|

市場調查報告書

商品編碼

1408554

資料中心伺服器:市場佔有率分析、產業趨勢與統計、2024年至2030年成長預測Data Center Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

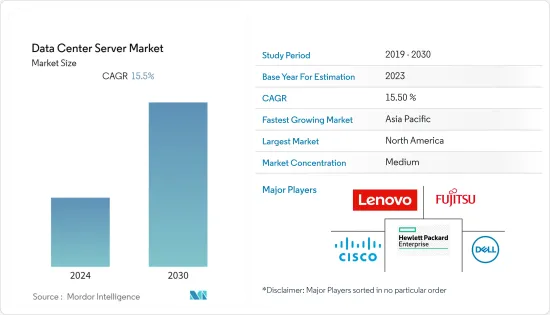

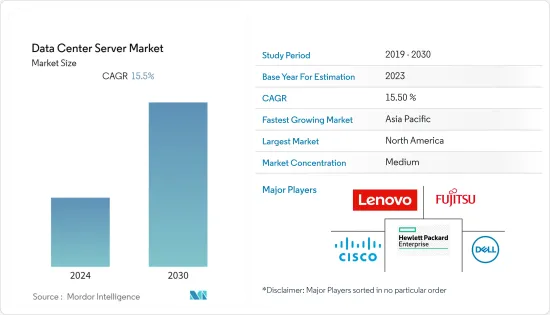

上年度全球資料中心伺服器市場規模達到889億美元,預計在預測期間內複合年成長率為15.5%。

中小企業對雲端運算需求的增加、政府對資料安全的監管以及國內企業投資的增加是推動全球資料中心需求的主要因素。

主要亮點

- 預計到2029年,全球資料中心伺服器市場未來IT負載容量將達到7.1億度。

- 到 2029 年,該地區的占地面積預計將增加至 2.739 億平方英尺。

- 到2029年,安裝的機架總數預計將達到1420萬個。預計到 2029 年,北美安裝的機架數量將最多。

- 有近500個海底電纜系統連接世界各地,其中許多正在建設中。 CAP-1 就是一個這樣的例子,它計劃於 2025 年開始服務,是一條橫跨 12,000 多公里的海底電纜,登陸點位於美國格羅弗海灘。

資料中心伺服器市場趨勢

IT和通訊佔很大比例。

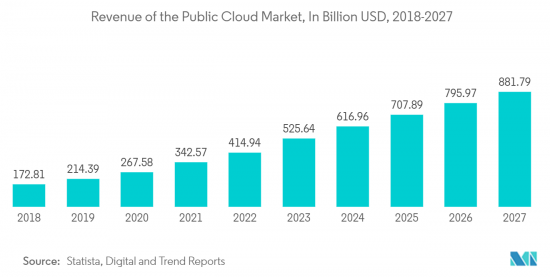

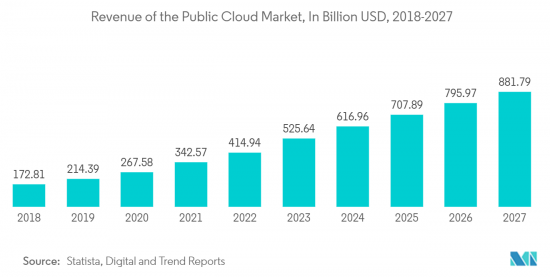

- 雲端和通訊預計將推動需求成長。北美、歐洲和亞洲國家對雲端服務的需求前景廣闊。目前,澳洲 10-15% 的資料是在集中式資料中心和雲端之外創建和處理的,但預計到 2025 年,這一數字將升至 60-70% 以上,反映了全球趨勢。丹麥對雲端解決方案的需求持續成長,並且對雲端基礎的資料保護和備份解決方案的需求預計將保持強勁。

- 拉丁美洲(美國、加拿大、墨西哥、巴西)、中東和非洲(奈及利亞、南非、埃及、土耳其、阿拉伯聯合大公國、沙烏地阿拉伯)以及東南亞(馬來西亞、越南)對雲端基礎的服務的需求正在成長、泰國、印尼、菲律賓)、新加坡)、亞太地區(印度、日本、中國)及歐洲部分地區。

- 在北美,雲端還提供計量收費選項,讓企業可以根據消費者存取雲端服務的頻率支付雲端服務費用,從而節省資金。大型組織正在迅速採用雲,因為雲端服務可以依需提供。 2022 年,美國航空將把麵向客戶的應用程式遷移到 IBM Cloud 上的 VMware HCX,以提供數位自助服務功能。隨著許多中小型企業採用雲端基礎的系統,北美資料中心市場預計將會成長。

- 此外,隨著4G的普及和5G浪潮的到來,通訊業者正在鼓勵對資料中心業務的投資。 2022年10月,南非通訊Telkom在中國華為科技公司的支援下建造了5G高速網路網路。華為持續支持南非5G網路發展。非洲大陸著名的 5G 網路部署了 2,800 多個基地台。

