|

市場調查報告書

商品編碼

1408422

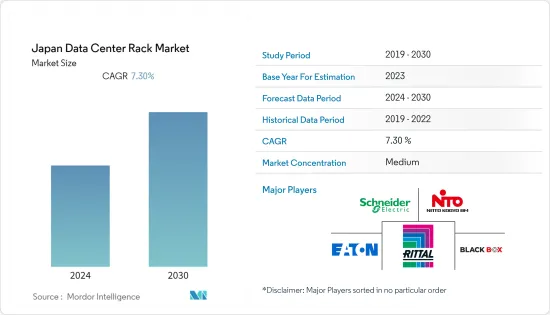

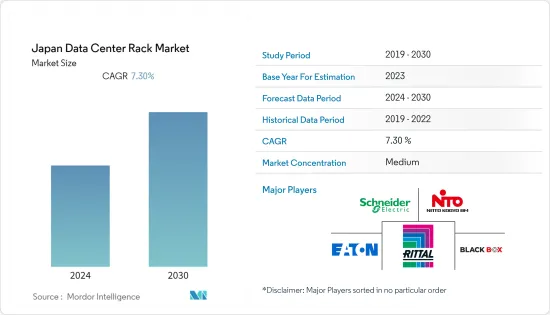

日本資料中心機櫃:市場佔有率分析、產業趨勢、統計資料、2024年至2030年成長預測Japan Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

上年度日本資料中心機櫃市場規模超過 33 萬台,預計在預測期內複合年成長率為 7.3%。

中小企業對雲端運算的需求不斷成長、政府有關資料安全的法規以及國內企業投資的增加是推動該國和地區資料中心需求的關鍵因素。

主要亮點

- 在建IT負載能力:日本資料中心市場未來IT負載能力預計到2029年將達到2000MW。

- 正在建造的高架建築面積:到 2029 年,日本的占地面積預計將增加到 1,000 萬平方英尺。

- 規劃的機架:預計到2029年,全國安裝的機架總數將達到50萬個。到 2029 年,東京將安裝最多數量的機架。

- 規劃中的海底電纜:連接菲律賓的海底電纜有近30條,其中許多正在建造中。東南亞-日本 2 號電纜 (SJC2) 是計劃於 2023 年投入使用的一條海底電纜,它將連接從千倉到日本志摩的 10,500 公里長。

日本資料中心機櫃市場趨勢

BFSI 預計將持有主要股份。

- BFSI產業的IT負載容量預計到2029年將增加超過400MW,複合年成長率為5%。在日本,銀行服務已經被大眾廣泛使用。因此,與歐美國家一樣,金融機構管理數位化的主要目的是提高管理效率,例如最佳化現有業務效率、重建舊有系統、重建分店和ATM網路等。目前,瑞穗金融集團、新生銀行集團、住信SBI網路銀行等都在關注BaaS(銀行即服務)。

- 在某些情況下,銀行正在考慮針對中小企業推出業務改善措施。一些中小型企業使用EDI(電子資料交換)系統進行訂購和下訂單。銀行正在建立付款管道並將其與EDI系統連接,以允許企業同時確認訂單(商業流程資料)和付款(財務資料)並自動執行對帳工作。

- 日本的大型銀行正在採取更開放的方式來推廣數位付款。三菱日聯銀行計劃與 Akamai 合作推出全球開放網路,利用區塊鏈技術在全球範圍內實現快速、安全的數位付款。銀行也在利用人工智慧和自動化。例如,瑞穗銀行開發了一種 AOR 解決方案,利用人工智慧、OCR 和 RPA,透過自動處理銀行 80% 以上的支票和文件來簡化後勤部門業務。銀行的這些趨勢和舉措預計將導致該領域的顯著成長。

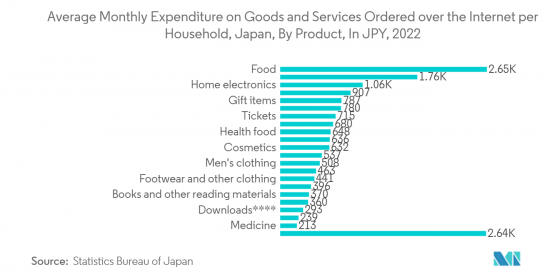

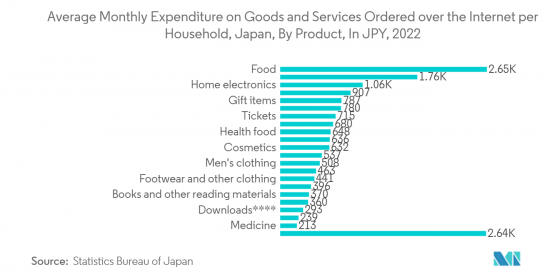

- 此外,行動錢包在日本各地的電子商務業務中非常普及。此外,這些現代化設備可以實現快速、安全的交易。例如,2022年4月,PayPal與銷售男士護膚品的「BULK HOMME」合作,作為新商家。透過此次合作,BULK HOMME 客戶將能夠使用其 PayPal 帳戶線上購買產品並使用 PayPal 進行購買。

