|

市場調查報告書

商品編碼

1408589

廢金屬回收:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Scrap Metal Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

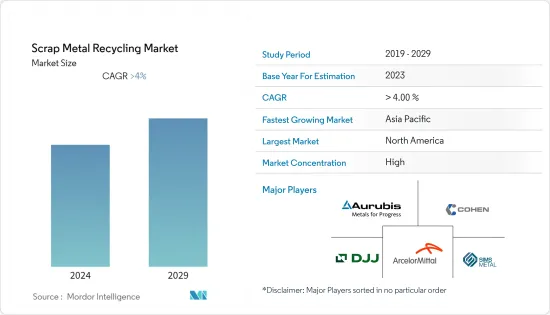

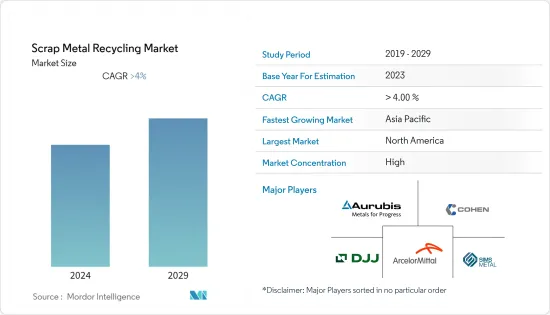

預計到年終,廢金屬回收市場將達到94,739萬噸,預計未來五年將達到11,6433萬噸,預測期內複合年成長率為4%。

COVID-19 對金屬需求產生了負面影響。供應鏈中斷和汽車、建築和製造業等工業生產下降導致產量大幅下降,導致廢金屬產量下降。不過,自從限制解除以來,該產業已經出現反彈。汽車需求的成長正在恢復市場的成長軌跡。

主要亮點

- 市場研究的主要促進因素是汽車、建築和包裝等各行業對金屬的需求不斷成長。此外,環境意識和永續性可能有利於市場成長。

- 另一方面,許多新興國家缺乏基礎設施和收集系統,預計將對預測期內廢金屬回收市場的成長產生負面影響。

- 對電子廢棄物回收的日益關注、對永續材料的需求增加以及對循環經濟的關注預計將為市場提供新的成長機會。

- 預計北美地區將在預測期內主導市場。嚴格的環境法規、強大的基礎設施和完善的回收生態系統支持了這一成長。

廢金屬回收市場趨勢

汽車產業主導市場

- 再生金屬在汽車產業中發揮著重要作用,有助於永續性發展並減少對環境的影響。

- 再生鋼在汽車行業的主要用途之一是生產車身和車架。它們也用於製造汽車中使用的各種鈑金零件,例如門、引擎蓋、擋泥板和行李箱蓋。此外,底盤和底盤部件通常由回收鋼製成。許多懸吊部件和安全部件(例如座椅框架和安全梁)通常由回收鋼製成。

- 由於其重量輕、強度高,鋁也是汽車產業的重要材料。再生鋁用於製造引擎缸體、車輪和車身面板等零件。回收鋁所需的能源比從鋁土礦原礦中生產鋁所需的能源要少得多,這使其成為環保選擇。再生銅也可用於汽車佈線和電氣元件。

- 此外,回收的鉛可以重新熔化來製造新的汽車電池,從而重新開始循環。

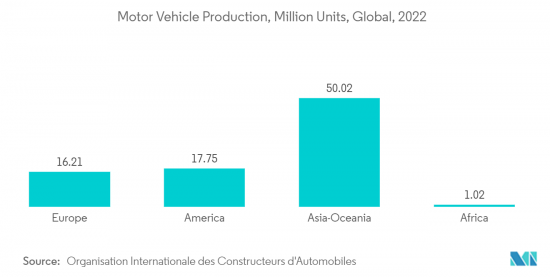

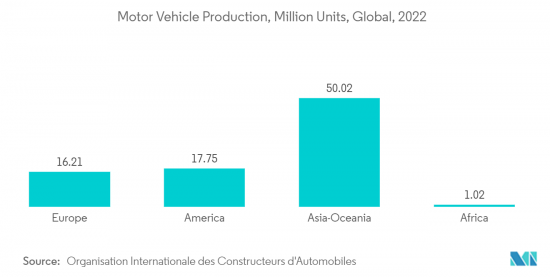

- 2022年,全球汽車產業的汽車產量將大幅成長,全球汽車產量將超過8,500萬輛。 6%與前一年同期比較成長表明汽車需求的增加,這對廢金屬回收市場產生了影響。

- 美國汽車產量成長尤為顯著,2022與前一年同期比較成長10%。加拿大產量預計將增加至122萬台,墨西哥產量將增加至350萬台,美國將增加至1,006萬台。

- 此外,美國對國內電動車(EV) 製造的投資表明,人們越來越關注電動車生產及相關零件。汽車製造商宣布,到2022年,他們將在電動車製造上總合投資130億美元,並且有明顯的趨勢轉向電動車的開發和引進。

