|

市場調查報告書

商品編碼

1408172

衛星物聯網通訊:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Satellite IoT Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

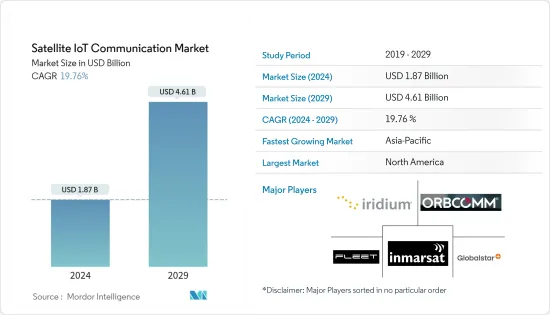

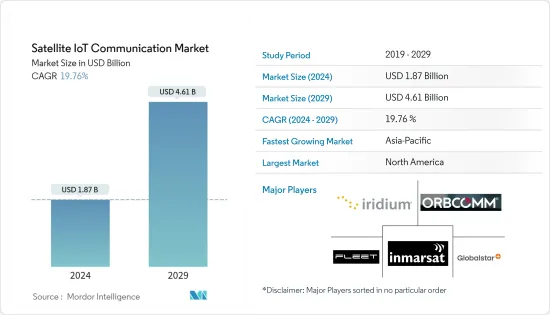

衛星物聯網通訊市場規模預計到 2024 年為 18.7 億美元,預計到 2029 年將達到 46.1 億美元,在預測期內(2024-2029 年)複合年成長率為 19.76%。

衛星通訊補充了偏遠地區的地面蜂巢式網路和非蜂巢式網路,並有利於各種工業應用。 5G生態系統將是衛星和地面網路無縫整合的關鍵趨勢。

主要亮點

- 衛星通訊的動力源自於物聯網(IoT)設備全球連結的迫切需求。該領域的幾家公司正在投資擴大衛星通訊的應用,特別是推出 SmallSat衛星群。多家公司正在使用衛星物聯網服務來監控和追蹤設備以實現智慧型資料傳輸。

- 全球衛星物聯網通訊市場是由5G無線連接的發展和成長所推動的。由於透過LEO衛星擴大5G連線的力度活性化,例如SAT 5G(歐盟支援的5GPPP計劃)和城域乙太網路論壇(MEF),需要更多的互動。建構安全、異質的衛星和地面5G網路也將幫助通訊業者和LEO衛星供應商更好地整合服務。

- LEO衛星市場的大規模投資是推動衛星物聯網通訊市場成長的關鍵方面。這項投資受到適應性、廉價成本、先進機械、易於組裝和發射、大量生產和短生命週期的推動,這些可能會推動未來幾年的市場成長。

- 此外,工業領域採用自主系統和連網型設備的成長趨勢也對市場研究產生了正面影響。據愛立信稱,到年終,預計近60%的蜂巢式物聯網連接將是寬頻物聯網,其中4G佔大多數。這可能會在整個預測期內為市場的成長和增強創造充足的機會。

- 外太空的極端氣溫是限制市場的重要因素。衛星暴露在惡劣的太空環境中,其內部的電子元件受到極端溫度的威脅。因此,衛星必須保持工作溫度,以避免系統故障且不影響通訊。

- COVID-19 大流行震驚了世界各地的每個行業。它也對衛星物聯網通訊領域產生了重大影響。該行業在多個領域依賴政府契約,例如衛星通訊服務的高可靠性和耐用性,這對於災難通訊和備份服務至關重要,這使得它們更容易受到全球流行病嚴重程度的影響。 。然而,大流行之後,地面連接服務的使用增加,為衛星物聯網通訊留下了巨大的機會。

