|

市場調查報告書

商品編碼

1429238

地工止水膜:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Geomembranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

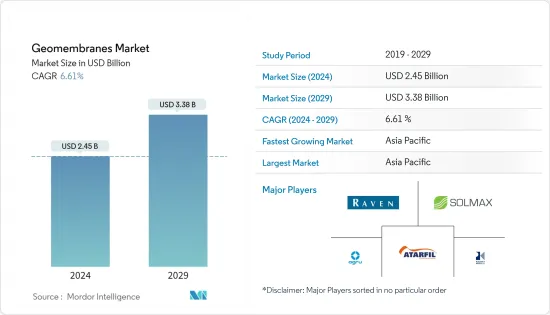

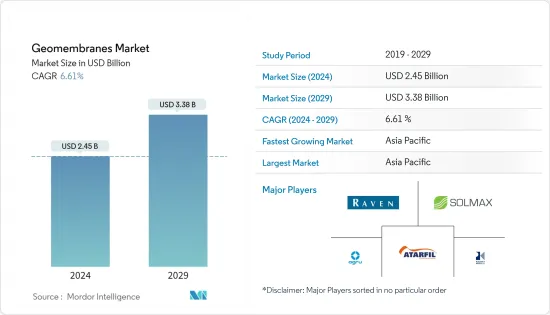

地工止水膜市場規模預計到 2024 年為 24.5 億美元,預計到 2029 年將達到 33.8 億美元,在預測期內(2024-2029 年)複合年成長率為 6.61%。

COVID-19 大流行對各個最終用戶行業成長的影響以及由此造成的供應鏈中斷正在對市場產生負面影響。除此之外,許多提供水處理技術的公司因經濟不確定性而降低了補貼價格,這進一步影響了市場研究。

主要亮點

- 推動市場成長的因素包括襯裡應用的使用增加、採礦應用中地工止水膜的使用增加以及嚴格的環境保護法規結構。

- 另一方面,地工合成黏土襯墊在襯砌系統和垃圾掩埋場中的使用越來越多,以及在某些情況下出現應力開裂的可能性,阻礙了所研究市場的成長。

- 適合惡劣操作條件的彈性地工止水膜的開發以及製造業節水意識的提高等因素可能會在預測期內為製造商提供許多機會。

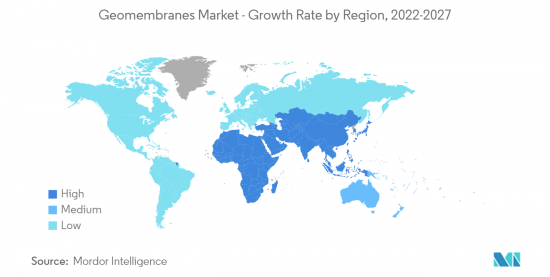

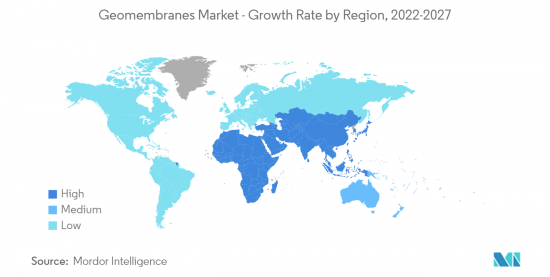

- 由於中國和印度等國家消費的增加,亞太地區在市場規模和成長率方面正在主導全球市場。

地工止水膜市場趨勢

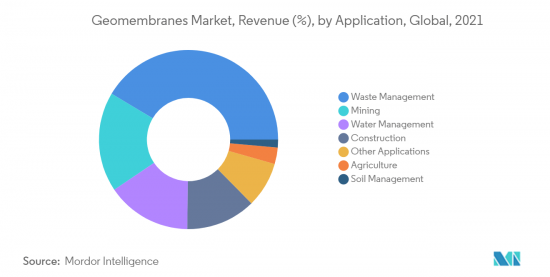

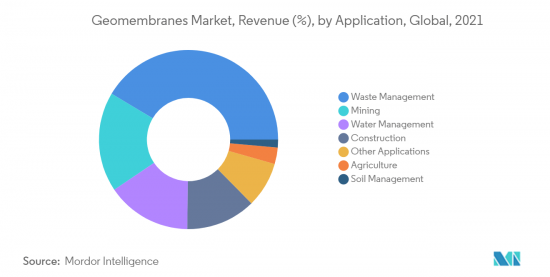

廢棄物管理領域佔據市場主導地位

- 近年來,水資源管理應用席捲了全球市場。從池塘、運河到水庫,地工止水膜隨處可見。世界各地已建成 50,000 多座大壩,還有更多正在建設中,地工止水膜在節水方面的使用率很高。

