|

市場調查報告書

商品編碼

1430501

直流 (DC) 馬達:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Direct Current (DC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

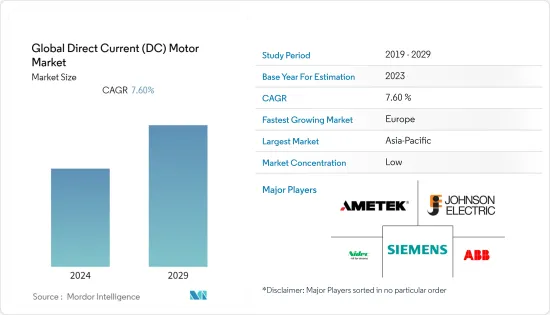

2024年直流(DC)馬達市場規模預計為5.3557億美元,預計到2029年將下降至5.0824億美元。

工業自動化的成長也推動了對直流馬達的需求,因為它們透過提供精確的控制和可靠的性能在自動化系統中發揮關鍵作用。新興國家的勞動力短缺導致製造業引入機器人技術,同時也創造了對不同類型直流馬達的需求,包括並聯馬達、自勵馬達和複合馬達。

主要亮點

- 在汽車中,直流馬達廣泛應用於雨刷馬達、電動座椅馬達、電動車窗馬達、HVAC系統等系統。此外,電動車的日益普及預計將在預測期內支持市場成長。多年來,汽車產業的日產量顯著成長。

- 石油和天然氣、採礦、發電、化學品和石化等行業經常涉及惡劣和爆炸性環境,這使得職業安全在世界許多地區和要求高質量空氣管理的政府中變得越來越重要。因此,暖通空調系統透過管理和控制空氣流通來幫助創造一個安全的工作環境。隨著暖通空調系統已成為工業領域不可或缺的一部分,直流馬達被用於暖通空調系統中的鼓風機馬達、變速驅動裝置和AHU,以實現高效率並最大限度地延長鼓風機系統的使用壽命。增加。

- 汽車產業正在迅速推出電動車(EV)等無污染車輛。開發和改進電動車以取代傳統汽車對於客戶滿意度和高技術性能變得極為重要。 IEA表示,電動車是全球新能源經濟快速崛起的驅動力之一,正在為全球汽車製造業帶來歷史性變化。

- 有幾個障礙阻礙了直流馬達的廣泛普及。主要挑戰圍繞著相關成本,例如能源成本、維護成本和初始購買成本。這是因為直流馬達的繞線轉子和換向器比感應馬達的轉子複雜得多。它由銅和鐵製成,而不是鋁和鐵。直流馬達具有較重的轉子,可能需要更昂貴的軸承。

- COVID-19全球大流行對市場的影響是巨大的,多國政府實施的遏制措施等各種遏制措施對工業部門的成長產生了重大影響。因此,供應鏈問題減緩了所研究市場的成長,尤其是在早期階段。然而,隨著主要最終用戶行業滿載恢復營運,對智慧AC馬達的需求預計將在新冠疫情後成長。

直流(DC)馬達市場趨勢

石油和天然氣將經歷顯著成長

- 電動馬達為鑽機系統和設備提供穩定可靠的動力,在石油和天然氣產業中發揮至關重要的作用。特別採用直流電機,確保鑽機系統和設備穩定可靠的供電。這些馬達有助於支援各種操作,包括原油、石油和天然氣以及其他商品的提取、加工、儲存和運輸。

- 石油和天然氣領域從儲存中提取石油和天然氣依賴陸上和海上鑽探活動的鑽機設備。直流馬達被廣泛用作這些鑽孔機的動力來源。這些直流馬達經過專門設計,可以承受石油和天然氣環境中常見的挑戰,包括振動、極端溫度、頻繁衝擊和腐蝕環境。由於其出色的性能,直流馬達在陸上石油和天然氣行業的使用具有特殊的意義。

- 國際能源總署 (IEA) 預測,儘管現有政策設置,全球石油和天然氣需求仍將在 2030 年達到頂峰。據 IEA 稱,10 年內全球需求將增加 800 萬桶/日,增加了對海上活動的需求。因此,由於海上業務和投資的增加,預計對AC馬達的需求將激增。這些馬達用於各種海上應用,包括為絞車和捲揚機、水泥泵、動力來源和推進器提供動力。

