|

市場調查報告書

商品編碼

1408570

綜合設施管理:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Integrated Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

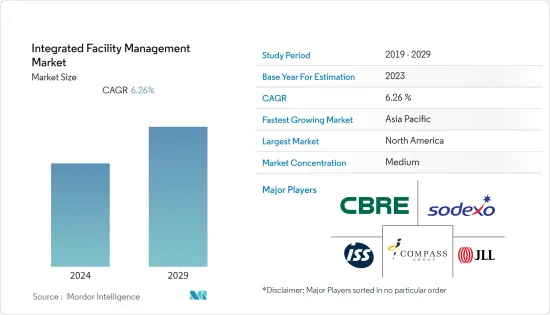

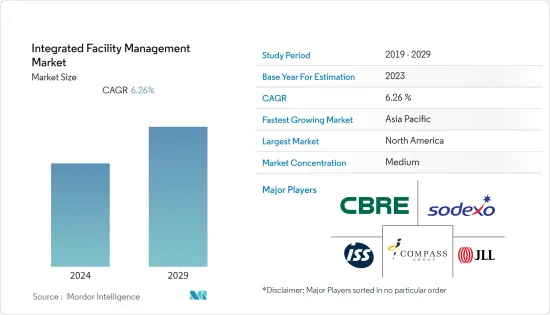

目前綜合設施管理市場的市場規模為1109億美元。

預計未來五年將達1502.3億美元,預測期內複合年成長率為6.26%。

主要亮點

- 綜合設施管理主要涉及將所有設施管理合約整合到一項服務中。整合設施管理將複雜的設施管理與安全、清潔和廢棄物管理等軟 FM 結合。將這些不同的服務整合到一起可以提供更好的客戶服務、設施管理服務之間更好的協調以及整合成本以在預算內完成這一切。

- 該國綜合設施管理的主要趨勢之一是對具有成本效益的解決方案的需求不斷成長。當企業尋找降低成本的方法時,整合設施管理提供者提供有助於降低成本的服務。透過將清潔、維護和安全等服務捆綁到一份合約中,整合設施管理提供者可以提供規模經濟並降低整體業務成本。對業務效率的需求也是推動綜合設施管理需求的因素之一。當公司尋求簡化業務和提高效率的方法時,整合設施管理提供者可以透過提供整合解決方案來幫助公司實現其目標。

- 採礦相關計劃預計將支撐義大利綜合設施管理服務的興起,因為採礦需要對採礦作業的實體資源進行規劃、組織和管理。例如,2022 年 7 月,Vulcan Energy Resources 宣布與義大利地熱能生產商 Enel Green Power (EGP) 合作,探勘和開發義大利羅馬附近的 Vulcan Cesano 許可證。透過利用各自的鋰提取和地熱專業知識,Vulcan 和 EGP 將探索在該地區開發地熱鋰計劃的潛力。

- 根據世界銀行2023年5月發布的資料,波蘭城市人口幾乎維持在60.0%左右不變。此外,2021年捷克共和國的城市人口幾乎維持不變,約75.21%。隨著城市人口密度的增加和都市區的擴大,對高效率建築維護的需求也隨之增加。綜合設施管理和服務包括維護協助、佔用者管理和其他支援服務,以維持建築物和相關基礎設施的順利運作。如此巨大的都市化很可能成為所研究市場的驅動力。

- 此外,設施管理人員必須始終了解能源消耗,並尋找最佳化能源使用和消除浪費的方法。如果沒有合適的工具和專業知識,這可能是一項艱鉅的任務,並且可能需要能源管理顧問的幫助。此外,設施管理團隊在預測和減輕自然災害、設備故障和供應鏈中斷等潛在風險和中斷方面可能面臨挑戰。

- 此外,疫情引發了人們對衛生的新視角,並凸顯了對清潔、消毒等設施管理服務的需求。因此,設施管理有望透過差異化服務來適應新的挑戰。同樣,一些付款人報告說技術支出增加。隨著全球範圍內限制的放鬆,設施管理行業的參與企業發現,根據各政府部門的指示,對商業組織提供的專業衛生和消毒服務的需求顯著增加。