- 但隨著淡水供應的減少,對水資源管理的需求從未如此強烈。

- 滲透是輸水工程中水損失的主要來源。然而,透過適當的襯裡,可以顯著減少這種損失。

- 隨著人們對節約用水的興趣日益濃厚,預計在預測期內對地工止水膜的需求也將迅速增加。

- 由於對有效用水和改善地下水位的需求不斷成長,運河襯砌應用對地工止水膜的需求也在增加。中國、印度和烏茲別克等亞太地區國家對運河襯砌應用中所使用的地工止水膜的需求最大。

- 預計這些積極因素將在預測期內推動地工止水膜在水資源管理行業的利用。

德國稱霸歐洲

- 德國在 2021 年 3 月下旬和 4 月遭受新型冠狀病毒疫情打擊,核准了補充預算以及延長對企業、受影響工人和醫療保健系統的財政支持。

- 德國總理梅克爾 16 年來首次辭去德國總理職務。隨著政治領導人對數位化和氣候變遷政策的退讓,課稅和支出可能會增加,對政府債務上升的擔憂可能會消退。

- 水處理活動的活性化(主要是在該國北部地區)正在推動對薄膜技術市場的需求。由於這一重要性,我們引入了高效的用水和污水處理方法,在德國,幾乎 100% 的污水都經過處理,以滿足歐盟 (EU) 設定的最高標準。

- 在德國,家庭、工業和貿易每年產生超過50億立方公尺的廢水。約30億立方公尺的路面和道路雨水排放污水處理廠,大量滲水經由滲漏進入污水系統。

- 此外,德國的綠色農業運動迅速發展,旨在打造更綠色的農業部門。如此巨大的規模,加上不斷成長的勢頭,預計將成為預測期內該國受調查農業應用市場的市場驅動力。

地工止水膜行業概況

全球地工止水膜市場是一個高度分散的市場,不存在佔據較大佔有率的參與者控制市場。地工止水膜市場的主要企業包括SOLMAX、Raven Industries, Inc.、AGRU America, Inc.、ATARFIL、SL、Plastika Kritis SA等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大內襯應用的用途

- 地工止水膜在採礦應用的使用增加

- 抑制因素

- 在襯砌系統和垃圾掩埋場中增加使用地工合成合成黏土襯砌

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料

- 高密度聚苯乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 線型低密度聚乙烯(LLDPE)

- 聚氯乙烯(PVC)

- 三元乙丙橡膠(EPDM)

- 聚丙烯(PP)

- 其他原料

- 目的

- 水資源管理

- 廢棄物管理

- 礦業

- 建造

- 農業

- 土壤管理

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率** (%)/排名分析

- 主要企業策略

- 公司簡介

- AGRU America, Inc.

- ATARFIL, SL

- Firestone Building Products Company LLC

- Istanbul Teknik

- Jutta Ltd.

- NAUE GmbH & Co. KG

- Nilex Inc.

- Officine Maccaferri Spa

- Plastika Kritis SA

- Raven Industries, Inc.

- RENOLIT SE

- Shanghai Yingfan Engineering Material Co., Ltd

- SOLMAX

- Sotrafa

- Texel Industries

第7章 市場機會及未來趨勢

- 製造業節水意識增強

The Geomembranes Market size is estimated at USD 2.45 billion in 2024, and is expected to reach USD 3.38 billion by 2029, growing at a CAGR of 6.61% during the forecast period (2024-2029).

The impact of COVID-19 pandemic on the various end-user industries' growth and the resultant supply chain disruptions has impacted the market negatively. Apart from this many companies that offer water treatment technologies have reduced subsidized prices due to economic instability which further has impacted the market studied.

Key Highlights

- The factors driving the growth of the market studied are the growing use in lining applications, increased use of geomembranes in mining applications, and stringent regulatory framework for environmental protection.

- On the flip side, increasing the use of geosynthetic clay liners in lining systems and landfills, and the potential for stress cracking in some situations will hinder the growth of the market studied.

