|

市場調查報告書

商品編碼

1408540

內容行銷市場:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Content Marketing Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

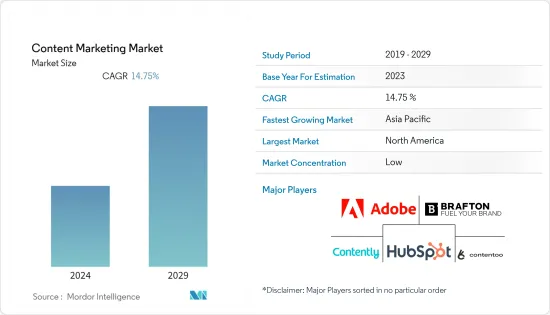

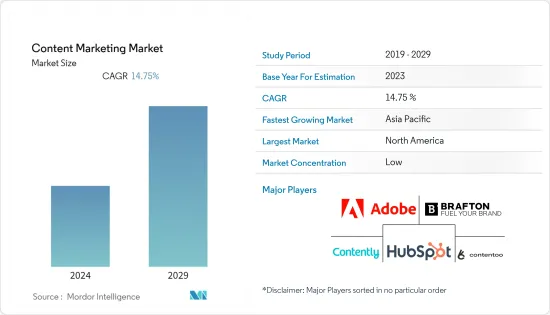

今年內容行銷市場規模預計為2630.9億美元。

預計未來五年將達5,234.5億美元,預測期內複合年成長率為14.75%。

主要亮點

- 推動內容行銷需求成長的主要趨勢之一是數位轉型。隨著公司將業務重點從傳統管道轉向行銷策略和客戶參與工作等數位平台,內容行銷已成為有效連接和吸引網路用戶的重要工具。

- 公司在網路上的存在需要增強客戶參與度,並使行銷策略與不斷變化的消費行為保持一致,這正在推動所研究市場的需求。隨著企業越來越依賴數位管道,內容行銷對於企業與受眾建立聯繫、互動並將其轉化為潛在客戶變得至關重要。

- 然而,由於缺乏能夠從源頭進行資料分析的內容行銷系統技能,市場受到阻礙。選擇正確的內容廣告策略來滿足消費者需求是一項艱鉅的任務,需要足夠的創造力和技術技能才能產生影響。

- 人工智慧驅動的自動化為負責人提供了競爭優勢,使他們能夠將時間花在行銷策略上,而不是重複和冗餘的任務上。因此,基於人工智慧的內容行銷解決方案的市場開拓預計將為內容行銷廠商帶來機會,以滿足未來幾年企業不斷變化的需求。例如,2023 年 7 月,創新的生成式 AI 平台 SpeedyBrand 籌集了主導Y Combinator 和 GV(Google Ventures)領資金籌措的 250 萬美元資金。本輪融資將用於進一步開發和擴展專為中小企業(SME)設計的人工智慧SEO內容行銷平台,並專注於中小企業市場。

- COVID-19 大流行對內容行銷產生了重大影響,重塑了世界各地企業的策略和優先事項。流行病封鎖和社交疏遠措施迫使人們花更多時間上網。因此,越來越多的人轉向數位消費,為品牌透過不同的內容格式與受眾互動提供了新的機會,從而增加了對內容行銷軟體和服務的需求。

- 企業正在認知到在不斷變化的消費市場中有效的數位溝通、線上參與和調整行銷策略的重要性。這次疫情加速了向數位管道的轉變,同時強化了內容行銷作為在關鍵時刻確保品牌相關性的重要工具的價值。

內容行銷市場趨勢

數位管道的興起推動市場成長

- 隨著消費者在網路上花費的時間越來越多,企業必須建立強大的網路形像以有效地接觸目標受眾。因此,擴大引入內容行銷解決方案和服務,以在各種數位平台上創建和分發所需的內容。

- 數位管道支援多種內容格式,包括部落格、資訊圖表、案例研究和影片,使企業能夠滿足不同的內容消費偏好。此外,它還可以幫助您根據人口統計、興趣和行為來定位受眾。為了滿足各種數位管道的廣泛目標受眾的需求,企業利用內容行銷解決方案變得非常重要。內容行銷解決方案可能在未來幾年進一步成長。

- 數位管道的興起創造了一個企業需要透過網路與目標受眾建立聯繫的環境。這種需求可以透過內容行銷來滿足,內容行銷提供高品質、引人入勝的內容,並提高網路影響力、品牌知名度和客戶參與。因此,隨著公司越來越依賴將內容行銷整合到其數位策略中,對內容行銷的需求也在增加。

北美佔最大市場佔有率

- 較早採用內容行銷策略,加上完善的市場生態系統,使得該地區佔據了最高的市場佔有率。北美企業處於數位轉型的最前沿,並認知到線上參與和品牌知名度的重要性。隨著內容行銷成為公司數位策略的重要參數,該地區的採用率正在增加。

