|

市場調查報告書

商品編碼

1429232

精密農業:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Precision Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

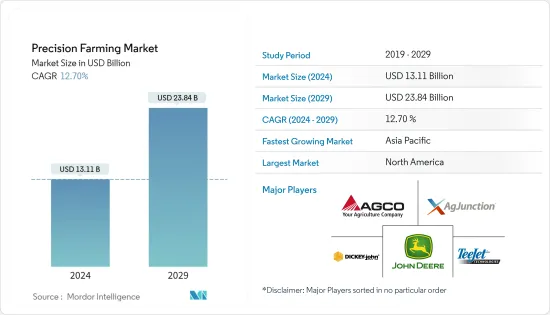

精密農業市場規模預計2024年為131.1億美元,預計2029年將達到238.4億美元,在市場估算和預測期間(2024-2029年)複合年成長率為12.70%。

氣候變遷、糧食需求增加、全球農業部門擴大採用智慧技術以及政府透過新技術提高農民效率的努力是推動精密農業採用的關鍵因素。

主要亮點

- 精密農業是一種農業管理概念,其核心是注意到、測量和應對田地內和田間作物的變化。植物生產集中在由財產邊界、特定田地的預期平均作物產量以及區域和生態學因素決定的地塊上。

- 2030年終,精密農業預計將超越其他進步,成為農業領域最具影響力的趨勢。遙感和地面通訊插座透過行動應用程式提供有關設備的即時資訊。可變比率技術(VRT)使農民能夠做出更客製化的土地管理決策,使他們能夠在不同的田間條件下更有效地使用種子、肥料和農藥等投入品。

- 更廣泛市場中的大多數供應商都提供導引系統、氣候/天氣預報和輸入散佈設備。這家小型供應商主要針對智慧灌溉和田間監測技術,並專注於物聯網解決方案。北美是技術的早期採用者,對精密農業中使用的許多創新技術的採用率很高。該地區在農業中大量採用了物聯網、巨量資料、無人機和機器人技術。然而,全球趨勢也反映在該地區。 i. 由於基礎設施和可用服務提供者的不同,各種技術的採用趨勢因地區而異。例如,在美國,McFadden 和 Schimmelpfenning 報告稱,精密農業公司在地理上較為集中,總部至少位於美國38 個州。許多採用趨勢也取決於該地區服務供應商的類型和數量。

- 此外,促進因素:對限制器、導引系統和 GPS 感測系統等技術的投資增加預計也將有助於研究期間精密農業市場規模的擴大。例如,2022 年 4 月,農業科技公司 EarthScout 將透過提供有關土壤濕度和土地生長限制的即時資料,幫助農民和食品生產者在乾旱期間節約用水並減少灌溉和投入。我們已經宣佈在我們的可擴展產品系列中添加一個獨特的功能創新農產品可幫助您實現這一目標。創新而獨特的 EarthScout Soil Cub 是一款經濟實惠、緊湊的 4.5"x3"x2"商務用感測器,可安裝在田間,監測兩個土壤深度的土壤濕度、土壤溫度和EC。種植者可以看到整個土壤的水分和養分等級根區域並調整輸入。

- 此外,村田製作所於 2022 年 4 月宣布推出一款高精度三合一土壤感測器,用於資料主導的永續農業。透過監測電導率、水分含量和土壤溫度,農民可以最大限度地提高蔬菜產量和質量,同時最大限度地減少肥料和水等資源。

- 此外,越來越多的政府措施支持採用現代農業技術和改善基礎設施,也有助於該區域市場的高收益。例如,隸屬於美國農業部的 NIFA 開展感測器、地理空間和精密技術項目,以提高農民的意識。 NIFA 正在與蘭德格蘭德大學合作,幫助農民開發強大的感測器、相關軟體和儀器,以觀察、建模和分析各種複雜的生物材料和過程。此外,2022年5月,加拿大政府宣布投資441,917.5美元,開發果樹精密農業綜合系統。該投資還旨在獲得永續的解決方案,以應對加拿大蘋果產業日益嚴峻的挑戰。