- Factors such as the development of resilient geomembrane suitable to harsh operational conditions and rising awareness about water conservation in the manufacturing sector are likely to offer numerous opportunities for the manufacturers over the forecast period.

- Asia-Pacific dominated the global market both in terms of size and growth owing to the increasing consumption for countries such as China and India, among others.

Geomembranes Market Trends

Waste Management Segment to Dominate the Market

- The water management application dominated the global market in the recent past. From ponds and canals to reservoirs, geomembranes have applications everywhere. With more than 50,000 dams worldwide and many more under construction, the use of geomembranes for water preservation is high.

- However, with the declining freshwater supplies, the need for water management is higher than ever.

- Seepage is a major source of water loss in conveyance schemes. However, this loss could be significantly curtailed through proper lining.

- As concerns about water conservation are on the rise, the demand for geomembrane too is expected to rise at a rapid pace over the forecast period.

- The demand for geomembrane is also increasing in canal lining applications, due to the growing need for the efficient usage of water and the remediate groundwater levels. Various countries in Asia-Pacific, such as China, India, and Uzbekistan, are generating the largest demand for geomembranes to be used in the canal lining application.

- These positive factors are expected to drive the usage of geomembrane in the water management industry over the forecast period.

Germany to Dominate the European Region

- Germany has been hit by new coronavirus outbreaks in late March and April 2021 and has approved supplementary budgets or extended financial support for businesses, affected workers, and the health care system.

- German Chancellor Angela Merkel is about to bow out as head of Germany after 16 years, marking the start of a new era for the country's economy. Taxation and spending could increase as political leaders double down on digitization and climate policy, thus wariness about rising government debt may take a back seat.

- The increasing water treatment activities, primarily in the northern region of the country, are boosting the demand for the membrane technologies market. This importance has led to efficient water and wastewater treatment methods, and nearly 100% of the wastewater in Germany is treated to meet the highest standards set by the European Union.

- Germany has more than five billion cubic meters of sewage water, which is generated, each year by private households, industry, and trade. Approximately three billion cubic meter of rainwater from paved surfaces and roads are discharged into sewage treatment plants, with a considerable additional amount of infiltration water entering the sewer system through leaks.

- Moreover, the green agriculture movement in Germany is growing fast, pushing the nation for an eco-friendlier agricultural sector. The huge size, coupled with the growing momentum, is projected to gain traction for the market studied in agricultural applications market in the country during the forecast period.

Geomembranes Industry Overview

The global geomembrane market is a highly fragmented market with no player having a significant share to influence the market. Key players in the geomembranes market include (not in any particular order) SOLMAX, Raven Industries, Inc., AGRU America, Inc., ATARFIL, S.L., and Plastika Kritis SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Use in Lining Applications

- 4.1.2 Increased Use of Geomembranes in Mining Applications

- 4.2 Restraints

- 4.2.1 Increasing Use of Geosynthetic Clay Liner in Lining Systems and Landfill

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Raw Material

- 5.1.1 High-density Polyethylene (HDPE)

- 5.1.2 Low-density Polyethylene (LDPE)

- 5.1.3 Linear Low-density Polyethylene (LLDPE)

- 5.1.4 Polyvinyl Chloride (PVC)

- 5.1.5 Ethylene Propylene Diene Monomer (EPDM)

- 5.1.6 Polypropylene (PP)

- 5.1.7 Other Raw Materials

- 5.2 Application

- 5.2.1 Water Management

- 5.2.2 Waste Management

- 5.2.3 Mining

- 5.2.4 Construction

- 5.2.5 Agriculture

- 5.2.6 Soil Management

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**(%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGRU America, Inc.

- 6.4.2 ATARFIL, S.L.

- 6.4.3 Firestone Building Products Company LLC

- 6.4.4 Istanbul Teknik

- 6.4.5 Jutta Ltd.

- 6.4.6 NAUE GmbH & Co. KG

- 6.4.7 Nilex Inc.

- 6.4.8 Officine Maccaferri Spa

- 6.4.9 Plastika Kritis SA

- 6.4.10 Raven Industries, Inc.

- 6.4.11 RENOLIT SE

- 6.4.12 Shanghai Yingfan Engineering Material Co., Ltd

- 6.4.13 SOLMAX

- 6.4.14 Sotrafa

- 6.4.15 Texel Industries

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness About Water Conservation in the Manufacturing Sector