|

市場調查報告書

商品編碼

1408838

嬰兒食品玻璃包裝:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Baby Food Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

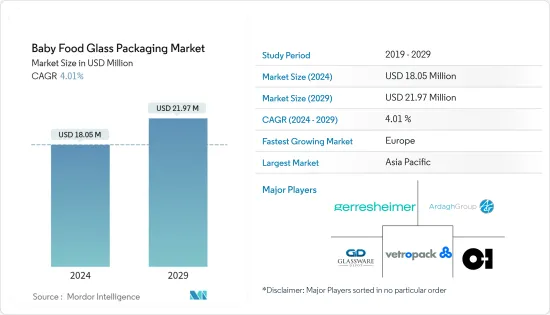

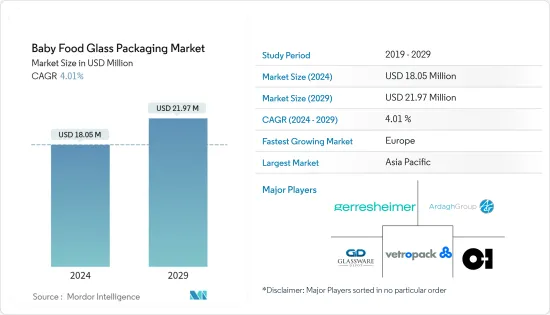

嬰兒食品玻璃包裝市場規模預計到2024年為1,805萬美元,預計2029年將達到2,197萬美元,在預測期內(2024-2029年)複合年成長率為4.01%。

嬰兒食品市場因食品安全要求的便利性而不斷上升。基於這個原因,衛生和攜帶性等因素是優選的。印度和中國等國家的出生率和消費者意識的提高是嬰兒食品玻璃包裝市場的驅動方面。

主要亮點

- 消費者選擇更健康食品(食品)的趨勢食品改變市場格局,並蔓延到嬰兒營養品產業。為新生兒提供充足營養以支持健康成長和發育的需求推動了對天然嬰兒食品的需求。因此,產品必須補充天然營養素,以支持健康生長和發育。

- 預計推動嬰兒食品市場成長的主要因素之一是人口的成長和職業女性數量的增加,而與嬰幼兒營養相關的問題也正在推動嬰兒食品的需求。根據國際貨幣基金組織的數據,2017年中國人口為14.11億,2022年將達14.1175億。人口成長預計將推動嬰兒食品玻璃包裝市場的發展。

- 根據 Baby Center LLC 2022 年 4 月進行的一項調查,消費者在購買嬰兒食品時,可以選擇玻璃瓶、塑膠容器和袋裝食品。玻璃瓶可回收利用,不會排放化學物質,但它們很重且容易破碎。塑膠容器重量輕且可回收,但如果它們不是由無BPA 的材料製成,它們可能會將化學物質滲入食品中。育兒袋很方便,不用擔心它們會破裂,但過度使用會延遲孩子的發展。美國小兒科會 (AAP) 建議使用玻璃罐來分類和準備食品。玻璃瓶消除了塑膠中有害化學物質污染嬰兒食品的風險,而且還可以回收。

- 市場也面臨著玻璃、金屬、塑膠和紙張等不同類型材料的嬰兒食品和包裝生產必須遵循的動態且嚴格的法規和標準的課題。

- 在 COVID-19 大流行期間,市場發生了顯著變化,促使人們轉向線上購物和恐慌性備貨,從而增加了對牛奶、嬰兒食品和蔬菜等基本食品的需求。由於 COVID-19 引起的食品衛生問題,無菌包裝也越來越受歡迎。預計客戶在未來幾年將選擇更好的包裝來預防這些疾病,迫使供應商考慮為嬰兒食品和嬰兒餐使用永續的無菌包裝(玻璃)。