- 此外,該地區還有許多行銷機構為企業提供內容行銷服務。此外,專業知識的可用性進一步促進了北美地區的市場成長。根據美國人口普查局的數據,2021 年美國廣告公司的總收入約為 570 億美元,比 2020 年增加了 62.4 億美元,2020 年因 COVID-19 大流行而收入下降。

- 隨著該地區內容行銷需求的不斷成長,企業紛紛進入該市場,計劃推出基於新技術的內容行銷平台和服務。例如,2022 年 9 月,總部位於德拉瓦的 Pepper Content Inc. 宣布,為行銷人員推出了基於 ChatGPT 的突破性人工智慧內容創建和創意工具,以引領下一階段的內容行銷。

內容行銷產業概述

內容行銷市場較為分散,許多主要企業進入該市場,包括 Adobe Inc.、HubSpot Inc. 和 Contently Inc.。為了保持市場競爭力並佔據較大的市場佔有率,市場參與者正在採取合併、收購、聯盟和產品發布等策略性舉措。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 數位管道的興起

- 對需求產生和個人化行銷策略的需求不斷增加

- 市場抑制因素

- 缺乏具備管理內容行銷活動技能的關鍵人才

第6章市場區隔

- 依成分

- 軟體

- 服務

- 依平台

- 部落格

- 影片

- 資訊圖

- 案例研究

- 其他

- 依最終用戶產業

- 零售

- BFSI

- 媒體娛樂

- 通訊

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Adobe Inc.

- Contently Inc.

- HubSpot Inc.

- Brafton Inc.

- Contentoo BV

- Hootsuite Inc.

- Seismic Software Inc.

- Upland Software, Inc.

- Influence and Co.

- Curata, Inc.

第8章投資分析

第9章 市場未來展望

The content marketing market size is estimated at USD 263.09 billion in the current year. It is expected to reach USD 523.45 billion in the next five years, registering a CAGR of 14.75% during the forecast period.

Key Highlights

- One key trend that is propelling the growth in content marketing demand is digital transformation. Content marketing has become a vital tool to efficiently connect with and engage internet users as enterprises shift their business focus from traditional channels into digital platforms, such as marketing strategies and client involvement efforts.

- Demand for the market studied is driven by the necessity of a business' presence on the Internet to enhance customer involvement and align marketing strategies with changing consumer behavior. Content marketing has become essential for businesses to connect, engage, and convert their audiences into potential customers as they increasingly rely on digital channels.

- The market is being hampered by a lack of skills regarding content marketing systems that enable the analysis of data from sources. It is a difficult task to choose the right content advertising strategy for meeting consumer demand, which requires creativity and technical skills that are sufficient in order to bring about an impact; this will also impede the growth of the market.

- AI-powered automation gives marketers a competitive advantage, allowing them to spend more time on marketing strategy rather than repetitive and redundant tasks. Thus, the development of AI-based content marketing solutions is expected to present opportunities for content marketing vendors in the coming years to cater to businesses' evolving needs. For instance, in July 2023, SpeedyBrand, an innovative Generative AI platform, raised USD 2.5 million in funding led by Y Combinator and GV (Google Ventures). The funds will be used to further develop and expand an AI-powered SEO content marketing platform designed for small and medium-sized enterprises (SMEs), focusing on the SME market.

- The COVID-19 pandemic has significantly impacted content marketing, reshaping strategies and priorities for businesses globally. People have had to spend more time online due to the pandemic lockdown and social distancing measures. Thus, more people switched to digital consumption, opening up new opportunities for brands to interact with their audiences through different content formats, which increased the need for content marketing software and services.

- The importance of effective digital communications, online engagement, and adaptation of marketing strategies in an evolving consumer market has also been recognized by businesses. The pandemic made the shift to digital channels more rapid while reinforcing the value of content marketing as an essential tool for ensuring brand relevance during a critical time.

Content Marketing Market Trends

Rise of Digital Channels to Drive Market Growth

- As consumers are spending more time online, it becomes essential for businesses to establish a robust online presence to reach their target audience effectively. This leads to increasing adoption of content marketing solutions and services to create and distribute necessary content across various digital platforms by businesses.

- Digital channels support various content formats such as blogging, infographics, case studies, videos, and others, enabling businesses to cater to diverse content consumption preferences. Further, it helps target audiences based on demographics, interests, and behavior. To cater to a broad range of target audiences on different digital channels, the need for businesses to use content marketing solutions becomes important. It is likely to grow in the coming years.

