|

市場調查報告書

商品編碼

1408587

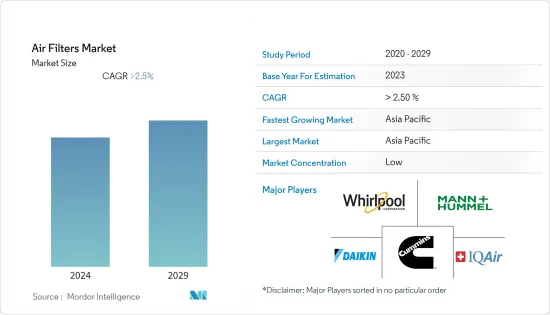

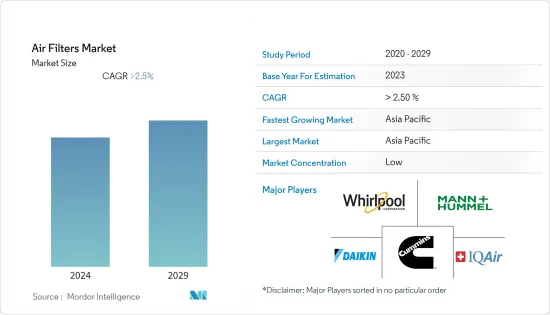

空氣濾網:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Air Filters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計 2024 年空氣濾網市場規模為 162.8 億美元,預估 2029 年將達 220.1 億美元,預測期內複合年成長率為 2.5%。

主要亮點

- 在短期內,汽車數量的增加(特別是在開發中國家)以及政府有關污染排放控制參數的政策等因素預計將在預測期內推動市場。

- 另一方面,空氣過濾器的技術限制預計將在預測期內抑制空氣過濾器市場。

- 但在中國、印度等開發中國家,人們的生活水準正在提高,意識正在轉向健康意識。低度開發國家和開發中國家正在青睞清新無塵環境的政府政策,這有望為空氣濾清器市場創造市場機會。

- 由於開發中國家使用空氣過濾器,亞太地區預計將在預測期內主導市場。

空氣濾清器市場趨勢

HEPA 過濾器預計將獲得大量需求

- HEPA 過濾器是高效微粒空氣過濾器。 HEPA 過濾器理論上可以去除 99.97% 以上的灰塵、花粉、黴菌、細菌和小至 0.3 微米(兩公尺)的空氣微粒。 0.3 微米的直徑規格對應於最壞情況下的最具穿透力的顆粒尺寸 (MPPS)。

- 使用 HEPA 過濾器有多種好處。 HEPA 過濾器是醫院和診所等醫療環境中的標準過濾系統。這主要是因為空氣濾網的效率更高,可以去除空氣中可能造成嚴重危害的無機灰塵和微生物。例如空氣中的病毒、細菌、蟎蟲、黴菌孢子和花粉。

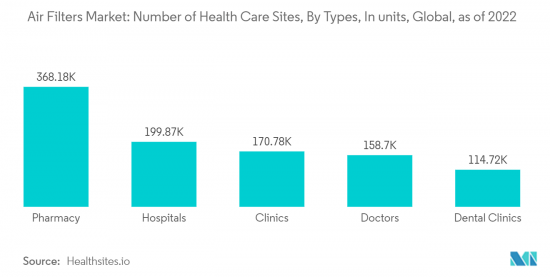

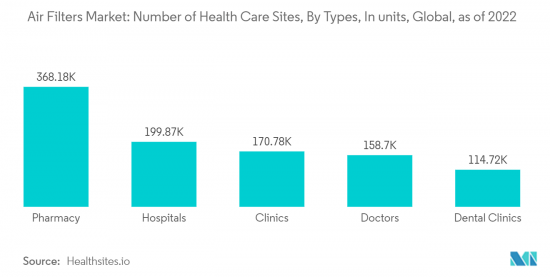

- 截至2022年,全球醫療機構總數為1,066,600個。隨著人口的增加,人們關心更好的呼吸環境,空氣過濾器的採用預計會增加,特別是在所有醫療環境中。

- 近年來,世界各地的污染水平急劇上升。因此,從事該行業的公司專注於開發和推出創新產品。例如,2022年12月,康斐爾集團宣布推出其最新系列的V-bank HEPA過濾器,預計該過濾器的使用壽命更長,維護成本更低。

- 因此,鑑於上述幾點,高效顆粒空氣(HEPA)技術預計將在預測期內佔據市場主導地位。

亞太地區預計將主導市場

- 亞太地區是空氣過濾器市場需求的驅動力。印度、新加坡、印尼和中國等開發中國家的工業成長正處於頂峰。預計在預測期內推動空氣清淨機市場的需求。

- 印尼正計劃在雅加達建造燃煤發電廠,這可能會加劇空氣污染並增加空氣清淨機的使用。例如,2022年12月,LG電子印尼公司宣布推出一系列針對住宅和商業終端用戶的室內空氣處理產品。

- 另一方面,在印度,空氣清淨機的市場主要局限於大城市。然而,預計在預測期內將會成長。此外,由於空氣過濾器的技術進步,預計市場在預測期內將成長。

- 例如,2022 年 12 月,IISc Banglore 開發了一種殺菌空氣過濾器,可以使用綠茶中常見的多酚和聚陽離子聚合物等成分來惰性細菌。這種新型抗菌空氣過濾器在 NABL 認可的實驗室進行了測試,發現對 SARS-CoV-2(Delta變種)的有效率為 99.24%。

- 綜上所述,亞太地區預計將在預測期內主導空氣過濾器市場。

空氣濾清器產業概況

- 空氣過濾器市場分散。市場的主要企業包括(排名不分先後)康明斯公司、大金工業有限公司、IQAir、曼胡默爾集團和惠而浦公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 汽車數量增加

- 政府污染排放控制政策

- 抑制因素

- 空氣過濾器的技術限制

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 種類

- 筒式過濾器

- 集塵機

- HEPA過濾器

- 袋式除塵器

- 其他

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 歐洲

- 英國

- 法國

- 義大利

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Cummins, Inc.

