|

市場調查報告書

商品編碼

1408392

電子書閱讀器:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測E-Reader - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

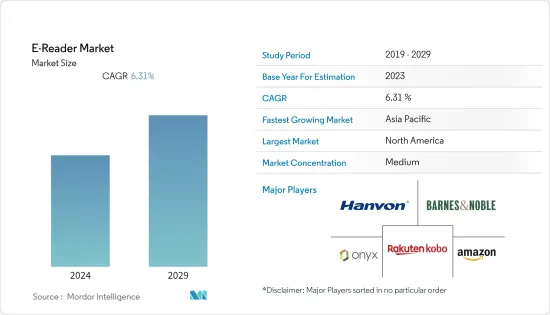

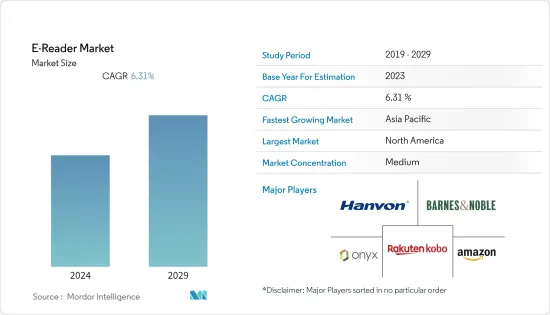

目前全球電子書閱讀器市場規模為73.6億美元,預計未來五年將達到100億美元,預測期內複合年成長率為6.31%。

市場的成長受到多種因素的推動,例如電子書使用量的增加、電子閱讀器電池壽命的延長以及電子閱讀器的無眩光/光污染特性。電子書閱讀器或電子書設備主要用於閱讀書籍的電子副本。該設備可以在螢幕上顯示文本,並根據讀者的喜好最佳化字體大小、亮度和文字層級。

主要亮點

- 電子閱讀器在螢幕技術方面更為先進。現今的高解析度顯示器可提高對比度、提高色彩準確度並減少眩光。這使得電子閱讀器更類似於印刷書籍,為使用者提供更舒適的閱讀體驗。一些電子閱讀器具有可調節的色溫,允許讀者根據自己的喜好自訂顯示。許多電子書平台現在提供線上讀書俱樂部和論壇等功能,讓讀者可以與具有相似興趣的人聯繫。還有一個平台,您可以與其他讀者共用您的筆記和註釋,創造更互動的閱讀體驗。這種趨勢很可能會持續下去,社交閱讀在電子閱讀中將變得越來越重要。

- 包括挪威在內的歐盟經濟和金融理事會成員國已宣布降低適用於電子出版物的增值稅。最近,德國承諾頒布立法,將電子書、線上日誌和報紙的付加稅率從 19% 降低至 7%。此舉是在歐盟理事會同意允許各國將電子書與減價/免稅實體書相匹配之後做出的。這項削減措施已在多個歐盟國家實施。電子出版 (EPUB) 是由國際數位出版論壇(萬維網聯盟的一部分)開發的最廣泛採用的電子書文件格式。另一種主要的電子書格式是由 Adobe 開發的 PDF。 PDF 格式因其易用性而在網路上廣泛使用。

- 電子書終端已發展成為單獨的銷售點,允許用戶瀏覽無限數量的書籍和內容,從新版本到舊書再到長期絕版書籍。數位化正在擴大閱讀和學習體驗,為出版商提供了發現人才的新來源,並為作家和插畫家提供了新的表達方式。例如,阿歇特圖書公司 (Hachette Livre) 在技術開發和創新方面走在圖書行業的前沿。阿歇特·利弗 (Hachette Livre) 應對新的閱讀方式和不斷變化的消費行為。另一方面,作為作者經濟利益的守護者,阿歇特·利弗熱衷於保證每本書的真實價值。

