|

市場調查報告書

商品編碼

1429485

阿明:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Amines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

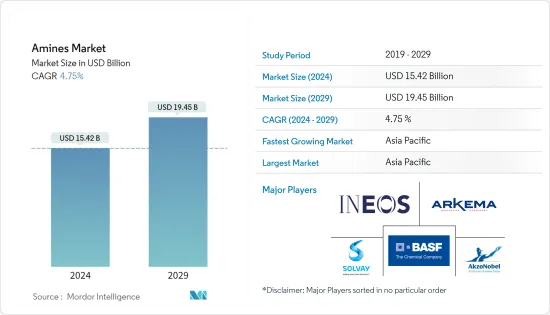

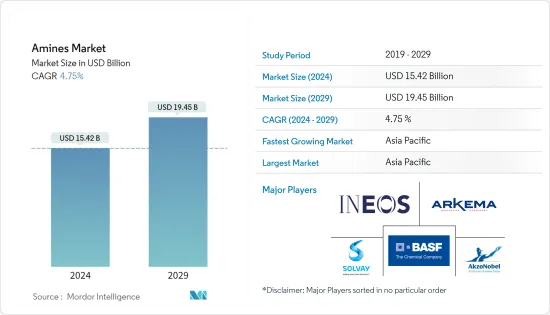

胺市場規模預計到2024年為154.2億美元,預計到2029年將達到194.5億美元,在預測期內(2024-2029年)複合年成長率為4.75%。

推動市場的主要因素是開發中國家對農業化學品的需求不斷成長。

主要亮點

