|

市場調查報告書

商品編碼

1408234

DevOps:市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測DevOps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

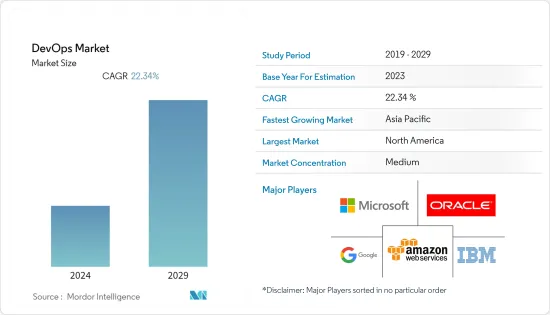

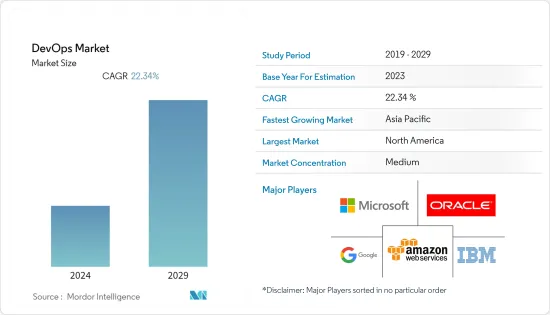

今年全球DevOps市場規模為107.4億美元。

預計到預測年末將達到 294.3 億美元,預測期內複合年成長率為 22.34%。

主要亮點

- 對高效、保守的營運流程的需求日益成長,雲端運算的日益普及,與 PaaS 相結合以減少軟體開發生命週期中的停機時間,正在推動新興市場的成長。世界各地的公司都致力於減少軟體開發和營運流程的時間和維護。 DevOps 可以改善開發人員之間的協作和同步,並減少持續開發流程的維護。

- MLOps 和 AIOps 是兩種流行的 DevOps 工具趨勢。最佳化 DevOps 流程對於獲得高品質和快速開發的好處至關重要,而 MLOps 和 AIOps 發揮關鍵作用。 AIOps 可實現 IT 流程和營運的自動化,而 MLOps 則負責維護機器學習開發系統。這是廣泛使用的 DevOps 即將出現的趨勢之一,也包含在 HCL 開發的 DRYiCE IntelliOps 平台中。作為管理企業全端 AIOps 及其可觀察性需求的解決方案,它專門致力於將 HCL 的客戶從被動轉變為主動。

- 低程式碼方法可實現敏捷性,使任何公司在要求苛刻且快節奏的軟體市場中獲得競爭優勢。低程式碼平台允許公司和企業無需導出編碼知識即可建立應用程式。這使得非技術專業人員可以透過完全控制應用程式開發過程的可視化介面參與軟體創建。使用者可以透過拖放元素來建立邏輯和工作流程。這是眾所周知的 DevOps 趨勢之一,它透過簡單地創建簡單且方便用戶使用的應用程式來加快開發和部署流程。

- 此外,GitLab 對 5,001 名技術經理和專業人士的調查發現,DevOps 實踐在過去 12 個月中顯著增加。到 2022 年,大多數受訪者 (47%) 表示 DevOps 或 DevSecOps 是他們的首選方法,比 2021 年增加了 5 個百分點。根據這項研究,DevOps 的興起伴隨著軟體交付節奏的提升。十分之七 (70%) 的 DevOps 團隊持續部署程式碼,描述為每天一次或每隔幾天一次,比去年增加了 63%。至少 60% 的開發人員開發程式碼的速度比以前更快。 35% 的程式碼開發速度提高了 2 倍,15% 的程式碼發布速度提高了 3 到 5 倍。

- DevOps 中最常見的問題之一是全面監控整個流程的課題。 DevOps 由多個活動部分組成,每個部分都有不同的指標來確定其有效性。例如,諸如部署頻率或程式碼分支數量之類的指標可能會涉及 CI/CD 方法。此外,諸如缺陷逃逸率之類的東西是連續測試管道的組成部分。在許多情況下,整個過程需要更清晰地視覺化。為此設計的手動流程需要大量工作,並且存在因人為錯誤而導致錯誤更新的風險。

