|

市場調查報告書

商品編碼

1431008

玄武岩纖維:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Basalt Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

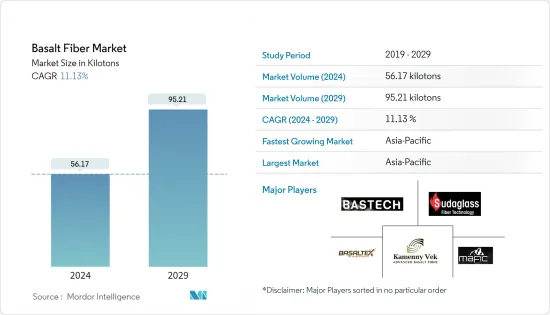

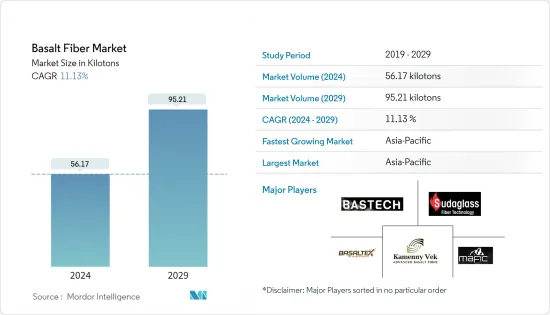

玄武岩纖維市場規模預計到2024年為56.17千噸,預計2029年將達到95.21千噸,在預測期內(2024-2029年)複合年成長率為11.13%。

COVID-19 的爆發對玄武岩紡織業造成了沉重打擊。全球封鎖和嚴格的政府監管迫使大多數生產基地關閉,造成毀滅性的挫折。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 從短期來看,汽車行業需求的增加以及住宅裝修和維修活動的支出是推動所研究市場成長的因素。

- 另一方面,現有替代產品的可用性和原料價格的波動預計將抑制市場成長。

- 然而,擴大採用環保材料可能會在未來幾年為市場提供機會。

- 預計亞太地區將主導市場,並且在預測期內也可能呈現最高的複合年成長率。

玄武岩纖維市場趨勢

增加在汽車產業的使用

- 玄武岩纖維環保,具有優異的機械強度、耐高溫、耐用性和耐化學性。由於這些特性,玄武岩纖維被用於汽車產業。

- 在汽車工業中,玄武岩纖維用於車頂內襯、CNG氣瓶、燃料箱、煞車皮、離合器片、排氣系統、消音器填料、面板、螢幕、輪胎罩、基於織物的內部和外部部件、熱塑性複合部件、用於組件等各種零件。

- 人口成長、生活水準提高和消費能力增強預計將推動全球汽車需求。例如,根據國際汽車工業協會(OICA)的數據,2022年全球整體小客車產量為6,159萬輛,較2021年成長8%。因此,小客車產量的增加預計將在預測期內增加玄武岩紡織品市場的需求。

- 此外,德國的供應鏈問題已經緩解,汽車產量正在上升。例如,根據 OICA 的數據,2022 年德國將生產約 3,677,820 輛汽車,比 2021 年成長 11%。因此,國內汽車產量的增加預計將為玄武岩紡織品市場帶來需求上行。

- 此外,美國也是全球第二大汽車銷售和生產市場。例如,根據國際汽車工業協會(OICA)的數據,2022年美國汽車產量為10,060,339輛,較2021年成長10%。因此,汽車產量的增加預計將對玄武岩纖維產生大量需求。

- 玄武岩纖維作為汽車消音器的填充材具有許多優點,表現出優異的隔音性能和良好的耐熱循環性。例如,豐田(世界領先的汽車公司之一)使用玄武岩纖維作為消音器的輔助材料。

- 由於這些因素,預測期內全球對玄武岩纖維的需求可能會成長。

亞太地區主導市場

- 由於中國、日本和印度等國家的汽車生產以及建設活動的增加,亞太地區主導了全球市場佔有率。

- 隨著消費者對電池驅動電動車的偏好增加,中國汽車產業正經歷轉變。中國汽車產業的擴張預計將使安定器纖維市場受益。根據國際汽車工業協會(OICA)的數據,中國是世界上最大的汽車生產國,佔全球產量的近34%。 2022年汽車產量為27,020,615輛,比2021年的26,121,712輛增加24%。因此,汽車產量的增加預計將創造對玄武岩纖維的需求。

