|

市場調查報告書

商品編碼

1408586

氣體過濾器:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Gas Filters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

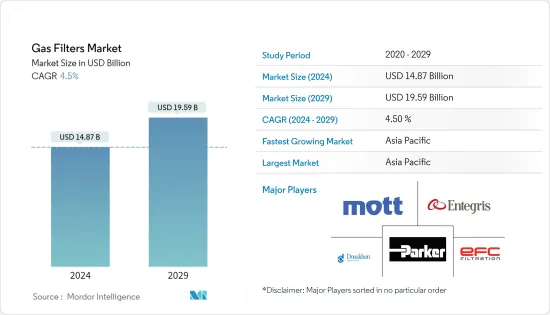

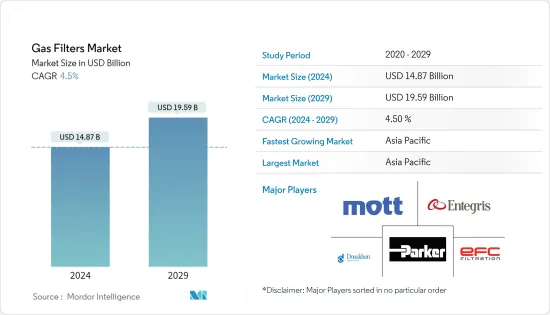

氣體過濾器市場規模預計到 2024 年為 148.7 億美元,預計到 2029 年將達到 195.9 億美元,在預測期內(2024-2029 年)複合年成長率為 4.5%。

預計到年終,氣體過濾器市場規模將達到142.3億美元,預計未來五年將達到187.5億美元,預測期內複合年成長率將超過4.5%。

主要亮點

- 從中期來看,由於工業化的進步以及天然氣用於供暖和發電等各種用途的增加,預計對氣體過濾器的需求將會增加。預計這些因素將在預測期內推動氣體過濾器市場的發展。

- 另一方面,安裝氣體過濾器會導致額外的基礎設施成本。這些條件可能會在預測期內抑制市場。

- 然而,一些政府對向大氣中的氣體排放制定了嚴格的規範和合規性。為了遵守這些標準,工業界必須安裝氣體過濾器,為市場創造利潤豐厚的機會。

- 由於天然氣、壓縮氣體和工業氣體等各領域各種氣體的工業化和利用不斷增加,預計亞太地區將主導市場成長。

氣體過濾器市場趨勢

天然氣過濾器領域呈現成長

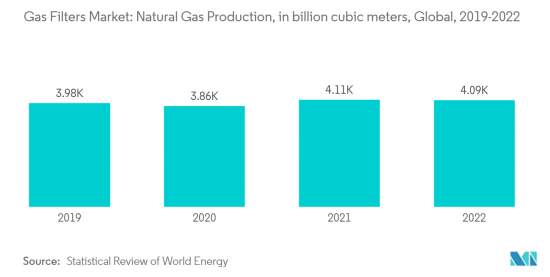

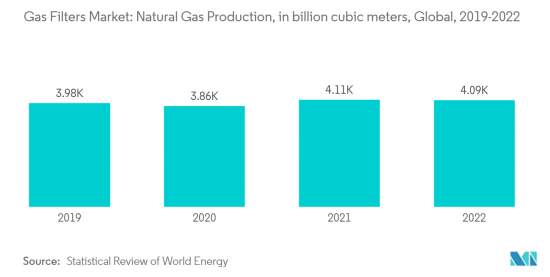

- 天然氣消費量將大幅增加,到2022年將達到40,890億立方公尺(bcm)。這是由於發電和運輸等多個行業對天然氣的需求增加。預計這一趨勢將持續下去,並可能顯著推動天然氣管道基礎設施的發展。

- 到2030年,由於中東、非洲和亞太等地區對環境效益和能源安全的追求,與其他燃料類型相比,天然氣的需求預計將出現更大的成長。

- 隨著液化天然氣消耗量的大幅增加,全球液化天然氣貿易預計將增加。根據CEDIGAZ公佈的資料,2022年液化天然氣貿易量平均約為517億立方英尺/天(Bcf/d)。

- 天然氣含有污染物,必須經過過濾才能使用或排放到環境中。天然氣含有大量固體和液體污染物,必須透過過濾有效去除這些污染物,然後才能進行商業性使用。

- 礦床氣等新天然氣來源的開發以及由此產生的價格壓力正在推動天然氣的國際貿易。這種情況進一步增加了對氣體過濾器的需求。

亞太地區主導市場

- 由於工業化程度的提高,亞太地區在預測期內可能會顯著成長。乙炔、氬氣、氧氣、氫氣、甲烷、二氧化碳和氦氣等氣體的使用預計將會增加。

- 該地區各國政府對多種工業實踐實施了嚴格的政策,包括安裝氣體過濾器。許多政府正在努力鼓勵該地區採用氣體過濾器。

- 此外,多個產業的擴張和發展也推動了亞太市場的發展。 2023年3月,華錦阿美公司與北方工業集團(阿美公司與盤錦新城工業集團的合資企業)宣佈在中國開始興建大型綜合石化聯合煉油廠。此精製石化聯合體總合為30萬桶/日,年產對二甲苯200萬噸、乙烯165萬噸。該綜合體預計將於 2026 年全面運作。

- 隨著減少石油和煤炭使用的力道加大,燃氣引擎和燃氣渦輪機的使用也增加。汽車產業的天然氣使用量也在增加,促使汽車和零件市場的成長。

- 上述因素預計將在預測期內推動亞太地區氣體過濾器市場的發展。

氣體過濾器產業概況

氣體過濾器市場處於半分散狀態。市場的主要企業包括(排名不分先後)Parker Hannifin Corporation、Donaldson Company Inc.、Mott Corporation、EFC Filtration BV 和 Entegris Inc.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 全球工業化進展

- 天然氣使用量增加

- 抑制因素

- 安裝和維護高成本

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 產品類別

- 天然氣過濾器

- 工業氣體過濾器

- 壓縮氣體過濾器

- 高純度氣體過濾器

- 目的

- 石油工業

- 化學工業

- 食品和飲料

- 製藥

- 電子產品

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Parker Hannifin Corporation

- Donaldson Company, Inc.