- 鑑於大多數 DevOps 團隊因新冠肺炎疫情在家工作,這項調查是在疫情期間對來自軟體和金融業的500 名IT 和工程專業人士進行的。根據軟體公司Harness 發布的一項調查,只有43%的開發人員表示在家工作以應對新冠病毒大流行。只有 43% 的開發者回答了自 COVID-19 以來開發速度有所加快的調查問題,但略多於一半 (52%) 的開發者聲稱疫情讓他們對自己的工作更加滿意。

DevOps 市場趨勢

BFSI 預計將佔據較大市場佔有率

- DevOps 讓金融機構能夠滿足甚至超越新的客戶期望。這種方法增加了金融機構成功為其客戶提供價值的可能性,同時降低了風險和成本。

- 因此,許多銀行、金融服務供應商和金融科技公司正在努力對其過時的銀行系統進行現代化改造。 DevOps 是一種驅動數位轉型的新機制,由活動、工具和方法組成。使用 DevOps 方法實施有效的管治、安全、風險和合規性策略可以提高應用程式發布的品質。

- 此外,銀行和金融服務業每天都會處理大量合約和投資。因此,保護敏感資訊並遵守廣泛的資料安全和隱私標準至關重要。軟體生命週期管道自動化得到廣泛使用的既定實踐的支持,例如基礎設施即程式碼和持續整合和配置(CI/CD)。應盡可能使用自動化,以確保完美的軟體交付,沒有人為錯誤。 DevOps 倡導的最佳實踐包括更全面的開發和測試階段文件、確保法規遵從性的通訊協定,以及應用程式管治、風險管理和安全性的清晰框架,所有這些都在更高的層面上為保護做出貢獻。

- 此外,金融服務企業累積的個人和資料資料也是網路攻擊的直接目標。因此,金融服務公司面臨著加強網路安全和加快軟體發布的持續壓力。此外,金融服務是全球監管最嚴格的行業之一。

- 這些只是金融部門必須實施 DevSecOps 的部分原因。 DevSecOps 是整個軟體開發生命週期中安全、開發和功能團隊的端到端協作。 DevSecOps 是整個軟體開發生命週期中安全、開發和功能團隊的端到端協作,旨在自動化每個團隊的任務,以頻繁地開發支援數位業務的軟體,其中包括安全性發布。

- 市場上的參與者正在擴大他們的產品,以滿足金融機構的廣泛需求。 例如,繼 2023 年 4 月被 ThoughtFocus, Inc. 收購總部位於芝加哥的 BreakFree Solutions 後,該公司最近宣佈了新服務,通過敏捷和 DevOps 框架的融合,幫助銀行和金融服務客戶實施和擴展戰略數位計劃。

- 憑藉其在產品開發、雲支援、DevOps 平臺工程、數位安全、基礎設施即代碼 (IaC) 和自動化方面的專業知識,ThoughtFocus 使本地金融服務組織能夠開發新的技能、流程和幫助他們使用工具像雲端原生 DevOps 團隊一樣行事方面有著良好的記錄。

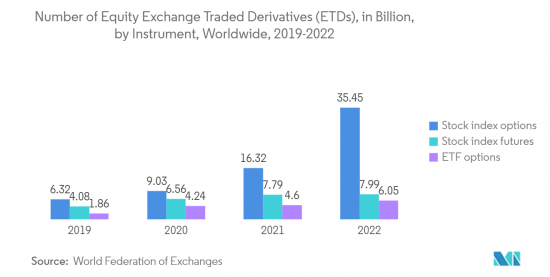

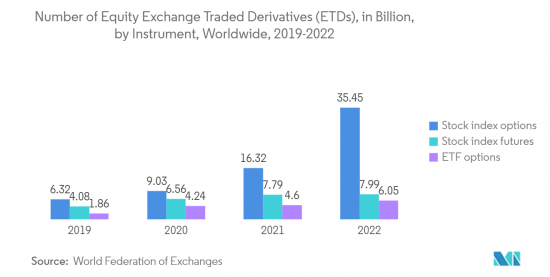

- DevOps 作為一種方法,使資本市場團隊能夠對每次增強或添加做出更好、更明智的決策,在交易和軟體開發風險之間找到平衡。根據世界交易所聯合會的數據,2022 年全球單一股票選擇權合約交易量約為 90 億份。如此龐大的選擇權交易可能會鼓勵金融機構採用 DevOps 來實現更好的功能並更好地服務客戶。

