|

市場調查報告書

商品編碼

1408494

工業人工智慧軟體:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Industrial AI Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

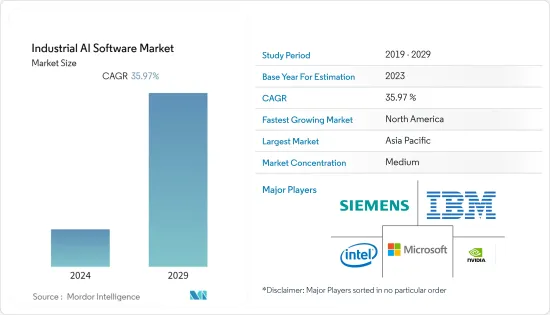

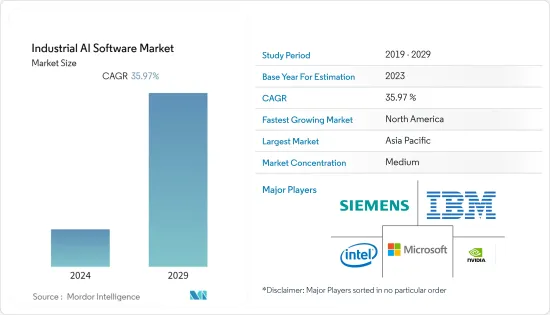

本會計年度工業人工智慧軟體市場價值843.4億美元。

預計未來五年將達到 3,919.7 億美元,預測期內複合年成長率為 35.97%。

主要亮點

- 越來越注重從工業資料中獲取價值。這增加了對多方面最佳化的需求,使得人工智慧驅動的決策和營運敏捷性對高階主管更加重要。為了在當今動盪的市場中取得成功,公司必須同時最佳化跨業務目標(例如報酬率、經濟性和永續性)的資產和流程。

- 歐盟委員會表示,歐洲人工智慧戰略旨在將歐盟(EU)打造為人工智慧樞紐,確保人工智慧(AI)值得信賴、人性化。這些目標反映在歐洲透過具體法律和行動追求卓越和信任的方法中。人工智慧卓越的關鍵是充分利用可用資源並協調投資。歐盟委員會打算透過其「數位歐洲」和「地平線歐洲」計畫每年在人工智慧領域投資 10 億歐元。在數位化十年期間,歐盟委員會也將動員私部門和成員國的其他投資,將年度投資額提高到200億歐元。

- 雖然人工智慧仍然是一個重要的技術領域,但組織需要有效的方法來擴展其人工智慧實踐,並利用人工智慧進行業務來加快人工智慧投資的投資報酬率。隨著組織面臨著最佳化工作流程的更大壓力,越來越多的公司將求助於 BI 團隊來管理和開發 AI/ML 模型。有兩個關鍵因素推動了新的基於 BI 的 AI 開發人員類別的發展:首先,使用自動化平台等工具支援 BI 團隊比僱用專門的資料科學家更具擴充性,成本昂貴且永續。其次,與資料科學家相比,BI 團隊更接近業務用例,從而由於工作模型要求而加快了生命週期。

- 隨著人工智慧技術的進步,政府比以往任何時候都更加重要的是對傳統方法進行創新,以實現更好的公民參與、互通性和課責。這些趨勢正在推動世界各地企業和組織對人工智慧管治的需求。例如,Google強調了政府與人工智慧從業者和更廣泛的民間社會合作,可以在圍繞人工智慧應用的期望方面發揮關鍵作用的五個領域。這包括可解釋性標準、安全考量、評估公平性的方法、共同責任框架以及人類與人工智慧協作的要求。

- 相反,雖然大多數企業 IT 採購僅限於簡單地選擇正確的軟體或硬體並最終將其部署以達到目的,但 AI 的根本問題是最初需要持續培訓、處理資料和校準才能獲得結果。存在限制電子記錄中的資料標準化的已知問題。其中包括自然語言處理 (NLP)、威脅開放式創新的專有資料集、由於日誌偏見或徹頭徹尾的詐欺而導致的醫學文獻中常見的偏見,以及歷史資料不夠具體,無法用於當前的預測。其中包括健康資料的併發症例如:

- COVID-19 大流行帶來的課題表明生產和再分配方面存在弱點,需要進行必要的改變以使供應鏈更具彈性。報告顯示,整個零售供應鏈中所有運輸環節對人工智慧的投資都在增加。每個地區的行業都將工人疾病和原料短缺視為其供應鏈面臨的最大課題。在大流行後的情況下,行業對自動化和數位化的日益關注預計將促使市場對分析和人工智慧解決方案的高需求,並在工業物聯網用戶中變得更普及。

工業人工智慧軟體市場趨勢

零售和消費品預計將佔據很大的市場佔有率。

- 推動擴張的因素包括不斷成長的網路用戶數量、智慧型設備、店內監控的需求以及政府鼓勵數位化的努力。零售業的人工智慧 (AI) 建立在企業過去幾十年的營運方式之上。

- 人工智慧解決方案和巨量資料分析對於數位業務至關重要,並且有潛力改變從客戶體驗到業務流程的一切。人工智慧透過縮小從洞察到行動的差距,幫助公司在電子商務、行銷、產品管理和其他業務領域更快地做出決策。美國商務部預計,2023年美國零售額將達5.99兆美元。

- 此外,零售商店的增加可能為人工智慧參與者創造機會開發新工具來滿足廣泛的零售客戶的需求。例如,根據美國勞工統計局的數據,2022年第三季美國私人零售企業數量為1,061,539家,高於2022年第一季的1,049,543家。是。此外,根據中國國家統計局的數據,去年中國零售連鎖店數量為292,383家。

- 此外,根據《麻省理工學院技術評論洞察》和亞馬遜的數據,零售和消費品行業近一半的受訪者表示,實施人工智慧將有助於改善顧客關懷。這意味著人工智慧解決方案可以接管增強對話來回答客戶問題,並在客戶無法提供協助時將其引導至正確的客服人員。此外,47% 的受訪者表示人工智慧可以透過幫助管理成本和買家需求來顯著改善庫存管理。人工智慧追蹤電子商務網站和實體店的需求和供應量,確保它們同步。

- 此外,各種零售公司正在實施人工智慧以更好地服務客戶。例如,線上委託零售商 ThredUp 推出了 Goody Box,其中包含根據每位客戶的風格量身定做的各種二手服裝商品。顧客保留他們想要的東西並付費,並退回他們不需要的東西。 AI演算法會記住每位顧客的喜好,以便未來的盒子將更適合他們的口味。客戶更喜歡非訂閱盒,因為他們可以看到單獨的零件。

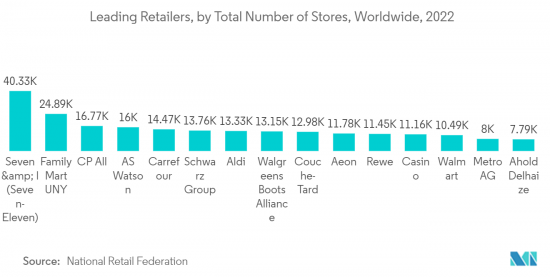

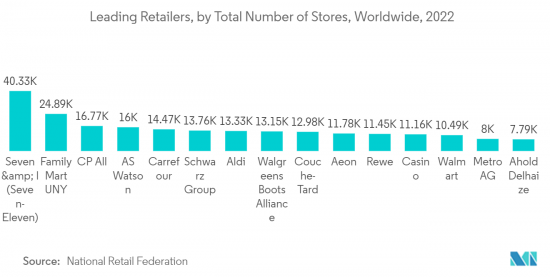

- 根據美國零售聯合會統計,7-11 零售連鎖店的母公司 Seven & i Holdings 2022 年在全球經營超過 40,000 家零售店。 7-11 是一家在世界各地營運的連鎖便利商店。那一年,Seven & i 的零售店數量超過了一些全球最大的零售商,例如擁有近 10,500 家門市的沃爾瑪和擁有約 13,750 家門市的 Schwartz Group。儘管沃爾瑪不是擁有最多商店的公司,但它是世界上最大的零售商之一。數量如此龐大的零售店很可能為市場參與者創造機會開發新的解決方案以佔領市場佔有率。