綜合設施管理市場的趨勢

商業領域預計將佔據較大佔有率

- 各國對商業建築業進行了大量投資,推動了設施管理業務的發展。各種投資公司依靠房地產管理公司來處理其房地產投資項目。根據世邦魏理仕義大利公司預計,2022年義大利投資額將達117億歐元(約138.06億美元),創歷史第二高。

- 設施管理市場也見證了供應商和商業實體之間的多種合作活動。例如,最近從西門子股份公司分拆出來的西門子能源公司已將與巴黎工業電氣公司的合作夥伴關係延長三年,以確保對約 385,000平方公尺的西門子辦公和生產空間的技術設施進行管理。此外,透過此次合作,SIPE 還將專注於建築通風、空調、電氣、暖氣和衛生系統、儀器和控制技術的檢查、維護和修理。這將使該公司能夠建立強大的市場地位並擴大基本客群。

- 由於經濟成長、持續多元化和人口成長,特別是高淨值人士 (HNI),每個國家的零售額都在成長。例如,透過私人和政府機構的共同努力,阿拉伯聯合大公國(United Arab Emirates)的零售業近年來經歷了重大轉型。杜拜和阿布達比等目的地擁有數千平方英尺的零售空間,正在利用其資源吸引來自世界各地的遊客。杜拜被譽為“購物中心女王”,被認為是世界上最重要的市場之一。這些都是可靠的指標,顯示杜拜是大多數希望首次進軍該地區的品牌的可靠目的地,並有望對該行業的綜合設施管理產生積極影響。

- 在印度,由於 IT 繁榮和智慧城市發展計劃,商業領域正在蓬勃發展。該國正在吸引商業投資,這增加了對調頻服務的需求。例如,2022 年 4 月,塔塔房地產和基礎設施有限公司宣布與加拿大退休金計畫投資委員會成立合資企業,在印度各地開發商業辦公空間。據兩家公司稱,該合資企業將由位於新德里的兩項資產組成:Intelllion 占地面積 Gurgaon(180 萬平方英尺)和 Intellion 占地面積 清奈 (460 萬平方英尺)。

- 根據歐洲公共房地產協會統計,截至2023年3月,全球各上市房地產市場規模有較大差異。北美擁有最大的上市房地產市場,價值 1.3 兆美元。上市房地產是指在證券交易所上市並透過房地產資產獲取收益的公司。房地產的成長可能會推動商業部門的發展,並為所研究的市場的成長創造更多機會。

預計歐洲將佔據很大的市場佔有率

- 在歐洲,有多種趨勢促進綜合設施管理。例如,物聯網 (IoT) 是指使用網際網路連接到整合 FM 團隊的實體設備和感測器。這些產生的性能資料可以提醒設施管理者潛在的問題。

- 整合設施管理可讓您從任何位置監控和控制設備。設施管理團隊利用物聯網 (IoT) 提供營運的即時洞察。物聯網可以與電腦維護管理系統 (CMMS) 等設施管理軟體結合,以識別問題(例如辦公室溫度不舒服)並自動建立工作訂單,無需人工干預,分配並追蹤其執行情況。

- 例如,中歐和東歐的獨立歐洲參與企業是 SPIE ICS 和 SPIE Facilities,它們都是 SPIE 集團的子公司。這個獨特的解決方案由 SPIE ICS 開發,作為其物聯網產品組合的一部分,基於感染 COVID-19 的風險與空氣中二氧化碳濃度之間的相關性。它負責為 SPIE 團隊處理從資料收集到管理實體現場操作的所有事務。

- 此解決方案依賴受保護的 LoRaWAN 遠端組織基礎設施,直接從結構內部收集的資訊可以透過攜帶式、獨立的多功能感測器傳輸。 SPIE 設施團隊擷取、分析和解釋這些感測器收集的資料,幫助我們的職場採取一系列具體步驟來改善工作場所安全。

- 近年來,隨著許多國際組織和政府在建築生命週期中推廣 BIM,對建築資訊模型 (BIM) 的需求不斷增加。 BIM 預計將在設施管理中帶來高效的資訊管理 (IM) 優勢。透過在 FM 中採用 BIM,可以提高職場生活品質 (QOL),FM 涵蓋多個學科,透過整合場所、人員、流程和技術來確保建築環境的更高功能。