預計北美將佔據很大的市場佔有率

- 北美是一個新興市場,多個市場參與者正在努力緩解企業的持續整合能力。目前正在最有效地部署大量資料整合技術和工具,以識別零售、銀行、金融服務和保險 (BFSI) 以及政府主導等關鍵最終用戶的資料同步模式。一般趨勢有利於採用持續整合 (CI) 基礎架構來推動 DevOps 和簡化營運。

- 對於早期採用者來說,一個值得注意的考慮因素是,當任務由共用基礎設施驅動時,法規必須公開可見,並且在整個開發和配置過程中偶爾部署。

- 此外,脫節的工具鏈和手動流程可能成為軟體開發生命週期中的瓶頸,從而削弱了開發和運營團隊更快部署軟體、降低風險的能力。 借助 Dynatrace 的雲自動化工具和整合,以及由同類最佳 DevSecOps 成員組成的生態系統,團隊擁有深入而普遍的可觀測性、運行時應用程式安全性和高級 AIOps,可自動執行工具鏈以進行修復和交付。 雖然數位化轉型計劃對企業有明顯的好處,但它們也給技術和數位服務團隊帶來了複雜性。 對整個軟體開發生命週期 (SDLC) 的編排和自動化的需求日益增長。

- 區域參與者正在共同努力,以更好地服務客戶。例如,2022 年 9 月,戴爾宣布與領先的開放原始碼軟體產品供應商紅帽公司擴大合作夥伴關係,以便更輕鬆地在多重雲端環境中部署和管理本地容器化基礎設施。在英特爾的支援下,這種協作簡化了容器編配本地基礎架構的部署和管理,並提供配置指導,同時提高了 DevOps 生產力。客戶可以透過快速運作本地基礎架構來擴展其 IT 敏捷性,同時可預測地利用戴爾公司 PowerFlex 軟體定義基礎架構上的紅帽 OpenShift 環境。

- 同樣在 2023 年 3 月,加拿大資訊管理軟體供應商 OpenText 發布了其雲端基礎的DevOps 和價值流管理 (VSM) 平台 ValueEdge 的最新版本。在此消息發布之前,OpenText 今年稍早以價值 60 億美元的全現金交易收購了英國軟體巨頭 Micro Focus(其中包括 ValueEdge)。它由 ValueEdge Strategy 和 ValueEdge Agile 提供支持,支援當今敏捷開發組織所需的持續規劃流程。它還具有投資組合管理和視覺化、投資優先級功能以及與敏捷管理的整合。

- 該地區的許多強大的公司都採用了低程式碼 DevOps 方法,這對他們的團隊非常有利。例如,2023 年 5 月,低程式碼業務流程自動化軟體公司 ProcessMaker 宣布發布其 Spring 2023 平台。此版本包括 ProcessMaker 人工智慧 (AI)、決策引擎、流程範本、相關選項清單、建模器可用性改進、動態選單增強、自動儲存和其他功能。決策引擎使用智慧型決策表作為獨立資產來自動化複雜的業務流程,而無需程式碼。

DevOps 產業概述

全球 DevOps 市場適度整合,參與者包括 Google LLC、Microsoft Corporation、IBM Corporation、Oracle Corporation 和 Amazon Web Services, Inc.。公司不斷投資於策略合作夥伴關係和產品開拓,以獲得顯著的市場佔有率。

2023 年 7 月 Appdome 是行動應用經濟的行動應用防禦一站式商店,提供持續整合和持續交付 (CI/CD) 功能,幫助團隊建置、測試和部署應用程式。宣布已整合其網路防禦自動化平台使用可實現自動化的Microsoft Azure DevOps雲端基礎服務。 Azure DevOps 現在是 Appdome Dev2Cyber 敏捷合作夥伴計畫的一部分,推動全球行動應用程式的安全交付。透過這種新的整合,Azure Pipelines 用戶可以在Azure Pipelines 中輕鬆利用Appdome 的配置即代碼,並在Android 上部署Appdome 的任何安全、反欺詐、反惡意軟體、反作弊和其他網路防禦功能,並且可以建立進入 iOS 應用程式。