預計北美將佔據很大佔有率。

- 以美國為首的北美地區,各產業的人工智慧(AI)解決方案市場正在不斷擴大。在北美,替代人工智慧的採用準備度和高成長率是其經濟影響的最大驅動力,反映了該地區對人工智慧及其採用的主導態度。此外,預計區域層面很快就會出現高度自動化潛力,這也是一個推動因素。

- 根據美國國家科學技術委員會的報告,2022會計年度(FY22)聯邦政府用於資訊科技研發的支出為87.6億美元,比上年增加4.1億美元(4.9%)。研究顯示,2022 財政年度所有聯邦政府研究機構在人工智慧研發上的支出為 25.8 億金額。這比上年度增加了 1.3 億美元(成長 5.3%)。報告稱,NSF(6.54 億美元)、NIH(5.51 億美元)、DARPA(4.57 億美元)和國防部(3.91 億美元)將在 2022 會計年度投資人工智慧研發。最大的資金來源是緊隨其後的是能源部科學辦公室(1.3 億美元)。如此龐大的人工智慧支出很可能為參與者提供開發新解決方案以增加市場佔有率的機會。

- 人工智慧解決方案在該行業中的優勢將使該地區的食品和飲料企業能夠在新工廠的試運行中實施人工智慧。例如,2023 年 2 月,推動永續植物來源和水果基食品和飲料未來發展的全球先驅 SunOpta 宣佈在德克薩斯州啟動新的植物來源飲料生產設施。公告。新的大型工廠將生產全系列植物來源奶、奶精和茶。包裝尺寸和配置包括用於外食、貨架零售和電子商務的植物性乳製品的 16 盎司和 32 盎司包裝,以及常用於高蛋白能量飲料的 330 毫升瓶裝。

- 越來越多的證據表明人工智慧 (AI) 將對加拿大的醫療實踐產生重大影響。 GE 醫療集團 Edison 平台的推出使得重症監護套件和氣胸演算法的開發成為可能。 Edison 能夠無縫上傳和共用醫院的影像,並提供共用網路的共享工作區,來自不同組織的放射科醫生可以在其中管理和註釋影像。多倫多亨伯河醫院是簽署資料共用協議開發重症監護套件的四家機構之一,為 GE Healthcare 提供了 156,000 張符合隱私要求的胸部 X 光影像和相關報告。

- 此外,2023 年 9 月,Google Cloud 與科技公司大陸集團宣佈建立策略合作夥伴關係,為汽車產業提供創新、靈活且面向未來的數位解決方案。此次合作將把大陸集團的汽車技術專業知識與Google的資料和人工智慧技術相結合,打造新一代安全、高效和以用戶為中心的汽車解決方案。此外,兩家公司期待將策略夥伴關係拓展到更多合作領域,為客戶打造更好的汽車連結和體驗。

工業人工智慧軟體產業概況

工業人工智慧軟體市場表現出適度的分散性,由幾家主要企業組成,包括西門子公司、英偉達公司和Cisco。目前市場主導地位集中在少數幾家大公司手中,這些公司正在採取策略聯盟來擴大市場佔有率並提高盈利。

2023 年6 月,Alphabet 旗下公司Intrinsic 宣布與西門子合作,帶來Intrinsic 的機器人軟體,旨在無縫利用基於人工智慧的功能,並且已開始探索與西門子數位工業公司的整合和介面,西門子數位工業公司以其可互通和開放的產品組合而聞名。

