|

市場調查報告書

商品編碼

1430593

硬木地板:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Hardwood Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2024年硬木地板市場規模預計為530.4億美元,預計到2029年將達到702.4億美元,在預測期內(2024-2029年)複合年成長率預計為5.78%。

近年來,硬木地板市場一直穩定成長,預計未來仍將持續成長。對硬木地板的需求是由住宅和商業建設活動的增加、對環保和永續選擇的需求不斷增加以及對美觀的地板解決方案的日益偏好所推動的。

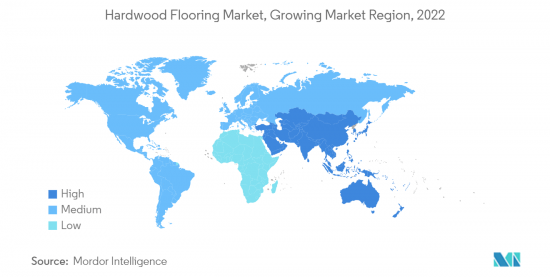

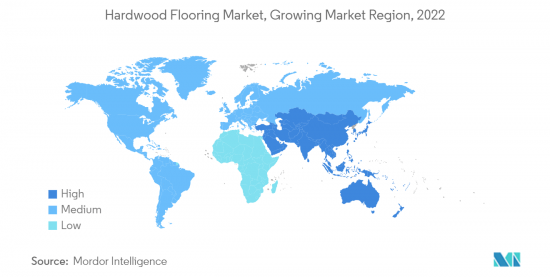

亞太地區是硬木地板最大的市場,其中中國和印度對成長做出了重大貢獻。由於快速的都市化、可支配收入的增加和中產階級人口的成長,預計該地區將繼續主導市場。北美和歐洲也是硬木地板的重要市場,其中美國是北美最大的市場。在歐洲,德國、英國和法國是硬木地板的主要市場。

COVID-19 是 2020 年硬木地板製造市場的巨大限制。貿易限制擾亂了供應鏈,世界各地政府的封鎖措施減少了消費。封鎖限制了住宅的建設和建築計劃,並限制了硬木地板的新購買。由於情況的變化和客戶對疫情的態度,預計市場將在預測期內復甦。

硬木地板市場趨勢

最大的工程木材領域

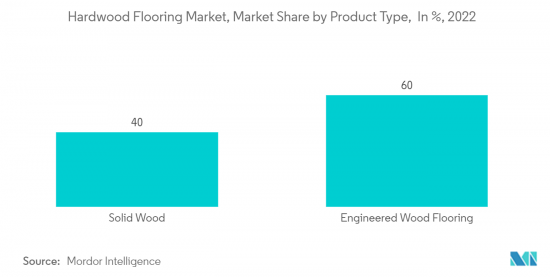

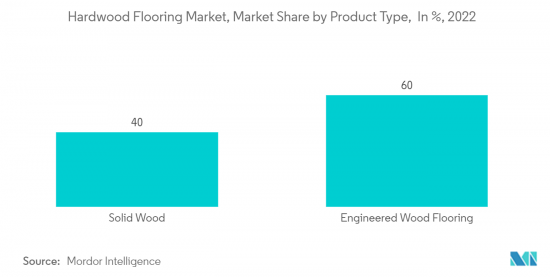

預計在預測期內,工程木材的需求將保持高位,因為它是混凝土和硬木的合適替代品。工程木製品被建築師、建築商、法律相關人員和設計師廣泛使用。他們也了解節能農業方法,可以節省能源、加快建設速度、降低人事費用並減少廢棄物。

預計該行業在北美和歐洲將以更快的速度發展,這些地區的可支配收入較高,工程木材的好處得到了廣泛的認可。實木地板產業在本年度總收入中佔很大比例。工程木製品的優點之一是它們的設計可以滿足最終用戶的需求和自訂規格。易於維護和獨特、多彩的設計也推動了這一領域的發展。

亞太地區預計成長率最高

亞太地區是一個快速成長的市場,預計在預測期內將顯著成長。這種成長的推動因素包括快速都市化以及相關的住宅和房地產開發、對豐富、美觀和豪華設計的熱帶木地板的偏好、經濟實惠的實木地板解決方案的推出以及中階。人們對地板裝飾的認知發生了變化。該地區以其熱帶木材而聞名,如桃花心木、柚木、烏木和紅木,這些木材生長在雨林和潮濕的硬木森林中。

