market. Throughout the region, the impact of COVID 19 varies from country to country. The manufacturing and production of the packaging and labeling industry work only in certain countries where packaging contributes significantly to GDP.

- In addition, three major regional industry groups such as the Federation of Indian Chamber of Commerce (FICCI), the All Indian Food Processors Association, the US India Strategic Partnership Forum (USISPF), and major beverage makers such as PepsiCo, Coca-Cola. Nestle, Mondelez, and others consider the food and beverage manufacturing sector an "essential service" and call on the government to exempt lockdown restrictions from continuing production.

Label Industry Overview

Global Label Market is fragmented, with inetnse competition among the vendors. The market has been witnessing continuous new entrants offering in Label Market. Due to these new entrants, exsisting companies are focusing on making product innovations to gain competitive advantage. Also, the companies are launching new product to interset their customer base.

- April 2021 - Neenah, Inc. achieved nine verified U.S. Department of Agriculture (USDA) Certified Biobased Products in the durable label solutions lineup as further evidence of its commitment to sustainability efforts. With this third-party verification, various DISPERSA, ENDURA, and PREVAIL durable label and board products have earned the ability to display a unique USDA label highlighting their biobased content ranging from 68-99%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand

- 5.1.2 Ability to conform to any size and shape, and yet provide the necessary protection

- 5.2 Market Challenges

- 5.2.1 Growing demand for stand-up pouches in the beverage sector and elaborate nature of the overall recycling process

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure-Sensitive Label

- 6.1.1.1 By Print Process

- 6.1.1.1.1 Offset Printing

- 6.1.1.1.2 Flexography Printing

- 6.1.1.1.3 Gravure

- 6.1.1.1.4 Other Analog Printing Process

- 6.1.1.1.5 Digital Printing

- 6.1.1.2 By Product Type

- 6.1.1.2.1 Liner

- 6.1.1.2.2 Linerless

- 6.1.1.2.3 VIP

- 6.1.1.2.4 Prime

- 6.1.1.2.5 Functional & Security

- 6.1.1.2.6 Promotional

- 6.1.1.3 End-User Industry

- 6.1.1.3.1 Food & Beverages

- 6.1.1.3.2 Pharmaceutical & Healthcare

- 6.1.1.3.3 Other End-Users

- 6.1.2 Shrink & Stretch Sleeve Label

- 6.1.2.1 By Type

- 6.1.2.1.1 Shrink Sleeve

- 6.1.2.1.2 Stretch Sleeve

- 6.1.2.2 By Material

- 6.1.2.2.1 PVC

- 6.1.2.2.2 PET

- 6.1.2.2.3 PE

- 6.1.2.2.4 OPP & OPS

- 6.1.2.2.5 Other Materials (PO, PLA, etc.)

- 6.1.2.3 End-User Industry

- 6.1.2.3.1 Food & Beverages

- 6.1.2.3.2 Pharmaceutical & Healthcare

- 6.1.2.3.3 Other End-Users

- 6.1.3 In-Mold Label

- 6.1.4 Wet Glue Label

- 6.1.5 Thermal Transfer Label

- 6.1.5.1 By Material

- 6.1.5.1.1 Paper

- 6.1.5.1.2 Polyester

- 6.1.5.1.3 PP

- 6.1.5.1.4 Other Materials

- 6.1.5.2 End-User Industry

- 6.1.5.2.1 Food & Beverages

- 6.1.5.2.2 Pharmaceutical & Healthcare

- 6.1.5.2.3 Other End-Users

- 6.1.6 Wrap Around Label

- 6.1.1 Pressure-Sensitive Label

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Neenah, Inc

- 7.1.2 Multi-Color Corporation

- 7.1.3 Mondi

- 7.1.4 Huhtamaki Group

- 7.1.5 CCL Industries, LLC

- 7.1.6 Constantia Flexibles Group GmbH

- 7.1.7 Avery Dennison

- 7.1.8 UPM Raflatc

- 7.1.9 Lintec

- 7.1.10 Bemis Company

- 7.1.11 Berry Global

- 7.1.12 Klockner Pentaplast

- 7.1.13 Taghleef Industries Inc.

- 7.1.14 Fort Dearborn Company

- 7.1.15 Fort Dearborn

- 7.1.16 CPC Packaging

- 7.1.17 Royal Sens Group

- 7.1.18 3M Company

- 7.1.19 Lintec Corporation

- 7.1.20 Fuji Seal International, Inc.

- 7.1.21 WestRock Company

- 7.1.22 Vintech Polymers Private Limited

- 7.1.23 KRIS FLEXIPACKS PVT. LTD.

- 7.1.24 GTPL

- 7.1.25 Leading Edge labels & Packaging