2023 年 2 月,公認的數位工程和雲端轉型合作夥伴 Mastech 與創新的人工智慧主導零售軟體解決方案提供商 Netail 合作。兩家公司之間的策略聯盟旨在幫助電子商務和全通路零售商最佳化其零售價值鏈,吸引、轉換和留住數位消費者。 Mastek 在數位商務和資料分析方面的豐富專業知識與 Netail 的尖端人工智慧技術(在產品選擇、定價和客戶參與決策中發揮關鍵作用)相結合,創造出高度協同效應的零售解決方案。這將會成為現實。 Mastek 和 Netail 為線上零售商提供個人化的晶粒、對消費行為的更深入的了解、高效的用戶體驗、靈活的分類策略和即時的市場可視性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 巨量資料技術在製造業的應用增多

- 擴大應用基礎並更加重視實施數位轉型以實現成本降低

- 市場抑制因素

- 敏感或合法資料的資料問題

第6章市場區隔

- 依類型

- 雲端基礎

- 本地

- 依最終用戶產業

- 汽車與運輸

- 零售/消費品

- 醫療保健/生命科學

- 航太/國防

- 能源/公共產業

- 其他最終用戶產業

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭環境

- 公司簡介

- IBM Corporation

- Intel Corporation

- Nvidia Corporation

- Microsoft Corporation

- Siemens AG

- Oracle Corporation

- Cisco Systems, Inc

- Veritone Inc.

- Advanced Micro Devices

- Google Inc

第8章投資分析

第9章 市場機會及未來趨勢

The industrial AI software market is valued at USD 84.34 billion in the current year. It is expected to register a CAGR of 35.97% during the forecast period to become USD 391.97 billion by the next five years.

Key Highlights

- Increased focus on capturing value from industrial data. This drives the need for multi-dimensional optimization, meaning AI-enabled decision-making and operational agility are becoming more critical to executives. To thrive in today's volatile market, companies must simultaneously optimize their assets and processes across business objectives such as margins, economics, sustainability, etc.

- According to the European Commission, the European AI Strategy seeks to establish the European Union (EU) as a premier AI hub and to guarantee that artificial intelligence (AI) is trustworthy and centered on people. Such a purpose is translated through specific laws and deeds into the European approach to excellence and trust. An essential part of excellence in AI is making the most of available resources and coordinating investments. The Commission intends to invest EUR1 billion annually in AI through the Digital Europe and Horizon Europe programs. Over the digital decade, it will mobilize other investments from the private sector and the Member States to reach an annual investment volume of EUR 20 billion.

- Although AI is still one of the critical technology areas, organizations require an efficient way to scale their AI practices and use AI in business to accelerate ROI in AI investment. As organizations face more significant pressure to optimize their workflows, more companies will ask BI teams to manage and develop AI/ML models. The two critical factors that will drive this boost of a new BI-based AI developer class: First, enabling BI teams with tools such as automation platforms is more scalable and more sustainable than hiring dedicated data scientists; second, because BI teams are significantly closer to the business use-cases compared to data scientists, the lifecycle from the working model's requirement will be accelerated.

- With the advancement in AI technology, it is becoming more important than ever for the government to innovate its traditional methods to achieve better citizen engagement, interoperability, and accountability. Such trends are driving the demand for AI Governance from enterprises and organizations worldwide. For instance, Google has highlighted five areas where the government, in collaboration with AI practitioners and wider civil society, can play a crucial role in clarifying expectations about AI's application on a context-specific basis. These include explainability standards, safety considerations, approaches to appraising fairness, general liability frameworks, and requirements for human-AI collaboration.

- On the contrary, While most enterprise IT procurement is limited to simply choosing suitable software or hardware and eventually deploying it to serve its purpose, the fundamental trouble with AI is that there's an ongoing requirement for initial training and working with data and calibrating it to deliver the result. There are known problems limiting normalizing data in electronic records. These include natural language processing (NLP), proprietary datasets threatening open innovation, frequent bias in the medical literature due to journal bias and even outright fraud, and the growing complexity of health data such that past data is not specific sufficiently to be useful for current predictions.