2023 年 4 月,發佈了最新版本的 Corbett,這是一個由 Digital.ai 的人工智慧 (AI) 提供支援的 DevOps 產品平臺。 Corbett 説明軟體開發團隊創建應用程式,在提高效率的同時增強用戶體驗。 據該公司稱,Corbett將提高智慧能力,使團隊和組織以及個人能夠利用人工智慧的力量來創建更好的軟體。 閱讀更多關於 Digital.ai 宣佈其人工智慧驅動的DevOps產品的最新版本的資訊。 通過集中和集成來自更多來源的數據,包括 AI 增強的 DevOps 產品和第三方軟體工具,從開發到生產,Digital.ai 現在能夠幫助團隊避免孤立的報告和分析,並利用 AI 的力量根據過去的表現預測潛在結果。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 日益需要縮短軟體開發流程和交付時間

- 軟體自動化的採用率不斷提高

- 市場抑制因素

- 從舊有應用程式遷移到微服務

第6章 市場區隔

- 依解決方案

- 監控和績效管理

- 生命週期管理

- 分析

- 交付和營運管理

- 測試和開發

- 依組織規模

- 中小企業

- 大型組織

- 依用途

- BFSI

- 零售

- 政府機關

- 製造業

- 資訊科技/通訊

- 衛生保健

- 其他用途

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭環境

- 公司簡介

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Amazon Web Services, Inc.

- Alibaba Group Holding Limited

- Broadcom Inc.

- Micro Focus

- Dell Technologies Inc

- Atlassian Corporation Plc

第8章投資分析

第9章 市場未來展望

The global DevOps market was valued at USD 10.74 billion in the current year. It is expected to reach USD 29.43 billion by the end of the forecasted year, registering a CAGR of 22.34% during the forecast period.

Key Highlights

- The increasing need for efficient and maintained operational processes and rising adoption of cloud computing coupled with PaaS lowered downtime in software development life cycles are pushing the growth of the DevOps Market. Different firms across the globe are focusing on decreasing the time and maintenance of the software development operation process. DevOps enables improved collaboration and synchronization among developers and reduces the maintenance of the constant development process.

- MLOps and AIOps are two of the renowned trending DevOps tools. Essential to optimize the DevOps processes to reap the benefits of high-quality and quick developments where MLOps and AIOps are important role players. AIOps enable automates IT processes and operations, whereas MLOps maintains the development system of machine learning. This is one of the widely used DevOps future trends, which has also been incorporated into a platform named DRYiCE IntelliOps, developed by HCL. As a solution that manages the full stack AIOps of the firms and its observability requirements, it specializes in converting the customers of HCL from reactive to proactive.

- The low-code approach enables agility, providing every firm with a competitive edge in the demanding and fast-paced software market. Low-code platforms enable businesses and enterprises to build applications without export coding knowledge. This allows non-technical professionals to also have a hand in creating software via a visual interface that entirely manages the app development process. It enables users to build their logic and workflow by dragging and dropping elements. This is one of the well-known DevOps trends that has enabled speed up the development and deployment process just by creating simplistic and user-friendly applications.

- Further, GitLab surveyed 5,001 technology managers and professionals and found a significant boost in DevOps practices over just the past 12 months. In 2022, a sizeable slice of respondents (47%) suggested DevOps or DevSecOps was their methodology of preference, a five percentage point increase over 2021. The survey shows that this rise in DevOps comes with an improved cadence in software delivery. 7 in 10 DevOps teams (70%) introduced code continuously, described as once a day or every few days, up 63 percent from last year. At least 60 percent of developers are developing code faster than before. A complete 35% said they are developing code twice as fast, while 15% release code between three and five times faster.

- One of the most common problems with DevOps is the challenge of holistically monitoring the entire process. DevOps consists of several moving parts, each with different metrics to judge their effectiveness. For example, a metric like the number of deployment frequency or code branches might deal with the CI/CD approach. Further, something like Defect Escape Rate is a component of the Continuous Testing pipeline. Often there needs to be clearer visibility over the entire process, leading to finger-pointing and production delays. Any manual processes made to envisage this lead to extensive labor and risks incorrect updates due to human error.