全機架預計將大幅成長

- 在日本,由於公司間空間日益短缺,全機架佔了大部分市場。由於行動寬頻、電子商務、電子競技的快速成長以及大巨量資料的興起,必須建造全機架的資料中心,以適應機架容量的增加。

- 例如,2022 年 7 月對每月至少玩一次智慧型手機遊戲的日本人進行的一項調查顯示,65% 的受訪者每天都會玩智慧型手機遊戲。此外,92% 的受訪者表示他們每週至少玩一次智慧型手機遊戲。此外,在不斷擴大的電競市場中,日本還有總獎金超過909,000美元(超過1億日圓)的大型賽事:Shadowverse World Grand Prix 2021、PUBG Mobile Japan League season 1等。預計此類案例將對該地區的資料儲存容量產生進一步的需求。

- 最初,資料中心機架空間受到的關注有限,尺寸和成本是部署期間的唯一考慮因素。然而,隨著包括網路銀行業務、通訊、媒體和娛樂在內的各個行業的用戶擴大採用高密度應用,資料中心機架空間的利用率可能會增加。

- 隨著企業每天產生大量資料,他們越來越依賴資料中心來有效管理資料庫和儲存。因此,資料中心機櫃利用率的主要驅動力是完全配置的資料中心部署的增加。大公司對 IT 服務和投資的需求不斷成長也影響著市場的成長。

- 一家全球資料中心供應商對在東京都市區建造的超大規模資料中心的一個區塊進行了數百億日圓的初步投資。整個計劃的總成本估計超過1000億日圓(668,498,400美元)。日本對資料中心機櫃的需求正在增加,因為超大規模設施主要配備全機架單元。

日本資料中心機櫃產業概況

隨著日本未來計畫的資料中心建設計劃,未來幾年對資料中心機櫃的需求可能會增加。日本資料中心機櫃市場由伊頓公司、Black Box Corporation、Rittal GMBH &Co.KG、施耐德電機 SE 和 Nitto Kogyo Corporation 等幾家主要企業適度整合。憑藉主導市場佔有率,這些領先公司專注於擴大其區域基本客群。

2022 年 10 月,伊頓宣布發布新的開放運算計劃(OCP) 開放機架 v3 (ORV3) 相容解決方案。它是專門建置和專用配置的,重點是為希望部署 ORV3 機架的資料中心設施高效且可擴展地提供關鍵電力。機架具有寬而深的機櫃,帶有開放式機架外殼,支援混合安裝設備和兩個鎖定的主機代管隔間。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 5G網路優勢日益凸顯

- 日本光纖連接網路的擴建

- 市場抑制因素

- 網路安全威脅和勒索軟體攻擊呈上升趨勢

- 資源可用性低

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 影響評估

第5章市場區隔

- 機架尺寸

- 四分之一架

- 半架

- 全機架

- 最終用戶

- 資訊科技/通訊

- BFSI

- 政府機關

- 媒體與娛樂

- 其他最終用戶

第6章 競爭形勢

- 公司簡介

- Eaton Corporation

- Black Box Corporation

- Rittal GMBH & Co.KG

- Schneider Electric SE

- Nitto Kogyo Corporation

- Dell Inc.

- nVent Electric PLC

- Hewlett Packard Enterprise

第7章 投資分析

第8章 市場機會及未來趨勢

The Japanese data center rack market reached a volume of over 330,000 in the previous year, and it is further projected to register a CAGR of 7.3% during the forecast period. The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country/region.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Japan data center market is expected to reach 2,000 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 10 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 500K units by 2029. Tokyo is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 30 submarine cable systems connecting the Philippines, and many are under construction. One such submarine cable that is estimated to start service in 2023 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 Kilometers with landing points from Chikura, Japan, to Shima, Japan.

Japan Data Center Rack Market Trends

BFSI Expected to hold the major share.

- The IT load capacity of the BFSI sector is anticipated to grow more than 400 MW by 2029, registering a CAGR of 5%. In Japan, banking services are already widely available to the public. Therefore, as in Europe and the United States, the main aim in digitalizing the management of financial institutions is to improve their management efficiencies, such as optimizing the efficiency of existing operations, rebuilding legacy systems, and restructuring branch and ATM networks. Mizuho Financial Group, Shinsei Bank Group, SBI Sumishin Net Bank, and others are currently focusing on BaaS (Banking as a Service).