- COVID-19 大流行對全球精密農業市場產生了負面影響,導致中國、印度、歐洲、日本和美國的多個工業設施暫時關閉。受此影響,精密農業裝備產量大幅下降。冠狀病毒大流行後政府強制關閉,對該行業產生了影響,並抑制了消費者對此類高價值資本財的需求。

- 然而,在 COVID-19 之後,遙感和農場管理軟體技術的引入可能會導致更廣泛的普及。公司已經開始更專注於支援作物健康監測、產量監測、灌溉調度、田間測繪和作物管理即時決策的無線平台。這可能會在預測期內推動所研究的市場需求。

精密農業市場趨勢

土壤監測可望佔有較大佔有率

- 有些農民擁有檢測土壤濕度和健康狀況的具體知識,但這種知識僅限於少數農民。在氣候變遷時代,根據土壤濕度和健康做出農業決策變得更加困難。土壤感測器測量重要的土壤特性,並透過可靠的通訊將其轉發到顯示設備。土壤感測器通常用於可變速率應用,並與 GPS 結合創建根據土壤特性分類的現場地圖。土壤感測器對於監測收穫季節作物的生存能力至關重要。

- 感測器在資料分析後產生即時資訊並觸發施用量的相應變化。使用基於地圖的方法的傳統模型被認為更有效率。它們為下一步分析問題和調整可變施用量提供了空間。就工業研究而言,用於土壤監測目的整合的不同類型的感測器包括電磁、光學、機械、聲學、電化學等。

- 此外,由於世界各地先進農民擴大使用各種土壤監測感測器,預計地面監測系統將在預測期內主導需求。地面監控擁有很大的市場佔有率,因為它需要很少的技術知識。智慧感測器技術的改進以及與物聯網模組的整合推動了對連網型農業的需求。

- 此外,一種名為 SoilSense 的設備是一種低成本智慧土壤監測系統,它正在興起,為那些在農業決策中苦苦掙扎的農民提供了潛在的幫助。 Proximal Soilsens Technologies Pvt 開發了 Soilens 產品線。新興企業得到了科學技術部 (DST) 以及電子和資訊技術部的支持,坐落於孟買的印度理工學院孟買分校 (IITB)。該系統整合了土壤濕度感測器、土壤溫度感測器、環境濕度感測器和環境溫度感測器。透過智慧型手機應用程式,農民可以根據這些參數推薦最合適的灌溉方法。雲端也可以存取此資訊。還有可攜式土壤濕度系統。

- 根據美國農業部2022年7月消息,保護創新津貼(CIG)農場保護創新試點計畫今年預計將獲得2,500萬美元的投資。透過 CIG,合作夥伴共同努力改善農業實踐,同時解決對我國水質、水量、空氣品質、土壤健康和動物棲息地的擔憂。 CIG 的農場試驗部門與農民合作,促進尖端保護策略的評估和廣泛採用。今年的融資重點是氣候智慧型農業實踐、灌溉用水管理、肥料管理和土壤健康。

- 此外,2023 年 2 月,村田製作所與長期系統整合合作夥伴 Centinum 合作,推出了 GAIA 土壤監測解決方案。此土壤感測器有助於最大限度地提高作物產量,同時減少化肥使用量並最大限度地減少灌溉所需的水量。

