|

市場調查報告書

商品編碼

1429209

通訊服務保障:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Telecom Service Assurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

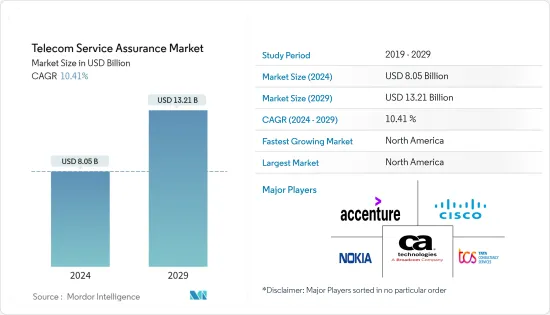

通訊服務保障市場規模預計到2024年為80.5億美元,預計到2029年將達到132.1億美元,在市場估計和預測期間(2024-2029年)複合年成長率為10.41%。 。

通訊服務保證 (TSA) 是通訊服務供應商 (CSP) 使用的一個系統,用於確保他們透過網路向消費者提供的服務滿足最佳用戶體驗所需的服務品質水準。

主要亮點

- 消費者對更高服務品質的需求不斷成長,預計將加速通訊服務提供者對通訊服務保障解決方案的使用。由於全球行動電話用戶數量的顯著增加以及對更快行動網路的需求,預計各種通訊服務供應商對通訊服務保障解決方案的使用將會增加。

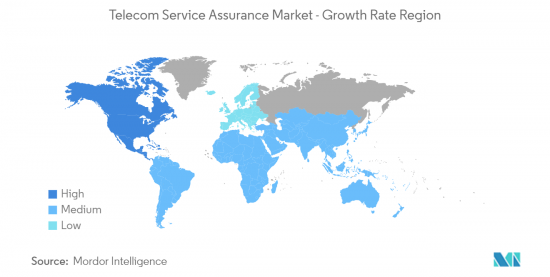

- 此外,此類複雜和先進技術的開拓以及已開發國家日益激烈的競爭預計將影響全球 TSA 市場的擴張。新興市場預計將提供世界上大部分的創新。

- 政府在通訊服務保障 (TSA) 行業中不斷採取的舉措和支持政策,以支持通訊基礎設施和高速網際網路,正在推動市場擴張。特別是在中國和印度等新興市場,各國政府正大力與民營市場參與企業合作,以支持通訊服務保障 (TSA) 業務的擴張。

- 此外,新興國家基礎設施的缺乏增加了企業的推出成本,並可能阻礙市場擴張。

- COVID-19 大流行使人們整天待在家裡(在許多國家,他們的門都鎖著),人們可以在家工作,與同事進行虛擬互動,並在網路上進行工作和娛樂聯繫。這增加了需求無線網際網路,因為人們被迫使用該服務。線上流量的增加是市場擴張的關鍵因素。

通訊服務保障市場趨勢

專業服務佔很大佔有率

- 為了有效部署通訊服務保障解決方案,專業服務領域包括規劃諮詢、營運維護、系統整合等服務。我們的專家服務還確保軟體透過改進的通訊服務完全支援您組織的目標。

- 此外,專業服務預計在預測期內將成長最快。由於全球客戶數量不斷增加,CSP 正在開發新服務,但這些服務必須與系統的當前設定配合使用。因此,對系統整合服務的需求將會增加,從而導致專業服務業的蓬勃發展。

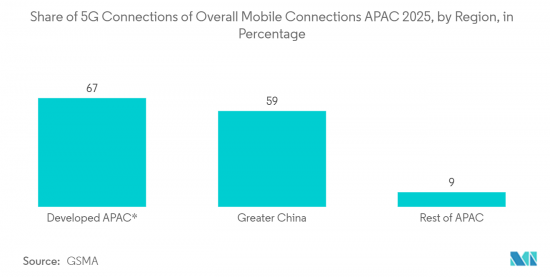

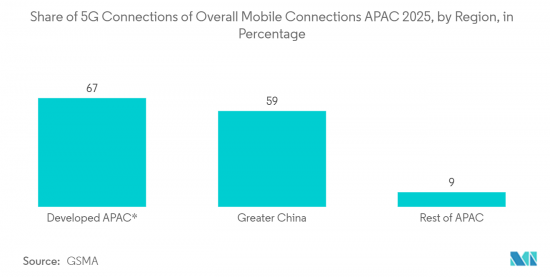

- 技術和通訊的進步提高了消費者的期望。隨著 5G(以及最近的 LTE)和其他下一代通訊技術的採用,消費者的偏好正在轉向更數位化的生活方式。

- 隨著智慧型設備的普及,網路服務領域也在改變。雖然通訊服務提供者有更多機會提供創新服務,但也有更多障礙需要克服。客戶需要頻寬頻寬應用程式和高品質的網路體驗,而通訊服務提供者需要協助來滿足這些需求。他們還需要管理多供應商,技術和營運孤島可能導致效率低下並對客戶體驗和品牌價值產生負面影響。