- 例如,2023 年 2 月,匈牙利 Studio IN-EX 和 Royal HaskoningDHV 將擴大其 BIM(建築資訊模型)能力中心,這是一種基於資訊豐富的 3D 模型的全球設計和施工技術。我將與您合作。 IN-EX Studio 是基於 BIM 設計的早期採用者,它從根本上徹底改變了建築物的規劃、建造、建造和維護方式。 BIM 使施工和設計團隊能夠更有效率地業務並收集營運和維護資料。

- 該市場的參與企業正在收購各種外包設施管理服務供應商,以擴大其在市場上的影響力。例如,2022 年 2 月,B+N Referencia Zrt. 於 2021 年春季收購了 ISS Group 在斯洛伐克、羅馬尼亞、捷克共和國和匈牙利的權益。接下來,我們收購了ISS集團的斯洛維尼亞子公司。截至本次收購,B+N持有這些公司 100% 的股份。透過此次收購,B+N Referencia Zrt. 廣泛的服務組合現已涵蓋中歐地區。該公司花了 20 年時間才在匈牙利這個競爭激烈的市場領域確立了市場領先地位。

綜合設施管理產業概述

全球綜合設施管理市場正逐步整合,許多主要企業如Jones Lang LaSalle, IP, Inc.、Sodexo Inc.、ISS Facility Service、CBRE Group Inc.和Compass Group PLC。這些公司不斷投資於策略合作夥伴關係和增強服務,以擴大其市場佔有率。該行業的一些值得注意的最新發展包括:

2023年6月,領先的綜合設施管理公司BMF Grup與專注於羅馬尼亞及其周邊地區的私募股權基金SARMIS Capital建立策略夥伴關係。此次合作旨在加強 BMF Grup 在綜合設施管理領域的領先地位。

2022 年 10 月,仲量聯行推出創新的績效最佳化計畫 (POP),以增強其綜合設施管理醫療保健解決方案。這種資料主導的方法為急性、非急性和門診設施提供了見解。與設施管理團隊密切合作,以顯著改善病患、訪客和員工的體驗。此外,您還可以降低風險並提高財務績效。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 商業活動的復甦預計將推動成長

- 強調生態永續的建築實踐

- 市場抑制因素

- 成本最佳化問題,缺乏專業人力資源

第6章市場區隔

- 按類型

- 難的

- 柔軟的

- 按最終用戶

- 公共/基礎設施

- 商業的

- 工業的

- 對於設施

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭環境

- 公司簡介

- Jones Lang LaSalle, IP, Inc.

- Sodexo Inc

- ISS Facility Service

- CBRE Group Inc

- Compass Group PLC

- Cushman & Wakefield

- AHI Facility Services Inc

- EMCOR Facility Services

- Facilicom

- CBM Qatar LLC.

第8章投資分析

第9章 市場機會及未來趨勢

The integrated facility management market is valued at USD 110.9 billion in the current year. It is expected to register a CAGR of 6.26% during the forecast period to reach a value of USD 150.23 billion by the next five years.

Key Highlights

- An integrated facilities management (IFM) primarily brings all the facility management contracts under a single service. IFM combines complex facilities management and soft FM such as security, cleaning, and waste management. Bringing all these different services together under a single umbrella can result in better customer service, better coordination between FM services, and consolidated costs to bring everything in under budget.

- One of the significant trends driving integrated FM in the country is the increasing demand for cost-effective solutions. With businesses looking for ways to reduce costs, IFM providers offer services that can save money. By combining services such as cleaning, maintenance, security, and other services under one contract, IFM providers can offer economies of scale and reduce overall business costs. The need for operational efficiency is another factor driving integrated FM demand. Firms are looking for ways to streamline operations and improve efficiency, and Integrated FM providers can help by offering integrated solutions that can help companies achieve their goals.

- The mining-related projects are expected to support the rise of integrated facility management services in Italy, as the mining industry requires planning, organizing, and managing the physical resources of a mining operation. For instance, in July 2022, Vulcan Energy Resources announced its partnership with Italy's geothermal energy producer Enel Green Power (EGP) to explore and develop Vulcan's Cesano license near Rome, Italy. By leveraging their respective lithium extraction and geothermal expertise, Vulcan and EGP will explore the potential development of geothermal lithium projects in the area.

