|

市場調查報告書

商品編碼

1408178

步進馬達:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Stepper Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

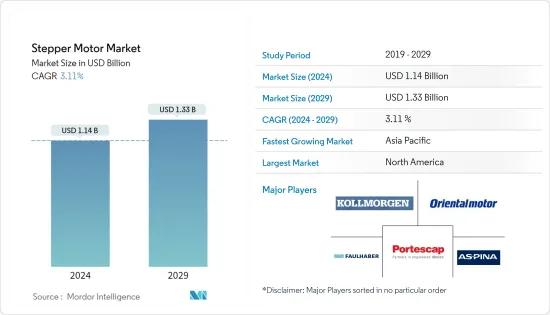

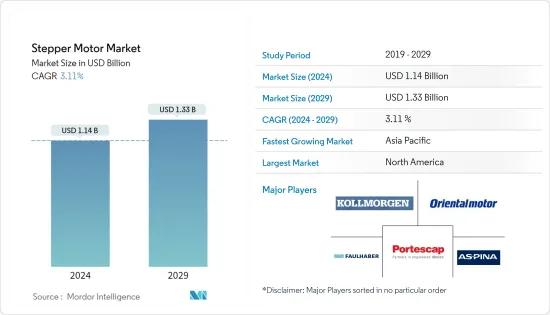

預計2024年步進馬達市場規模為11.4億美元,預計到2029年將達到13.3億美元,在預測期內(2024-2029年)複合年成長率為3.11%。

主要亮點

- 步進馬達的優點是沒有內建電子裝置或電刷,可以進行開放回路控制,這使得它們非常容易控制,並且不需要編碼器或特殊的輔助因素來監控轉子位置。步進馬達有多種尺寸和样式,因此當今有許多不同類型的步進馬達。一些最常用的步進馬達包括永磁步進馬達、混合步進馬達和可變磁阻步進馬達。

- 步進馬達的低成本和精確的運轉能力極大地擴展了這些馬達的應用領域。步進馬達可用於許多熟悉的工業和商業應用。這些馬達的典型家庭應用包括驅動空調百葉窗、電動窗簾、打開和關閉管道閥門以及數位相機和行動電話相機中的變焦和自動對焦機制。在商業領域,這些馬達常見於 ATM 機和旋轉監視錄影機設備中。

- 工業和製造業中自動化和機器人化解決方案的滲透以及醫療設備產業的擴張等因素正在推動市場成長。

- 醫療設備也是步進馬達擴大用於無刷換向的關鍵領域。步進馬達經過最佳化的齒輪裝置和高品質的軸承系統可提供較長的使用壽命,使其適用於關鍵的救生應用。醫療掃描儀、採樣器、數位牙科攝影、人工呼吸器、流體泵和血液分析設備是使用步進馬達的一些常見醫療設備。

- 步進馬達的限制包括在非常高的速度下運行受限、需要專用控制電路以及使用比DC馬達更高的電流。

- 此外,伺服馬達等替代品的可用性對於所研究的市場來說也是一個成長挑戰,這些替代品可以在具有複雜要求的應用(例如需要高精度的數控機床)中提供更好的性能。

步進馬達市場趨勢

機器人和自動化解決方案的採用增加

- 向工業 4.0 的過渡預計將帶來生產力和效率的顯著提高,以及工業流程的營運轉型。將網路連接到製造流程並透過自動化提高生產效率預計將改變傳統業務並在未來創造許多商機。

- 近年來,人事費用上升和競爭公司之間的競爭刺激了對自動化系統的需求。例如,根據美國勞工統計局 (BLS) 2022 年 12 月的報告,美國私人企業工人的薪資成本每年增加 5.1%。根據歐盟統計局的數據,預計 2022 年第二季度歐元區每小時勞動成本將上漲 4.3%。

- 快速工業化正在推動中國、日本、印度、巴西和韓國等新興國家的技術創新和高效工業設備的引進。中國國家統計局數據顯示,2023年7月中國工業生產比去年同月成長3.7%。中國的目標是到2025年將汽車產量從2018年的2,230萬輛增加到3,500萬輛。此外,由於最近的稅收優惠和「中國製造2025」計劃,預計國內製造業將快速成長。