衛星物聯網通訊市場趨勢

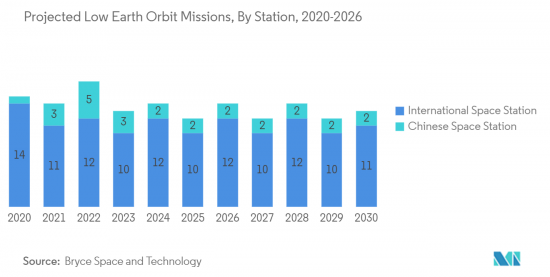

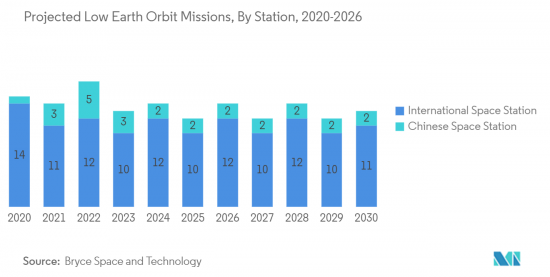

低地球軌道 (LEO) 推動衛星物聯網通訊的成長

- 圍繞地球上方 160 至 2000 公里運行的低地球軌道 (LEO)衛星星系對於將 5G 連接擴展到沒有地面覆蓋的偏遠、服務欠缺和偏遠地區具有潛在的吸引力。它是一個目標。由於地球表面只有約 10% 的區域提供地面連接服務,因此使用 LEO 衛星進行衛星物聯網通訊仍然存在巨大的機會。

- LEO衛星因其適應性強、價格實惠、機械先進以及易於組裝和發射而吸引了各大公司的大量投資。衛星的生命週期短,且生產量大。政府機構和零售、銀行、石油和天然氣等商業部門對低成本、高速網路的需求很高。此外,新興國家的個人消費者對農村地區網路存取的需求正在推動對低地球軌道衛星群的投資。

- LEO適合低功耗通訊,訊號傳播損耗低,降低了用戶設備的功耗要求,非常適合接觸低功耗物聯網設備。目前,大多數用於物聯網的LEO衛星主要利用CubeSat技術建造,該技術允許公司批量生產組件並提供現成的組件,從而可以顯著減少設計和開發衛星所需的成本和時間。這已成為老牌衛星通訊業者和推出衛星物聯網通訊服務的新興企業的首選。

- 此外,重要的公司也在投資、與其他企業合併以及投資新計畫,以擴大消費群並更好地滿足各種應用的需求。例如,2023年4月,第一家營運5G-IoT標準低地球軌道(LEO)衛星星系的公司Sateliot發射了有史以來第一顆5G標準LEO衛星Sateliot_0「The GroundBreaker」。

- 2023 年 2 月,美國Rivada Networks, Inc.的完全子公司Rivada Space Networks GmbH (RSN) 宣布,Rivada 的創新型「我們已委託為 Sky Network 生產 300 顆低地球軌道 (LEO) 衛星。 RSN 的天基資料網路提供類似光纖的低延遲和每秒Gigabit的資料傳輸,並且具有超安全性和高彈性。

預計北美將佔據最大佔有率

- 北美在衛星物聯網通訊市場中佔有很大佔有率。這一成長是由於政府在軍事和通訊網路方面的支出增加。霍尼韋爾國際公司、通用動力公司和 L3Harris 技術公司等主要參與企業的存在極大地推動了該地區的市場成長。

- 5G網路將在幫助政策制定者和政府將城市轉變為智慧城市、使居民獲得社會經濟效益、參與先進的數位化和資料密集型經濟方面發揮關鍵作用,我將實現這一目標。因此,當局將需要建置和升級光纖網路和資料中心等被動資產,以滿足衛星物聯網通訊市場的需求。

- 此外,政府、農業、採礦、能源、海事和航空等最終用戶行業不斷成長的需求正在加強該地區的市場成長。此外,該地區還改善了網路連接並擁有強大的技術基礎設施立足點。例如,2022 年 8 月,Inmarsat 和 hiSky 建立了一個新的可擴展物聯網解決方案,為物聯網採用者提供經濟高效的服務,同時增強連接性。