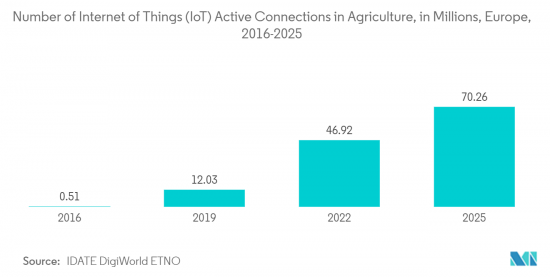

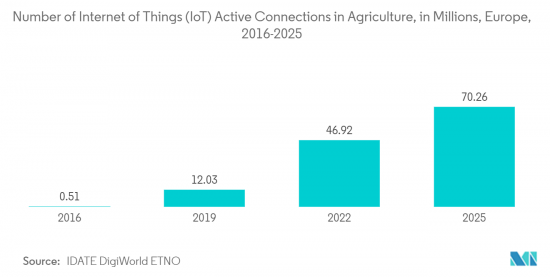

- 此外,農業技術進步可能會進一步推動所研究市場的成長。據 ETNO 稱,未來幾年歐盟 (EU) 農業中的物聯網活躍連接數量預計將增加。預計2022年連線數將達到4692萬,2025年連線數將達到7026萬。物聯網設備在農業中的應用包括使用無人機進行監控和種子分發。

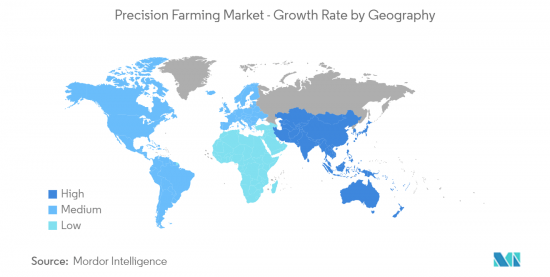

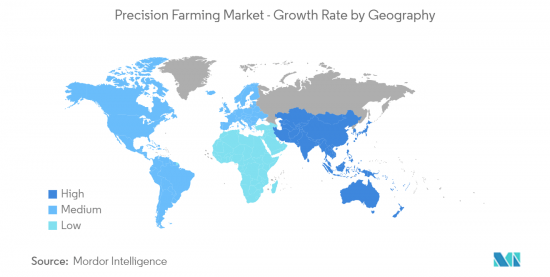

亞太地區將經歷顯著的市場成長

- 據預測,由於政府努力鼓勵採用現代精密農業技術,從而最大限度地提高生產力,預計該地區的研究市場(主要是新興國家)將在預測期內出現強勁成長。 2022 年,印度政府計劃推出 Kisan 無人機,用於作物評估、土地記錄數位化以及散佈農藥和營養物質。 IBEF的數據顯示,23與前一年同期比較年(2022年4月至7月)印度農產品和加工食品出口額為95.98億美元,年增30%。

- IBEF 表示,在價值 1 兆美元的基礎設施項目和 Pradhan Mantri 等政府舉措的支持下,印度加工食品市場預計將從近期的1,931,288.7 千萬印度盧比(2,630 億美元)成長到2025 年的34,513,525 億印度盧比舉措 Sampada Yojana。預計將成長至 4,700 億盧比(4,700 億美元)。

- 根據聯合國糧食及農業組織 (FAO) 的數據,撒哈拉以南非洲和亞洲 80% 以上的糧食消費是由小農種植的。全球食品加工商和消費者對整個產品生命週期課責的需求不斷成長,這為小農開拓了新的機會。作物保護解決方案的精準應用正在改變亞洲的農業部門。據德國 Jebagro GmbH 稱,其緬甸子公司近一半的農藥產品都是用無人機散佈的。

- 許多亞洲國家的服務提供者正在轉向先進的散佈方法,使亞洲農業成為接受調查的市場供應商的主要關注點。該地區的小農戶無需投資昂貴的基礎設施,就可以更輕鬆地獲得智慧曳引機、無人機、整地服務、衛星圖像、農作物散佈、灌溉服務以及手持式決策診斷和決策支援。在日本等國家,農民的平均年齡為67歲。因此,在勞動力短缺的情況下,精密農業對於糧食生產和安全至關重要。

- 此外,2022 年 12 月。印度生鮮食品公司 IG International 宣布與 Fyllo 合作,Fyllo 是一家基於 SaaS 的精密農業公司,由人工智慧、機器學習和物聯網提供支援。預計這將使公司能夠利用人工智慧、機器學習和物聯網進行精密農業,生產高品質的水果。作為聯盟的一部分,IG International 的企業農場將與土壤分析和灌溉管理設備 Nero 整合。

