|

市場調查報告書

商品編碼

1408393

直線馬達:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Linear Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

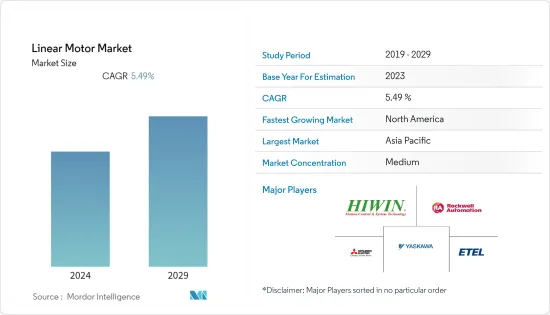

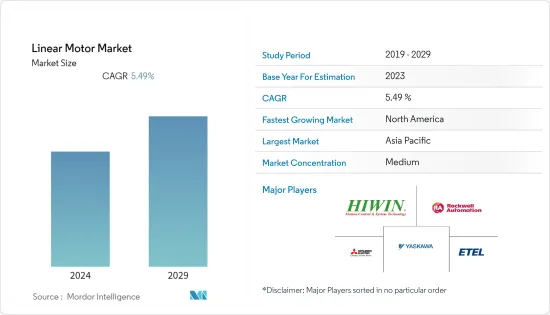

直線馬達市場上年度市場規模為18.8億美元,預計未來五年將達24.6億美元,複合年成長率為5.49%。

直線電機是一種旋轉電機,無需接觸任何部件即可產生直線運動。這消除了間隙、纏繞和維護問題。因此,工具機、半導體設備、電子製造和許多其他工業運動控制應用對直線馬達的需求不斷增加。用於各種工業應用的自訂直線馬達的可用性也在增加。

主要亮點

- 預計在預測期內,直線馬達市場將出現強勁成長。圓柱形直線馬達是具有平滑軸向運動的高剛性機器。直線馬達目前廣泛用於自動化車輛性能,加速了汽車產業的市場成長。隨著汽車行業的快速發展,對為駕駛員提供便利和安全的直線馬達的需求正在迅速增加。汽車製造業的成長將增加對直線馬達在生產線輸送、搬運、定位、分類和送料方面的需求。

- 亞太地區預計將在全球直線馬達市場中顯著成長。 Technotion 是一家領先的直接驅動組件製造商,最近在中國蘇州開設了新的銷售辦事處,這是其持續國際擴張的重要一步。對於該公司在直線運動行業的高性能產品和豐富的行業知識而言,中國是一個潛在的成長市場。為了滿足亞太地區的市場需求,新興市場的技術開拓正在推動直線馬達的發展。

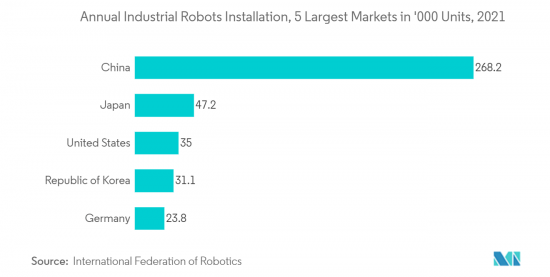

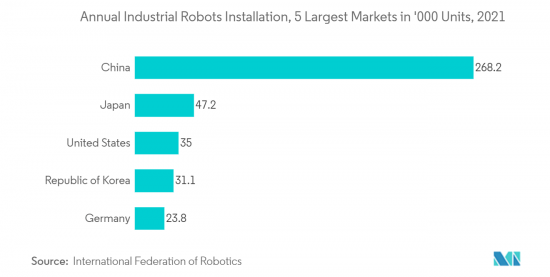

- 高性能工業自動化所佔比例的不斷增加正在推動直線馬達在全球範圍內的採用。亞洲被認為是全球最大的工業機器人部署市場。中國、日本和韓國是亞太地區年度工業自動化裝置的重要市場。這些資料預示著該地區直線馬達的未來成長。

- 今年,西門子宣布了一項20億美元的投資策略,在新加坡建造一座新的高科技工廠,以服務東南亞快速成長的智慧型硬體技術市場。該公司還宣布對該工廠投資 2.15 億美元,以整合高度自動化的製造流程。

- COVID-19 大流行促使各行業採用工業自動化來更好地管理業務。利用有限且昂貴的勞動力資源來管理高速營運的需求正在推動對自動化設備的需求。為了因應這一趨勢,即使在COVID-19之後,製造業的自動化預計仍將持續,以降低全球供應鏈風險。這可能會在後疫情時代促進全球直線馬達市場的採用。

