|

市場調查報告書

商品編碼

1429228

製造業雲端安全 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Cloud Security in Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

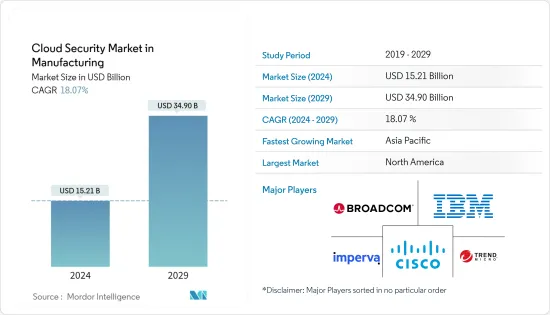

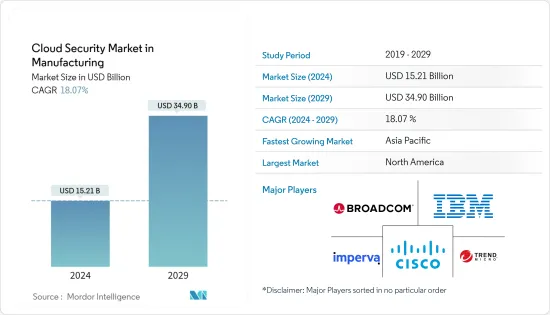

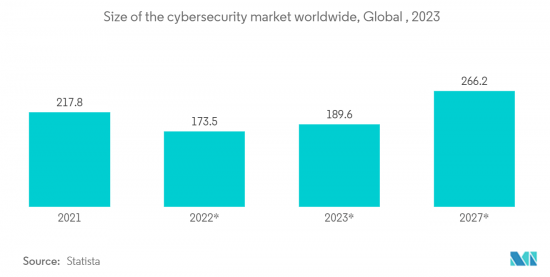

製造業雲端安全市場預計將從2024年的152.1億美元成長到2029年的349億美元,預測期間(2024-2029年)複合年成長率為18.07%。

製造業正在迅速發展,對敏捷系統創新和流程支援的需求不斷增加。這種需求正在推動雲端安全解決方案的採用,為製造商提供更大的可見度和彈性。

主要亮點

- 製造業是網路攻擊最有針對性的行業之一,大約一半的製造商遭遇過網路安全事件。這導致了重大的財務損失和業務營運中斷。因此,企業預算的很大一部分都花在了安全解決方案上。

- 然而,將生產流程從本地遷移到雲端是一項艱鉅的挑戰,因為目前大多數生產流程都是由本地解決方案支援的。製造公司應該專注於可以轉移到雲端的新事件,同時開發更智慧的 ERP 系統,可以處理舊事件並允許製造能力根據需要進行擴展。

- 世界各國政府正透過官民合作關係投資雲端基礎的運算交付方法,為創新的特大城市企業和智慧交通網路提供動力。雲端基礎的技術提供可靠、經濟且可擴展的結果,可以將大城市轉變為數位連接的智慧結構。在中東,各國政府正在支持發展智慧城市和創新交通服務的舉措,例如杜拜網路城 (DIC) 和沙烏地阿拉伯王國 (KSA) 2030 年願景。

- 此外,2023 年 7 月,Sight Machine Inc. 宣布其製造資料平台已成為 Microsoft Cloud for Manufacturing 的認證解決方案,進一步擴大其在 Microsoft Azure 市場中的影響力。 Cytomachine 對微軟製造合作夥伴生態系統的多年參與將使各公司能夠幫助世界各地的製造商實現業務轉型,並利用由雲端、資料和人工智慧以及永續性支援的先進技術實現新的生產力水平。

- 然而,由於對雲端服務供應商 (CSP) 缺乏信任,大型和小型企業都可能對將業務遷移到雲端猶豫不決。由於 CSP 持有敏感資料,因此它們非常容易受到複雜的網路攻擊,這可能會阻止公司將非公開資料委託給這些提供者。

- 由於網路釣魚犯罪增加,COVID-19 大流行增加了對雲端解決方案(包括雲端安全解決方案)的需求。詐騙希望利用新冠病毒 (COVID-19) 來賺取收入,而遠距工作的轉變使得實施臨時詐騙計畫變得更加容易,因為溝通在很大程度上依賴臨時工。