- 相反,音訊使用的增加可能會阻礙所研究的市場。有音訊是逐字或縮寫地大聲朗讀文本的口頭錄音。音訊是普通書籍的有用資訊來源,也是視覺障礙者的重要資訊來源。大多數位裝置都可以播放 MP3 檔案等音訊格式,Google Books 和 Amazon 等公司提供對廣泛書籍庫的存取。此外,Audiobook Creation Exchange (ACX) 可以輕鬆建立和分發數位有聲音訊。 ACX Marketplace 讓專業音訊創建數位音訊版本並賺取高達 40% 的版稅。 ACX 與數百家音訊製作人、演員和工作室建立了聯繫,可以透過版稅共用合作夥伴關係付費或免費聘用他們。

- 在 COVID-19 大流行期間,確保學生和教師只能線上上存取學習資源是當務之急。除了成長機會外,電子閱讀器還為出版商提供了一個很好的機會,可以擺脫傳統書店模式,透過數位平台直接接觸消費者,從而增加利潤。疫情爆發的最初幾個月,市場實體結構的危機導致教育內容轉向直接面向家長,供應鏈的壓縮增加了出版商對電子書的積極接受度。

電子書閱讀器市場趨勢

數位學習的新興趨勢可望推動市場發展

- 遠距教學的日益普及以及這些服務在智慧型手機、平板電腦、其他行動裝置和穿戴式技術上的使用越來越多,數位學習產業可能會受益。這些變數為數位學習和服務業務提供了各種成長機會。學校和培訓機構正在將智慧技術融入其數位學習環境,而不是傳統的黑板方法。在大學層面,採用智慧學習等多種方法,為學生獲取符合產業需求的相關有用技能提供替代途徑和可能性。這種數位學習趨勢預計將推動受訪市場的發展。

- 卡達的國家電子學習入口網站提供各種資訊科技和商業領域的線上課程。從 2,500 多個課程中進行選擇,享受靈活的學習。數位學習入口網站已被卡達 24 個組織和 37 家中小企業使用,已完成 4,000 多門課程。此外,哈馬德醫療公司、杜哈銀行和卡達石油公司已獲得資訊和通訊技術最高委員會批准,將卡達國家數位學習入口網站的課程涵蓋其就業發展計劃,被稱讚為成功實施。 HMC 被評為頂級組織。

- 行動學習課程設計者面臨的挑戰是建立不需要下載大量資料的課程。透過 MLearning,資訊可以透過行動裝置共用。因此,數位學習模組必須針對小螢幕進行客製化。數位學習課程中應允許使用需要更詳細資訊、複雜視覺效果或更多資料或頻寬的媒體。每個螢幕一個想法的小型模組、突出的按鈕和簡單的導航是呈現資訊的理想方式,並且各種供應商都有望滿足這一需求。

- 另一方面,再培訓是指學習或教導新技能,以便勝任同一公司內或公司外的不同工作。例如,如果某項工作被自動化取代,則該工作的員工必須培養管理技術的技能或將其轉移到完全不同的角色。超過三分之一 (37%) 的公司目前正在實施再技能培訓,近五分之三 (56%) 計劃在明年內實施。以下是公司對個人進行新工作再培訓最常見的方式。其中包括輔導和指導(57%)、工作見習(41%)和在職訓練(65%)。新興市場的開拓預計將推動受訪市場的發展。