嬰兒食品玻璃包裝市場趨勢

嬰兒食品是成長最快的應用領域

- 帶有 P/T 密封的玻璃包裝對於儲存巴氏殺菌或滅菌的嬰兒食品非常有效。這種包裝可提供可靠的保護,防止微生物腐敗和氧化,並允許長期冷藏,同時保留其寶貴的品質。

- 此外,玻璃包裝向食品轉移的物質較少,並且可以與金屬密封件一起有效回收。因此,包裝廢棄物不會威脅環境。科學家表示,奶瓶餵食的嬰幼兒每天會攝取數百萬個微塑膠顆粒。人們發現,建議用於對塑膠瓶進行消毒和配方奶粉的高溫處理會排放數百萬個微塑膠和數兆個甚至更小的奈米塑膠。

- 推廣永續包裝是全行業的一大趨勢。玻璃是一種高度永續的材料,因為它 100% 可回收和可重複使用。這對有環保意識的父母很有吸引力,他們希望選擇環保的嬰兒食品,因為大多數父母都擔心嬰幼兒的安全和健康。玻璃容器被認為是儲存嬰兒食品的安全無毒的選擇,因為它們可以防止有害化學物質滲入嬰兒食品並保持內容物的純度。

- 玻璃容器可以讓消費者看到裡面的產品,讓他們放心嬰兒食品的品質和新鮮度。這種透明度是一個關鍵賣點,特別是對於有機和天然嬰兒食品而言。採用真空密封和氣密蓋等先進包裝技術來延長玻璃容器中嬰兒食品的保存期限。這確保了產品在不使用防腐劑的情況下保持更長時間的新鮮度。

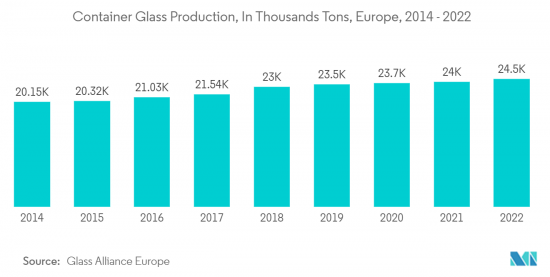

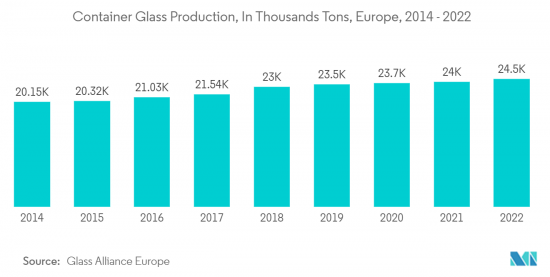

歐洲錄得顯著成長

- 對方便、多樣化和更有營養的嬰兒食品的需求正在推動嬰兒食品消費的增加。中階的壯大和職業婦女數量的增加也是推動市場的因素。消費者越來越關心寶寶的健康,對天然、素食和有機嬰兒食品的需求不斷增加。對有機和純素嬰兒食品不斷成長的需求促使製造商開發新產品以增加市場佔有率。滿足各種嬰兒食品(包括有機食品和純素食品)的需求需要不同類型的包裝。製造商可能需要專門的包裝解決方案來維持這些產品的品質和安全。這就需要嬰兒食品包裝的創新。

- 在德國,消費者對更健康嬰兒食品的偏好、玻璃製造商的創新方法以及行業對永續性的日益關注,共同推動了嬰兒食品玻璃包裝市場的持續擴張。

- 從英國進口玻璃瓶的增加表明對玻璃容器的需求增加。供應量的增加將有利於嬰兒食品玻璃包裝市場,因為這意味著有更多的玻璃包裝可供選擇,並可能導致玻璃瓶製造商之間的競爭加劇。這種競爭可以提高嬰兒食品玻璃瓶行業公司的價格和品質。