- 總而言之,在網路威脅、對更高敏捷性的需求以及系統創新和流程支援的可見性的推動下,雲端安全解決方案在製造業的採用預計將快速成長。政府對雲端基礎的技術的投資也將有助於市場成長,但對通訊服務提供者的信任問題仍然是一個挑戰。 COVID-19 大流行凸顯了雲端安全解決方案的重要性。

雲端安全市場趨勢

入侵偵測和預防是一個快速成長的領域

- 入侵偵測和防禦軟體 (IDPS) 是一種安全系統,用於監視網路流量以查找潛在攻擊的徵兆。其主要目的是識別潛在危險活動並立即採取行動防止攻擊。這包括丟棄惡意資料包、阻止網路流量和重置連線。此外,IDPS 通常會發送警報來提醒安全管理員潛在的威脅。

- 數位孿生是使用物聯網 (IoT)資料創建的實體物件、環境和流程的虛擬表示。製造商可以使用數位雙胞胎透過在虛擬環境中模擬和分析資料來最佳化產品、流程和決策。在整個生命週期中連接和管理資料的方式稱為數位執行緒。

- IT效能提升的製造商可以利用基於IT的模擬、建模和資料分析來最佳化對不同應用場景的支援。高效能運算 (HPC) 功能,例如複雜的運算、提高的操作敏捷性以及更好地利用 IT 資源,是此最佳化過程中使用的標準工具。 HPC 系統用途廣泛,廣泛應用於製藥、離散和製程製造等各個領域。

- 數位工程利用雲端基礎的製造資料工具和相容合作夥伴解決方案的生態系統,可以幫助製造商加快產品開發流程。

- IDS 或 IPS 系統的成功部署和運作取決於兩個主要因素:部署的簽章和通過它們的網路流量。全面且定期更新的簽章資料庫可確保系統能準確偵測潛在威脅。流經系統的網路流量是一級資訊來源,系統必須能夠對其進行即時處理和分析。

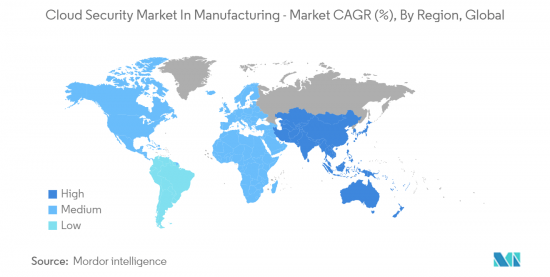

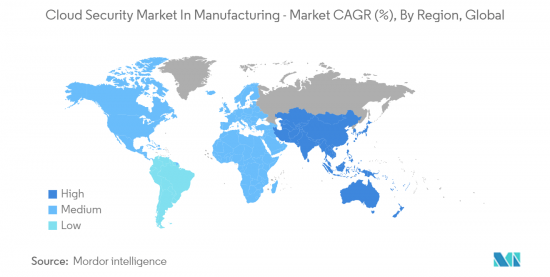

亞太地區將經歷最高成長

- 亞太地區是目前全球成長最快的地區。根據《東協郵報》報道,製造業是東南亞國家聯盟(東協)經濟成長的關鍵驅動力。

- 推動這一成長的關鍵舉措之一是東協經濟共同體(AEC),其目標是將東協建立為單一市場和生產中心。此外,區域全面經濟夥伴關係(RCEP)等大型貿易協定可以成為創建更廣泛的亞太自由貿易區(FTAAP)的重要一步,為促進自由貿易提供寶貴支持。預計它將發揮政府間論壇的作用。

- IBM 宣布對網路安全資源進行重大投資,以幫助亞太 (APAC) 地區的企業做好準備並管理日益成長的網路攻擊威脅。這項投資的核心是 IBM 安全指揮中心,它提供高度真實的網路攻擊模擬,並向從技術執行長到最高管理層的所有人教授回應技術。

- 作為這項投資的一部分,IBM 還將收購一個全新的安全營運中心 (SOC),並將其整合到其廣泛的全球 SOC 網路中,為全球客戶提供 24 小時安全回應服務。

- 許多大公司正在擴大在亞太地區的業務。例如,Google最近將亞太地區的Google雲端平台區域數量從三個增加到六個。

雲端安全產業概況

由於對網路攻擊的擔憂日益增加,製造業雲端安全市場變得越來越分散。許多公司正在擴展其服務以適應各種規模的組織。該市場的主要企業包括 Cisco Systems Inc、IBM Corporation、Broadcom 和 Imperva。