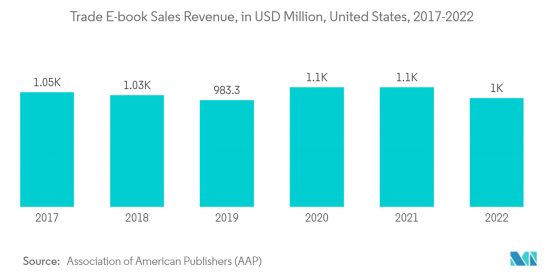

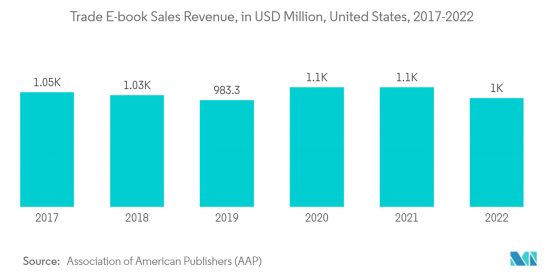

- 根據美國出版商協會 (AAP) 統計,美國電子書銷售額估計為 10 億美元。市場上智慧型手機、平板電腦和筆記型電腦等行動裝置的普及預計將對電子書市場的成長產生積極影響。據愛立信預計,2027年西歐的行動/行動電話用戶數量預計將達到7,800萬,中歐和東歐將達到6,900萬。這些數字預計將呈指數級成長,從而增加對數位閱讀訂閱的需求。

預計北美將佔據很大的市場佔有率

- 預計北美將在預測期內佔據最大佔有率並佔據重要的市場佔有率。智慧型手機、平板電腦和 iPad 等連網裝置的日益普及增加了對電子書閱讀器的需求。該國的競爭對手正專注於開發電子閱讀器和電子書,以增加市場競爭。例如,樂天工房公司推出了一款創新的數位閱讀技術設備「Kobo Libra H2O」。這款電子書閱讀器是一款7吋防水輕巧設備,旨在為最終用戶提供更好的閱讀體驗。

- 電子書的日益普及和普及正在極大地改變出版業,但電子書的性質和範圍因公司和類型而異。此外,透過互動式和動畫電子書,電子出版業務使許多出版商和作者能夠以更快、更先進的方式將他們的作品推向市場。能夠提供數位媒體的設備的激增和網際網路普及的提高使消費者能夠隨時隨地訪問他們喜愛的媒體內容,包括資訊、娛樂和社交活動。

- 該地區的參與企業正在策略性地開發新的行銷技術,以贏得市場佔有率。例如,亞馬遜以固定價格提供電子書,為 Prime 會員提供特殊優惠,並為作者提供自助出版服務。一些消費者和出版商批評這種封閉的環境,懷疑亞馬遜將主導這一領域。 Kindle Direct Publishing(KDP)服務允許作者在亞馬遜平台上自助出版書籍,並在短短 24 小時內賺錢。該公司正在擴大其電子書庫,讓作者更容易、更平易近人。該公司正在透過各種設備的應用程式提供電子書來擴展其電子書業務。

- 截至 2023 年 7 月,Overdrive 是公共圖書館最著名的數位發行商,為大多數圖書館的音訊和電子書館藏提供支援。如果圖書館需要一位暢銷書作者的多本書,就必須為每本書支付費用。費用因出版商而異,有些書籍在藉閱一定數量後就會過期。圖書館為其顧客購買音訊和電子書的最常見方式是透過一份、一個使用者模型。如果圖書館購買一本暢銷書,一次只能藉一本。大型圖書館系統可能有足夠的副本來滿足需求,而較小的分行可能只能購買少量副本。

- 同樣,亞馬遜最近發布了三款新的電子閱讀器:Kindle Paperwhite、Kindle Paperwhite Signature 和 Kindle Paperwhite Kids。這些型號配備新處理器、更大的 6.8 吋螢幕、10 週的電池壽命、暖光支援和新的 USB-C 充電。

電子書閱讀器產業概況

全球電子書閱讀器市場適度整合,有亞馬遜公司、Barnes & Noble Inc.、Rakuten Kobo Inc.、Hanvon Technology 和 Onyx International Inc. 等多家參與企業。公司不斷投資於策略聯盟和產品開拓,以獲得顯著的市場佔有率。近期市場開拓如下。

2023年5月,提供電子紙技術的E Ink元太科技宣布與聯發科加強合作,透過系統晶片開發進軍全球電子書閱讀器市場。憑藉E Ink元太科技的電子紙及系統技術與聯發科技先進的晶片解決方案的整合,兩家公司將為台灣製造商在全球電子書閱讀器市場帶來新的業務前景。