直線馬達市場趨勢

研究直線馬達的最佳控制特性以推動市場成長

- 高性能直線運動系統可以精確滿足性能要求並適應特定行業的應用。因此,直線運動系統製造商正在專注於獨特的設計,以實現最佳化的控制和更好的運作品質。這也使得目標商標產品(OEM) 能夠最佳化“齒槽效應”,即鐵芯直線馬達中經常出現的力脈動。

- 對直線馬達動態特性的日益成長的要求促使製造商與自動化專家合作以實現他們的目標。人們對輕型線性伺服驅動器的需求不斷成長,這些驅動器比傳統機械驅動系統更節能且具有更好的控制技術。

- 先進的運動控制器和伺服驅動器為線性馬達運動提供增強的控制特性。因此,透過創新,OEM正在為直線馬達引入新的模組化設計。直線馬達採用一流的控制技術,為各種應用提供快速、準確且可靠的運動控制能力。與傳統馬達相比,直線馬達在剛度和頻率響應方面的優越性預計將推動全球直線馬達市場的成長。

- 在電子和半導體行業,晶圓處理、檢查、測試、組裝和包裝等應用對直線馬達的需求量很大。線性驅動器能夠有效控制電子和半導體行業中的高精度、高功率和低維護等挑戰,使當局能夠確保長期和永續的競爭優勢。

- 隨著全球電子工業的發展,對微晶片的需求不斷增加。隨著世界各地建立越來越多的半導體製造地,對製造微晶片的機器人和自動化的需求不斷增加。高度控制的線性馬達可以支援廣泛的半導體應用,從晶圓級到檢查、拾放和計量要求。

亞太地區可望主導全球直線馬達市場

- 亞太地區擁有全球最大的工業自動化市場。根據國際機器人聯合會的數據,中國是亞太地區工業機器人系統的最大採用者,其次是日本。高精度、高速度和高反應性將推動機器人、CNC工具機和自動化系統對直線馬達的需求。

- 亞太地區的工業正在採用 U 形直線馬達進行拾取程序,以避免生產過程中的材料損壞。線性伺服驅動器具有用於精確拾放運動的客製化開發平台。客製化開發平台提高運作速度和效率,同時提供精確控制。

- 亞太地區直線馬達市場為許多國家提供了巨大的成長機會。馬來西亞、新加坡、台灣和泰國是電子公司最青睞的目的地。近年來,由於人事費用低且靠近重要終端市場,印度和越南已成為重要地點。

- 第四次工業革命為工廠引進了先進的硬體和軟體,提高了效率。隨著工業4.0的快速發展,東南亞國家正在將數位技術融入製造業,以提高生產力。據威斯康辛州經濟發展公司稱,新加坡最近宣布了一項十年藍圖,計劃在本年終末將其製造業成長 50%。同樣,馬來西亞計劃同期將工業生產力提高30%。

- 亞太地區先進製造和工業4.0的成長趨勢為直線馬達市場的公司提供了實現營運精度和效率的機會,從而推動了區域市場的成長。

直線馬達行業概況

由於多家公司的存在,直線馬達市場呈現分散化狀態。主要企業包括 ETEL SA、三菱電機公司、Tecnotion、羅克韋爾自動化、Aerotech, Inc.、Fanuc Corporation、Hiwin Corporation、Sinotech, Inc.、Faulhaber Group 和 Yaskawa Electric Corporation。該市場的主要企業正在推出創新的新產品並建立夥伴關係和協作,以獲得競爭優勢。

2022 年 10 月,機器自動化製造商和電腦數值控制專家 NUM 集團推出了專為工具機連續工作循環應用而設計的新系列無刷線性伺服馬達。該公司的LMX系列直線馬達可以減少惡劣運轉條件的影響。堅固的不銹鋼和整合式冷卻迴路可最大限度地提高初級線圈流量、最大限度地減少齒槽力並減少熱損失。

2022年4月,電機與發電機製造商三洋電機開發出高能效高速加減速線性伺服電機,以擴大其伺服系統陣容。此線性馬達可將設備加速至高速,從而縮短週期時間並提高生產率。此新產品適用於印刷基板表面黏著技術的傳送帶和進給軸等高速驅動裝置。減少馬達的功率損耗可以提高設備的能源效率,確保始終如一的高精度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 宏觀經濟因素及其對市場影響的評估