- 在法國,嬰兒食品市場近年來取得了重大進展,小型製造商不斷湧現。根據財經報紙《迴聲報》報道,當地企業家正在顛覆該行業,以滿足對有機和手工產品不斷成長的需求。有機和自製嬰兒食品通常高價位。投資這些健康選擇的消費者往往更喜歡優質包裝,例如玻璃。玻璃容器通常與品質和安全性聯繫在一起,這使其成為針對注重健康的父母的產品的有吸引力的選擇。因此,隨著消費者消費有機產品趨勢的增加,嬰兒食品市場也快速成長。政府對嬰幼兒食品生產的嚴格監管導致市場成長緩慢。這些法規還透過確保食品安全和高品質產品的使用使消費者受益。政府對嬰兒食品生產嚴格監管,確保食品安全和高品質產品的使用。玻璃容器被認為是一種安全無毒的包裝選擇。由於政府法規執行嚴格的品質和安全標準,玻璃包裝適合使用,因為它有助於維持嬰兒食品的完整性和品質。

- 在其他歐洲國家,永續性受到了廣泛關注。 Ardagh Glass Packaging 等公司正在投資創新解決方案,以減少排放並最大限度地減少資源使用。這對嬰兒食品產業至關重要,因為父母越來越要求為孩子的用餐提供環保永續的包裝選擇。

嬰兒食品玻璃包裝產業概況

嬰兒食品玻璃包裝市場較為分散,主要參與者包括 Ardagh Group、Gerresheimer AG、SGD Pharma、Pigeon India 和 Evenflow Feeding。該行業的參與者專注於透過聯盟、收購和合併來擴大業務。

- 2023 年 10 月,SGD Pharma 宣布退役位於法國 Saint-Quentin-L'Empot 生產廠的兩座最先進熔爐之一。該計劃是該公司全面脫碳計畫的一部分,將有助於2040年將全球二氧化碳排放減少三分之二。

- 2023 年 5 月,英國Ardag Glass Packaging (AGP) 宣佈建造一座高度永續性且高效的熔爐,以最大限度地減少玻璃生產過程中的溫室氣體排放。該熔爐將安裝在 AGP英國唐卡斯特工廠,採用最新的工業技術打造更有效率的熔爐,可顯著降低氣體消費量和碳排放。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 生態系分析

第5章市場動態

- 市場促進因素

- 與玻璃容器相比,塑膠繼續保持強勁成長

- 對有機和天然嬰兒食品的需求整體成長以及嬰兒食品包裝的創新

- 市場抑制因素

- 材料監管問題

- 嬰兒食品產業區域趨勢摘要

- 行業法規和標準

- 主要材料類型玻璃、塑膠、紙板和金屬的相對需求分析

- 永續性和便利性在嬰兒食品包裝行業中的作用

第6章市場區隔

- 依用途

- 嬰兒食品

- 其他用途

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 中東/非洲

- 拉丁美洲

- 北美洲

第7章市場區隔:嬰兒玻璃奶瓶(母乳哺育/哺乳用)

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 北美洲

第8章 競爭形勢

- 公司簡介

- OI Glass Inc.

- Gerreshmier AG

- Vetropack Holding Ltd

- Ardagh Group SA

- Glassware Depot

- SGD SA(SGD Pharma)

- Pigeon Corporation

- Mayborn Group Limited

- Evenflo Feeding

- Sundelight Infant Products Ltd

第9章 市場未來展望

The Baby Food Glass Packaging Market size is estimated at USD 18.05 million in 2024, and is expected to reach USD 21.97 million by 2029, growing at a CAGR of 4.01% during the forecast period (2024-2029).

The market for baby food is rising due to the convenience in the demand for food safety. Due to this, there is a preference given to the hygiene and easy-to-carry factor. The increasing birth rate in countries like India and China and the consciousness of consumers are the aspects that drive the baby food packaging market.

Key Highlights

- Consumer propensity for healthier food choices, whether organic, natural, or even functionally improved, has transformed the market's environment, spreading to the baby nutrition business. The demand for natural baby food products is driven by the need to give newborns adequate nutrition to support healthy growth and development. As a result, the products must be supplemented with naturally present nutrients that assist in healthy growth and development.