- The issues caused by the COVID-19 pandemic suggested the weaknesses in production and redistribution with changes needed to make the supply chain more resilient. An increased investment toward AI in any in-transit element across the retail supply chain was presented. The industries in the various regions then depicted the biggest problems facing the supply chains as employee illness and shortages of raw supplies. The growing industrial focus on automation in the post-pandemic scenario and the move towards digitalization will result in higher demand for analytics and AI solutions in the market, which is expected to be more prevalent among IoT users in industries.

Industrial AI Software Market Trends

Retail and Consumer Packaged Goods is Expected to Hold Significant Share of the Market

- Factors driving expansion include the ever-increasing number of internet users, smart gadgets, the necessity for surveillance and monitoring in physical stores, and government initiatives encouraging digitization. Artificial intelligence (AI) in retail is based on how firms have operated over the last few decades.

- AI solutions and Big data analytics are essential to digital business; they have the potential to alter everything from customer experience to business processes. Artificial intelligence drives faster firms' decisions in e-commerce, marketing, product management, and other business areas by decreasing the gap from insights to action. According to the United States Department of Commerce, retail sales in the United States are expected to reach USD 5.99 trillion in 2023.

- Further, the rise in retail stores would create an opportunity for AI players to develop new tools to cater to a broad range of retail customers. For instance, According to the United States Bureau of Labor Statistics, in the 3rd quarter of 2022, there were 1,061,539 private retail trade establishments in the United States, which is a rise from the 1st quarter of 2022 private retail establishments, i.e., 1,049,543. Further, according to the National Bureau of Statistics of China, there were 292,383 retail chain stores in China last year.

- Moreover, according to MIT Technology Review Insights and Amazon, about half of the retail and consumer goods industry respondents state that deploying AI can help improve customer care. This means an AI solution could take over augmented conversations to respond to client questions and lead the customer to the right agent when it cannot assist. Additionally, 47% of respondents said that AI could significantly improve inventory management by helping to manage costs and buyers' needs. AI tracks quantities of supply and demand at both e-commerce sites and physical locations, ensuring they are in sync.

- Moreover, various retail firms are adopting AI to provide better services to customers. For Example, ThredUp, an online consignment business, introduced Goody Boxes, comprising different used apparel items tailored to each customer's style. Customers keep and pay for the things they want while returning the ones they don't. An AI algorithm recalls each customer's preferences so that future boxes are more tailored to their interests. Customers prefer non-subscription boxes overlooking individual parts.

- According to the National Retail Federation, Seven & I Holdings, the parent company of the 7-Eleven retail chain, had over 40,000 retail stores in operation worldwide in 2022. 7-Eleven is a chain of convenience stores that operate in many countries globally. That year, Seven & I had more retail stores than any of the world's leading retail companies, such as Walmart, which had nearly 10,500 retail outlets, or the Schwarz Group, with some 13,750 stores. Although Walmart was not the company with the most locations, it was the world's leading retailer. Such a huge number of retail stores would create an opportunity for market players to develop new solutions to capture the market share.

North America is Expected to Hold a Significant Share.

- The market for artificial intelligence (AI) solutions in various industries is growing in North America, with the United States leading the way. In North America, the readiness for adoption and high fractional growth in replacement AI are the foremost drivers of their economic impact, which reflects the region's leading stance on artificial intelligence and its implementation. Moreover, the high automation potential is expected to occur at the regional level shortly, and it is also aiding the cause.

- According to the National Science and Technology Council report, In Fiscal Year 2022 (FY22), the Federal Government spent USD 8.76 billion USD on research and development in information technology, up USD 410 million or 4.9 percent from the year before. According to the study, USD 2.58 billion was spent on AI research and development in FY22 by all Federal research organizations. This is an increase of USD 130 million (+5.3%) from the prior fiscal year. According to the report, NSF (USD 654 million), NIH (USD 551 million), DARPA (USD 457 million), and the Department of Defense (USD 391 million) were the top funding sources for AI R&D in FY22, with DOE Office of Science (USD 130 million) following closely behind. Such massive spending on Artificial intelligence would create an opportunity for the players to develop new solutions to expand their market share.