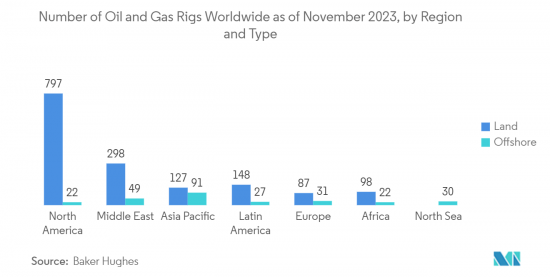

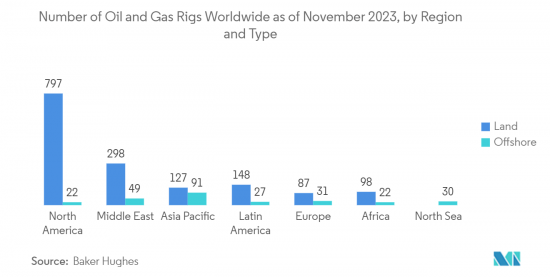

- 直流馬達非常適合海上鑽井活動,因為它們能夠為泥漿泵、絞車、轉盤和頂部驅動等關鍵設備提供變速。海上鑽油平臺在全球石油鑽井平台數量中發揮重要作用,貝克休斯報告稱,到2023年11月,全球將有272個鑽井平台在運作,其中超過91個位於亞洲,位於太平洋地區。海上石油的重新探勘是由多種因素推動的,包括全球能源需求增加、烏克蘭衝突造成的供應中斷以及與大流行前水平相比仍然較高的油價。

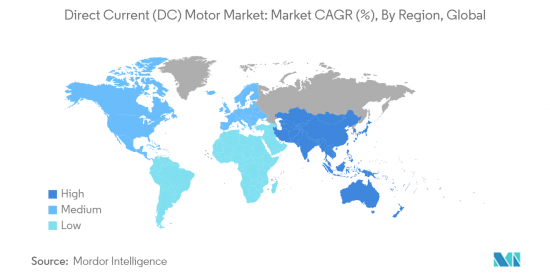

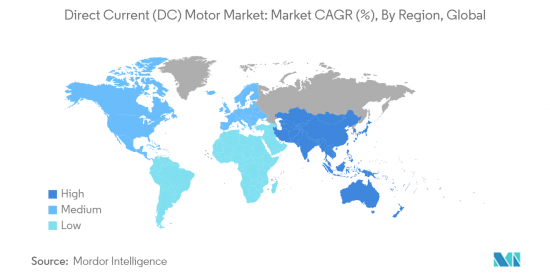

亞太地區預計將經歷顯著成長

- 中國的直流電機市場預計在未來幾年將顯著成長。推動市場發展的因素有很多,包括電動車需求的增加、中國製造業自動化程度的提高以及中國消費性電子產品需求的增加。

- 智慧製造措施預計將推動工業直流馬達在中國的使用。資訊化部通報稱,國內已啟動一批智慧製造先導計畫。此外,《智慧製造「十三五」規劃》提出,2025年,加強智慧製造體系建設,實現重點產業全面轉型。透過這些努力,預計直流馬達在日本各領域的採用將會增加。

- 隨著印度人口和工業部門的快速成長,污水量也大幅增加。這種驚人的成長增加了該國對污水處理廠的需求。據NITI Aayog稱,到2025年,印度這些加工廠的市值預計將達到43億美元。這一成長主要是由於全國範圍內對市政和廢水處理設施的需求增加。為了在處理過程中有效地輸送水,水處理廠嚴重依賴泵浦和馬達系統。因此,全國對此類加工設施的需求不斷增加,這也將支持對直流馬達的需求。

- 此外,該領域的市場擴張主要歸功於技術進步和各個最終用戶行業擴大使用自動化技術。推動該國直流馬達需求的其他關鍵因素包括快速都市化、配套技術進步、有利的政府法規以及強勁的外國直接投資流入。

直流 (DC) 馬達產業概覽

直流(DC)馬達市場分散,企業之間的競爭日益加劇。該市場的主要參與者包括ABB Ltd.、AMETEK Inc. (Dunkermotoren GmbH)、德昌電機控股有限公司、日本電產株式會社和西門子股份公司。從市場佔有率來看,目前這些大公司佔據市場主導地位。然而,隨著技術創新的不斷增加,許多公司正在透過贏得新契約和開拓新市場來擴大其市場佔有率。