- 根據達拉斯聯邦儲備銀行的數據,2022 年 5 月(不包括美國)全球工業生產較 2021 年成長 4%。這些趨勢正在為所考慮的市場創造有利的成長前景。此外,製造業自動化的興起正在推動市場成長。

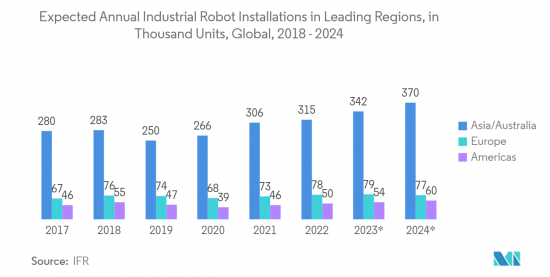

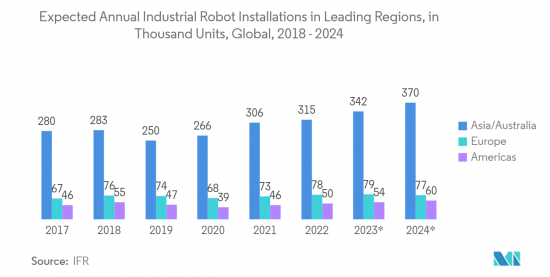

- 工業領域擴大採用自動化和機器人解決方案也推動了所研究市場的成長,因為步進馬達用於需要精確運動的地方。例如,IFR預測,到2024年,全球工廠中將有超過518,000台工業機器人運作,其中亞洲和澳洲的數量預計將達到370,000台。

北美地區預計將實現顯著成長

- 預計北美仍將是步進馬達的重要市場。成熟的醫療設備、機器人和計算的存在預計將成為該地區成長的主要推動力。

- 北美由美國和加拿大組成,擁有最好的醫療基礎設施,也是先進醫療設備的主要市場之一。根據先進醫療技術協會(AdvaMed)的數據,美國是全球領先的醫療設備市場,佔全球醫療設備市場的40%。

- 由於北美醫療用品和設備分銷鏈的公共和私人醫療設備支出穩步成長,預計醫療設備設備行業在預測期內將顯著推動步進馬達的需求。例如,2022年11月,美國疾病管制與預防中心(CDC)撥款32億美元,協助美國地方、區域和州司法管轄區加強公共衛生基礎設施和勞動力。這筆資金直接授予各級衛生部門,以提供促進和保護美國社區健康所需的人員、系統和服務。

- 同樣,2022 年 10 月,美國農業部宣布津貼1.1 億美元,用於改善美國農村的醫療設施。這些津貼將幫助 208 個農村衛生組織為 43 個州和關島的約 500 萬人提供關鍵服務。這種趨勢對研究市場的成長產生積極影響,因為醫療設備預計將佔此類投資的很大一部分。

- 預計美國將在醫療設備領域佔據壓倒性的市場佔有率。例如,根據美國人口普查局的一項研究,美國醫療設備和用品製造商的行業收益預計將從 2020 年的 432.3 億美元成長到 2024 年的 435.1 億美元。

- 此外,北美地區也是工業自動化和機器人解決方案的主要採用者之一。由於步進馬達廣泛應用於自動化和機器人設備,這為所研究市場的成長創造了良好的前景。根據IFR預測,北美製造業安裝的工業機器人總數將成長約12%,到2022年達到41,624台。

步進馬達產業概況

步進馬達市場高度分散,主要公司有Kollmorgen (Altra Industrial Motion Corp.)、Shinano Kenshi、Faulhaber Oriental Motor、Portescap等。

2023年7月,印度泰米爾納德邦索納學院的研究人員開發出一種步進電機,用於印度太空任務「月船3號」。 SonaSpeed 的單軸永磁步進馬達用於 LVM 3 火箭的致動器組件,用於控制火箭引擎的液體氧化劑和燃料混合比。

2023 年 1 月,科爾摩根發布了新型步進驅動器 P80630-SDN。該公司決定在其旗艦產品 P8000 步進驅動器平台的基礎上進行構建,並在未來幾個月內推出更多步進驅動器和功能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 對資料進行三角測量並產生見解

第3章執行摘要

第4章市場洞察

- 市場概況

- 技術開發

- 宏觀經濟因素的影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業供應鏈分析

第5章市場動態

- 市場促進因素

- 更多採用機器人和自動化解決方案

- 步進馬達在醫療保健行業的使用增加

- 市場抑制因素

- 性能限制以及與伺服馬達的競爭

第6章市場區隔

- 依馬達類型

- 混合

- 永久磁鐵

- 可變磁阻

- 按用途

- 醫療設備

- 機器人

- 工業設備

- 計算

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭形勢

- 公司簡介

- Kollmorgen(Altra Industrial Motion Corp.)