- 2022年,歐洲汽車產量小幅下降1%至16,216,888總合。這種下降是由多種因素造成的,包括歐洲能源危機和持續的供應鏈中斷。這些挑戰對歐洲汽車產業產生負面影響,並增加其在 2023 年的脆弱性。

- 在該地區人口成長的推動下,亞洲的經濟和產業不斷發展。汽車產業是受益於此成長的產業之一,人口的成長增加了對高效行動解決方案的需求。亞洲因擁有一些全球最有價值的汽車製造商而享有盛譽。

- 同樣,韓國的汽車產量也出現了正成長。根據韓國汽車工業協會(KAMA)預測,2022年韓國汽車產量為375萬輛,比上年的362萬輛產量增加9%。

- 南美洲的汽車工業取得了重大進展,但各國的生產趨勢各不相同。哥倫比亞成長顯著,達 51,455 輛,與前一年同期比較成長 26%。阿根廷也出現了24%的大幅成長,產量達到536,893輛。

- 考慮到這些因素,廢金屬回收市場預計將受益於全球汽車產量增加、北美和亞洲汽車製造激增以及電動車市場擴大導致的汽車需求增加。

北美市場佔據主導地位

- 鋼和鋁等再生金屬通常用於建築計劃。它們用於製造結構元件、鋼筋、屋頂材料和外牆板。建築中的再生金屬減少了對原料的需求,節省能源並減少碳排放。

- 許多電子設備都使用金屬,特別是金、銀、鉑和鈀等貴金屬。這些金屬用於電路基板、連接器、接線和各種組件。廢棄物電子廢棄物對於回收有價值的金屬和防止有害物質最終進入垃圾掩埋場至關重要。

- 在航太領域,鋁和鈦等回收金屬用於製造機翼、機身和引擎零件等飛機零件。它們還可用於各種消費品。椅子和床架等金屬家具通常含有回收材料。在家用電器中,它用於金屬外殼、框架和內部零件等部件。

- 美國擁有北美最大的航空市場,也擁有世界上最大的持有隊之一。航太零件對法國、中國和德國等國家的出口強勁,美國的個人消費也強勁,因此航太工業的製造活動不斷增加,這也增加了該國的航太材料市場。有望帶來動力。

- 此外,根據美國聯邦航空管理局(FAA)的數據,到2041年,美國民航機數量預計將增加至8,756架,複合年成長率為2%。

- 航太的成長預計將對航太材料的需求產生積極影響,從而影響該國的廢金屬回收市場。

- 在2022年國防預算中,美國政府批准了7,682億美元用於國防項目,比拜登政府最初的預算要求增加了約2%。

- 根據美國人口普查局的數據,美國住宅量顯著成長,顯示住宅建築業蓬勃發展。 2023年5月私人住宅開工數量經季節性已調整的的年率達1,631,000套,與2023年4月的修正數字相比大幅增加21.7%。 2023年5月單戶住宅開工數量也大幅增加18.5%。這些數字顯示了對住宅的強勁需求以及所研究的住宅建築市場的潛力。

- 2022年,加拿大電商用戶將超過2,700萬,佔加拿大人口的75%。預計到 2025 年這一數字將增至 77.6%。根據國際貿易局統計,2022年3月電子商務銷售額約23.4億美元。到 2025 年,零售電子商務銷售額預計將達到 403 億美元。隨著電子商務的不斷擴張,對電子產品高效回收和處置的需求也將成長。

- 所有上述因素預計將在預測期內推動北美廢金屬回收市場的成長。

廢舊金屬回收業概況

廢金屬回收市場正在整合。主要公司(排名不分先後)包括 Aurubis AG、COHEN、The David J. Joseph Company, LLC、Sims Limited 和 ArcelorMittal。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 環保意識與永續性

- 金屬回收可節省能源

- 各個最終用戶產業不斷成長的需求

- 抑制因素

- 許多國家缺乏基礎設施和收集系統

- 品質和污染問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 金屬類型

- 鐵

- 鐵

- 鋼

- 有色金屬

- 銅

- 鋁

- 鉛

- 其他

- 鐵

- 按行業分類

- 車

- 航太/國防

- 建造

- 電力/電子

- 製造業和工業部門

- 家用電器

- 其他

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AIM Recycling

- ArcelorMittal

- Aurubis AG

- CMR Green Technologies Ltd

- COHEN

- Greenwave Technology Solutions, Inc.