- One of the primary factors that is expected to drive the growth of the baby food market is the growing population and the growing number of working women, and the problems regarding nutrition in infants and young children are also driving the demand for baby food. According to the International Monetary Fund, the population of China was 1400.11 million in 2017, and it reached 1411.75 million in 2022. Such population growth would leverage the baby food glass packaging market.

- According to a study conducted by Baby Center LLC in April 2022, when buying baby food, consumers can choose glass jars, plastic containers, and pouches. Glass jars are recyclable and do not drain chemicals, but they are heavy and prone to breaking. Plastic containers are light and recyclable but may drain chemicals into food if not made from BPA-free material. Pouches are convenient and do not break but may delay developmental skills in children if overused. Glass jars are recommended by the American Academy of Pediatrics (AAP) for sorting or preparing food. Glass jars eradicate the risk of harmful chemicals found in some plastics that can contaminate baby food and are also recyclable.

- The market also encounters challenges with the dynamic and strict regulations and standards that have to be followed for making baby food and packaging it in different types of materials such as glass, metal, plastic, and paper.

- The market developed significantly during the COVID-19 pandemic and caused people to switch to internet shopping and panic stocking, raising demand for essential foods like milk, baby food, and vegetables. Aseptic packaging has also gained popularity due to concerns about food hygiene caused by COVID-19. Customers are anticipated to choose superior packaging in the upcoming years to prevent these diseases, forcing vendors to consider sustainable aseptic packaging (glass) for baby and toddler food.

Baby Food Glass Packaging Market Trends

Baby Food to be the Fastest Growing Application Segment

- Glass packaging with P/T seals proves highly effective for preserving pasteurized or sterilized baby food. This packaging ensures protection from microbial spoilage and oxidation, allowing it to remain unrefrigerated for extended periods while maintaining its valuable qualities.

- Moreover, glass packaging boasts minimal material migration to food and can be efficiently recycled alongside metal seals. Consequently, packaging waste poses no threat to the environment. According to scientists, bottle-fed infants are ingesting millions of microplastic particles daily. The recommended high-temperature procedure for sterilizing plastic bottles and preparing formula milk was found to cause the shedding of millions of microplastics and trillions of even smaller nanoplastics.

- The push for sustainable packaging is a significant trend across industries. Glass is a highly sustainable material as it is 100% recyclable and can be reused. This appeals to eco-conscious parents who seek eco-friendly options for their baby's food, as most parents are conscious of the safety and health of their infants. Glass containers are considered a safe and non-toxic option for storing baby food, as they do not leach harmful chemicals into the food, ensuring the purity of the contents.

- Glass containers allow consumers to see the product inside, reassuring them about the quality and freshness of the baby food. This transparency is a key selling point, particularly for organic and natural baby food products. Advanced packaging technologies, such as vacuum-sealing and airtight lids, are being used to extend the shelf life of baby food in glass containers. This ensures longer product freshness without the need for preservatives.

Europe to Register Significant Growth

- The demand for convenience, variety, and more nutritional baby food is a factor driving the increasing consumption of baby food. The growth of the middle class and the rising working female population are also factors boosting the market. Consumers are more conscious of their baby's health, which increases demand for natural, vegan, and organic baby food. In response to the growing demand for organic and vegan baby foods, manufacturers are developing new products to expand their market share. The demand for a variety of baby food products, including organic and vegan options, necessitates different types of packaging to cater for these products. Manufacturers may require specialized packaging solutions to maintain the quality and safety of these products. This drives the need for innovation in baby food packaging.

- In Germany, the combination of consumer preferences for healthier baby food options, the innovative approach of glass manufacturers, and a growing focus on sustainability within the industry is set to fuel the continued expansion of the baby food glass packaging market.

- The increase in glass bottle imports from the United Kingdom indicates a growing demand for glass containers. This increase in supply can benefit the baby food glass packaging market because it suggests that there may be more available glass packaging options, potentially leading to greater competition among glass bottle manufacturers. This competition can lead to better pricing and quality for businesses in the baby food packaging industry.