- Faulhaber

- Oriental Motor

- Shinano Kenshi Co. Ltd

- Portescap

- Nanotec Electronic GMBH & Co. KG

- JVL AS

- I.CH Motion

- Changzhou Fulling Motor Co. Ltd.

- Shanghai MOONS'Electric Co. Ltd.

第8章投資分析

第9章市場的未來

The Stepper Motor Market size is estimated at USD 1.14 billion in 2024, and is expected to reach USD 1.33 billion by 2029, growing at a CAGR of 3.11% during the forecast period (2024-2029).

Key Highlights

- As stepper motors do not have integrated electronics or brushes and can be controlled in an open loop, they have the advantage of being very simple to control and need no encoder or special driver to monitor the position of the rotor. Stepper motors come in different sizes and styles; hence, various types of stepper motors are available today. Some of the most used stepper motors include permanent magnet, hybrid, and variable reluctance stepper motors.

- The low cost and precise movement features of stepper motors significantly expand the application area of these motors. Stepper motors are available in many familiar industrial and commercial applications. Some typical domestic applications of these motors include applications in air conditioning louvers, driving electrically operated drapes, turning pipe valves on or off, and the zoom and autofocus mechanisms in digital or phone cameras. In the commercial sector, these motors can commonly be found in ATMs, rotating security cameras, etc.

- Factors such as the growing penetration of automation and robotics solutions in the industrial and manufacturing sectors and the expanding medical equipment industry are driving the market's growth.

- Medical equipment is another major sector wherein stepper motors are increasingly used for brushless commutation. An optimized gearing and high-quality bearing system in stepper motors provide long life, making them suitable for critical lifesaving applications. Medical scanners, samplers, digital dental photography, respirators, fluid pumps, and blood analysis machinery are among the common medical equipment wherein stepper motors are used.

- Some limitations of stepper motors are operational limitations at extremely high speeds, the requirement of a dedicated control circuit, and using more current than D.C. motors, among others.

- Furthermore, the availability of alternatives, such as servo motors that perform better in applications with complex requirements, such as CNC machinery, as it requires high accuracy, also challenges the studied market's growth.

Stepper Motor Market Trends

Growing Adoption of Robotics and Automation Solutions

- The transition to Industry 4.0 is expected to result in significant improvements in productivity and efficiency and a shift in industrial processes' operations. Connecting the network to the manufacturing process and increasing production efficiency through automation are expected to change traditional business operations and create numerous opportunities in the future.

- In recent years, increased labor costs and competitive rivalry have fueled demand for automated systems. For example, according to the Bureau of Labour Statistics (BLS) December 2022 report, compensation costs for private industry workers in the United States increased by 5.1 percent yearly. According to Eurostat, hourly labor costs in the eurozone were estimated to rise by 4.3 percent in the second quarter of 2022.

- Rapid industrialization has boosted innovation and the adoption of efficient industrial equipment in emerging economies such as China, Japan, India, Brazil, and South Korea. According to the National Bureau of Statistics of China, industrial production in China increased 3.7 percent year-on-year in July 2023. China aims to produce up to 35 million automobiles by 2025, up from 22.3 million units in 2018. Moreover, the manufacturing units in the country are expected to grow rapidly due to recent tax breaks and the 'Made in China 2025' initiative.

- According to the Federal Reserve Bank of Dallas, global industrial production, excluding the United States, increased by 4 percent in May 2022 compared to 2021. Such trends are creating a favorable growth scenario for the market under consideration. Furthermore, the rise of automation in the manufacturing sector has fueled the market's growth.