- 在印度,汽車廢氣法規的收緊、車輛安全的進步、ADAS(高級駕駛輔助系統)的引入以及零售和電子商務領域物流的快速成長正在催生新型先進的輕商業車輛(輕型商用車)。這極大地推動了對汽車的需求。例如,根據國際汽車工業協會(OICA)的數據,2022年印度輕型商用車產量達到617,398輛,較2021年成長27%。

- 此外,印度汽車工業的投資增加和進步預計將增加安定器紡織品的消費。例如,2022年4月,塔塔汽車宣布計畫未來5年向小客車業務投資30.8億美元。這一擴張預計將對該國的玄武岩纖維市場產生積極影響。

- 此外,中國在亞太地區建築市場中佔有最大佔有率。由於該國投資和建設活動的增加,預計玄武岩纖維的需求在預測期內將會增加。例如,根據國家統計局(NBS)的數據,2022年中國建築業產值將達到27.63兆元人民幣(41,085.81億美元),比2021年增加6.6%。

- 隨著2025年大阪世博會的舉辦,日本建設產業預計將蓬勃發展。此外,ESR Cayman、OS Cosmosquare資料中心和大阪項目是日本最大的建設計劃,總成本達20億美元,將於2022年第四季開工。 ESR 開曼、OS Cosmosquare 資料中心、大阪計畫將於 2021 年第二季在大阪(市)宣布,預計第一季完工。第二名計劃是國土交通省設樂大壩開發(愛知縣),於2022年第四季開始開發,計劃價值5.7億美元。日本國土交通省的設樂大壩開發計劃位於日本,於 2022 年第三季宣布,預計竣工日期為 2034 年第四季。

- 由於這些因素,預計該地區的玄武岩纖維市場在預測期內將穩定成長。

玄武岩紡織業概況

玄武岩紡織品市場本質上是部分一體化的。市場的主要企業(排名不分先後)包括 Kamenny Vek、Basaltex、Sudaglass Fiber Technology、MAFIC、BASTECH 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車產業的需求不斷增加

- 住宅裝修/維修支出增加

- 其他司機

- 抑制因素

- 輕鬆取得替代產品

- 原物料價格波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:基於數量)

- 類型

- 連續式

- 離散的

- 最終用戶產業

- 建築/施工

- 車

- 建造

- 海洋

- 能源工業

- 其他(體育、化工、工業)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)/排名分析

- 主要企業策略

- 公司簡介

- ARMBAS

- Basalt Engineering, LLC

- Basaltex

- BASTECH

- Deutsche Basalt Faser GmbH

- Fiberbas construction and building technologies

- FINAL ADVANCED MATERIALS

- Galen Ltd

- INCOTELOGY GmbH

- JiLin Tongxin Basalt Technology Co.,Ltd

- Kamenny Vek

- MAFIC

- Sudaglass Fiber Technology

- Technobasalt Invest

第7章 市場機會及未來趨勢

- 增加環保材質的使用

- 其他機會

The Basalt Fiber Market size is estimated at 56.17 kilotons in 2024, and is expected to reach 95.21 kilotons by 2029, growing at a CAGR of 11.13% during the forecast period (2024-2029).

The COVID-19 epidemic harmed the basalt fiber sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the businesses were recovering since 2021 and are expected to rise significantly in the coming years.

Key Highlights

- Over the short term, increasing demand from the automotive industry and spending on home remodeling and retrofitting activities are factors driving the studied market's growth.

- On the flip side, the easy availability of existing substitute products and fluctuations in raw material prices are expected to hinder the studied market's growth.

- However, increasing adoption of environmentally friendly materials will likely create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Basalt Fiber Market Trends

Increasing Usage in the Automotive Industry

- Basalt fiber is environmentally friendly and includes good mechanical strength, resistance to high temperatures, durability, and chemical resistance. Due to all these properties and characteristics, basalt fiber is used in the automotive industry.