- Considering that most DevOps teams are now working from home due to the COVID pandemic, according to a survey of 500 IT and engineering professionals from the software and finance industries conducted during the pandemic and published by the software company Harness during the pandemic. Only 43% of developers responded to the survey's question about the development pace increasing since COVID-19, but slightly over half (52%) claimed the pandemic has made them happy in their jobs.

DevOps Market Trends

BFSI is Expected to Hold a Significant Share of the Market

- DevOps allows financial institutions to meet and even surpass new customer expectations. This method increases financial institutions' chances of successfully delivering value to customers while reducing risks and expenses.

- As a result, many banks, financial services providers, and Fintechs are working to modernize outdated banking systems. DevOps is the new mechanism for driving digital change, consisting of activities, tools, and methodologies. Effective governance, security, risk, and compliance policies may be implemented with DevOps approaches, which can improve the quality of application releases.

- Further, Numerous agreements and investments are processed daily in the banking and financial services industry. As a result, it is essential to protect sensitive information and adhere to a wide range of data security and privacy standards. Automation of software lifecycle pipelines is aided by the widespread use of established practices like infrastructure as code and continuous integration and deployment (CI/CD). Automation should be used whenever possible to guarantee flawless software delivery free of human mistakes. Best practices advocated by DevOps, such as more thorough documentation of the development and testing phases, protocols for ensuring regulatory compliance, and explicit frameworks for application governance, risk management, and security, all contribute to a higher level of protection.

- Moreover, the personal and financial data accumulated by financial services businesses makes them an immediate target for cyber attacks. Thus, financial services organizations face constant pressure to boost their cyber security and speed up their software releases. Additionally, financial services are one of the most regulated sectors globally.

- These are just a few reasons why implementing DevSecOps is imperative for the finance sector. DevSecOps is the end-to-end collaboration of security, development, and functions teams throughout the software development lifecycle. It also includes automating their tasks, resulting in the frequent and secure release of software that empowers digital businesses.

- The players in the market are expanding their products to cater to a wide range of needs of financial institutions. For instance, in April 2023, Following the acquisition of Chicago-based BreakFree Solutions by ThoughtFocus, Inc., the company recently announced new services that help banking and financial services clients implement and scale strategic digital initiatives through a marriage of agile and DevOps frameworks.

- ThoughtFocus, through its expertise in product development, cloud enablement, DevOps platform engineering, digital security, infrastructure as code (IaC), and automation, has a demonstrated track record of helping on-prem financial services organizations behave like cloud-native DevOps teams with new skills, processes, and tools.

- DevOps as a methodology enables capital markets teams to make better, more informed decisions about each enhancement or addition and find their balance between trading and software development risk. According to the World Federation of Exchanges, In 2022, approximately nine billion contracts for single stock options were traded worldwide. Such huge trade of options would push financial institutions to deploy DevOps for better functioning and provide better services to its customer.

North America is Expected to Hold Significant Share of the Market

- North America is a developed market, owing to several market players working toward easing the continuous integration capabilities of firms. Bulk data integration methods and tools are currently most efficiently implemented to identify data synchronization patterns in critical end users such as retail, banking, financial service, and insurance (BFSI), or government initiatives. The general trend has favored adopting continuous integration (CI) infrastructure to advance DevOps and streamline operations.

- A notable consideration of early adopters has been that if a task is driven by shared infrastructure, the regulation must consequently be publicly available and deployed occasionally throughout the development and deployment process, ensuring access of the code to quality assurance and security audits by the public, and additional relevant third parties, allowing for rapid development and fixing process.

- Further, disparate toolchains and manual tasks that make bottlenecks in the software development lifecycle compromise Develop and Operation teams' ability to introduce software faster and with less risk. With the Dynatrace cloud automation tool and integrations, plus an ecosystem of best-in-breed DevSecOps members, teams get deep and expansive observability, run-time application security, and advanced AIOps to automate toolchains for remediation and delivery. While digital transformation initiatives have evident advantages for businesses, they also bring growing complexity to technology and digital services teams. The need for orchestration and automation across the software development lifecycle (SDLC) has increased.