- 泰國投資委員會透過直接投資和商業配對服務促進Start-Ups計劃和企業的發展。大疆創新和極飛科技等領先的無人機公司正在該地區的價值鏈中推廣該技術,以基於先進的服務選項創建新的本地業務。 ListenField 連接衛星、無人機、感測器和農場資料,提供分析和建議,並與日本的許多組織合作。一個值得注意的計劃是與日本、印度和泰國的大學合作開發氣候智慧型資料庫農業。

- 印度農業政策最近認知到智慧農業的好處,重點是到 2022 年使農民收入翻倍。政府還推出了多語言行動應用程式“CHC-Farm Machinery”,農民可以透過當地的CHC租賃和安裝農業機械。像 Barton Breeze 這樣使用水耕和其他形式的無土耕作的Start-Ups,儘管受到限制,仍繼續經營自己的農場。據 DataLabs 稱,印度估計有超過 1,090 家農業技術Start-Ups,該行業處於技術革命的先鋒,特別是在無人機、物聯網設備、人工智慧和衛星影像資料分析方面。

精密農業產業概況

精密農業市場由幾家主要企業組成。從市場佔有率來看,目前該市場由幾家主要企業佔據。這些擁有顯著市場佔有率的領先公司致力於擴大海外基本客群。這些公司利用集體策略舉措來增加市場佔有率和盈利。市場表現良好的公司也正在收購致力於精密農業技術的新興企業,以增強其產品能力。

2022 年 11 月,Elders 與 Precision Agriculture Pty Ltd. 合作,幫助農民提高養分利用率並提高作物永續性。這項新的合作關係使精準農業的專業服務,包括建立土壤管理區、個人化土壤測試和識別關鍵土壤限制,更容易為埃爾德斯的客戶所使用。

2022 年 3 月,投資管理公司 Signature 與 Start Life 合作,最大限度地利用自然資源並加強非洲和公司未來幾年將發展的其他地區的糧食安全。這種夥伴關係可以為影響力主導的高科技新興企業提供一條在農場檢驗最尖端科技的途徑。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 使用人工智慧和物聯網技術的土壤監測正在推動市場

- 新技術的出現

- 政府措施和新興企業的崛起

- 市場挑戰

- 由於地區意識的差異,實施模式因地區而異。

- 市場機會

- 技術進步正在降低許多先進設備的成本。

- 支援LiDAR的無人機等技術進步、資料分析和該領域雲的出現

第6章市場區隔

- 依技術

- 引導系統

- 全球定位系統 (GPS)/全球衛星導航系統 (GNSS)

- 全球資訊系統(GIS)

- 遙感

- 可變利率技術

- 變數肥料

- 變速播種

- 變速農藥

- 無人機和無人機

- 其他技術

- 引導系統

- 按成分

- 硬體

- 軟體

- 按服務

- 按用途

- 產量監控

- 可變利率申請

- 現場測繪

- 土壤監測

- 作物偵察

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- AGCO Corporation

- Ag Junction Inc

- John Deere

- DICKEY-john Corporation

- TeeJet Technologies

- Raven Industries Inc.

- Lindsay Corporation

- Topcon Precision Agriculture

- Land O'lakes Inc.

- BASF SE

- Yara International ASA

第8章投資分析

第9章市場的未來

The Precision Farming Market size is estimated at USD 13.11 billion in 2024, and is expected to reach USD 23.84 billion by 2029, growing at a CAGR of 12.70% during the forecast period (2024-2029).

Changing climate, growing demand for food, increasing the adoption of smart technologies in the global agriculture sector, and government initiatives to enhance farmers' efficiency through new technologies are some of the major factors driving the adoption of precision farming.

Key Highlights

- Precision farming is an agricultural management concept centered on noticing, measuring, and reacting to crop variability within and between fields. Plant production is focused on land parcels determined by property lines, the anticipated average crop yield of a particular field, and regional and ecological factors.

