|

市場調查報告書

商品編碼

1408369

冷庫:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Cold Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

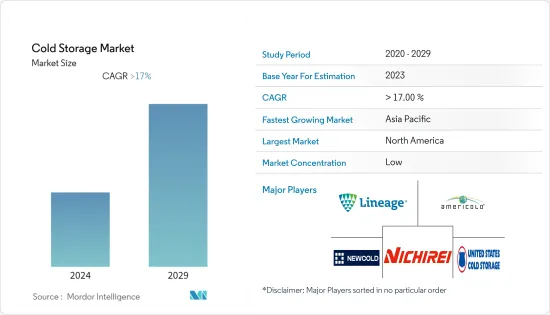

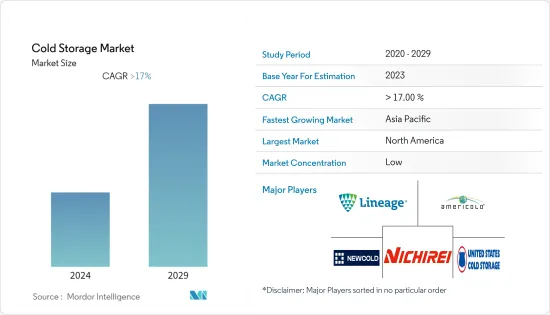

預計2024年,全球冷庫市場規模將達到1,902.4億美元,預測期內複合年成長率為17%。

市場受益於對溫度敏感產品生產和供應的嚴格監管。

主要亮點

- 這一市場的擴大與商業和工業組織對冷庫的需求不斷增加以及監管合規性的要求有關。大部分擴張將出現在印度、中國、巴西、印尼和墨西哥等新興經濟體。

- 根據冷庫產業統計,53%的企業希望增加冷庫容量。對食品和藥品的需求不斷成長以及對安全性的日益重視正在推動對冷藏空間的需求。

- 2022年,冷凍品類引領市場,約佔全球銷售額的77.3%。印度和中國等新興國家冷凍食品消費的增加尤其推動了冷凍食品產業的發展。此類倉庫的儲存溫度保持在 -10 至 20 F 之間。這裡儲存冷凍蔬菜、水果、魚、肉、魚貝類等。

- 缺乏支持低溫運輸的必要基礎設施預計將成為尋求在新興國家發展的公司的主要障礙。此外,交通樞紐和港口的冷凍拖車沒有電源連接可能會阻礙這些地區的工業擴張。 COVID-19 已導致世界許多地區關閉和旅行限制,並影響了許多行業的供應鏈。 COVID-19 的影響對市場產生了重大影響。

冷庫市場趨勢

食品藥品進出口快速成長

由於進出口的增加,冷庫的需求迅速增加。由於全球貿易的增加以及對安全儲存基礎設施的需求,冷儲存市場正在蓬勃發展。

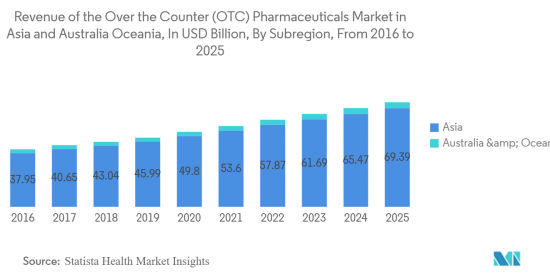

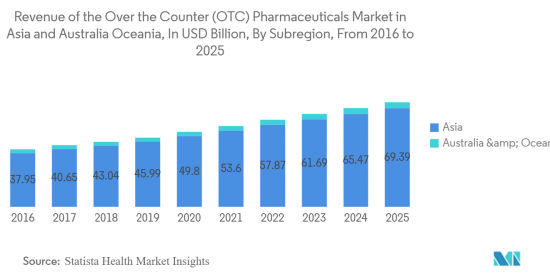

印度佔全球藥品和醫療產品市場的5.92%。醫藥產品和生技藥品佔印度出口的大部分(73.31%),其次是醫藥中間體和原料藥。 2021-22年,印度出口藥品價值246.2億美元,與前一年同期比較成長2%。 2020-2021年出口額為244億美元,與前一年同期比較成長18%。

2022年3月,印度出口醫藥產品價值24億美元,比2022年2月的19.7億美元成長23%。美國、英國、南非、俄羅斯和奈及利亞是印度前五名出口目的地。

2022年12月,我國藥品出口總額9.9億美元,進口總額32.9億美元,貿易負虧損23億美元。 2021年12月至2022年12月,我國藥品出口由40.3億美元下降至9.9億美元,下降30.4億美元(-75.4%);進口由37.1億美元下降至9.9億美元,下降4.23億美元(- 11.4%)。 )增至32.9億美元。