第5章市場動態

- 市場促進因素

- 工業自動化的興起推動了對直線馬達的需求

- 半導體產業對高性能直線馬達的需求不斷擴大

- 市場抑制因素

- 初始投資高

- 高負載應用程式中功耗增加

第6章市場區隔

- 按設計

- 圓柱形

- 平板型

- U型

- 按用途

- 建築/施工

- 電力/電子

- 食品和飲料

- 纖維

- 農業

- 車

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- ETEL SA

- Mitsubishi Electric Corporation

- Tecnotion

- Rockwell Automation

- Aerotech, Inc.

- FANUC CORPORATION

- Hiwin Corporation

- Sinotech, Inc.

- FAULHABER GROUP

- YASKAWA ELECTRIC CORPORATION

第8章投資分析

第9章 市場機會及未來趨勢

The linear motor market was valued at USD 1.88 billion in the previous year and is expected to register a CAGR of 5.49%, reaching 2.46 billion by the next five years. A linear motor is a rotary electric motor that can produce linear motion without contacting parts. This helps in eliminating backlash, windup, and maintenance issues. Thus, there is a growing demand for linear motors in machine tools, semiconductor equipment, electronic manufacturing, and many other industrial motion control applications. There is also a rising availability of custom linear motors for various industry applications.

Key Highlights

- The cylindrical motor segment is anticipated to witness robust growth in the linear motor market during the forecast period. A cylindrical linear motor is a highly rigid machine with smooth axis movement. The broader use of linear motors in cars to automate their performance is accelerating the market growth in the automotive sector. As the automotive industry is rapidly evolving, there is a surge in demand for linear motors to provide convenience and safety to drivers. Growth in automotive manufacturing will likely boost the demand for linear motors in production line transport, handling, positioning, sorting, and material provisioning.

- Asia Pacific is anticipated to grow significantly in the global linear motor market. Tecnotion, a leading direct drive components manufacturer, recently opened its new sales office in Suzhou, China, as an essential step towards continuous international expansion. China stands as a potential growth market for the company's high-performance products and vast industry knowledge in the linear motion industry. Growing technological advancements are aiding linear motors' development to meet the market demands in the Asia Pacific region.

- The growing rate of high-performance industrial automation is fuelling the adoption of linear motors globally. Asia is regarded as the world's largest market for the deployment of industrial robots. China, Japan, and the Republic of Korea are significant markets for annual industrial automation installations in Asia Pacific. Such data indicates the region's growth of linear motors in the coming years.

- In the current year, Siemens presented its investment strategy of USD 2 billion for a new high-tech factory in Singapore to serve Southeast Asia's booming intelligent hardware technologies market. The company also announced an investment of USD 215 million in the factory to incorporate highly automated manufacturing processes.

- The COVID-19 pandemic encouraged industries to adopt industrial automation to manage operations better. With the need to manage high-velocity operations with limited and expensive labor resources, the demand for automated equipment has risen. Following this trend, manufacturers are expected to increase automated manufacturing post-COVID-19 to mitigate global supply chain risks. This is likely to boost the adoption of the linear motor market across the globe in the post-pandemic era.

Linear Motor Market Trends

Optimum Control Characteristics of Linear Motors to Propel the Growth of the Market Studied

- A high-performance linear motion system enables performance requirements to be met precisely and adapts to industry-specific applications. As a result, linear motion system manufacturers focus on unique designs to achieve optimized control and better-traversing quality. This also enables original equipment manufacturers (OEMs) to optimize 'cogging,' a force ripple occurring frequently in iron-core linear motors.

- Growing demands for dynamic characteristics of linear motors are encouraging manufacturers to collaborate and cooperate with automation specialists to achieve their objectives. There is a rising demand for lightweight linear servo drives, which can be more energy efficient than conventional mechanical drive systems and with solid control technology.

- Sophisticated motion controllers and servo drives provide enhanced control characteristics to the motion of the linear motor. OEMs are, therefore, introducing new modular designs in linear motors through innovation. Linear motors with best-in-class control technology offer faster, precise, and reliable motion control capabilities for various applications. The advantage of linear motors in terms of stiffness and frequency response compared to traditional motors is anticipated to propel the global linear motor market growth.