- 2023 年 4 月 - AWS 發布製造和工業能力。 AWS 宣布推出 AWS 製造和工業能力。 AWS 製造和工業能力已擴展到包括類別,以進一步區分合作夥伴並協助客戶找到適合其相同業務需求的解決方案。

- 2022 年 5 月 - 雲端產業最著名的公司Google宣布推出面向智慧工廠和智慧員工的全新谷歌雲端製造。 Google Cloud 的全新製造解決方案使製造工程師和工廠經理能夠從不同的資產和流程中存取統一的情境化資料。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 網路攻擊威脅的增加擴大了市場

- 市場限制因素

- 將製造流程從本地轉移到雲端是一項重大挑戰

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按解決方案

- 身分和存取管理

- 預防資料外泄

- IDS/IPS

- 安全資訊/事件管理

- 加密

- 安全

- 應用程式安全

- 資料庫安全

- 端點安全

- 網路安全

- 網路/電子郵件安全

- 依部署方式

- 民眾

- 私人的

- 混合

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Trend Micro Inc.

- Imperva Inc.

- Broadcom Inc.

- IBM Corporation

- Cisco Systems Inc.

- Fortinet Inc.

- Sophos PLC

- Mcafee LLC

- Qualys Inc.

- Check Point Software Technologies Ltd

- Computer Science Corporation(CSC)

第7章 投資分析

第8章 市場機會及未來趨勢

The Cloud Security Market in Manufacturing Industry is expected to grow from USD 15.21 billion in 2024 to USD 34.90 billion by 2029, at a CAGR of 18.07% during the forecast period (2024-2029).

The manufacturing industry is rapidly evolving, and with it comes an increasing demand for agile system innovation and process support. This demand has led to the adoption of cloud security solutions, which offer greater visibility and flexibility to manufacturers.

Key Highlights

- Manufacturing is one of the most highly targeted industries for cyberattacks, with almost half of all manufacturers have experienced a cybersecurity incident. This has resulted in significant financial losses and disruptions to business operations. As a result, a major portion of a company's budget is being spent on security solutions.

- However, migrating production processes from on-premise to the cloud can be challenging, as most production processes are currently supported by on-premise solutions. Manufacturers should focus on new events that can be transferred to the cloud while developing a more intelligent ERP system to handle older events, enabling manufacturing functions to scale as needed.

- Governments worldwide are investing in cloud-based computing delivery methods through public-private partnerships to advance innovative megacity enterprises and intelligent transportation networks. Cloud-based technology provides reliable, affordable, and scalable outcomes that can transform metropolises into digitally connected and intelligent structures. In the Middle East, governments are endorsing initiatives like the Dubai Internet City (DIC) and the Kingdom of Saudi Arabia (KSA) Vision 2030 to develop smart municipalities and innovative transportation services.

- Furthermore, in July 2023, Sight Machine Inc. announced that its Manufacturing Data Platform is now a certified solution for Microsoft Cloud for Manufacturing, further expanding its reach within the Microsoft Azure Marketplace. Sight Machine's multi-year participation in Microsoft's partner ecosystem for manufacturing enables organizations to assist manufacturers around the globe in transforming their businesses and unlock new levels of productivity and sustainability with leading cloud, data and AI-powered technology.

- However, large and small organizations may be hesitant to shift their operations to the cloud due to a lack of trust in cloud service providers (CSPs). CSPs hold critical data, making them highly vulnerable to complex cyberattacks that can discourage businesses from entrusting their nonpublic data to these providers.

- The COVID-19 pandemic increased the demand for cloud solutions, including cloud security solutions, due to an increase in phishing offenses. Scammers were using COVID-19 as a lure to generate income, and the shift to remote working made dispatch fraud schemes easier to execute as communication relies heavily on dispatch.

- In conclusion, the manufacturing industry's adoption of cloud security solutions is expected to grow rapidly, driven by cyber threats, demand for greater agility, and visibility in system innovation and process support. The government's investments in cloud-based technology will also contribute to market growth, though the issue of trust in CSPs remains a challenge. The COVID-19 pandemic highlighted the importance of cloud security solutions, which will continue to be in high demand in the foreseeable future.

Cloud Security Market Trends

Intrusion Detection and Prevention is the Fastest Growing Segment

- An intrusion detection and prevention software (IDPS) is a security system that monitors network traffic for any signs of potential attacks. Its primary purpose is to identify any potentially dangerous activity and take immediate action to prevent the attack. This may involve dropping malicious packets, blocking network traffic, or resetting connections. Additionally, the IDPS typically sends an alert to security administrators to inform them of the potential threat.