- By the end of 2030, precision farming is expected to become the most influential trend in agriculture, eclipsing other advancements. Remote sensing and ground communication outlets enable real-time information about equipment through the mobile app. Variable-rate technologies (VRTs) have allowed farmers to make more customized land management decisions, enabling more efficient use of inputs such as seeds, fertilizers, and pesticides under variable in-field conditions.

- Most broad-market vendors offer guidance systems, climate-weather predictions, and input applications equipment. Small vendors mainly target smart irrigation and field monitoring techniques specializing in IoT solutions. North America is the early adopter of technology and has a significant adoption rate of many innovative technologies used in precision farming. The region is a substantial adopter of IoT, big data, drones, and robotics in agriculture. However, the global trend is also reflected in the region, i.e., adoption curves of various technologies vary by region because of infrastructure and available service providers. For instance, within the United States, McFadden and Schimmelpfenning reported that precision agriculture companies are headquartered in at least 38 US states but are geographically concentrated. Many adoption trends also depend on the area's type and number of service providers.

- Moreover, growing investments in technologies such as driverless tractors, guidance systems, and GPS sensing systems are also anticipated to contribute to the precision agriculture market scope growth during the study period. For instance, in April 2022, Agtech firm EarthScout announced a unique addition to its scalable line of innovative agriculture products that assist farmers and food producers during a drought to save water and reduce irrigation and inputs by providing real-time data about soil moisture and growing constraints on their land. The innovative, unique EarthScout Soil Cub is an affordable, miniature 4.5"x3"x2" commercial-grade sensor that's installed in the field to monitor soil moisture, soil temperature, and EC at two soil deeps so growers can see moisture and nutrient grades throughout the root site and adjust inputs.

- Further, in April 2022, Murata introduced a high-accuracy 3-in-1 soil sensor for data-driven sustainable agriculture. By monitoring the electrical conductivity, water content, and soil temperature, the sensor allows farmers to maximize the yield and quality of vegetables while minimizing resources such as fertilizers and water.

- Moreover, Increasing government initiatives that support the adoption of modern agriculture technologies and developed infrastructure have contributed to the high revenue of the regional market. For instance, the NIFA, a part of the U.S. Department of Agriculture, conducts sensor, geospatial, and precision technology programs to build awareness among farmers. In collaboration with Land-Grand universities, NIFA helps farmers generate robust sensors, associated software, and instrumentation for observing, modeling, and analyzing a broad range of complex biological materials and processes. Furthermore, in May 2022, the Government of Canada announced an investment of USD 4,41,917.5 to develop an integrated system for precision fruit tree farming. The investment also aimed to acquire sustainable solutions to tackle the uprising challenges in Canada's apple industry.

- The COVID-19 pandemic negatively impacted the global market for precision farming, resulting in the temporary closure of multiple industrial facilities in China, India, Europe, Japan, and the United States. As a result, the manufacturing of precision farming equipment significantly decreased. Government-enforced shutdowns following the coronavirus pandemic impacted the industry and slowed consumer demand for such expensive capital goods.

- However, more significant adoption could result from deploying remote sensing and farm management software technologies after COVID-19. Businesses have already started concentrating more on wireless platforms to support real-time decision-making for crop health monitoring, yield monitoring, irrigation scheduling, field mapping, and harvesting management. This may propel the studied market demand in the forecasted period.

Precision Farming Market Trends

Soil Monitoring is Expected to Hold Significant Share

- While some farmers have specific knowledge of detecting soil moisture and health, such knowledge is confined to only a few. Making farming decisions based on soil moisture and fitness has become even more difficult in the age of climate change. Soil sensors measure essential soil properties and relay them to a display device through reliable communication. Soil sensors are generally used in conjunction with variable rate applications or GPS to generate field maps, categorized according to the properties of the soil. Soil sensors are crucial to monitor the feasibility of the growth of the crops during the harvesting period.

- Sensors generate real-time information after the data analysis and cause the corresponding changes in the application rate. Conventional models of the utilization of a map-based approach are considered to be more productive. They allow space for problem analysis and adjusting the variable rate application in the following steps. The various type of sensors being integrated for soil monitoring purposes includes electromagnetic, optical, mechanical, acoustic, and electrochemical, as far as industrial research has reached.