- The benefits of AI solutions in the industry would enable the region's food and beverage players to deploy AI to commission new plants. For instance, in February 2023, SunOpta, a global pioneer fueled by the future of sustainable, plant-based, and fruit-based food and beverages, is pleased to announce the launch of its new plant-based beverage production facility in Midlothian, Texas. The new mega-factory will produce a whole line of plant-based milk, creamers, tea, and other items. Package sizes and configurations will include 16-ounce and 32-ounce packages used in food service, shelf-stable retail, and e-commerce for plant-based milk products, as well as 330-milliliter bottles used broadly in high-protein nutritious beverages.

- There is growing evidence that artificial intelligence (AI) is poised to significantly impact the practice of medicine in Canada. The development of the Critical Care Suite and the pneumothorax algorithm was made possible by the launch of GE Healthcare's Edison platform. Edison allows seamless uploading and sharing of images from partnering hospitals and provides a shared Web-based workspace on which radiologists from different organizations can curate and annotate the images, an essential prerequisite to training an algorithm. Humber River Hospital in Toronto, one of four institutions to sign a data-sharing agreement for developing the Critical Care Suite, provided 156,000 privacy-compliant chest X-rays and associated reports to GE Healthcare.

- Further, in September 2023, Google Cloud and technology company Continental announced a strategic partnership to provide innovative, flexible, and future-oriented digital solutions for the automotive industry. The partnership will combine Continental's expertise in automotive technology with Google's data and AI technologies to create a new generation of safe, efficient, and user-focused automotive solutions. Furthermore, the two parties expect to expand their strategic partnership into additional fields of collaboration in the future to build greater in-car connectivity and experiences for customers.

Industrial AI Software Industry Overview

The industrial AI software market exhibits moderate fragmentation and comprises several key players, including Siemens AG, Nvidia Corporation, and Cisco Systems, among others. Market dominance is currently concentrated among a select few major players who employ strategic collaborations to expand their market presence and enhance profitability.

In June 2023, Intrinsic, an Alphabet company, announced a partnership with Siemens to explore integrations and interfaces between Intrinsic's robotics software, designed to facilitate seamless utilization of AI-based capabilities, and Siemens Digital Industries, renowned for its interoperable and open portfolio for industrial production automation and management.

In February 2023, Mastek, a reputable digital engineering and cloud transformation partner, joined forces with Netail, an innovative AI-driven retail software solutions provider. Their strategic alliance aims to empower e-commerce and Omni-channel retailers to optimize their retail value chain while attracting, converting, and retaining digital consumers. Combining Mastek's extensive expertise in digital commerce and data analytics with Netail's cutting-edge AI technology, which plays a pivotal role in decision-making related to product selection, pricing, and customer engagement, will result in a synergistic retail solution. Together, Mastek and Netail will provide online retailers with personalized merchandising, a deeper understanding of consumer behavior, an efficient user experience, a flexible assortment strategy, and real-time market visibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Usage of Big Data Technology in Manufacturing

- 5.1.2 Expanding application base and growing emphasis on adoption of digital transformation practices to realize cost savings

- 5.2 Market Restrains

- 5.2.1 Data Privacy Concerns of the Confidential And Legal Data

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Cloud Based

- 6.1.2 On-Premise

- 6.2 By End User Industries

- 6.2.1 Automotive and Transportation

- 6.2.2 Retail and Consumer Packaged Goods

- 6.2.3 Healthcare and Life Science

- 6.2.4 Aerospace and Defense

- 6.2.5 Energy and Utilities

- 6.2.6 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 Nvidia Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Siemens AG

- 7.1.6 Oracle Corporation

- 7.1.7 Cisco Systems, Inc

- 7.1.8 Veritone Inc.

- 7.1.9 Advanced Micro Devices

- 7.1.10 Google Inc