- According to the World Bank published data in May 2023 2021, Poland's urban population remained nearly unchanged at around 60.0%. Further, In 2021, the Czech Republic's urban population remained roughly unchanged at about 75.21%. As cities become more densely populated and urban areas expand, the need for efficient building maintenance and management increases. Integrated Facility management services include maintenance assistance, user management, and other support services to ensure the smooth operation of buildings and their associated infrastructure. Such a huge rate of urbanization would drive the studied market.

- Furthermore, facilities managers must constantly be aware of energy consumption and seek ways to optimize energy usage and reduce waste. This can be a difficult task without the right tools and expertise and may require the help of energy management consultants. Additionally, facility management teams may face challenges in predicting and mitigating potential risks and disruptions, such as natural disasters, equipment failures, or supply chain disruptions, which can impact the budget and result in unexpected expenses.

- Moreover, the pandemic has also called for a renewed view on hygiene and has highlighted the need for FM services, such as cleaning, disinfecting, and sanitization. Hence, FM is expected to adapt to the new challenges through differentiated services. Likewise, multiple payers have reported increasing their spending on tech. As restrictions are being eased globally, FM players witness a significant rise in demand for professional sanitization and disinfection services from commercial entities, as directed by the various government authorities.

Integrated Facility Management Market Trends

Commercial segment is Expected to hold a Significant Share

- The commercial building industry has seen significant investments in various countries, propelling the facility management business. Various investment firms have hired real estate management businesses to handle their real estate investments. According to CBRE Italy, the volume of investments in Italy in 2022 will be Euro11.7 billion (USD 13.806 billion), the second-best outcome ever, owing to a robust post-COVID rebound powered by exceptional Logistics performance and revived interest in Offices.

- The facility management market has also witnessed multiple partnership activities between vendors and commercial entities. For instance, Siemens Energy, which recently spun off from Siemens AG to operate as a separate company, extended its partnership with Societe Parisienne pour l 'Industrie Electrique for three years to ensure technical facility management for Siemens office and production space that covers around 385,000 square meters. Moreover, with the partnership, SIPE's are looking into inspecting, maintaining, and repairing ventilation, air conditioning, electrical, heating, sanitary systems, instrumentation, and control technology in buildings. This will enable the company to establish a strong position in the market and expand its customer base in Europe.

- Economic growth, ongoing diversification, and a growing population, especially among high-worth individuals (HNIs), have increased retail sales in various countries. For instance, with the collective effort of the private and government institutions, UAE's retail has seen a massive transformation in the last few years. With thousands of square feet in retail space, destinations like Dubai and Abu Dhabi have utilized their resources to draw visitors worldwide. Dubai is hailed as the queen of "Shopping Malls" and is considered one of the world's most important markets. All these are reliable indicators that it remains a definite destination for most brands looking to enter the region for the first time, which is expected to impact Integrated facility management in the sector positively.

- The commercial sector is gaining momentum in India due to the IT boom and smart city development plans. The country is attracting commercial investments that drive the need for FM services. For instance, in April 2022, TATA Realty and Infrastructure Limited announced a joint venture with Canada Pension Plan Investment Board to develop its commercial office space across India. According to the companies, the joint venture will be seeded with two assets the Intellion Edge Gurgaon, National Capital Region of Delhi (Gross Living Area: 1.8 million sq. ft), and Intellion Park Chennai (Gross Living Area: 4.6 million sq. ft).

- According to the European Public Real Estate Association, as of March 2023, there were significant differences between the size of various listed real estate markets worldwide. North America was home to the largest listed real estate market worth USD 1.3 trillion. Listed real estate refers to companies quoted on stock exchanges and receiving income from real estate assets. Such a rise in real estate would drive the commercial sector, further creating an opportunity for the studied market to grow.

Europe is Expected to Hold Significant Share of the Market

- There are various trends that may propel integrated facility management in the European region. For example, the Internet of Things (IoT) refers to physical equipment and sensors that use the Internet to connect with integrated FM teams. They generate performance data that alerts facility managers to potential problems.