- 2023 年 12 月 - Franklin Electric Co. Inc. 宣布已收購 Action Manufacturing &Supply Inc. 的資產。透過本次收購,本公司將加強和拓展在重點地區的水處理管道和產品。

- 2023 年 7 月 - 日本電產株式會社加入 TAR, LLC d/b/a Houma Armature,後者是一家服務合作夥伴,為路易斯安那州和德克薩斯州的石油和天然氣生產商提供電機和發電機再製造和現場服務。宣布已獲得Works 的全部所有權。此次收購將使 NMC 能夠加強其服務產品,包括擴大其在美國的市場佔有率。侯馬將能夠為 NMC 的客戶提供服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 擴大採用無刷直流電機

- 電動車的普及

- 市場挑戰

- 高成本

第6章市場區隔

- 按類型

- 永磁/自激式

- 個人激勵

- 按最終用戶產業

- 油和氣

- 化工/石化

- 發電

- 用水和污水

- 金屬/礦業

- 食品和飲料

- 離散製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- ABB Ltd

- AMETEK Inc.(Dunkermotoren GmbH)

- Johnson Electric Holdings Limited

- Nidec Corporation

- Siemens AG

- Franklin Electric

- Allied Motion Technologies Inc.

- Regal Rexnord Corporation

- North American Electric, Inc.

- Maxon

- Buhler Motor GmbH

- MinebeaMitsumi Inc

第8章投資分析

第9章市場的未來

The Direct Current Motor Market size is estimated at USD 535.57 million in 2024, and is expected to decline to USD 508.24 million by 2029.

Increasing industrial automation also drives the demand for DC motors as it plays a vital role in automated systems by providing precise control and reliable performance. Labor shortages in emerging countries are leading to the adoption of robotics in the manufacturing industry, which is also creating demand for different types of DC motors, such as shunt motors, separately excited motors, compound motors, etc.

Key Highlights

- In automobiles, DC motors are widely used in systems for wiper motors, power seat motors, power window motors, and HVAC systems. Additionally, Growing adoption of electric vehicles is expected to support the market growth during the forecast period. The automotive sector has witnessed a significant increase in the number of daily units produced over the years.

- Owing to the rising importance of occupational safety in the global regions, the government has mandated quality air management as industries such as oil & gas, mining, power generation, chemicals, and petrochemicals often involve harsh and explosive atmospheres. Thus, HVAC systems aid in creating a safe working environment by managing and controlling air circulation. With HVAC systems turning out to be an integral part of the industrial sector, DC motors are also able to create a generous demand as they are used in HVAC systems' blower motors, variable speed drives, and AHUs to achieve high efficiency in airflow systems along with in maximizing their lives.

- The automotive industry has rapidly introduced pollution-free vehicles such as electric vehicles (EVs). The development and improvement of the EV to replace the conventional vehicle become crucial to obtaining customer satisfaction and high technology achievements. As per IEA, electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging, and they are bringing about a historic transformation of the car manufacturing industry worldwide.

- There are several obstacles that are preventing the widespread use of DC motors. The main challenges revolve around the associated expenses, including energy costs, maintenance costs, and initial purchase costs. This is because the wound rotor and commutator of a DC motor are quite a bit more complicated than the rotor of an induction motor. It is made out of copper and iron rather than aluminum and iron. The heavier rotor of the DC motor may require more expensive bearings.

- A notable impact of the global outbreak of COVID-19 has been observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase, due to supply chain issues. However, with significant end-user industries resuming operations at total capacity, the demand for smart AC motors is anticipated to grow post-COVID.

Direct Current (DC) Motor Market Trends

Oil & Gas to Witness Major Growth

- Electric motors play a crucial role in the oil and gas industry by delivering a steady and dependable power source to drill rig systems and equipment. DC motors are specifically utilized to ensure a consistent and reliable power supply to drilling rig systems and equipment. These motors are instrumental in supporting various operations such as the extraction, processing, storage, and transportation of commodities like crude oil, petroleum, and natural gas.

- The extraction of oil and natural gas from reservoirs in the oil and gas sector relies on drilling rig equipment for both onshore and offshore drilling activities. These drilling rig equipment extensively utilize DC motors as their power source. These DC motors are specifically designed to withstand the challenging conditions commonly found in oil and gas settings, such as vibration, extreme temperatures, frequent impacts, corrosive environments, and more. As a result of their exceptional performance, the utilization of DC electric motors in onshore oil and gas industries has a notable significance.