- Digital twins are virtual representations of physical objects, environments, and processes, created using data from the Internet of Things (IoT). Manufacturers can use digital twins to optimize their products, processes, and decisions by simulating and analyzing data in a virtual environment. The means of connecting and managing data throughout its lifecycle are known as digital threads.

- Manufacturers with improved IT performance can optimize their support for different application scenarios by leveraging IT-based simulations, modeling, and data analysis. High-performance computing (HPC) capabilities, such as complex calculations, greater operational agility, and better IT resource utilization, are standard tools used in this optimization process. HPC systems are incredibly versatile and widely used in various sectors, including pharmaceutical, discrete, and process manufacturing.

- Digital engineering, which involves utilizing cloud-based manufacturing data tools and an ecosystem of compatible partner solutions, can help manufacturers accelerate their product development process.

- The successful deployment and operation of an IDS or IPS system rely on two main factors - the deployed signatures and the network traffic that flows through it. A comprehensive and regularly updated database of signatures ensures that the system can accurately detect potential threats. The network traffic that flows through the system is the primary source of information, and the system must be capable of processing and analyzing it in real time.

Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific region is currently experiencing the fastest growth in the world, thanks in large part to the expansion of its manufacturing sector. According to a report from the ASEAN Post, the manufacturing industry has been a crucial driver of economic growth for the Association of Southeast Asian Nations (ASEAN).

- One of the key initiatives driving this growth is the ASEAN Economic Community (AEC), which aims to establish ASEAN as a single market and production base. Additionally, mega trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) could be a significant step towards the creation of a broader Free Trade Area of the Asia-Pacific (FTAAP), which would serve as a valuable intergovernmental forum for promoting free trade.

- To help businesses in the Asia Pacific (APAC) region prepare for and manage the growing threat of cyberattacks, IBM has announced a significant investment in its cybersecurity resources. The centerpiece of this investment is the IBM Security Command Center, which uses highly realistic simulated cyberattacks to teach response techniques to everyone from technical staff to the C-suite.

- As part of this investment, IBM has also acquired a brand-new Security Operation Center (SOC), which will be integrated into the company's extensive global network of SOCs to provide round-the-clock security response services to clients worldwide.

- Many major companies are expanding their presence in the APAC region. For example, Google has recently increased the number of Google Cloud Platform regions in APAC from three to six.

Cloud Security Industry Overview

The market for cloud security in the manufacturing industry has experienced fragmentation due to increasing concerns about cyberattacks. To cater to organizations of all sizes, many companies are expanding their services. Some of the significant players in this market include Cisco Systems Inc, IBM Corporation, Broadcom, and Imperva, among others.

- April 2023 - AWS announced the Manufacturing and Industrial Competency. AWS announced the launch of the AWS Manufacturing and Industrial Competency. The AWS Manufacturing and Industrial Competency has expanded to include the categories to further differentiate partners and assist customers in finding the right solution for their identical business needs.

- May 2022 - Google, the most prominent player in the cloud industry, introduced the new Google Cloud Manufacturing for smart factories and intelligent employees. Google Cloud's new manufacturing solutions allow manufacturing engineers and plant managers to access united and contextualized data from all their diverse assets and procedures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Threats of Cyber Attacks is Expanding the Market

- 4.4 Market Restraints

- 4.4.1 Migration of Manufacturing Processes from On-premise to Cloud is a Major Challenge

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Identity and Access Management

- 5.1.2 Data Loss Prevention

- 5.1.3 IDS/IPS

- 5.1.4 Security Information and Event Management

- 5.1.5 Encryption

- 5.2 By Security

- 5.2.1 Application Security

- 5.2.2 Database Security

- 5.2.3 Endpoint Security

- 5.2.4 Network Security

- 5.2.5 Web and Email Security

- 5.3 By Deployment Mode

- 5.3.1 Public

- 5.3.2 Private

- 5.3.3 Hybrid

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trend Micro Inc.

- 6.1.2 Imperva Inc.

- 6.1.3 Broadcom Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Fortinet Inc.

- 6.1.7 Sophos PLC

- 6.1.8 Mcafee LLC

- 6.1.9 Qualys Inc.

- 6.1.10 Check Point Software Technologies Ltd

- 6.1.11 Computer Science Corporation (CSC)