- In addition, ground-based monitoring systems are anticipated to dominate the demand during the forecast period due to the increased use of various soil monitoring sensors among forward-thinking farmers worldwide. Ground-based monitoring has a sizable market share because it requires little technical knowledge. The demand for connected farming results from improvements in intelligent sensor technology and their integration with IoT modules.

- Additionally, a device called Soilsens, a low-cost smart soil monitoring system, has emerged as a potential aid to farmers struggling to make a farming decision. Proximal Soilsens Technologies Pvt created the Soilsens product line. Ltd, a startup supported by the Department of Science and Technology (DST) and the Ministry of Electronics and Information Technology and housed in the Indian Institute of Technology Bombay (IITB), Mumbai. A soil moisture sensor, a soil temperature sensor, an ambient humidity sensor, and an ambient temperature sensor are all built into the system. Farmers are given recommendations for the best irrigation practices based on these parameters through a smartphone app. The cloud also has access to this information. A portable soil moisture system is also available.

- In July 2022, the Conservation Innovation Grants (CIG) On-Farm Conservation Innovation Trials program was expected to receive a USD25 million investment this year, according to USDA. Through CIG, partners collaborate to improve agricultural practices while addressing concerns with our country's water quality, water quantity, air quality, soil health, and animal habitat. The CIG's On-Farm Trials component promotes the evaluation and broad adoption of cutting-edge conservation strategies in collaboration with farmers. This year's financing priorities are climate-smart agriculture practices, irrigation water management, fertilizer management, and soil health.

- Additionally, in February 2023, Murata, in collaboration with longstanding systems integration partner Sentinum, announced the GAIA soil monitoring solution, which, according to the company, could have a crucial role to play in smart agriculture. These soil sensors help maximize crop yields while decreasing fertilizer use and minimizing the amount of water needed for irrigation.

- Furthermore, technological advancement in farming may further propel the studied market growth. According to ETNO, the number of IoT active connections in agriculture was expected to increase in the European Union through the years. It was recorded at 46.92 million connections in 2022 and is expected to reach 70.26 million by 2025. Some uses for IoT devices in agriculture would be drone usage for surveillance or distributing seeds.

Asia-Pacific to Experience Significant Market Growth

- The region is anticipated to witness significant growth over the forecasted period in the studied market, primarily due to government initiatives in developing countries to encourage the implementation of modern precision farming technologies, thereby maximizing productivity. In 2022, the Government of India planned to launch Kisan Drones for crop assessment, digitization of land records, and spraying insecticides and nutrients. According to IBEF, India's agricultural and processed food products exports stood at USD 9,598 million in FY23 (April-July 2022), up by 30% year on year.

- According to IBEF, the processed food market in India is expected to grow to INR 3,451,352.5 crore (USD 470 billion) by 2025, from INR 1,931,288.7 crore (USD 263 billion) recently on the back of government initiatives such as planned infrastructure worth USD 1 trillion and Pradhan Mantri Kisan Sampada Yojana.

- According to the UN's Food and Agriculture Organization (FAO), more than 80% of the food consumed in sub-Saharan Africa and Asia is grown by smallholder farmers. Growing global demand from food processors and consumers for accountability for the entire product lifecycle is developing new access opportunities for smallholder farmers. Precision application of crop protection solutions is changing the agriculture sector in Asia. According to the German-based company Jebagro GmbH, its Myanmar subsidiary applies almost half of its pesticide products with UAVs.

- Service providers in many Asian countries are leapfrogging to advance application methods, making Asian agriculture the prime focus for the studied market vendors. Smart tractors, UAVs, ground leveling services, satellite imaging, pesticide application, irrigation services, and handheld decision diagnostics and decision support are becoming more accessible for smallholder farmers in the region without investment in expensive infrastructure. In countries like Japan, the average farmer's average age is 67; therefore, with labor shortages, precision farming is significant for food production and security.