- 已開發國家擴大使用農業生物基產品預計將阻礙市場成長。

- 增加使用基因改造抗除草劑種子可能是未來的一個機會。

胺市場趨勢

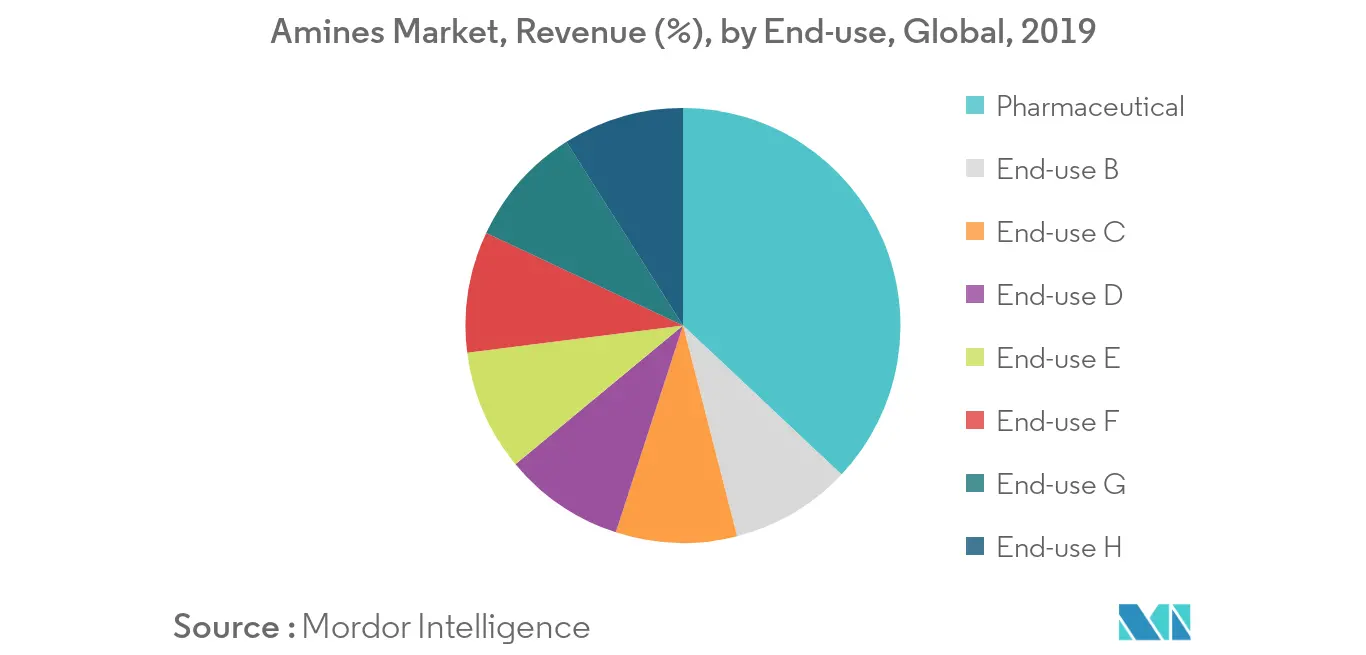

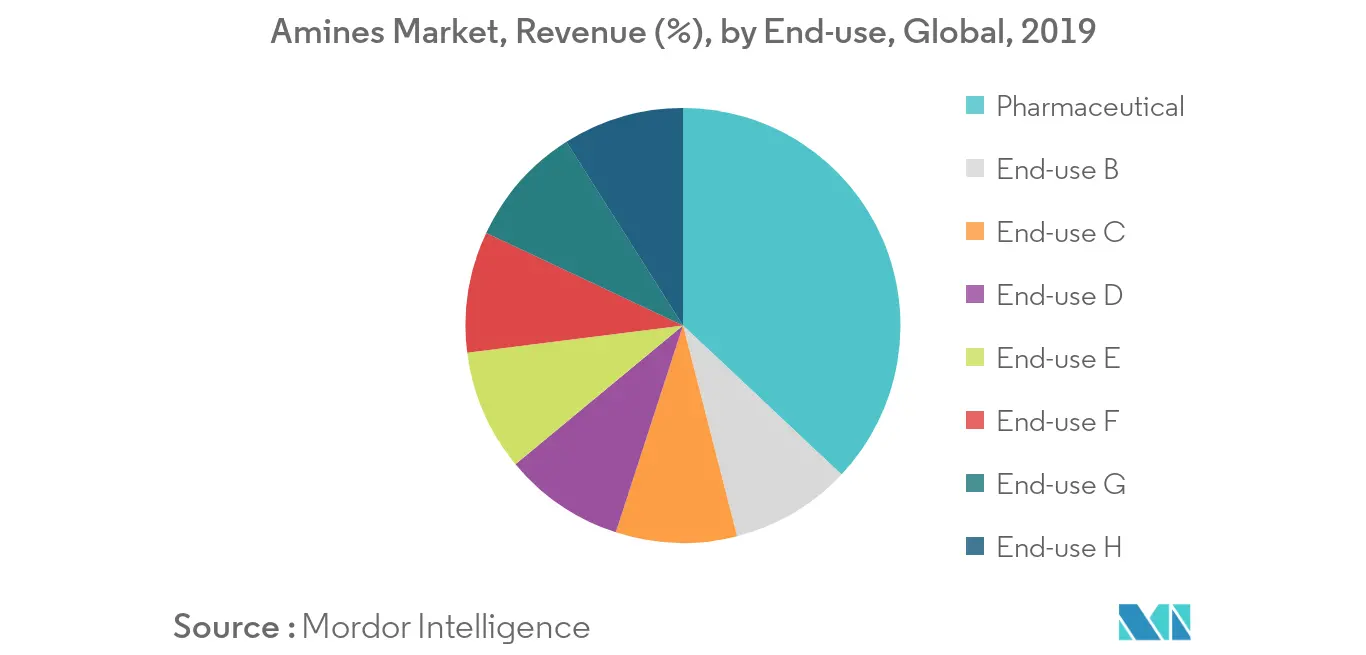

製藥業需求增加

- 胺主要用於製藥工業。抗精神病藥物Aripiprazole、降膽固醇藥rosuvastatin、局部麻醉劑、抗癌藥Imatinib藥物中大量含有它,也用作多種藥物製造中的溶劑和催化劑。

- 根據 IQVIA 人類數據科學研究所的數據,2018 年全球醫藥市場價值達到 1.2 兆美元。預計該市場在預測期內的複合年成長率為 4-5%。由於美國製藥業發揮主導作用,北美地區佔據了收益的最大部分。