- 新興市場的開拓,例如雲端服務的日益採用、5G網路的擴展以及線上付款需求的增加,預計將推動IT和通訊領域對資料中心市場的需求,從而促使成長預測期內的伺服器需求。

快速成長的亞太地區

- 亞太地區是全球資料中心成長最快的地區之一。該地區龐大的人口基數佔全球估計人口的近 50%,是主機代管資料中心服務和設施的主要推動力。

- 中國和澳洲擁有最多的資料中心設施。中國的運算能力正在不斷增強,已成為超級電腦數量的領先國家。截至2022年6月,全球最強大的500台超級電腦中有173台位於中國,比其最接近的競爭對手美國多三分之一。

- 在澳大利亞,澳洲政府資訊管理辦公室 (AGIMO) 等政府舉措在最佳化資料中心資源方面處於領先地位,推出了《2010-2025 年澳洲政府資料中心策略》。這項策略意味著從使用政府營運的資料中心轉向第三方多租戶資料中心。

- 在澳大利亞,2019 年對公共雲端服務的需求持續成長,42% 的澳洲企業報告使用雲端運算(2015-16 年為 31%)。市場供應商正在開發為 IT 行業最終用戶量身定做的豐富產品,這也推動了該領域的成長。

- 在印度和印尼等新興市場,都市化的加速和普及的提高預計將帶來下一波成長。截至 2022 年 7 月,印度擁有 6.92 億活躍網路用戶,截至 2022 年 2 月,印度全國活躍社群媒體用戶為 4.67 億。普及網際網路的日益普及增加了Over-The-Top和社交媒體的使用,增強了連接的力量。孟買和清奈等印度沿海城市因其密集的濕電纜生態系統而在競爭中處於領先地位。該地區擁有可靠的電力供應和有線網路登陸站,可以實現足夠的延遲。

- 技術的不斷發展、雲端服務的不斷採用、電子商務銷售以及網路人口的成長正在推動資料中心的需求,資料中心伺服器的需求預計將增加,並在未來幾年出現顯著成長。

資料中心伺服器產業概況

該地區即將進行的資料中心建設計劃將增加未來幾年對資料中心伺服器的需求。全球資料中心伺服器市場由戴爾、惠普企業、富士通和聯想Group Limited等幾家主要企業適度整合。憑藉壓倒性的市場佔有率,這些領先公司正專注於擴大每個地區的基本客群。

2023 年 8 月,戴爾將把下一代 Dell PowerEdge 伺服器從 OSA 遷移到 ESA,其中 PowerEdge R760 配備第四代英特爾至強處理器。

2023 年 1 月,思科宣布推出搭載第四代英特爾至強可擴充處理器的第七代 UCS C 系列和 X 系列伺服器。憑藉對最新英特爾處理器的支持,思科發布了 X 系列的兩款新刀片:Cisco UCS X210c M7 計算節點和 Cisco UCS X410c M7 計算節點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 採用雲端運算服務

- 5G網路大規模商用

- 市場抑制因素

- 加大資料中心建置資金投入

- 網路安全威脅與勒索軟體攻擊

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 依外形尺寸

- 刀鋒伺服器

- 機架式伺服器

- 直立式伺服器

- 依最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 媒體與娛樂

- 其他最終用戶

- 依地區

- 北美洲

- 南美洲

- 歐洲

- 中東

- 非洲

- 亞太地區

第6章 競爭形勢

- 公司簡介

- Dell Inc.

- Hewlett Packard Enterprise

- Lenovo Group Limited

- Fujitsu Limited

- Cisco Systems Inc.

- Kingston Technology Company Inc.

- Huawei Technologies Co. Ltd.

- Inspur Group

- International Business Machines(IBM)Corporation

- Atos SE

第7章 投資分析

第8章 市場機會及未來趨勢

The Global data center server market reached the value of USD 88.9 billion in the previous year, and it is further projected to register a CAGR of 15.5% during the forecast period. The increasing demand for cloud computing among small and medium-sized enterprises (SMEs), government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers globally.

Key Highlights

- The upcoming IT load capacity of the Global data center server market is expected to reach 71K MW by 2029.

- The region's construction of raised floor area is expected to increase 273.9 million sq. ft by 2029.

- The region's total number of racks to be installed is expected to reach 14.2 million units by 2029. North America is expected to house the maximum number of racks by 2029.

- There are close to 500 submarine cable systems connecting the regions globally, and many are under construction. One such submarine cable that is estimated to start service in 2025 is CAP-1, which stretches over 12,000 Kilometers with a landing point in Grover Beach, United States.

Data Center Server Market Trends

IT & Telecommunication Holds the Major Share.

- Cloud and telecom are expected to drive the major demand growth. The demand for cloud services is promising in North American, European, and Asian countries. Currently, 10-15% of data in Australia is created and processed outside a centralized data center or cloud, but the number is expected to cross 60-70% by 2025, a global trend that is also reflected in Australia. The need for cloud solutions continues to grow in Denmark, and the demand for cloud-based data protection and backup solutions is expected to get robust.