- Daikin Industries, Ltd.

- IQAir

- MANN+HUMMEL Group

- Whirlpool Corporation

- Panasonic Corporation

- Donaldson Company, Inc.

- Air Filters, Inc.

- Sharp Electronics Corporation

- K&N Engineering, Inc.

第7章 市場機會及未來趨勢

- 制定政府支持政策,打造清新無塵環境

簡介目錄

Product Code: 50001272

The air filters market size is estimated at USD 16.28 billion in 2024 and is expected to reach USD 22.01 billion by 2029, registering a CAGR of 2.5% during the forecast period.

Key Highlights

- Over a short span, factors like increasing numbers of automobiles, especially in developing countries, and government policies regarding pollution emission control parameters are expected to drive the market in the forecast period.

- On the other hand, the technological limitations of air filters are expected to restrain the air filter market during the forecast period.

- Nevertheless, people are improving their living standards in developing countries like China, India, etc, and shifting their mindset towards health consciousness. Supportive government policies for a fresh and dust-free environment in underdeveloped and developing countries are expected to create market opportunities for the air filter market.

- Asia-Pacific is expected to dominate the market in the forecast period owing to the use of air filters in developing countries.

Air Filters Market Trends

HEPA filters are Expected to Witness Significant Demand

- HEPA filters are high-efficiency particulate air filters. They can theoretically remove at least 99.97% of dust, pollen, mold, bacteria, and any airborne particles with a size of 0.3 microns (µm). The diameter specification of 0.3 microns corresponds to the worst case, the most penetrating particle size (MPPS).

- There are various advantages to using HEPA filters. HEPA filters are the standard filtration system in medical settings, such as hospitals and clinics. This is mainly because air filters with higher efficiency remove inorganic dust suspended in the air and microscopic organisms that may cause serious harm. Some examples are airborne viruses, bacteria, dust mites, mold spores, and pollen.

- As of 2022, there were a total number of 1066.6 thousand healthcare sites across the world. As the population increases, people are concerned about a better respiratory environment and air filter adoption is expected to increase, especially in all medical sites.

- Pollution levels across the globe have increased dramatically in recent years. Hence, companies operating in the industry have focused on developing and introducing innovative products. For instance, in December 2022, the Camfil group announced the launch of its latest range of V-bank HEPA filters, which are expected to have a longer lifespan and reduced maintenance costs.

- Therefore, owing to the above points, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has been a catalyst for demand in the air filters market. In developing nations such as India, Singapore, Indonesia, and China, industrial growth is at its peak. It is expected to drive demand in the air purifier market during the forecast period.

- Indonesia is set to build more coal-fired power plants in Jakarta, which may lead to more air pollution and increase the adoption of air purifiers. For instance, in December 2022, LG Electronics Indonesia announced the launch of a series of indoor air treatment products for residential and commercial end users.

- On the other hand, in India, the market for air purifiers is mainly confined to metropolises. However, it is expected to grow during the forecast period. Additionally, with technological improvements in air filters, the market is expected to grow in the forecast period.

- For instance, in December 2022, IISc Banglore developed a germ-destroying air filter that can inactivate germs using ingredients like polyphenols and polycationic polymers commonly found in green tea. The novel antimicrobial air filters were tested at a NABL-accredited laboratory and were found to be 99.24% effective against SARS-CoV-2 (delta variant).

- Therefore, owing to the above points, the Asia-Pacific region is expected to dominate the air filter market during the forecast period.

Air Filters Industry Overview

- The air filter market is fragmented. Some of the major players in the market (in no particular order) include Cummins Inc., Daikin Industries Ltd, IQAir, MANN+HUMMEL Group, Whirlpool Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Number of Automobiles

- 4.5.1.2 The Government Policy Regarding Pollution Emission Control Parameters

- 4.5.2 Restraints

- 4.5.2.1 The Technological Limitations of Air Filters

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Cartridge Filters

- 5.1.2 Dust Collectors

- 5.1.3 HEPA Filters

- 5.1.4 Baghouse Filters

- 5.1.5 Others

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Germany

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cummins, Inc.

- 6.3.2 Daikin Industries, Ltd.

- 6.3.3 IQAir

- 6.3.4 MANN+HUMMEL Group

- 6.3.5 Whirlpool Corporation

- 6.3.6 Panasonic Corporation

- 6.3.7 Donaldson Company, Inc.

- 6.3.8 Air Filters, Inc.

- 6.3.9 Sharp Electronics Corporation

- 6.3.10 K&N Engineering, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developing a Supportive Government Policy for a Fresh and Dust-Free Environment

02-2729-4219

+886-2-2729-4219