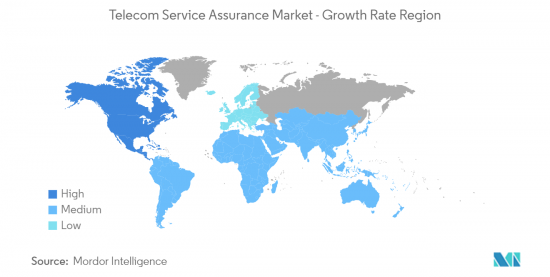

北美正在經歷快速成長

- 美國通訊業已經成熟,預計將隨著通訊設備數量的增加而顯著成長。近年來,由於OEM技術的進步以及消費者對更新、功能更強的行動電話的興趣,行動電話訂購數量急劇增加。

- 此外,該領域的主要行動電話服務供應商正在努力滿足消費者對服務的需求。在這些情況下使用通訊服務保障解決方案來提高客戶滿意度和服務品質。北美TSA市場預計將受到此類因素的推動。

- 該地區的通訊業者正在對其網路基礎設施進行現代化改造,以滿足快速成長的 5G 服務需求。當然,在開發新的網路基礎設施時,需要仔細考慮服務保障。物聯網產生大量資料,隨著物聯網使用的增加,對資訊服務的需求也會增加。

- LTE-A(進階長期演進)是一種廣泛使用的無線網路。由於許多通訊業者提供 LTE-A 服務,提供者需要了解其客戶以防止客戶解約率上升,這將導致 TSA 市場在預測期內成長。

- 隨著5G的實施,該地區的TSA行業預計將得到顯著提振,推動消費者對更好體驗的需求。

通訊服務保障產業概況

通訊服務保障市場分散,許多公司分佈在多個地區。著名的參與者包括塔塔電信服務公司、IBM、思科和埃森哲。

2023年3月,諾基亞公司宣布Airtel Africa將透過採用SaaS交付模式iSIM來支援營運商的數位化努力,為客戶提供基於5G和物聯網的按需服務。諾基亞的通訊SaaS,整合了 SaaS SIM (iSIM) Secure Connect 技術,使支援 eSIM 和 iSIM 的設備的通訊服務供應商(CSP) 和企業能夠保護消費者設備和機器對機器的訂閱流程。

2022年9月,思科宣布其子公司Webex India獲得了政府頒發的通訊許可證,使其能夠提供企業級的國內和國際通訊連接。 Webex 成為第一家獲得通訊許可證的 OTT 公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 對服務品質的要求不斷成長

- 行動電話用戶數量顯著增加

- 對高階最佳化和降低成本的需求日益成長

- 市場限制因素

- 資料隱私問題

- 新興國家缺乏基礎設施

第6章市場區隔

- 按發展

- 本地

- 託管

- 按服務

- 專業的

- 管理

- 按系統

- 探針系統

- 網路管理

- 勞動力管理

- 故障管理

- 品質監控

- 其他系統類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Nokia Corporation

- Broadcom Inc.(CA Technologies Inc.)

- Cisco Systems, Inc.

- Tata Consultancy Services Limited

- Accenture PLC

- IBM Corporation

- JDS Corporation

- NEC Corporation

- Hewlett-Packard Company

- Ericsson Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Telecom Service Assurance Market size is estimated at USD 8.05 billion in 2024, and is expected to reach USD 13.21 billion by 2029, growing at a CAGR of 10.41% during the forecast period (2024-2029).

Telecom service assurance (TSA) is the application of policies and processes by a Communications Service Provider (CSP) to ensure that the services offered over networks to consumers meet the required service quality level for an optimal subscriber experience.

Key Highlights

- The rise in consumer demand for higher service quality is anticipated to accelerate CSPs' use of TSA solutions. The use of TSA solutions by various CSPs is expected to increase since there is an enormous increase in mobile cellular subscriptions worldwide and a requirement for faster mobile network speeds, which results from consumers' growing demand for better and more sophisticated quality.

- In addition, the development of such complex and advanced technologies and increased competition in developed nations are expected to affect the expansion of the worldwide TSA market. It is anticipated that developed markets will provide the majority of global innovations.