- The International Energy Agency (IEA) has projected that the peak of global oil and gas demand will occur by 2030, despite the existing policy settings. According to the IEA, there will be an approximate increase of eight million barrels per day (bpd) in global demand by the end of the decade, which will lead to a greater requirement for offshore activities. Consequently, there is an anticipated surge in the demand for AC motors due to the growth in offshore operations and investments. These motors are utilized in various offshore applications, including powering winches and windlasses, cement pumps, propulsion, and thrusters.

- DC motors are highly suitable for offshore drilling activities due to their ability to provide variable speeds to essential equipment such as mud pumps, drawworks, rotary tables, and top drives. Offshore drilling rigs play a significant role in the global oil rig count, with 272 active rigs worldwide in November 2023, over 91 of which are located in the Asia-Pacific region, as reported by Baker Hughes. The renewed search for offshore petroleum is driven by a combination of factors, including increased global energy demand, supply disruptions caused by the conflict in Ukraine, and crude oil prices that have remained elevated compared to pre-pandemic levels.

Asia-Pacific is Expected to Witness Significant Growth

- The China DC motors market is poised for significant growth in the coming years. Several factors drive the market, including the increasing demand for EVs, the growing automation in the Chinese manufacturing sector, and the rising demand for consumer electronics in China.

- In China, it is anticipated that smart manufacturing endeavors will facilitate the utilization of industrial DC motors. The Ministry of Information Technology has reported the initiation of numerous smart manufacturing pilot projects in the country. Furthermore, as outlined in the 13th smart manufacturing five-year plan, the government intends to enhance its smart manufacturing system and achieve a comprehensive transformation of key industries by 2025. Such initiatives are expected to drive the adoption of DC motors across the country's sectors.

- With the rapid growth of both India's population and its industrial sector, there has been a significant increase in the volume of wastewater. This alarming rise has prompted the country's need for wastewater treatment plants. According to NITI Aayog, the market value of these treatment plants in India is projected to reach USD 4.3 billion by 2025. This growth is primarily driven by the rising demand for nationwide municipal and sewage water treatment facilities. To efficiently and effectively move water through the treatment process, water treatment plants heavily rely on pump and motor systems. Consequently, the increasing demand for these treatment plants nationwide will also drive the demand for DC motors.

- Moreover, the market's expansion in this area is primarily due to technical advancements and the increased usage of automation technologies across various end-user industries. Other significant drivers driving the DC Motor demand in the country include rapid urbanization, complementary technical improvements, favorable government regulations, and robust FDI inflows.

Direct Current (DC) Motor Industry Overview

The Direct Current (DC) motor market is fragemented and is witnessing rising competitiveness among companies. The market consists of major players, such as ABB Ltd., AMETEK Inc. (Dunkermotoren GmbH)., Johnson Electric Holdings Limited, Nidec Corporation, and Siemens AG. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- December 2023 - Franklin Electric Co. Inc. announced that it has acquired the assets of Action Manufacturing & Supply Inc. This acquisition helps the company strengthen and expand its channels and products for water treatment in key geographic areas.

- July 2023 - Nidec Corporation announced that it has acquired full ownership of TAR, LLC d/b/a Houma Armature Works, which is a service partner that remanufactures motors and generators and provides field service to oil and gas producers operating out of Louisiana and Texas. Through this acquisition, NMC will be able to enhance its service offering, including expanding its share within its own US installed base. Houma will be able to provide services to NMC's customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Brushless DC Motor

- 5.1.2 Growing Prevalence of Electric Vehicles

- 5.2 Market Challenges

- 5.2.1 High Cost and Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Permanent Magnet and Self-Excited

- 6.1.2 Separately Excited

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water and Wastewater

- 6.2.5 Metal and Mining

- 6.2.6 Food and Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 AMETEK Inc. (Dunkermotoren GmbH)

- 7.1.3 Johnson Electric Holdings Limited

- 7.1.4 Nidec Corporation

- 7.1.5 Siemens AG

- 7.1.6 Franklin Electric

- 7.1.7 Allied Motion Technologies Inc.

- 7.1.8 Regal Rexnord Corporation

- 7.1.9 North American Electric, Inc.

- 7.1.10 Maxon

- 7.1.11 Buhler Motor GmbH

- 7.1.12 MinebeaMitsumi Inc