- The demand for cloud-based services is highly concentrated in regions like Central America and South America (the United States, Canada, Mexico, and Brazil), Middle East & Africa (Nigeria, South Africa, Egypt, Turkey, the United Arab Emirates, and Saudi Arabia), Southeast Asia (Malaysia, Vietnam, Thailand, Indonesia, the Philippines, and Singapore), Asia-Pacific (India, Japan, and China), and parts of Europe.

- In North America, the cloud also offers pay-as-you-go options, which enable businesses to pay for cloud services in accordance with how frequently consumers access them, resulting in lower expenses. Since cloud services are available on demand, large-scale organizations are embracing them quickly. In 2022, American Airlines moved customer-facing applications to VMware HCX on IBM Cloud to offer digital self-service features. The North American market for data centers is expected to grow due to many small and medium-sized businesses adopting cloud-based systems.

- Further, Telecom suppliers are encouraged to invest in the data center business due to the rising adoption of 4G and the impending 5G wave. In October 2022, the 5G high-speed internet network was established by South African telecoms provider "Telkom," supported by Huawei Technologies from China. Huawei continues to assist South Africa in developing its 5G networks. The prominent 5G network on the African continent has more than 2,800 base stations deployed.

- Developments such as increasing adoption of cloud services, expansion of 5G networks, and the ongoing demand for online payments are, in turn, expected to boost the demand for the data center market from the IT and telecom segment, leading to major demand for the servers during the forecast period.

Asia-Pacific Region is the Fastest Growing

- APAC is one of the fastest-developing data center regions in the world. The region's huge population base, which accounts for nearly 50% of the estimated global count, is ultimately the key driver for colocation data center services and facilities.

- China and Australia have the most data center facilities. China is boosting its computing power, and it has become a prominent nation in terms of supercomputer volume. As of June 2022, 173 of the world's 500 most powerful supercomputers were located in China, which is a third more than that of its nearest competitor, the United States.

- In Australia, government initiatives such as the Australia Government Information Management Office (AGIMO) are leading the way in optimizing data center resources with the introduction of the Australia Government Data Centre Strategy 2010-2025. The strategy represents a transition from using government-run data centers to third-party, multi-tenant data centers.

- The appetite for public cloud services in Australia continued to grow in 2019, with 42% of businesses in the country reporting the use of cloud computing compared to 31% in 2015-16. Market vendors are rolling out enhanced product offerings curated for IT industry end users, which is also driving growth in this segment.

- Growing urbanization and greater penetration in emerging markets such as India and Indonesia are expected to drive the next wave of growth. In India, as of July 2022, there were 692 million active internet users, and as of February 2022, there were 467 million active social media users across the country. The growing penetration of mobile internet boosted the power of connectivity through increased over-the-top (OTT) and social media usage. Due to their dense wet cable ecosystem, coastal cities in India, such as Mumbai and Chennai, are leading the race. The proper latencies can be found here, having reliable power sources and landing stations for cable networks.

- The increasing technology developments, the growing adoption of cloud services, e-commerce sales, and the increasing internet population drive the demand for data centers, which is expected to grow significantly, resulting in an increasing need for data center servers in the coming years.

Data Center Server Industry Overview

The upcoming DC construction projects in the region will increase the demand for data center servers in the coming years. The global data center server market is moderately consolidated with a few major players, such as Dell Inc., Hewlett Packard Enterprise, Fujitsu, and Lenovo Group Limited. These major players, with a prominent market share, focus on expanding their regional customer base.

In August 2023, Dell Inc. is transitioning its servers with Next-generation Dell PowerEdge servers from OSA to ESA with PowerEdge R760 powered by 4th-generation Intel Xeon Processors.

In January 2023, Cisco announced the launch of the 7th generation of UCS C-Series and X-Series servers, powered by 4th generation Intel Xeon Scalable processors. With support for the latest Intel processors, Cisco has launched two new blades for the X-Series: the Cisco UCS X210c M7 Compute Node and the Cisco UCS X410c M7 Compute Node.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of cloud computing services

- 4.2.2 Large-scale commercialization of 5G networks

- 4.3 Market Restraints

- 4.3.1 Rising CapEx for data center construction

- 4.3.2 Cybersecurity Threats and Ransomware attacks

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Form Factor

- 5.1.1 Blade Server

- 5.1.2 Rack Server

- 5.1.3 Tower Server

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-User

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Middle East

- 5.3.5 Africa

- 5.3.6 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dell Inc.

- 6.1.2 Hewlett Packard Enterprise

- 6.1.3 Lenovo Group Limited

- 6.1.4 Fujitsu Limited

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Kingston Technology Company Inc.

- 6.1.7 Huawei Technologies Co. Ltd.

- 6.1.8 Inspur Group

- 6.1.9 International Business Machines (IBM) Corporation

- 6.1.10 Atos SE