- In the automotive industry, basalt fiber is used for different parts such as headliners, CNG cylinders, fuel tanks, brake pads, clutch plates, exhausting systems, Muffler's filler, panels, screens, tire covers, interior and exterior parts based on fabrics, thermoplastic compound parts, and components.

- The rising population, improved living standards, and increased spending power will likely boost the demand for automobiles globally. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021. Therefore, an increase in the production of passenger cars is expected to create an upside demand for the basalt fiber market during the forecast period.

- Moreover, with the ease of supply chain issues in Germany, automobile production in the country observed an upside trend. For instance, according to OICA, in 2022, around 36,77,820 units of automobiles were produced in Germany, which shows an increase of 11% compared to 2021. Therefore, an increase in the production of automobiles in the country is expected to create an upside demand for the basalt fiber market.

- Furthermore, the United States is the second-largest vehicle sales and production market globally. For instance, according to The International Organization of Motor Vehicle Manufacturers (OICA), in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create a significant demand for basalt fiber.

- Basalt fibers provide many benefits as filler for car mufflers showing great silencing properties and good resistance to thermal cycling. For instance, Toyota (one of the world's leading automotive companies) uses basalt fiber as sub- Muffler stuffing for their cars.

- Owing to all these factors, the demand for basalt fiber will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share owing to the increasing automotive production and building and construction activities in the countries like China, Japan, and India.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit the ballast fiber market. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing the production of automobiles is expected to create demand for basalt fiber.

- In India, increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist system introduction, and rapidly growing logistics in the retail and e-commerce sectors significantly drove the demand for new and advanced Light commercial vehicles (LCVs). For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, light commercial vehicle production in India amounted to 6,17,398 units, showing an increase of 27% compared to 2021.

- Moreover, increased investments and advancements in the automobile industry in India are expected to increase the consumption of ballast fiber products. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This expansion is expected to include a positive impact on the basalt fiber market in the country.

- Furthermore, China holds the largest Asia-Pacific share of the construction market. The demand for basalt fiber is expected to rise throughout the forecast period due to rising investments and construction activity in the country. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4,108.581 billion), an increase of 6.6% compared with 2021.

- The Japanese construction industry is expected to be booming as the country will host the World Expo in 2025 in Osaka, Japan. Furthermore, the ESR Cayman, OS Cosmosquare Data Centre, Osaka project, valued at USD 2,000 million, was Japan's largest building project, on which construction started in Q4 2022. The ESR Cayman, OS Cosmosquare Data Centre, Osaka project was announced in Q2 2021 in Osaka (City), Japan, with a completion date of Q1 2026. The second-largest project, the MLIT Japan, Shitara Dam Development, Aichi, with a project value of USD 570 million, began development in Q4 2022. The MLIT Japan, Shitara Dam Development, Aichi project is located in Japan and was announced in Q3 2022, with a completion date of Q4 2034.

- Due to all such factors, the region's basalt fiber market is expected to grow steadily during the forecast period.

Basalt Fiber Industry Overview

The Basalt Fiber Market is partially consolidated in nature. The major players in this market (not in a particular order) include Kamenny Vek, Basaltex, Sudaglass Fiber Technology, MAFIC, and BASTECH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Automotive Industry

- 4.1.2 Increase in Spending on Home Remodeling and Retrofitting Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Easy Availability of Substitute Products

- 4.2.2 Fluctuations in Raw Material Prices

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Continuous

- 5.1.2 Discrete

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Marine

- 5.2.5 Energy Industry

- 5.2.6 Other (Sports, Chemical Industry, Petroleum Industry)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARMBAS

- 6.4.2 Basalt Engineering, LLC

- 6.4.3 Basaltex

- 6.4.4 BASTECH

- 6.4.5 Deutsche Basalt Faser GmbH

- 6.4.6 Fiberbas construction and building technologies

- 6.4.7 FINAL ADVANCED MATERIALS

- 6.4.8 Galen Ltd

- 6.4.9 INCOTELOGY GmbH

- 6.4.10 JiLin Tongxin Basalt Technology Co.,Ltd

- 6.4.11 Kamenny Vek

- 6.4.12 MAFIC

- 6.4.13 Sudaglass Fiber Technology

- 6.4.14 Technobasalt Invest

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing adoption of environmentally friendly materials

- 7.2 Other Opportunities