可再生冷凍技術開闢新的市場機會

冷凍是成長最快的能源使用,但它也是當今最重要的能源討論盲點之一。冷卻需求的增加給電力基礎設施帶來了壓力,並增加了一些國家的排放。歐盟委員會的供暖和製冷戰略確定了脫碳製冷的兩個重要領域,以便在 2050 年實現歐盟的氣候變遷目標:「增加再生能源的比例」和「排放工業排放」。它列出了以下措施: “再利用產生的能源廢棄物。”因此,開發和部署能夠靈活「吸收」可再生能源和廢熱、將其「轉換」為冷能並儲存以快速響應最終用戶需求的新技術非常重要。

太陽能冷藏系統可減少約 80% 的採後損失,並將生鮮食品的保存期限從 2 天延長至 21 天。

還有一些冷卻系統使用氨 (NH3) 或二氧化碳 (CO2) 等天然冷媒從現場收集熱量並啟動冷鏈過程。此外,即時負載監控可讓您收集位置、溫度、濕度、二氧化碳水平和開門等變數的資料,以便更好地控制。

提高監控和控制低溫運輸的能力,可以在關鍵變數超出品管設定範圍時及時採取糾正措施,從而創造避免或減少損失的機會。

基於5G(無所不在)物聯網的智慧型系統是低溫運輸物流設計中的新興技術。物聯網憑藉其技術優勢,正朝向物流領域滲透,並取代其原有的工業形態。這為批發商和零售商做出物流決策提供了堅實的基礎,對於提高整個低溫運輸的物流效率具有重要的應用價值。

冷庫產業概況

市場有些分散,有各種各樣的區域參與企業。這些市場參與企業尋求透過投資、合作、收購和合併等技術來增加市場佔有率。公司也投資於新產品開發。此外,我們致力於保持有競爭力的價格。 Lineage Logistics Holdings、NewCold、Cloverleaf Cold Storage、Burris Logistics 和 Americold Logistics LLC 是市場的主要參與企業。

Americold Logistics LLC 還計劃透過收購全球第四大、歐洲第三大冷藏倉庫營運商 Agro Merchants Group 來擴大其在歐洲、南美、美國和澳洲的業務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 目前的市場狀況

- 市場動態

- 促進因素

- 抑制因素

- 機會

- 價值鏈/供應鏈分析

- 行業法規政策

- 倉儲市場的整體趨勢

- 物流領域技術發展

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 依建築類型

- 大容量存儲

- 生產儲存

- 港口

- 按溫度分類

- 冷藏

- 冷凍的

- 按用途

- 水果和蔬菜

- 乳製品、魚、肉、魚貝類

- 加工過的食品

- 藥品

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭形勢

- 市場集中度概覽

- 公司簡介

- Lineage Logistics Holdings

- Americold Logistics LLC

- The United States Cold Storage

- NewCold

- Nichirei Corporation

- Kloosterboer

- Tippmann Group

- Congebac Inc.

- Snowman Logistics Pvt Ltd

- Burris Logistics

- Cloverleaf Cold Storage

- VX Cold Chain Logistics

- Constellation Cold Logistics*

第7章 市場機會及未來趨勢

第8章附錄

The global cold storage market size was valued at USD 190.24 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 17% during the forecast period. The market has benefitted significantly from the stringent regulations governing the production and supply of temperature-sensitive products.

Key Highlights

- Its expansion can be linked to rising demand for cold storage in commercial and industrial organizations, as well as regulatory compliance demands. The majority of the expansion was seen in emerging nations such as India, China, Brazil, Indonesia, and Mexico, among others.

- According to the cold storage industry, 53% of enterprises want to enhance their cold storage capacity. Increasing demand for food and pharmaceuticals, as well as a greater emphasis on safety, has resulted in a rise in demand for cold storage space.

- In 2022, the frozen category led the market, accounting for around 77.3% of worldwide sales. Increasing frozen food consumption in emerging nations such as India and China is pushing the frozen food industry in particular. Warehouses in this category keep their storage temperatures between -10°F and -20°F. They hold frozen vegetables, fruit, fish, meat, seafood, and other items.

- The absence of infrastructure necessary to support the cold chain is expected to provide a significant hurdle for enterprises looking to grow into emerging economies. Furthermore, the unavailability of power hook-ups for reefer trailers at transportation hubs and ports may stymie industry expansion in these areas. COVID-19 caused lockdowns and travel restrictions in numerous regions of the world, affecting the supply chains of many industries. The consequences of COVID-19 have had a considerable impact on the market.