- 亞太地區和北美是胺市場的主導地區。在亞太地區,中國所佔佔有率最大,其次是印度。

- 製藥業的胺市場不斷成長,部分原因是人們對健康問題的認知不斷提高。

- 所有這些因素都可能增加預測期內對胺的需求。

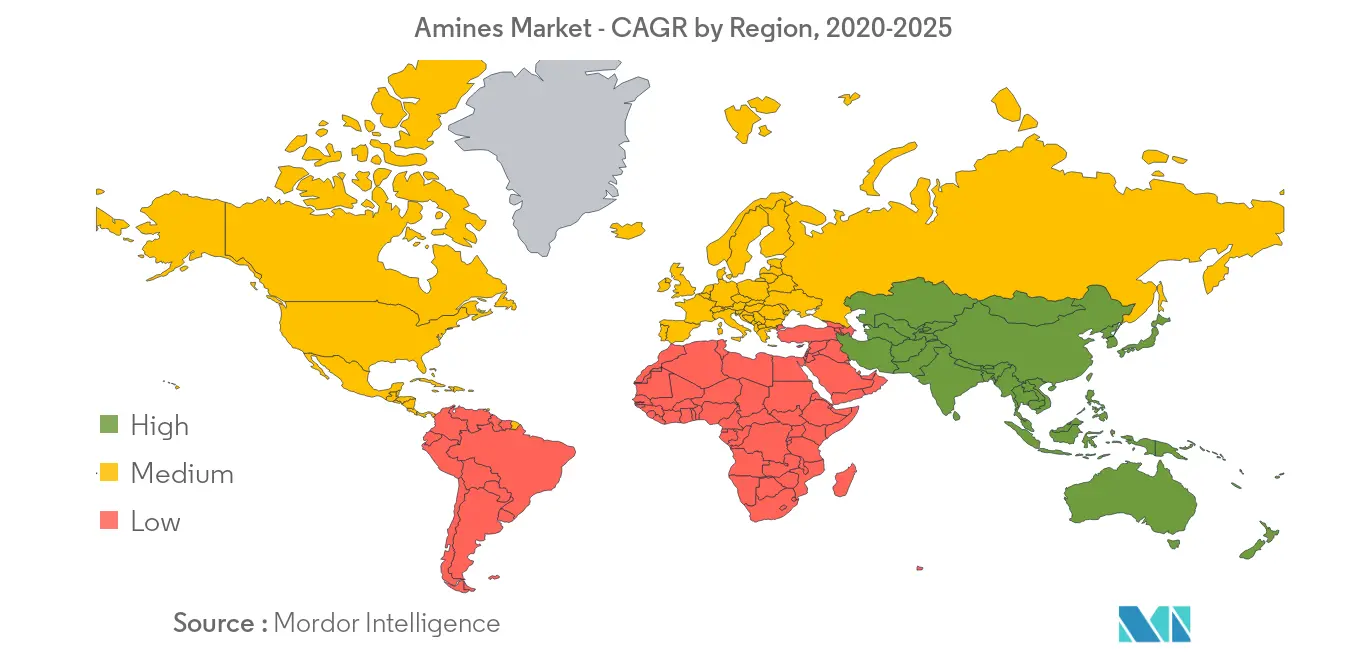

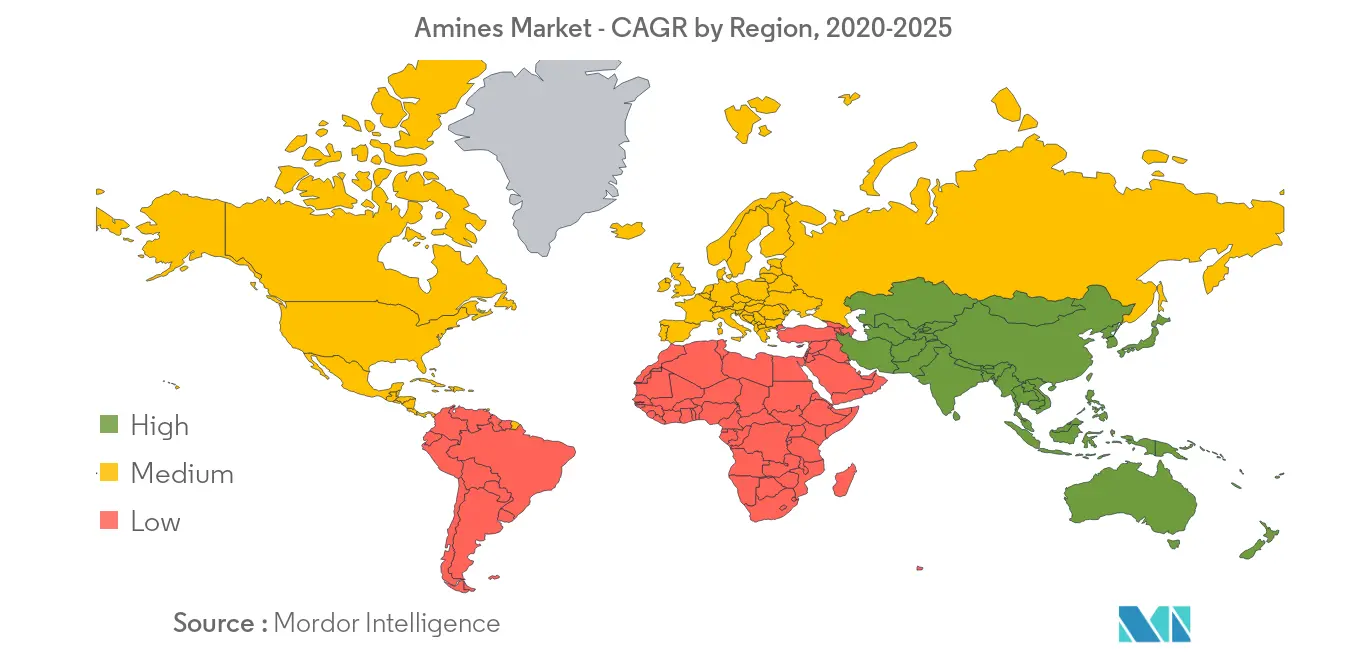

亞太地區主導市場

- 亞太地區既是最大的胺消費國,也是最大的胺生產國之一。其生產已達到較高水平,成為向美國、聯合國、西班牙等已開發國家出口化妝品和個人保健產品的主要基地。

- 韓國等二級市場對個人保健產品的需求預計將激增。此外,中國和印度似乎也是個人護理市場的機會。

- 人們對多功能個人保健產品益處的認知不斷提高,預計將在預測期內推動胺需求。

- 總體而言,亞太地區在個人護理行業(包括化妝品等)的市場佔有率已顯著成長,並且在預測期內可能會遵循相同的趨勢,從而推動該地區的整體胺市場。

胺行業概況

胺市場高度整合。受訪的主要企業包括BASF公司、阿科瑪集團、阿克蘇諾貝爾公司、索爾維和英力士。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區對個人保健產品的需求不斷成長

- 新興國家對農藥的需求加速成長

- 建築業的需求和使用不斷增加

- 抑制因素

- 無木製品消費增加

- 已開發國家農業生物基產品的使用增加

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格分析

- 生產分析

- 技術簡介

- 目前技術

- 沸石催化甲胺工藝

- 異丁烯直接胺基

- 催化蒸餾

- EDC氨解

- 未來科技

- 目前技術

第5章市場區隔

- 種類

- 乙撐胺

- 烷基胺

- 脂肪胺

- 特殊胺

- 乙醇胺

- 最終用途

- 橡皮

- 個人保健產品

- 清潔產品

- 黏劑、塗料、樹脂

- 農藥

- 石油/石化

- 其他最終用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- Air Products and Chemicals, Inc.

- Akzo Nobel NV

- Alkyl Amines Chemicals Limited

- Arkema Group

- BASF SE

- Celanese Corporation

- Clariant

- Daicel Corporation

- DowDuPont

- Huntsman International LLC

- INEOS

- INVISTA

- Kemipex

- LyondellBasell Industries NV

- Mitsubishi Gas Chemical Company Inc.

- SABIC

- Solvay

- Tosoh Corporation

第7章 市場機會及未來趨勢

- 開發新應用

- 增加使用基因改造抗除草劑種子

簡介目錄

Product Code: 49467

The Amines Market size is estimated at USD 15.42 billion in 2024, and is expected to reach USD 19.45 billion by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

Major factor driving the market studied is the accelerating demand for pesticides from developing countries.

