|

市場調查報告書

商品編碼

1408831

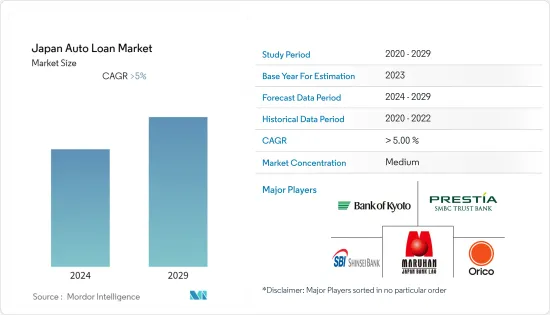

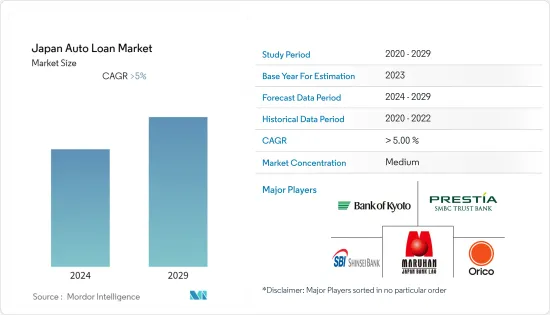

日本汽車貸款:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Japan Auto Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

本會計年度日本汽車貸款市場貸款餘額預計為86.7億美元,預測期內複合年成長率將超過5%。

日本的貸款餘額持續逐年增加,顯示包括汽車貸款在內的貸款合約數量增加。在日本的小客車領域,中型汽車和小型貨車的銷售佔有率較高,貸款提供者專注於汽車貸款市場的特定部分。自新冠疫情以來,國內商用車銷量持續下降,導致貸款提供者轉向小客車以增加市場佔有率。違約率上升、工資成長放緩導致的通貨膨脹以及政府的支持措施都對該行業產生了負面影響。

由於國內貸款利率下降,貸款機構主要關注汽車價格的上漲,促使客戶選擇汽車貸款購買汽車,增加了汽車貸款機構的業務。汽車製造商創建自己的融資公司,讓買家更容易購買汽車。豐田、SUZUKI、大發、本田和日產都有自己的金融公司,如豐田金融服務、日產金融服務以及其他作為日本主要經銷商存在的金融公司。

長野縣、群馬縣、茨城縣和栃木縣的汽車持有率超過65%。在日本,由於都市區大眾交通工具的可用性,小客車的比例隨著遠離都市區都市區而增加,而這一人群正在成為汽車貸款的潛在購買者。自COVID-19以來,隨著電動車市場的興起,政府正在補貼電動車的購買成本,因為電動車的價格相對高於傳統汽車,這使其成為汽車貸款提供者的新選擇。創造新的商業機會。

日本汽車貸款市場趨勢

小客車銷量增加

自COVID-19以來,日本小客車銷量有所增加,而商用車銷量持續下降。 SUV、中型轎車、大型轎車和全尺寸貨車正在推動小客車的成長,而其他區隔市場則繼續呈現小幅下滑。隨著因COVID-19而陷入負成長的經濟逐漸走強,新車銷售量與前一年同期比較呈現超過20%的高成長率。從小客車銷售來看,豐田、SUZUKI、大發、本田、日產、馬自達是日本排名前列的汽車製造商。除此之外,該地區的三輪車銷量也呈現正成長,加上推出的電動車燃油效率的提高,小客車銷量在未來幾年將呈現正成長,從而帶動貸款業務。預計會去。

網路銀行業務增加

隨著銀行、金融科技公司、非銀行金融公司、OEM和其他貸款機構擴大涉足汽車貸款領域,市場競爭持續變得更加激烈。因此,貸款提供者正在轉向數位技術來擴大其市場範圍,並使客戶更能負擔得起汽車貸款。借款人發現,透過一個舒適的地點比較混合貸款和線上貸款提供者的不同汽車貸款報價更加舒適。 COVID-19 之後,日本數位銀行的淨利息收入持續增加,促使線上提供產品的汽車貸款提供者增加。隨著越來越多的貸方接受數位化存在以提高銷售的作用,銀行、金融公司和OEM正在投資數位化其貸款流程服務,這也是汽車貸款的未來貸款過程模式。

日本汽車貸款產業概況

日本汽車貸款市場較為分散,參與企業數量不斷增加。汽車價格急劇上升促使更多的人透過貸款為汽車融資。銀行業的技術創新使金融機構能夠提供數位貸款服務,擴大其覆蓋範圍和市場規模。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 小客車需求增加

- 透過數位銀行業務快速處理貸款

- 市場抑制因素

- 利率增加

- 市場機會

- 由於金融公司靈活的利率設置,貸款銷售增加

- 電動車新興市場擴大汽車貸款市場

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 日本汽車貸款市場的技術創新

- COVID-19 對市場的影響

第5章市場區隔

- 依車型

- 小客車

- 商用車

- 車齡

- 新車

- 二手車

- 依最終用戶

- 個人

- 公司

- 依貸款提供者

- 銀行

- OEM

- 信用合作社

- 其他

第6章 競爭形勢

- 市場集中度概覽

- 公司簡介

- Maruhan Japan Bank

- SMBC Trust Bank

- Bank of Kyoto

- Orient Corporation

- Orient Corporation

- Mitsubishi UFJ Financial Group

- Volkswagen Financial Services Japan

- HDB Financial Service

- Toyota Financial Services

- Nissan Financial Services

第7章 市場未來趨勢

第 8 章 免責聲明/關於出版商

Japan's auto loan market has a loan outstanding of USD 8.67 billion in the current year and is poised to register a CAGR of more than 5% for the forecast period.