2023 年 4 月,數位書籍銷售和出版公司 Rakuten Kobo 宣布將開始在美國和英國提供 Kobo Plus。 Kobo Plus 是一項無限閱讀服務,每月提供超過 130 萬本電子書和 10 萬本音訊,非常適合書籍愛好者。 Kobo Plus 是一項無限閱讀訂閱服務,非常適合收集經典文學遺願清單、完整的作者目錄或深入研究新的興趣領域。透過每月支付較低費用的定期訂閱,您可以試閱您以前從未讀過的作者或類型的書籍的幾頁,如果您不喜歡它,請繼續閱讀其他內容否則不用感到內疚..

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 數位學習市場的新趨勢

- 低成本電子書閱讀器的普及

- 市場抑制因素

- 供應商/開發人員合作夥伴關係和基礎設施需求可能是該行業面臨的挑戰

第6章市場區隔

- 按螢幕大小

- 6吋以下

- 6-8英寸

- 8吋或以上

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他

- 中東/非洲

- 拉丁美洲

- 北美洲

第7章 競爭環境

- 公司簡介

- Amazon.com Inc.

- Barnes & Noble Inc.

- Rakuten Kobo Inc

- Hanvon Technology Co. Ltd.

- Onyx International Inc.

- Bookeen

- PocketBook International SA

- Sony Corportation

- Apple Inc

- ECTACO Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The global E-Reader market is valued at USD 7.36 billion in the current year and is expected to register a CAGR of 6.31% during the forecast period to reach a value of USD 10.00 billion by the next five years. The market's growth depends on various factors, including the growing use of E-books, E-readers' more extended battery life, and E-readers' glare/light pollution-free nature. An E-book reader or E-book device is predominantly used to read electronic copies of the book. The device can display text on the screen and optimize font size, brightness, and text level according to the reader's preferences.

Key Highlights

- E-readers are becoming more advanced in terms of their screen technology. Today's high-resolution displays deliver improved contrast, better color accuracy, and reduced glare. This makes e-readers more similar to print books, providing users with a more comfortable reading experience. Some e-readers also feature adjustable color temperature, allowing readers to customize the display to their preferences. Many e-reading platforms now offer features enabling readers to connect with others who share their interests, such as online book clubs and discussion forums. Some platforms also allow readers to share notes and annotations with others, creating a more interactive reading experience. This trend will likely continue, with social reading becoming increasingly important in the e-reading landscape.

- EU Economic and Financial Affairs Council members, including Norway, have announced a cut VAT applicable on electronic publications. Recently, Germany committed to enacting laws to cut the VAT rate for e-books, online journals, and newspapers from 19% to 7%. The move comes after the EU Council agreed to allow countries to align their reduced/nil-rated physical books with their electronic counterparts. The cut has already been applied in several EU countries. Electronic Publication (EPUB) is the most widely adopted e-book file format developed by the International Digital Publishing Forum (part of the World Wide Web Consortium). Another major e-book format is the PDF, developed by Adobe. PDF format is widely used around the web because of its ease of use.

- E-reader devices have evolved into individual points of sale, allowing users to browse an unlimited selection of books and content, ranging from new releases to backlist titles to long-out-of-print titles. Digital is expanding the reading and learning experience, offering publishers new ground for talent scouting and providing authors and illustrators with new avenues for expression. For instance, Hachette Livre has been at the forefront of the book industry's response to technical developments and innovations. It has adapted to new kinds of reading and developing consumer behavior. On the other hand, Hachette Livre is keen to guarantee that each book's genuine value is recognized as the custodian of its authors' financial interests.