Key Highlights

- Increasing usage of bio-based products for agriculture in developed countries is expected to hinder the growth of the market studied.

- Increasing usage of genetically modified herbicide-tolerant seeds is likely to act as an opportunity in the future.

Amines Market Trends

Increasing Demand form Pharmaceutical Industry

- Amines are majorly used in the pharmaceutical industry. It contains a ring-like structure known as aryl group which is majorly seen in pharmaceuticals such asantipsychotic aripiprazolecholesterol-lowering rosuvastatin, local anesthetic lidocaine, anticancer drug imatinib and are also used as solvents and catalysts in various drug manufacturing.

- According to IQVIA Institute for Human Data Science, the global pharmaceutical market reached a value of USD 1.2 trillion in 2018. The market is expected to register at a CAGR of 4-5% during the forecast period. North America is partly responsible for the largest portions of the revenue, due to the leading role of the United States pharmaceutical sector.

- Asia-Pacific and North America are the dominant regions in the amines market. In Asia-Pacific, China occupies the largest share, followed by India, while regarding the growth rate, India is expected to witness the fastest growth.

- The amines market is growing in the pharmaceutical industry, due to increasing awareness regarding health issues, etc.

- All the aformentoned factors are likely to increase the demand for amines over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific has become the largest consumer, as well as one of the largest producer of amines. The production has reached such high levels that it has become a major hub for exporting of cosmetics and personal care products to developed nations, such as the United States, United Nations and Spain.

- The tier-2 markets, such as South Korea, are expected to witness a rapid rise in the demand for personal care products. Moreover, China, and India are also likely to experience good opportunities for the personal care market.

- Increasing awareness about the advantages of multi-functional personal care products is expected to boost the demand for amines during the forecast period.

- Overall, the market share of Asia-Pacific in the personal care industry (including cosmetic products, and others) is growing significantly and is likely to follow the same trend during the forecast period, driving the overall market for amines in the region.

Amines Industry Overview

The amines market is highly consolidated in nature. Some of the key players in the market studied include BASF SE, Arkema Group, Akzo Nobel N.V., Solvay, and INEOS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Personal Care Products from Asia-Pacific

- 4.1.2 Accelerating Demand for Pesticides from Developing Countries

- 4.1.3 Increasing Demand and Usage in Construction Sector

- 4.2 Restraints

- 4.2.1 Rising Consumption of Wood-free Products

- 4.2.2 Increasing Usage of Bio-Based Products for Agriculture in Developed Countries

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Production Analysis

- 4.7 Technological Snapshot

- 4.7.1 Current Technologies

- 4.7.1.1 Zeolite-catalyzed Methylamines Processes

- 4.7.1.2 Direct Amination of Isobutylene

- 4.7.1.3 Catalytic Distillation

- 4.7.1.4 Ammonolysis of EDC

- 4.7.2 Upcoming Technologies

- 4.7.1 Current Technologies

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ethyleneamines

- 5.1.2 Alkylamines

- 5.1.3 Fatty Amines

- 5.1.4 Specialty Amines

- 5.1.5 Ethanolamines

- 5.2 End-use

- 5.2.1 Rubber

- 5.2.2 Personal Care products

- 5.2.3 Cleaning Products

- 5.2.4 Adhesives, Paints, and Resins

- 5.2.5 Agro Chemicals

- 5.2.6 Oil and Petrochemical

- 5.2.7 Other End-uses

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals, Inc.

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Alkyl Amines Chemicals Limited

- 6.4.4 Arkema Group

- 6.4.5 BASF SE

- 6.4.6 Celanese Corporation

- 6.4.7 Clariant

- 6.4.8 Daicel Corporation

- 6.4.9 DowDuPont

- 6.4.10 Huntsman International LLC

- 6.4.11 INEOS

- 6.4.12 INVISTA

- 6.4.13 Kemipex

- 6.4.14 LyondellBasell Industries N.V.

- 6.4.15 Mitsubishi Gas Chemical Company Inc.

- 6.4.16 SABIC

- 6.4.17 Solvay

- 6.4.18 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Applications

- 7.2 Increasing Usage of Genetically Modified Herbicide-Tolerant Seeds

02-2729-4219

+886-2-2729-4219