- The government's increasing initiatives and supportive policies in the telecom service assurance (TSA) industry to support communication infrastructure and high-speed internet drive market expansion. Governments, particularly those in developing nations like China and India, have made a significant effort to work with the participants in the private market to encourage the expansion of the telecom service assurance (TSA) business.

- Moreover, the lack of infrastructure in emerging economies may allow businesses to incur high startup costs, which may impede the market's expansion.

- The COVID-19 pandemic raised the demand for wireless internet since individuals were compelled to work from home, interact virtually with their peers, and use online services for both work and enjoyment because they were confined to their homes all day (due to lockdowns in many nations). Online traffic increased as a significant element in the market's expansion.

Telecom Service Assurance Market Trends

Professional Services to Account for a Significant Share

- For the effective deployment of the telecom service assurance solution, services like planning and consulting, operations and maintenance, and system integration are included in the professional services sector. The expert service also ensures that the software fully supports the organizational objectives through improved communication services.

- Also, the professional services sector is anticipated to increase the fastest during the projection period. CSPs are developing new services due to the increasing number of customers worldwide, but these services must work with the system's current setup. As a result, this increases the need for system integration services, which in turn helps the professional services sector thrive.

- Consumer expectations have increased as a result of technological and communication advancements. The adoption of 5G (and, more recently, LTE) and other next-generation communication technologies are shifting consumer preferences towards a more digital way of life.

- The network service sector has changed as smart devices become more widely used. While there are more chances for CSPs to provide innovative services, there are also more obstacles to overcome. With customers demanding bandwidth-intensive applications and high-quality network experiences, CSPs need help to stay up. Another requirement is managing multi-vendor settings with technological and operational silos that could result in inefficiencies and have a detrimental influence on customer experience and brand value.

North America to Execute the Fastest Growth Rate

- The United States telecom industry is mature, and significant growth rates are anticipated as the number of telecom devices rises. Mobile cellular subscriptions have increased dramatically over the past few years due to OEM technology advancements and consumer interest in newer, more advanced phones.

- Also, the major cellular service providers in this area are attempting to meet consumer service demand. TSA solutions are used in situations like this to improve client satisfaction and the caliber of services. The North American TSA Market is anticipated to be driven by this factor.

- Telecom providers in the area are modernizing their networking infrastructure to meet the escalating demand for 5G services in the future. Developing a new networking infrastructure will certainly require careful consideration of service assurance. IoT generates enormous amounts of data, and as IoT usage rises, so will the demand for data services.

- Long-term evolution-advanced (LTE-A) is a widely available wireless network. Since many operators offer the LTE-A service, the providers must keep track of their customers to prevent any increase in the churn rate, which will help the TSA market grow over the forecast period.

- The region's TSA industry will enjoy a substantial boost due to the implementation of 5G, which will enhance consumer demand for an improved experience.

Telecom Service Assurance Industry Overview

The telecom service assurance market is fragmented because many players are dispersed throughout several areas. Tata Telecommunication Services, IBM, Cisco, and Accenture are a few notable participants.

In March 2023, Nokia Corporation announced Airtel Africa chose the iSIM in SaaS delivery model to support the operator's digitalization efforts, offering its customers 5G and IoT-based on-demand services, while Nokia's telecom SaaS, integrated SaaS SIM (iSIM) Secure Connect technology enables communication service providers (CSPs) and businesses for eSIM- and iSIM-enabled devices, to safely handle consumer device and machine-to-machine subscriptions.

In September 2022, Cisco announced that the subsidiary Webex India received a telecom license from the government, enabling it to provide enterprise-grade national and international telecom connectivity. Webex has become the first Over-The-Top (OTT) player to get a telecom license.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Service Quality

- 5.1.2 Significant Increase in the Number of Cellular Subscribers

- 5.1.3 Rising Need for High Optimization and Increased Cost Savings

- 5.2 Market Restraints

- 5.2.1 Data Privacy Concerns

- 5.2.2 Lack of Infrastructure in Emerging Economies

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Hosted

- 6.2 By Service

- 6.2.1 Professional

- 6.2.2 Managed

- 6.3 By System

- 6.3.1 Probe System

- 6.3.2 Network Management

- 6.3.3 Workforce Management

- 6.3.4 Fault Management

- 6.3.5 Quality Monitoring

- 6.3.6 Other System Types

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Broadcom Inc. (CA Technologies Inc.)

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 Tata Consultancy Services Limited

- 7.1.5 Accenture PLC

- 7.1.6 IBM Corporation

- 7.1.7 JDS Corporation

- 7.1.8 NEC Corporation

- 7.1.9 Hewlett-Packard Company

- 7.1.10 Ericsson Inc.