- The rise of digital channels creates an environment where business needs to connect with their target audience on the Internet. This demand will be met through content marketing, which delivers high-quality and engaging content to enhance the presence on the Internet, brand recognition, and customer engagement. Thus, demand for content marketing is rising as companies become increasingly dependent on the integration of content marketing in their digital strategies.

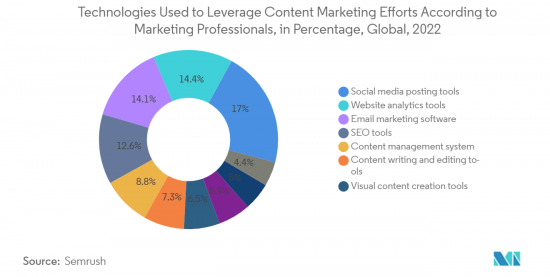

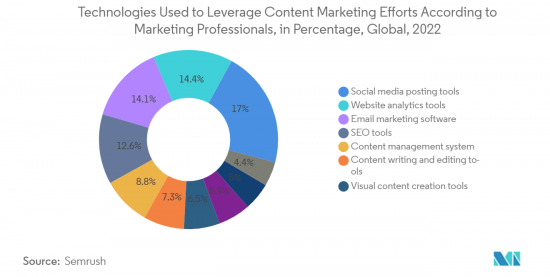

- According to a survey conducted by Semrush, the online visibility management and content marketing SaaS platform provider, in 2022, 58% of responding marketing professionals said they used social media posting tools to leverage their content marketing efforts, while 30% said they utilized a content management system (CMS) for the same purpose.

North America Holds Largest Market Share

- The early adoption of content marketing strategies combined with a well-established market ecosystem positions the region to hold the leading market share. North American businesses have been at the forefront of digital transformation, recognizing the importance of online engagement and brand visibility. As content marketing becomes an essential parameter of digital strategies for businesses, it has resulted in a higher regional adoption rate.

- In addition, the region has a thriving number of marketing agency landscapes that offer businesses content marketing services. Also, the availability of professional expertise is further contributing to the growth of the market in the North American region. According to the U.S. Census Bureau, advertising agencies in the United States generated a total revenue of around USD 57 billion in 2021, an increase of USD 6.24 billion compared to 2020, when U.S. agencies recorded a decline in revenue amidst the COVID-19 pandemic.

- In a November 2022 survey conducted by Parse.ly, one of the leading content analytics platforms for professionals working in Content Marketing, 18% said they were using social media posts as part of their marketing strategy; 13% claimed to have used videos, 7% cited infographics, and 6% relied on case studies. This shows the use of social media posts and video platforms for content marketing is increasingly being adopted.

- With growing demand for content marketing in the region, the companies are entering the market with plans to launch content marketing platforms and services based on new technologies. For instance, in September 2022, Delaware-based Pepper Content Inc. launched a revolutionary AI content creation and ideation tool for marketers built on top of ChatGPT to lead in the next phase of content marketing.

Content Marketing Industry Overview

The content marketing market is fragmented, with a large number of key players operating in the market, including Adobe Inc., HubSpot Inc., Contently Inc., and several others. The players operating in the market are undergoing strategic initiatives such as mergers, acquisitions, partnerships, product launches, and others to remain competitive in the market and constitute significant market share.

- November 2022 - UberStrategist, a North American public relations and full-service marketing agency that serves global video game, entertainment, and technology clients, acquired the Raleigh-based content marketing agency VirTasktic.

- February 2022 - GroupM launched the Australian INCA, a purpose-built AI-powered, brand-safe, influencer and content marketing platform. Intuitive data-driven planning, a network of creators, workflow management, content amplification, analytics, and optimization capabilities are the core of INCA's platform. INCA is part of GroupM's portfolio of tech-driven specialty media products that includes addressable TV and addressable content, programmatic, social, and search expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on Market

5 MARKET DYNAMICS

- 5.1 Market Driver

- 5.1.1 Rise of Digital Channels

- 5.1.2 Growing Need for Demand Generation and Personalized Marketing Strategy

- 5.2 Market Restraint

- 5.2.1 Lack of Key Personnel with Skills to Manage Content Marketing Activities

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Platform

- 6.2.1 Blogging

- 6.2.2 Videos

- 6.2.3 Infographics

- 6.2.4 Case Studies

- 6.2.5 Others

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Media and Entertainment

- 6.3.4 Telecom

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe Inc.

- 7.1.2 Contently Inc.

- 7.1.3 HubSpot Inc.

- 7.1.4 Brafton Inc.

- 7.1.5 Contentoo B.V.

- 7.1.6 Hootsuite Inc.

- 7.1.7 Seismic Software Inc.

- 7.1.8 Upland Software, Inc.

- 7.1.9 Influence and Co.

- 7.1.10 Curata, Inc.