- On the contrary, the increase in the usage of audiobooks may hamper the studied market. An audiobook records a reading text orally, either word for word or shortened. It is a helpful alternative to regular books and a vital source of information for the visually impaired. Most digital devices can play audio formats like MP3 files, and companies such as Google Books and Amazon provide access to extensive libraries of books. Further, The Audiobook Creation Exchange (ACX) allows making and distributing digital audiobooks simple. ACX's marketplace of professional audiobook creates a digital audiobook edition of the book and earn up to 40% royalties. ACX connects with hundreds of audiobook producers, actors, and studios who may be hired for a fee or a royalty-sharing partnership at no cost.

- During the COVID-19 pandemic, providing students and teachers with online-only access to learning resources was a priority, and it will continue to be a goal as colleges and universities offer hybrid learning and teaching settings. Apart from the growth, e-readers provided a prime opportunity for publishers to switch from conventional bookstore models and directly reach consumers via digital platforms, thus increasing their profits. The crisis in the brick-and-mortar structure in the market during the initial months of the pandemic resulted in direct-to-parents for educational content, and compression of the supply chain increased the positive reputation of the e-book in publishers' minds.

E-Reader Market Trends

Emerging Trends in the E-Learning is Expected to Drive the Market

- The E-learning industry will most likely benefit from the growing popularity of distance learning and the increased use of these services on smartphones, tablets, other mobile devices, and wearable technology. These variables open up various growth opportunities for the E-learning and services businesses. Schools and training facilities are incorporating smart technology into E-learning environments rather than using the traditional blackboard method. Different methods, such as smart learning, are being used at the university level to give alternative pathways and possibilities for students to build relevant and useful skills in line with industry demands. Such trends toward E-learning are expected to drive the studied market.

- Qatar's National e-Learning Portal offers online courses on various information technology and business disciplines. It has over 2,500 different courses to choose from and flexible learning. The e-Learning Portal is already used by 24 organizations and 37 small and medium businesses in Qatar, with over 4,000 courses completed. Further, Hamad Medical Corporation, Doha Bank, and Qatar Petroleum were recognized for successfully incorporating courses available on the Qatar National e-Learning Portal into employment development plans by the Supreme Council of Information and Communication Technology. HMC was recognized as the top organization.

- The difficulty for course designers in mobile learning is building courses that do not require a large amount of data download. Information is shared via mobile devices in mLearning. Hence, eLearning modules must be tailored for small screens. More detailed information, complex visuals, or media that demand a lot of data or bandwidth should be allowed in eLearning courses. Bite-sized modules with one idea per screen, prominent buttons, and simple navigation are the ideal way to present information, and various vendors are expected to cater to this demand.

- Reskilling, on the other hand, entails learning or teaching new skills for a person to be qualified for a different job within the same firm or outside. Employees in those roles, for example, must be reskilled to manage that technology or transfer it into a completely different capacity when a job function is replaced by automation. More than one-third of firms (37%) now offer reskilling training, and nearly three-fifths (56%) expect to do so within the following year. The following are the most prevalent methods through which firms reskill individuals for new jobs: Coaching or mentoring (57%), job shadowing (41%), and on-the-job training (65%). Such developments are expected to drive the studied market.

- According to the Association of American Publishers (AAP), the E-book sales in the United States were estimated to be USD 1,000 Million. The proliferation of mobile devices, such as smartphones, tablets, and laptops in the market is expected to positively impact the growth of e-books in the market. According to Ericsson, in 2027, the number of estimated mobile/cellular subscriptions will account for 78 million in Western Europe and 69 million in Central and Eastern Europe. These numbers are expected to increase exponentially, which will create increased demand for digital reading subscriptions.

North America is Expected to Hold Significant Share of the Market

- North America is expected to have a significant market share by capturing the maximum share during the forecast period. The rising penetration of connected gadgets such as smartphones, tablets, iPads, and others has generated a high demand for eReaders.Also, the technological advancements and the increasing ITC expenditure among area is anticipated to drive the market. Critical firms in this country are focused on establishing eReaders and eBooks to gain a competitive edge in the market. For instance, Rakuten Kobo Inc. launched an innovative digital reading technology device - 'Kobo Libra H2O'. This eReader is a 7-inch waterproof and lightweight device designed to give the end-user a better reading experience.