- The regional players are collaborating to provide better services to its customer. For instance, in September 2022, Dell announced expanding its partnership with leading open-source software products provider Red Hat to facilitate deploying and managing on-premises, containerized infrastructure in multi-cloud environments. Powered by Intel, this collaboration streamlines and provides configurative direction for deploying and managing on-premises infrastructure for container orchestration while enabling DevOps productivity. Customers can scale IT agility by quickly getting their on-premises infrastructure running while predictably utilizing a Red Hat OpenShift environment on Dell inc PowerFlex software-defined infrastructure.

- Similarly, in March 2023, Canadian information management software provider OpenText introduced the latest version of ValueEdge, a cloud-based DevOps and value stream management (VSM) platform. This announcement comes after OpenText acquired UK software giant Micro Focus, which included ValueEdge, in a USD 6 billion all-cash transaction earlier this year. Powered by ValueEdge Strategy and ValueEdge Agile, this will allow the continuous planning process required in today's agile development organizations. It also features portfolio management and visualization, investment prioritization capabilities, and integration into agile management.

- Many robust enterprises in the region have adopted a low-code DevOps approach which has been quite beneficial for teams. For instance, in May 2023, ProcessMaker, a low-code business process automation software company, announced the release of its Spring 2023 Platform. ProcessMaker artificial intelligence (AI), a decision engine, process templates, dependent choose lists, modeler usability improvements, dynamic menu enhancements, autosave, and other features are included in this release. The decision engine uses intelligent decision tables as a stand-alone asset to automate complex business processes without requiring code.

DevOps Industry Overview

The global DevOps market is moderately consolidated with the presence of several players like Google LLC, Microsoft Corporation, IBM Corporation, Oracle Corporation, Amazon Web Services, Inc., etc. The companies continuously invest in strategic partnerships and product developments to gain substantial market share. Some of the recent developments in the market are:

In July 2023, Appdome, the mobile app economy's one-stop shop for mobile app defense, announced it had integrated its Cyber Defense Automation Platform with a cloud-based service from Microsoft Azure DevOps that provides continuous integration and continuous delivery (CI/CD) capabilities, allowing teams to automate the build, test, and deployment of their applications. Azure DevOps is now part of the Appdome Dev2Cyber Agility Partner Initiative to advance the delivery of secure mobile apps globally. With this new integration, Azure Pipelines users can leverage Appdome's configuration-as-code easily from inside Azure Pipelines and build any of Appdome's security, anti-fraud, anti-malware, anti-cheat, and other cyber defenses into Android and iOS apps.

In April 2023, the newest version of Digital.ai's artificial intelligence (AI)-powered DevOps product platform, Corbett, was introduced to help businesses create applications with improved user experiences while boosting software development teams' efficiency. According to the company, Corbett has improved intelligence capabilities that allow teams and organizations, not just individuals, to harness AI's power to produce better software. Read more about Digital.ai unveiling the latest version of the AI-enhanced DevOps product. From development through to production, Digital.ai now centralizes and integrates data from more sources, including AI-enhanced DevOps products and third-party software tools, so teams can avoid siloed reports and analytics and utilize the power of AI to make predictions about potential outcomes based on past performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Reducing Software Development Process and Accelerating Delivery

- 5.1.2 Increase in Adoption of Software Automation

- 5.2 Market Restrains

- 5.2.1 Moving From Legacy Applications to Microservices

6 MARKET SEGEMENTATION

- 6.1 By Solution

- 6.1.1 Monitoring and Performance Management

- 6.1.2 Lifecycle Management

- 6.1.3 Analytics

- 6.1.4 Delivery and Operation Management

- 6.1.5 Testing and Development

- 6.2 By Organization Size

- 6.2.1 SME Organization

- 6.2.2 Large Organizations

- 6.3 By Application

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 IT and Telecommunication

- 6.3.6 Healthcare

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETETIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC

- 7.1.2 Microsoft Corporation

- 7.1.3 IBM Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 Amazon Web Services, Inc.

- 7.1.6 Alibaba Group Holding Limited

- 7.1.7 Broadcom Inc.

- 7.1.8 Micro Focus

- 7.1.9 Dell Technologies Inc

- 7.1.10 Atlassian Corporation Plc