- In France, a significant breakthrough has been observed in the baby food market in recent years, with small-scale manufacturers gaining prominence. According to the financial newspaper Les Echos, local entrepreneurs are disrupting the industry and meeting the growing demand for organic and homemade products. Organic and homemade baby food products often command premium prices. Consumers who invest in these healthier options are more likely to prefer premium packaging options like glass. Glass containers are often associated with quality and safety, making them an attractive choice for products targeting health-conscious parents.Spanish consumers are increasingly demanding that their children be provided with organic foods. Hence, the baby food market has also taken off with the growing trend of consumer consumption of organic products. Consumer strict government regulation of the manufacture of infant foods has led to slower growth in the market. It benefits consumers, as these regulations ensure food safety and quality products are used. Strict government regulations for baby food production ensure that food safety is maintained and high-quality products are used. Glass containers are considered a safe and non-toxic packaging option. Strict quality and safety standards enforced by government regulations make glass packaging suitable for use as they help maintain the integrity and quality of baby food products.

- The baby food glass packaging market in the Rest of Europe is witnessing a significant focus on sustainability. Companies like Ardagh Glass Packaging are investing in innovative solutions to reduce emissions and minimize resource usage. This is crucial in the context of the baby food industry, as parents are increasingly looking for eco-friendly and sustainable packaging options for their children's food.

Baby Food Glass Packaging Industry Overview

The Baby Food Glass Packaging Market is fragmented with the presence of major players such as Ardagh Group, Gerresheimer AG, SGD Pharma, Pigeon India, and Evenflow Feeding. Players operating in the industry are focused on expanding their business through collaborations, acquisitions, and mergers.

- In October 2023, SGD Pharma announced the decommissioning of one of its two state-of-the-art furnaces at the company's production facility in Saint-Qentin-Lampotte, France. This project is part of the company's comprehensive decarbonization plan and will contribute to a two-thirds reduction in global carbon emissions by 2040.

- In May 2023, Ardagh Glass Packaging (AGP) - UK announced the building of a highly sustainable, efficient furnace that is set to minimize greenhouse gas emissions from the glass production process. The furnace, set to be installed at the AGP - Doncaster, UK Facility, employs the latest industrial technology to provide a more efficient melter with significantly reduced gas consumption and carbon emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Plastics Continue to Record Stronger Growth Compared to Glass Containers

- 5.1.2 Overall Growth in Demand for Organic and Natural Baby Foods and Innovations in Baby Food Packaging

- 5.2 Market Restraints

- 5.2.1 Issues Related Material Regulations

- 5.3 Summary of Baby Food Industry with Geographical Trends

- 5.4 Industry Regulations and Standards

- 5.5 Relative Demand Analysis of Major Material Types Glass, Plastic, Paperboard and Metal

- 5.6 Role of Sustainability and Convenience in the Baby Food Packaging Industry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Baby Food

- 6.1.2 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Middle East & Africa

- 6.2.5 Latin America

- 6.2.1 North America

7 MARKET SEGMENTATION - BABY GLASS BOTTLES (NURSING/FEEDING)

- 7.1 By Geography

- 7.1.1 North America

- 7.1.1.1 United States

- 7.1.1.2 Canada

- 7.1.2 Europe

- 7.1.2.1 Germany

- 7.1.2.2 United Kingdom

- 7.1.2.3 France

- 7.1.2.4 Spain

- 7.1.2.5 Rest of Europe

- 7.1.3 Asia-Pacific

- 7.1.3.1 China

- 7.1.3.2 Japan

- 7.1.3.3 India

- 7.1.3.4 Rest of Asia-Pacific

- 7.1.4 Rest of the World

- 7.1.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 O-I Glass Inc.

- 8.1.2 Gerreshmier AG

- 8.1.3 Vetropack Holding Ltd

- 8.1.4 Ardagh Group S.A.

- 8.1.5 Glassware Depot

- 8.1.6 SGD SA (SGD Pharma)

- 8.1.7 Pigeon Corporation

- 8.1.8 Mayborn Group Limited

- 8.1.9 Evenflo Feeding

- 8.1.10 Sundelight Infant Products Ltd