- The widespread availability and rising popularity of e-books are transforming the publishing industry, while the nature and scope of e-books changes differ significantly from company to company and genre to genre. Further, With interactive e-books and animated e-books, e-publishing businesses have enabled many publishers and authors to get their works to market faster and in an advanced way. The growing number of devices capable of providing digital media and the increasing internet penetration have allowed consumers to access media content of their choice, in terms of information, entertainment, or social activity, anywhere.

- The players in the region are strategically developing new marketing techniques to capture the market share. For example, Amazon provides e-books at a flat rate, special offers for Prime customers, and a self-publishing service for authors. Some consumers and publishers have been criticizing this closed environment, as they are suspicious that Amazon might dominate the segment. The Kindle Direct Publishing (KDP) service allows authors to self-publish books on the Amazon platform and earn money in as little as 24 hours. By making it easier and more approachable for authors, the company is expanding its e-book library. By making e-books accessible through apps for different devices, the company is increasing its e-book business.

- In July 2023, Overdrive is the most prominent digital distributor for public libraries, and they power audiobook and e-book collections of the vast majority of them. If libraries wanted many books by a bestselling author, they had to pay for each title individually. Each publisher has different rates; some books expire after a certain number of loans. The most popular method for libraries to buy audiobooks and e-books for their patrons is under the one copy, one user model. If a library buys a bestselling title, only one copy can be loaned out at a time. Larger library systems can ensure enough copies to meet the demand, while smaller branches can only buy a few copies.

- Similarly, recently, Amazon announced the launch of three new Kindle Paperwhite e-readers: the Kindle Paperwhite, Kindle Paperwhite Signature, and Kindle Paperwhite Kids. The models feature a new processor, a larger 6.8-inch screen, ten weeks of battery life, warm light support, and new USB-C charging.

E-Reader Industry Overview

The global E-Reader market is moderately consolidated with the presence of several players like Amazon.com Inc., Barnes & Noble Inc., Rakuten Kobo Inc., Hanvon Technology Co. Ltd., Onyx International Inc., etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In May 2023, E Ink, the provider of ePaper technology, announced the enhancement of its collaboration with MediaTek to enter the global eReader market through system chip development. By integrating E Ink's ePaper and system technology with MediaTek's advanced chip solutions, the two companies are poised to offer new enterprise prospects for Taiwanese manufacturers in the global eReader market.

In April 2023, The digital reading retailer and publisher Rakuten Kobo announced the US and UK launches of Kobo Plus, the all-you-can-enjoy subscription offering book lovers unlimited access to over 1.3 million e-books and over 100,000 audiobooks for a low monthly fee. The Kobo Plus subscription is an ideal way to come up with a bucket list of literary classics, an entire author's catalog, or to dive into a new field of interest. With endless reading for one low monthly payment, the subscription allows readers to sample a few pages from an author or genre they have never read and move on to another book guilt-free if it's not to their taste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging trends in the eLearning market

- 5.1.2 The proliferation of low-cost e-reader devices

- 5.2 Market Restrains

- 5.2.1 Vendor-developer partnerships and need for the developed infrastructure may pose challenges to the industry.

6 MARKET SEGMENTATION

- 6.1 By Screen Size

- 6.1.1 Below 6 Inch

- 6.1.2 6-8 Inch

- 6.1.3 More than 8 Inch

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Others

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Others

- 6.2.4 Middle East and Africa

- 6.2.5 Latin America

- 6.2.1 North America

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Barnes & Noble Inc.

- 7.1.3 Rakuten Kobo Inc

- 7.1.4 Hanvon Technology Co. Ltd.

- 7.1.5 Onyx International Inc.

- 7.1.6 Bookeen

- 7.1.7 PocketBook International SA

- 7.1.8 Sony Corportation

- 7.1.9 Apple Inc

- 7.1.10 ECTACO Inc.