The value of outstanding loans in Japan has observed a continuous rise over the years, signifying an increase in the number of loan policies being taken, including auto loans as well. In the passenger vehicles segment of the country, medium cars and minivans have more share in market sales, leading to loan providers focusing on certain sections of the auto loan market. Sales of commercial vehicles in the country are observing a continuous decline post covid resulting in loan providers shifting toward passenger vehicles to increase their market share. Rise in the level of default rate, inflation with a decline in wage rate growth, and government support measures are among the factors negatively affecting the industry.

With an existing lower interest rate on loans in the country, loan providers are majorly focusing on the rising price of automobiles, which is resulting in customers opting for auto loans to finance their vehicles and increase the business of automobile loan providers. Automobile manufacturers are coming up with their own finance companies to make it simple for buyers to buy the car. Toyota, Suzuki, Daihatsu, Honda, and Nissan are existing as leading sellers in Japan having their own finance companies such as Toyota Financial Services, Nissan Financial Services, and others.

Nagano, Gunma, Ibaraki, and Tochigi are among the cities in Japan with a leading automobile share of more than 65% of their population. The share of passenger vehicles in the country increases with distance away from cities because of the availability of public transportation facilities in the cities and is leading to population segment away from cities emerging as potential buyers of auto loans in the market. Post-COVID-19, with the emerging market of electric vehicles, the government is providing subsidies on the cost of electric vehicles as their price is relatively higher than conventional vehicles and is leading to the creation of new business opportunities for auto loan providers.

Japan Auto Loan Market Trends

Increasing Sales Of Passenger Vehicles

Post-COVID-19, sales of passenger vehicles in Japan are observing an increase with a continuous decline in sales of commercial vehicles. SUVs, medium cars, large cars, and full-sized vans are among the segments driving the growth of passenger vehicles, with other segments still observing a small decline in sales. As the economy is gaining strength after observing a negative decline during COVID-19, sales of new vehicles are coming up with strong growth of more than 20% in comparison to last year. Among the passenger vehicle sales, Toyota, Suzuki, Daihatsu, Honda, Nissan, and Mazda are existing as automobile manufacturers leading in auto sales in the country. In addition to this, sales of three-wheelers in the region are also observing positive growth, and combined with the fuel efficiency of launched electric vehicles, sales of passenger vehicles are expected to observe positive growth over the coming years and drive its loan segment business as well.

Rising Online Banking

With an increase in business participation ranging from banks, fintech, NBFC, OEM, and other financial lenders in auto loans, there is continuously increasing competition in the market. As a result of this, loan providers are opting for digital technologies to make it affordable for users to borrow automobile loans and increase their market reach. Borrowers are finding it more comfortable to compare different auto loan offers of hybrid and online loan providers through their comfort place. Post-COVID-19, the net interest income of digital banks in Japan observed a continuous rise, leading to an increasing number of auto loan providers offering their products online. With an increasing number of lenders accepting the role of digital presence for improving their sales, banks, financial companies, and OEMs are investing in digitizing their loan process services, and this is an upcoming loan processing model for auto loans as well.

Japan Auto Loan Industry Overview

The Japanese auto loan market is fragmented, with a continuously increasing number of players in the market. The rising price of automobiles is leading to an increasing number of people financing their vehicles through loans. Technological innovations in the banking industry are resulting in lenders offering their digital loan services to increase their reach and market size. Some of the existing players in the Japanese auto loan market are Maruhan Japan Bank, SMBC Trust Bank, Bank of Kyoto, and SBI Shinsei Bank.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase In Demand For Passenger Vehicles

- 4.2.2 Quick Processing of Loan through Digital Banking

- 4.3 Market Restraints

- 4.3.1 Rise of Interest Rates

- 4.4 Market Opportunities

- 4.4.1 Flexible Interest Rate by Financing Companies Raising their Loan Sales

- 4.4.2 Emerging Market of Electric Vehicles Expanding the Auto Loan Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Japan Auto Loan Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicle

- 5.1.2 Commercial Vehicle

- 5.2 By Vehicle Age

- 5.2.1 New Vehicle

- 5.2.2 Used Vehicle

- 5.3 By End User

- 5.3.1 Individual

- 5.3.2 Enterprise

- 5.4 By Loan Provider

- 5.4.1 Banks

- 5.4.2 OEM

- 5.4.3 Credit Unions

- 5.4.4 Other Loan Providers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Maruhan Japan Bank

- 6.2.2 SMBC Trust Bank

- 6.2.3 Bank of Kyoto

- 6.2.4 Orient Corporation

- 6.2.5 Orient Corporation

- 6.2.6 Mitsubishi UFJ Financial Group

- 6.2.7 Volkswagen Financial Services Japan

- 6.2.8 HDB Financial Service

- 6.2.9 Toyota Financial Services

- 6.2.10 Nissan Financial Services*