Cold Storage Market Trends

Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical

Cold storage facilities are witnessing rapid growth in demand owing to the increasing import and export activities. The cold storage market is booming with increasing global trade and the corresponding need for secure storage infrastructure.

India accounts for 5.92% of the worldwide pharmaceutical and medicine market. Formulations and biologics accounted for most of India's exports (73.31%), followed by drug intermediates and bulk medicines. In 2021-22, the country exported pharmaceutical items worth USD 24.62 billion, a 2% increase over the previous year. Exports increased by 18% yearly to USD 24.4 billion in 2020-21.

In March 2022, India exported USD 2.4 billion worth of drugs and pharmaceuticals, a 23% increase from USD 1.97 billion in February 2022. The USA, UK, South Africa, Russia, and Nigeria are India's top five export destinations.

In December 2022, China's pharmaceutical product exports totalled USD 990 million, while imports totaled USD 3.29 billion, resulting in a USD 2.3 billion negative trade deficit. From December 2021 and December 2022, China's pharmaceutical exports fell by USD -3.04B (-75.4%) from USD 4.03B to USD 990M, while imports fell by USD -423M (-11.4%) from USD 3.71B to USD 3.29B.

Renewable Refrigeration Technologies to Open New Market Opportunities

Cooling is the fastest-growing energy use, but it is also one of the most crucial energy debate blind spots today. Rising cooling demand is putting a strain on electrical infrastructure and pushing up emissions in several countries. The European Commission's Heating and Cooling Strategy mentions measures such as "raising the percentage of renewables" and "reuse of energy waste from industry" as two essential areas for decarbonizing cooling to meet the EU's climate objectives by 2050. As a result, new technology development and adoption are critical to meet end users' needs promptly by flexibly 'absorbing' renewable energy and/or waste heat and then 'converting into' and storing cooling energy.

Solar-powered cold storage systems reduce post-harvest loss by roughly 80% and increase the shelf life of perishable foods from two to 21 days.

There are also cooling systems that use natural refrigerants like ammonia (NH3) or carbon dioxide (CO2) to collect heat from the field and start the cold chain process. Load monitoring in real time also enables the collection of data on location, temperature, humidity, and other variables such as CO2 levels or door opening to improve control.

Increasing the capacity to monitor and control the cold chain allows for timely corrective actions to be taken when a critical variable departs from the ranges established for quality control, providing the opportunity to avoid or reduce losses, while registration itself, the log of conditions throughout the chain, allows the parties involved to validate that the products were kept in the required conditions.

Intelligent systems based on the 5G (ubiquitous) Internet of Things are an emerging technology in the design of cold chain logistics. With its technological benefits, the Internet of Things is infiltrating the logistics area and replacing the original industrial shape. This provides a solid foundation for wholesalers and retailers to make logistical decisions, and it has significant application value for increasing the logistics efficiency of the whole cold chain.

Cold Storage Industry Overview

The market is somewhat fragmented, with various local players present. These market participants are attempting to increase their market share through techniques such as investments, collaborations, acquisitions, and mergers. Businesses are also investing in the creation of new products. Furthermore, they are concentrating on keeping competitive pricing. Lineage Logistics Holdings, NewCold, Cloverleaf Cold Storage, Burris Logistics, and Americold Logistics LLC are the market's leading participants.

Americold Logistics LLC also plans to extend its activities in Europe, South America, the United States, and Australia with the acquisition of Agro Merchants Group, the world's fourth-biggest cold storage operator and the third-largest in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Policies and Regulations

- 4.5 General Trends in Warehousing Market

- 4.6 Technological Developments in the Logistics Sector

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers/Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Construction Type

- 5.1.1 Bulk storage

- 5.1.2 Production stores

- 5.1.3 Ports

- 5.2 By Temperature

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Dairy, Fish, Meat, & Seafood

- 5.3.3 Processed Food

- 5.3.4 Pharmaceuticals

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest Of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lineage Logistics Holdings

- 6.2.2 Americold Logistics LLC

- 6.2.3 The United States Cold Storage

- 6.2.4 NewCold

- 6.2.5 Nichirei Corporation

- 6.2.6 Kloosterboer

- 6.2.7 Tippmann Group

- 6.2.8 Congebac Inc.

- 6.2.9 Snowman Logistics Pvt Ltd

- 6.2.10 Burris Logistics

- 6.2.11 Cloverleaf Cold Storage

- 6.2.12 VX Cold Chain Logistics

- 6.2.13 Constellation Cold Logistics*