- OmniSource, LLC

- Sims Limited

- SL Recycling

- The David J. Joseph Company(Nucor Corporation)

- TKC Metal Recycling Inc.

第7章 市場機會及未來趨勢

- 不斷成長的電子廢棄物回收市場

- 對永續材料的需求不斷成長並關注循環經濟

The scrap metal recycling market is estimated to reach 947.39 million tons by the end of this year and is projected to reach 1,164.33 million tons in the next five years, registering a CAGR of 4% during the forecast period.

Covid-19 negatively impacted the demand for metals. The disruption in supply chains and decline in industrial production such as automotive, construction, and manufacturing experienced a significant decline in production, leading to reduced scrap metal generation. However, since restrictions were removed, the industry has been recovering. A rise in demand for automobiles is restoring the market's growth trajectory.

Key Highlights

- A major factor driving the market studied is the growing demand for metals from various industries such as automotive, construction, and packaging. Additionally, environmental awareness and sustainability will likely favor the market's growth.

- On the flip side, the lack of infrastructure and collection systems in many developing countries will negatively affect the growth of the scrap metal recycling market during the forecast period.

- The growing focus on E-waste recycling, increasing demand for sustainable materials, and focus on circular economy will likely provide new growth opportunities for the market.

- North American region is expected to dominate the market during the forecast period. Stringent environmental regulations, strong infrastructure development, and a well-established recycling ecosystem drive this growth.

Scrap Metal Recycling Market Trends

Automotive Industry to Dominate the Market

- Recycled metals play a significant role in the automotive industry contributing to sustainability efforts and reducing environmental impacts.

- One of the primary uses of recycled steel in the automotive industry is in the production of vehicle bodies ad frames. These are also used to manufacture various sheet metal components used in vehicles, such as doors, hoods, fenders, and trunk lids. Moreover, chassis and undercarriage components are often made from recycled steel. Many of the suspension parts and safety components, such as seat frames and safety beams, are often made of recycled steel.

- Aluminum is another essential material in the automotive industry due to its lightweight and strength properties. Recycled aluminum is used to produce parts like engine blocks, wheels, and body panels. Recycling aluminum requires significantly less energy than producing it from raw bauxite ore, making it a more environmentally friendly option. Recycled copper can also be used in automotive wiring and electrical components.

- Moreover, recycled lead can be remelted to create new car batteries, starting the cycle from the beginning.

- The global automotive industry experienced a significant increase in vehicle production in 2022, with more than 85 million motor vehicles manufactured worldwide. This 6% growth compared to the previous year indicates a rising demand for automotive, influencing the scrap metal recycling market.

- The growth in America's automotive production is particularly notable, with a 10% year-on-year increase in 2022. Canada, Mexico, and the United States all witnessed production expansions, reaching production figures of 1.22 million units, 3.50 million units, and 10.06 million units, respectively.

- Furthermore, the investment in domestic electric vehicle (EV) manufacturing in the United States indicates a growing focus on EV production and associated components. With auto manufacturing companies announcing a combined investment of USD 13 billion in EV manufacturing in 2022, there is a clear push toward developing and adopting electric vehicles.

- In 2022, Europe experienced a slight decline of 1% in motor vehicle production, with a total of 16,216,888 vehicles manufactured. This decrease can be attributed to several factors, such as the energy crisis in Europe and ongoing supply chain disruptions. These challenges have had a negative impact on the European automotive sector, making it more vulnerable in 2023.

- Asia's economies and sectors, driven by the region's growing population, continuously evolve. The automotive industry is one of the sectors benefiting from this growth, as the increasing population creates a higher demand for efficient mobility solutions. Asia has gained a reputation for being home to some of the world's most valuable vehicle manufacturers.

- Similarly, South Korea has experienced positive growth in automotive production. According to the Korea Automobile Manufacturers Association (KAMA), the country produced 3.75 million vehicles in 2022, representing a notable 9% increase compared to the previous year's production of 3.62 million units.