- As stepper motors are used where precise movement is required, the growing adoption of automation and robotics solutions in the industrial sector also facilitates the studied market's growth. For instance, according to IFR forecasts, global adoption will exceed 518,000 industrial robots operational across factories worldwide by 2024, with Asian/Australian installations expected to reach 370,000 units.

North America is Expected to Witness Significant Growth

- North America is expected to remain a significant market for stepper motors. The presence of mature medical and industrial equipment, robotics, and computing is likely to be the main drivers of this region's growth.

- North America, comprising the United States and Canada, has the best healthcare infrastructure and is among the primary markets for advanced medical equipment. According to the Advanced Medical Technology Association (AdvaMed), the United States is among the leading medical device markets in the world, comprising 40% of the global MedTech market.

- With healthcare expenditures by public and private sources steadily growing across North America's entire medical supplies and devices distribution chain, the medical equipment industry is expected to drive the demand for stepper motors significantly during the forecast period. For instance, in November 2022, the Center for Disease Control and Prevention (CDC) awarded USD 3.2 billion to help local, territorial, and state jurisdictions across the United States strengthen their public health infrastructure and workforce. This funding is awarded directly to health departments at different levels to provide the people, systems, and services needed to promote and protect health in US communities.

- Similarly, in October 2022, USDA announced USD 110 million in grants to improve healthcare facilities in rural towns in the United States. These grants will help 208 rural healthcare organizations expand critical services for about 5 million people in 43 states and Guam. As medical devices are anticipated to comprise a significant portion of such investments, these trends positively influence the studied market's growth.

- The United States is expected to hold a dominant market share in the medical equipment sector. For instance, according to a US Census Bureau survey, the industry revenue of medical equipment and supplies manufacturers in the United States was anticipated to grow from USD 43.23 billion in 2020 to USD 43.51 billion by 2024.

- Furthermore, the North American region is also among the leading adopters of industrial automation and robotics solutions. This creates a favorable outlook for the growth of the studied market, as stepper motors are widely used in automation and robotics equipment. According to IFR, total installations of industrial robots in the North American manufacturing sector grew by about 12 percent, reaching 41,624 units in 2022.

Stepper Motor Industry Overview

The stepper motor market is highly fragmented, with major players such as Kollmorgen (Altra Industrial Motion Corp.), Shinano Kenshi Co. Ltd, Faulhaber Oriental Motor, and Portescap present. Partnerships, innovations, investments, and acquisitions are among the strategies used by market participants to improve their product offerings and gain a sustainable competitive advantage.

In July 2023, Researchers of Sona College, Tamil Nadu, India, developed a stepper motor that was used in India's space mission "Chandrayan 3". The SonaSpeed's simplex permanent magnet stepper motor was used in the actuator assembly of the LVM 3 rocket for controlling the rocket engine's liquid oxidizer and fuel mixture ratio.

In January 2023, Kollmorgen launched its new P80630-SDN stepper drive. The company decided to introduce additional stepper drives and features in the coming months, building upon the flagship P8000 stepper drive platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Developments

- 4.3 Impact of Macroeconomic Factors

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

- 4.5 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Robotics and Automation Solutions

- 5.1.2 Increasing Usage of Stepper Motors in the Healthcare Industry

- 5.2 Market Restraints

- 5.2.1 Performance Limitations and Competition from Servo Motors

6 MARKET SEGMENTATION

- 6.1 By Type of Mortor

- 6.1.1 Hybrid

- 6.1.2 Permanent Magnet

- 6.1.3 Variable Reluctance

- 6.2 By Application

- 6.2.1 Medical Equipment

- 6.2.2 Robotics

- 6.2.3 Industrial Equipment

- 6.2.4 Computing

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kollmorgen (Altra Industrial Motion Corp.)

- 7.1.2 Faulhaber

- 7.1.3 Oriental Motor

- 7.1.4 Shinano Kenshi Co. Ltd

- 7.1.5 Portescap

- 7.1.6 Nanotec Electronic GMBH & Co. KG

- 7.1.7 JVL AS

- 7.1.8 I.CH Motion

- 7.1.9 Changzhou Fulling Motor Co. Ltd.

- 7.1.10 Shanghai MOONS' Electric Co. Ltd.