- There are examples of banks considering introducing measures to improve business operations for SMEs. Some SMEs use electronic data interchange (EDI) systems to place and receive orders. Banks are trying to construct a settlement platform and link it to an EDI system so that companies can check their order (commercial data) and settlement (financial data) at the same time and automate the process of reconciliation.

- Megabanks in Japan are adopting a more open approach to push digital payments. MUFG bank plans to launch a global open network with Akamai to make high-speed and secured digital payments globally by leveraging blockchain technologies. Banks are also leveraging AI and automation. For instance, Mizuho Bank developed an AOR solution leveraging AI, OCR, and RPA to automatically process more than 80% of the checks and documents of the bank, which streamlined its back-office operations. Such trends and initiatives by banks are expected to lead to considerable growth in this segment.

- Further, Mobile wallets are becoming extremely popular all over Japan for e-commerce businesses. Additionally, the usage of these modern instruments enables quick and secure transactions. For instance, In April 2022, as a new merchant, PayPal collaborated with "BULK HOMME," a skincare company that sold items for guys. Due to the partnership, customers of Bulk Homme would be able to use their PayPal accounts to shop for products online and make purchases using PayPal.

Full Rack is Expected to Grow Significantly

- In Japan, due to growing space scarcity between various companies, the full rack has a majority of the market share. In order to cope with increasing rack capacity due to the rapid growth of mobile broadband, e-commerce, esports, and the increase in Big Data Analytics combined with cloud computing, it is necessary to build a fully rack-equipped data center.

- For instance, In a July 2022 survey of Japanese residents who played smartphone games at least once a month, 65% of respondents played smartphone games every day. Overall, 92% of respondents reported playing smartphone games at least once a week. Additionally, in the growing esports market, Japan has a large tournament with a prize of more than 909,000 USD (more than 100 million yen): Shadowverse World Grand Prix 2021, PUBG Mobile Japan League season 1. Such instances are expected to create more need for data storage space in the region.

- At first, there was a limited focus on rack space in data centers; only size and cost were taken into account during deployment. Nevertheless, there is an opportunity for increased use of rack space in the data center as more and more users from different sectors, such as online banking, telecommunications, media and entertainment, and others, are adopting applications with higher density.

- Companies increasingly rely on data centers for efficient management of their databases and storage, as they generate significant amounts of data every day. The main driving factor for data center rack usage is, therefore, the increased deployment of fully configured data centers. Also, the growth of the market is being influenced by the growing demand for IT services and investments made by large companies.

- A global data center vendor invested an initial amount into tens of billions of Japanese yen in the Tokyo metropolitan region for one block of a hyperscale data center it constructed. The whole project is estimated to cost more than JPY 100 billion (USD 668498400). Hyperscales facilities are majorly equipped with full rack units, which results in rising demand for data center racks in the country.

Japan Data Center Rack Industry Overview

The upcoming DC construction projects in the country will likely increase the demand for Data Center Racks in the coming years. The Japan Data Center Rack Market is moderately consolidated with a few major players, such as Eaton Corporation, Black Box Corporation, Rittal GMBH & Co.KG, Schneider Electric SE, and Nitto Kogyo Corporation in the market. These major players, with a prominent market share, focus on expanding their regional customer base.

In October 2022, Eaton announced the release of its new Open Compute Project (OCP) open rack v3 (ORV3) compatible solutions. It is purpose-built and preconfigured, focusing on the efficient, scalable delivery of critical power for their data center facilities seeking to deploy ORV3 racks. The rack features extra-wide and extra-deep cabinets; the open rack enclosure supports hybrid mounting equipment and two locking-colocation compartments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Rising Dominance of the 5G Network

- 4.2.2 Fiber Connectivity Network Expansion in the Country

- 4.3 Market Restraints

- 4.3.1 Increasing Cybersecurity Threats and Ransomware Attacks

- 4.3.2 Low Availability of Resources

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Rack Size

- 5.1.1 Quarter Rack

- 5.1.2 Half Rack

- 5.1.3 Full Rack

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Eaton Corporation

- 6.1.2 Black Box Corporation

- 6.1.3 Rittal GMBH & Co.KG

- 6.1.4 Schneider Electric SE

- 6.1.5 Nitto Kogyo Corporation

- 6.1.6 Dell Inc.

- 6.1.7 nVent Electric PLC

- 6.1.8 Hewlett Packard Enterprise