- Further, in December 2022. Indian fresh produce company IG International announced a collaboration with Fyllo, an AI, ML, IoT-driven, SaaS-based precision agriculture company. This was expected to help companies use precision farming with AI, ML, and IoT to produce high-quality fruits. As a part of Alliance, IG International's corporate farms would be integrated with 'Nero,' a soil analysis and irrigation management device.

- The Thailand Board of Investment promotes startup projects and companies through direct investment and business matchmaking services. Major drone companies, like DJI and XAG, are pushing their technology in the region through the value chain to create new local businesses based on advanced service options. ListenField, which connects satellites, drones, sensors, and on-farm data, delivers analysis and recommendations and collaborates with numerous organizations in Japan. One notable project involves working with universities in Japan, India, and Thailand on data-based farming in the face of climate change.

- India's agricultural policies have recently acknowledged the advantage of smart farming and focused on doubling farmers' income by 2022. The government also introduced the multilingual mobile app 'CHC-Farm Machinery,' enabling farmers to rent and implement farm machinery through a CHC in their area. Startups, such as Barton Breeze, have been doing hydroponic and other soil-less farming, and their farms continue to operate even in lockdown. According to DataLabs, India is estimated to have more than 1090 agritech startups, and this sector has been spearheading a revolution in technology, especially in drones, IoT devices, and data analytics to AI and satellite imagery.

Precision Farming Industry Overview

The precision farming market consists of several major players. In terms of market share, few of the significant players currently dominate the market. These major players, with a prominent market share, focus on extending their customer base across foreign countries. These firms leverage collective strategic initiatives to increase their market share and profitability. The companies performing in the market are also acquiring start-ups working on precision farming technologies to strengthen their product capabilities.

In November 2022, Elders and Precision Agriculture Pty Ltd. partnered to help farmers improve their nutrient utilization and increase the sustainability of their crops. The new arrangement made Precision Agriculture's specialized services, such as establishing soil management zones, individualized soil testing, and identifying significant soil restrictions, more easily accessible to Elders clients.

In March 2022, to maximize natural resources and enhance food security in Africa and other regions where the company would grow in the upcoming years, investment management firm Signature partnered with StartLife. The partnership could offer a path to on-farm validation of cutting-edge technologies for impact-driven tech startups.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment Of COVID-19 Impact On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Soil Monitoring using AI and IOT technologies to drive the market

- 5.1.2 Emergence of New Technologies

- 5.1.3 Government Initiative and Increasing Number of Startups

- 5.2 Market Challenges

- 5.2.1 Difference in Awareness in Different Regions is also Resulting in Varying Adoption Patterns in These Regions

- 5.3 Market Opportunities

- 5.3.1 Technological Advancement is Reducing the Cost of Many Advance Equipment

- 5.3.2 Advancement in Technologies, like LIDAR-enabled Drones, and Emergence of Data Analytics and Cloud in the Sector

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Guidance System

- 6.1.1.1 Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS)

- 6.1.1.2 Global Information System (GIS)

- 6.1.2 Remote Sensing

- 6.1.3 Variable-rate Technology

- 6.1.3.1 Variable Rate Fertilizer

- 6.1.3.2 Variable Rate Seeding

- 6.1.3.3 Variable Rate Pesticide

- 6.1.4 Drones and UAVs

- 6.1.5 Other Technologies

- 6.1.1 Guidance System

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.2.3 Services

- 6.3 By Application

- 6.3.1 Yield Monitoring

- 6.3.2 Variable Rate Application

- 6.3.3 Field Mapping

- 6.3.4 Soil Monitoring

- 6.3.5 Crop Scouting

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AGCO Corporation

- 7.1.2 Ag Junction Inc

- 7.1.3 John Deere

- 7.1.4 DICKEY-john Corporation

- 7.1.5 TeeJet Technologies

- 7.1.6 Raven Industries Inc.

- 7.1.7 Lindsay Corporation

- 7.1.8 Topcon Precision Agriculture

- 7.1.9 Land O'lakes Inc.

- 7.1.10 BASF SE

- 7.1.11 Yara International ASA