硬木地板產業概況

該報告涵蓋了在硬木地板市場營運的主要國際公司。從市場佔有率來看,目前該市場由幾家大型企業佔據主導地位。然而,隨著技術進步和產品創新的出現,中小企業正在透過贏得新契約和開拓新市場來增加其市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究結果和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 價值鏈/供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 洞察產業技術進步

- COVID-19 對市場的影響

第5章市場區隔

- 產品類別

- 實木

- 紅橡木

- 白橡木

- 楓

- 其他實木

- 工程木材

- 實木

- 最終用戶

- 住宅

- 商業的

- 分銷管道

- 實體門市

- 網路商店

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭形勢

- 市場集中度概況

- 公司簡介

- Mohawk Industries

- The Armstrong Flooring, Inc.

- Mannington Mills, Inc.

- Home Legend, LLC

- Somerset Hardwood Flooring

- Provenza Floors, Inc.

- Beaulieu International Group

- BerryAlloc

- Classen

- Egger

- Formica*

第7章 市場機會及未來趨勢

第8章 免責聲明

The Hardwood Flooring Market size is estimated at USD 53.04 billion in 2024, and is expected to reach USD 70.24 billion by 2029, growing at a CAGR of 5.78% during the forecast period (2024-2029).

The hardwood flooring market is growing steadily for the past few years and is expected to continue in the coming years. The demand for hardwood flooring is driven by increasing residential and commercial construction activities, rising demand for eco-friendly and sustainable options, and a growing preference for aesthetically pleasing flooring solutions.

The Asia-Pacific region is the largest market for hardwood flooring, with China and India being the major contributors to growth. The region is expected to continue to dominate the market, driven by rapid urbanization, increasing disposable incomes, and a growing middle-class population. North America and Europe are also significant markets for hardwood flooring, with the United States being the largest market in North America. Europe, Germany, the UK, and France are the major markets for hardwood flooring.

The Coronavirus disease (COVID-19) was a massive restraint on the hardwood flooring manufacturing market in 2020. Supply chains were disrupted due to trade restrictions, and consumption declined due to lockdowns imposed by governments globally. The lockdown restricted the construction of housing and building projects and limited the new purchase of hardwood flooring. Due to the changed situations and customers ' approach towards the pandemic, the market is anticipated to bounce back during the forecast period.

Hardwood Flooring Market Trends

Largest Engineered Wood Segment

Demand for engineered wood is expected to remain high during the forecast period, as it is an apt alternative to concrete and hardwood. Architects, builders, code officials, and designers widely use engineered wood products. They also know about energy-efficient farming practices that conserve energy, speed up construction, cut labor costs, and reduce waste.

The segment is expected to move at a higher pace in North America and Europe, owing to high disposable income and widespread awareness of the benefits of engineered wood among the populace. The engineered wood floor segment contributed a large share of the total revenue in the current year. One of the advantages of engineered wood products is that they can be designed per the end-user's demand and custom specifications. Easy maintenance and the uniqueness of colorful design are among other features pushing the segment's growth.

Asia-Pacific is Anticipated to Grow at the Highest Rate

Asia-Pacific ranks as the fastest-growing market, with a significant growth rate likely to be witnessed over the forecast period. This growth is led by rapid urbanization and resulting housing and real estate development, preference for tropical wood flooring in rich, beautiful, and luxurious designs, the launch of affordable engineered wood flooring solutions, and expanding middle class and their changing attitude toward flooring decors. The region is famous for tropical wood growing in rainforests and moist broadleaf forests such as mahogany, teak, ebony, and rosewood.

Hardwood Flooring Industry Overview

The report covers major international players operating in the hardwood flooring market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Advancements in the Industry

- 4.7 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Solid Wood

- 5.1.1.1 Red Oak

- 5.1.1.2 White Oak

- 5.1.1.3 Maple

- 5.1.1.4 Other Solid Woods

- 5.1.2 Engineered Wood

- 5.1.1 Solid Wood

- 5.2 End-User Type

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Distribution Channel

- 5.3.1 Offline Stores

- 5.3.2 Online Stores

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mohawk Industries

- 6.2.2 The Armstrong Flooring, Inc.

- 6.2.3 Mannington Mills, Inc.

- 6.2.4 Home Legend, LLC

- 6.2.5 Somerset Hardwood Flooring

- 6.2.6 Provenza Floors, Inc.

- 6.2.7 Beaulieu International Group

- 6.2.8 BerryAlloc

- 6.2.9 Classen

- 6.2.10 Egger

- 6.2.11 Formica*