- Mott Corporation

- EFC Filtration BV

- WITT-GASETECHNIK GmbH & Co KG

- Entegris, Inc.

第7章 市場機會及未來趨勢

- 最終用途行業的嚴格政府規範

The Gas Filters Market size is estimated at USD 14.87 billion in 2024, and is expected to reach USD 19.59 billion by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The gas filter market is estimated to be at USD 14.23 billion by the end of this year and is projected to reach USD 18.75 billion in the next five years, registering a CAGR of over 4.5% during the forecast period.

Key Highlights

- Over the medium term, the demand for gas filters is expected to increase due to rising industrialization and increasing utilization of natural gas for various purposes like heating, electricity generation, and others. These factors are expected to boost the gas filter market during the forecast period.

- On the other hand, the installation of gas filters adds to the additional cost of infrastructure. This situation is likely to restrain the market during the forecast period.

- Nevertheless, several governments have imposed stringent norms and compliances related to gas emissions into the atmosphere. In order to comply with these standards, industries must install gas filters, thereby creating lucrative opportunities for the market.

- The Asia-Pacific region is expected to dominate the market growth, owing to the rising industrialization and utilization of various gases, such as natural gas, compressed gas, and industrial gas, across various sectors.

Gas Filters Market Trends

Natural Gas Filter Segment to Witness Growth

- Natural gas consumption increased significantly, reaching 4089 billion cubic meters (bcm) in 2022, owing to the increasing demand for natural gas in multiple industries, including power generation and transportation. This trend is expected to continue in the coming years, and it is likely to drive the gas pipeline infrastructure significantly.

- By 2030, due to environmental benefits and the quest for energy security in regions such as the Middle East, Africa, and Asia-Pacific, the demand for natural gas is expected to witness significant growth compared to other fuel types.

- LNG trade is expected to witness a global increase as the consumption of such gases is increasing significantly. In 2022, the average volume of LNG trade was around 51.7 billion cubic feet per day (Bcf/d), according to the data published by CEDIGAZ.

- Natural gas contains contaminants that must be filtered before its utilization and emission into the environment. Natural gas contains numerous solid and liquid contaminants, which must be efficiently removed through filtration before the gas can be used commercially.

- The development of new sources of natural gas, such as shale gas deposits, and the resulting price pressure are boosting the international trade of natural gas. This situation is further boosting the demand for gas filters.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is likely to witness significant growth during the forecast period, owing to increasing industrialization. The utilization of gases, such as acetylene, argon, oxygen, hydrogen, methane, carbon dioxide, and helium, is expected to rise.

- Governments of various countries across the region have imposed stringent policies pertaining to several industrial practices involving the installation of gas filters. Many governments are making efforts to encourage the adoption of gas filters in the region.

- The expansion and development of several industries are also boosting the market in the Asia-Pacific region. In March 2023, Huajin Aramco and a joint venture between NORINCO Group, Aramco, and Panjin Xincheng Industrial Group announced the commencement of the construction of a major integrated petrochemical complex and refinery in China. This refinery and petrochemical plant complex will have a combined capacity of 300,000 barrels per day, along with an annual production capacity of 2 million metric tons of paraxylene and 1.65 million metric tons of ethylene. The complex is expected to be fully operational by 2026.

- The utilization of gas engines and gas turbines is also increasing in the region amid rising efforts to reduce the use of oil and coal. The utilization of gas is also increasing in the automotive sector, thereby leading to growth in the automotive and spare parts markets.

- The above-mentioned factors are likely to boost the gas filter market in the Asia-Pacific region during the forecast period.

Gas Filters Industry Overview

The gas filter market is semi fragmented. Some of the major players in the market (in no particular order) include Parker Hannifin Corporation, Donaldson Company Inc., Mott Corporation, EFC Filtration BV, and Entegris Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Industrialization across the Globe

- 4.5.1.2 Increasing Utilization of Natural Gas

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Installation and Maintenance

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Natural Gas Filter

- 5.1.2 Industrial Gas Filter

- 5.1.3 Compressed Gas Filter

- 5.1.4 High Purity Gas Filter

- 5.2 Application

- 5.2.1 Petroleum Industry

- 5.2.2 Chemical Industry

- 5.2.3 Food and Beverage

- 5.2.4 Pharmaceutical

- 5.2.5 Electronics

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Parker Hannifin Corporation

- 6.3.2 Donaldson Company, Inc.

- 6.3.3 Mott Corporation

- 6.3.4 EFC Filtration B.V.

- 6.3.5 WITT-GASETECHNIK GmbH & Co KG

- 6.3.6 Entegris, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Stringent Government Norms across End-Use Industries