- Integrated facilities management (FM) can monitor and control equipment from any location. FM teams use the Internet of Things (IoT) to deliver real-time insights into their operations. IoT paired with FM software, such as a computerized maintenance management system (CMMS), identifies problems (e.g., uncomfortable office temperatures), automatically prepares and assigns work orders without human intervention, and tracks their execution.

- For instance, the independent European player in various Central and Eastern European regions is SPIE ICS and SPIE Facilities, both subsidiaries of the SPIE group. This unique solution, developed by SPIE ICS as part of their Internet of Things portfolio, is based on the correlation between the risk of contracting COVID-19 and the concentration of CO2 in the air. This will handle everything from data collection to SPIE teams' physical on-site operations management.

- The solution depends on the protected LoRaWAN remote organization foundation, which permits information gathered straightforwardly from inside the structure to be sent in by portable and independent multifunction sensors. SPIE Facilities teams retrieve, analyze, and interpret the data collected by these sensors as part of a series of concrete steps to increase the client's workplace safety.

- The demand for building information modeling (BIM) has recently increased as many international organizations and governments promote BIM in the building life cycle. BIM promises the benefits of efficient information management (IM) in FM. There will be improved quality of life (QOL) in the workplace when embracing BIM in FM that encompasses multiple disciplines to ensure higher functionality of the built environment by integrating places, people, processes, and technology.

- For instance, in February 2023, Studio IN-EX, a Hungary-based firm, and Royal HaskoningDHV will collaborate to expand their building information modeling (BIM) competence center, a global design and construction technique based on information-rich 3D models. IN-EX Studio was an early user of BIM-based design, which has radically revolutionized how buildings are planned, constructed, built, and maintained. BIM enables construction and design teams to operate more effectively and collects data for operations and maintenance.

- The players in the market are acquiring various outsourcing FM service providers to expand their market presence. For instance, in February 2022, B+N Referencia Zrt. took over the company interests of the ISS Group in Slovakia, Romania, the Czech Republic, and Hungary in the spring of 2021. This was followed by acquiring the Slovenian subsidiary of the ISS Group. B+N has 100% ownership in these companies, just like in the new addition. With this recent acquisition, B+N Referencia Zrt.'s highly extensive service portfolio covers the Central European region. It took the company two decades to establish its market-leading position in this highly competitive segment in Hungary.

Integrated Facility Management Industry Overview

The global integrated facility management market exhibits moderate consolidation, featuring several key players, including Jones Lang LaSalle, IP, Inc., Sodexo Inc., ISS Facility Service, CBRE Group Inc., and Compass Group PLC. These companies consistently invest in strategic partnerships and service enhancements to expand their market presence. Notable recent developments in the industry include:

In June 2023, BMF Grup, a leading integrated facility management company, forged a strategic alliance with SARMIS Capital, a private equity fund specializing in Romania and neighboring regions. This partnership aimed to reinforce BMF Grup's position as a frontrunner in the integrated facility management sector.

In October 2022, JLL introduced an innovative performance optimization program (POP) to enhance its integrated facilities management healthcare solutions. This data-driven approach offers insights into acute care, non-acute care, and ambulatory facilities. It collaborates closely with in-house facilities management teams to measurably enhance the experiences of patients, visitors, and employees. Additionally, it reduces risks and improves financial performance, all achieved without the need for additional outsourcing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rebounding commercial activity expected to drive growth ?

- 5.1.2 Emphasis on Green and Sustainable Building Practices

- 5.2 Market Restrains

- 5.2.1 Cost Optimization Problems, and Lack of Specialized Talents ?

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hard FM

- 6.1.2 Soft FM

- 6.2 By End -User

- 6.2.1 Public/Infrastructure

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.2.4 Institutional

- 6.2.5 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jones Lang LaSalle, IP, Inc.

- 7.1.2 Sodexo Inc

- 7.1.3 ISS Facility Service

- 7.1.4 CBRE Group Inc

- 7.1.5 Compass Group PLC

- 7.1.6 Cushman & Wakefield

- 7.1.7 AHI Facility Services Inc

- 7.1.8 EMCOR Facility Services

- 7.1.9 Facilicom

- 7.1.10 CBM Qatar LLC.