- In South America, there have been notable developments in the automotive industry, with different countries experiencing varying production trends. Colombia witnessed a significant increase in year-on-year production, with a 26% jump, reaching 51,455 units. Argentina also experienced substantial growth, with a 24% increase and production reaching 536,893 units.

- Considering these factors, the scrap metal recycling market is expected to benefit from the increased demand for automobiles driven by the growing global vehicle production, the surge in North American and Asian automotive manufacturing, and the expanding EV market.

North America to Dominate the Market

- Recycled metals, such as steel and aluminum, are commonly used in construction projects. They are utilized to create structural elements, reinforcing bars, roofing materials, and facade panels. The recycled metals in construction reduce the demand for raw materials, conserves energy, and lowers carbon emissions.

- Many electronic devices contain metals, especially precious metals like gold, silver, platinum, and palladium. These metals are used in circuit boards, connectors, wiring, and various components. Recycling electronic waste is crucial for recovering valuable metals and preventing hazardous materials from ending up in landfills.

- The aerospace sector utilizes recycled metals, such as aluminum and titanium, in the manufacturing of aircraft components, including wings, fuselages, and engine parts. These can also be used in various consumer goods. Metal furniture pieces, such as chairs and bed frames, often contain recycled contents. In household appliances, these are used in components like metal casings, frames, and internal parts.

- The United States has the largest aviation market in North America and one of the world's largest fleet sizes. Strong exports of aerospace components to countries, such as France, China, and Germany, along with robust consumer spending in the United States, have been driving the manufacturing activities in the aerospace industry, which is expected to induce a positive momentum for the aerospace material market in the country.

- Additionally, in the United States, according to the Federal Aviation Administration (FAA), the commercial fleet is forecast to increase to 8,756 in 2041, with an average annual growth rate of 2% per year.

- This growth in the aerospace industry is expected to positively impact the demand for aerospace materials, thereby influencing the scrap metal recycling market in the country.

- In the 2022 defense budget, the United States government allowed USD 768.2 billion for national defense programs, which is about a 2% increase from the Biden administration's original budget request.

- According to the United States Census Bureau, housing starts have shown a notable increase in the United States, indicating a thriving residential construction sector. Privately-owned housing starts in May 2023 reached a seasonally adjusted annual rate of 1,631,000, a significant rise of 21.7% compared to the revised April 2023 estimate. Single-family housing starts also experienced a substantial growth rate of 18.5% in May 2023. These figures indicate a strong demand for housing and a potential market for the studied market in residential construction.

- In 2022, there were over 27 million eCommerce users in Canada, accounting for 75% of the Canadian population. This number is expected to grow to 77.6% in 2025. According to the International Trade Administration, in March 2022, e-commerce sales amounted to approximately USD 2.34 billion. Retail eCommerce sales are estimated to total USD 40.3 billion by 2025. As e-commerce continues to expand, there will be a corresponding need for efficient recycling and disposal of electronics.

- All the above-mentioned factors are likely to fuel the growth of North America's scrap metal recycling market over the forecast time frame.

Scrap Metal Recycling Industry Overview

The scrap metal recycling market is consolidated. Some of the major companies (in no particular order) are Aurubis AG, COHEN, The David J. Joseph Company, LLC, Sims Limited, and ArcelorMittal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Awareness and Sustainability

- 4.1.2 Metal Recycling Leading to Energy Saving

- 4.1.3 Growing Demand from Various End-user Industries

- 4.2 Restraints

- 4.2.1 Lack of Infrastructure and Collection Systems in Many Countries

- 4.2.2 Quality and Contamination Issues

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Ferrous

- 5.1.1.1 Iron

- 5.1.1.2 Steel

- 5.1.2 Non-ferrous

- 5.1.2.1 Copper

- 5.1.2.2 Aluminum

- 5.1.2.3 Lead

- 5.1.2.4 Others

- 5.1.1 Ferrous

- 5.2 Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Manufacturing and Industrial Sectors

- 5.2.6 Consumer Appliances

- 5.2.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AIM Recycling

- 6.4.2 ArcelorMittal

- 6.4.3 Aurubis AG

- 6.4.4 CMR Green Technologies Ltd

- 6.4.5 COHEN

- 6.4.6 Greenwave Technology Solutions, Inc.

- 6.4.7 OmniSource, LLC

- 6.4.8 Sims Limited

- 6.4.9 SL Recycling

- 6.4.10 The David J. Joseph Company (Nucor Corporation)

- 6.4.11 TKC Metal Recycling Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing E-waste Recycling Market

- 7.2 Increasing Demand for Sustainable Materials and Focus on Circular Economy