- There is a growing demand for linear motors in the electronics and semiconductor industries for applications such as wafer handling, inspection, testing, assembly, and packaging, among others. The ability of the linear drives to effectively control the challenges, such as high precision, high dynamics, and low maintenance, in the electronics and semiconductor industries, enables authorities to secure long-term, sustainable competitive advantages.

- As the global electronics industry evolves, the need for microchips is proliferating. The growing establishment of semiconductor manufacturing hubs worldwide has increased the demand for robotics and automation to produce microchips. High-control linear motors can assist through a wide range of semiconductor applications from the wafer level, through inspection to pick and place and measurement requirements.

Asia Pacific Expected to Dominate the Global Linear Motor Market

- The Asia Pacific region accounts for the world's largest industrial automation market. The International Federation of Robotics states that China is the largest adopter of industrial robotic systems in Asia Pacific, followed by Japan. High accuracy, speed, and responsiveness are likely to boost the demand for linear motors in robotics, CNC machines, and automation systems.

- Industries in Asia Pacific have adopted the U-shaped linear motor for the pick and place procedure to avoid damaging materials during production. Linear servo drives feature a customized development platform for precise pick and place motion. The personalized development platform enhances operational speed and efficiency while achieving precise control.

- The Asia Pacific linear motor market presents significant growth opportunities for many countries. Malaysia, Singapore, Taiwan, and Thailand are some of the most preferred sites for relocating electronics companies. India and Vietnam have become important hubs in recent years, mainly due to their low labor costs and proximity to crucial final markets.

- The Fourth Industrial Revolution involved equipping factories with advanced hardware and software that promoted greater efficiency. With rapid advancements in Industry 4.0, Southeast Asian countries are incorporating digital technology in manufacturing to improve productivity. According to the Wisconsin Economic Development Corporation, Singapore recently announced a ten-year roadmap to grow its manufacturing sector by 50 percent by the end of this decade. Similarly, Malaysia plans to increase its industrial productivity by 30 percent within the same time.

- Growing trends of advanced manufacturing and Industry, 4.0 in Asia Pacific will provide opportunities for businesses in the linear motor market to achieve operational accuracy and efficiency, thereby promoting regional market growth.

Linear Motor Industry Overview

The Linear Motor Market is fragmented because of the presence of several companies. Some key players are ETEL SA, Mitsubishi Electric Corporation, Tecnotion, Rockwell Automation, Aerotech, Inc., Fanuc Corporation, Hiwin Corporation, Sinotech, Inc., Faulhaber Group, Yaskawa Electric Corporation., etc. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

In October 2022, NUM Group, a machine automation manufacturer and Computerized Numerical Control specialist launched its new series of brushless linear servo motors designed for continuous duty cycle applications in machine tools. The company's LMX series linear motors can help mitigate the effect of arduous operating conditions. Robust stainless steel and integrated cooling circuits maximize the flow rate in the primary coil section, which minimizes cogging forces and reduces thermal losses.

In April 2022, Motors and generators company Sanyo Denki Co., Ltd. developed an energy-efficient linear servo motor with fast acceleration and deceleration to expand its servo system lineup. The linear motor accelerates equipment faster, shortens the cycle time, and increases productivity. The new product is for high-speed drive equipment applications such as conveyor machines and feed axes of PCB surface mounters. Reduced power loss offered by the motor makes equipment more energy efficient, consistently providing high precision.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macro-economic factor and its Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Industrial Automation is fuelling the demand for linear motors

- 5.1.2 Growing demand for high performance linear motor in the semiconductor industry

- 5.2 Market Restraints

- 5.2.1 High Initial Investment

- 5.2.2 Increased power consumption for high load applications

6 MARKET SEGMENTATION

- 6.1 By Design

- 6.1.1 Cylindrical

- 6.1.2 Flat Plate

- 6.1.3 U-Channel

- 6.2 By Application

- 6.2.1 Building and Construction

- 6.2.2 Electrical and Electronics

- 6.2.3 Food and Beverage

- 6.2.4 Textile

- 6.2.5 Agriculture

- 6.2.6 Automotive

- 6.2.7 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ETEL SA

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Tecnotion

- 7.1.4 Rockwell Automation

- 7.1.5 Aerotech, Inc.

- 7.1.6 FANUC CORPORATION

- 7.1.7 Hiwin Corporation

- 7.1.8 Sinotech, Inc.

- 7.1.9 FAULHABER GROUP

- 7.1.10 YASKAWA ELECTRIC CORPORATION.