- 2023年6月,高通技術公司宣布推出兩款具有衛星通訊功能的調變解調器晶片組(高通9205S調變解調器和高通212S調變解調器)。高通的新型調變解調器晶片組將主要支援需要獨立非地面網路(NTN)連接或與地面網路混合連接的離網工業用例,並將由物聯網開發商、企業、 OEM使用,並且使ODM能夠利用關鍵技術即時資訊和見解,特別適合管理各種業務計劃。

- 此外,銥星通訊公司也宣佈於2022年12月推出銥星資訊傳輸SM(Iridium Messaging TransportSM)服務。它是一種雙向雲端原生網路資料,主要針對 Iridium Certus 上的使用進行了最佳化,旨在輕鬆地將衛星連接整合到現有或新的物聯網解決方案中。 IMT 提供銥星網路獨特的 IP資料傳輸服務,專為中小型訊息而構建,以支援衛星物聯網應用。這項新服務與 Iridium CloudConnect 和 Amazon Web Services 整合,可最大限度地降低各種新型 Iridium Connected IoT 設備的開發成本並縮短上市時間。

衛星物聯網通訊業概況

衛星物聯網通訊市場競爭激烈,由幾家主要參與者組成,包括 Astrocast、Inmarsat Technologies、Kepler Communications、Ligado Networks、Galaxy Space 和吉利。目前,只有少數大公司在市場佔有率方面佔據主導地位。這些擁有重要市場佔有率的領先公司致力於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。主要進展包括:

2023年3月,全球物聯網解決方案供應商移遠無線推出了物聯網產業的CC200A-LB衛星模組,採用全球物聯網通訊與解決方案供應商ORBCOMM提供的衛星物聯網連線。該模組主要旨在以經濟高效的價格分佈和超低延遲提供可靠的全球連接和覆蓋。該模組是運輸、海事、重型設備、採礦、農業以及石油和天然氣監測等廣泛應用的理想解決方案。

全球衛星和地面網路解決方案供應商 Marlink 與低地球軌道(LEO) 5G 物聯網衛星電信業者OQ Technology 就相容現有蜂巢式網路、3GPP 5G 非地面網路蜂窩簽署了標準全球銷售合作夥伴關係合作備忘錄基於衛星的5G連線和硬體銷售。

T-Mobile US 和 Starlink 宣佈建立技術合作夥伴關係,開發衛星到設備的直接連接。同樣,美國的 Omnispace 正在與菲律賓行動電話Smart(PLDT 的子公司)合作,利用符合 3GPP 的 5G NTN 標準探索 Smart 的 5G 網路與 Omnispace 的 LEO 衛星之間的互通性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 5G 無線連線的發展與成長

- LEO衛星星系的重大投資

- 市場挑戰

- 極端的宇宙溫度

- 產業吸引力模型—波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對文件管理市場的影響

第5章市場區隔

- 按軌道類型

- 低地球軌道(LEO)

- 中軌道(MEO)

- 地球靜止軌道(GEO)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭形勢

- 公司簡介

- Iridium Communications Inc.

- Orbcomm

- Inmarsat Global Limited

- Globalstar Inc

- Fleet Space Technologies Private Limited

- Viasat, Inc

- Cobham Limited

- Boeing

- L3Harris Technologies

第7章 投資分析

第8章 市場機會及未來趨勢

The Satellite IoT Communication Market size is estimated at USD 1.87 billion in 2024, and is expected to reach USD 4.61 billion by 2029, growing at a CAGR of 19.76% during the forecast period (2024-2029).

Satellite communication complements terrestrial cellular and non-cellular networks in remote locations, which benefits various industrial applications. 5G ecosystems would be a key trend in seamlessly integrating satellite and terrestrial networks.

Key Highlights

- The drive for satellite communications stems from the pressing need for global connectivity for the Internet of Things (IoT) devices. Several businesses in this sector are investing in broadening the applications for satellite communication, most notably with the introduction of SmallSat constellations. Several businesses use satellite IoT services to monitor and track equipment for intelligent data transfers.

- The Global satellite Internet of Things communication market is driven by the development and growth of 5G wireless connectivity. The demand for more interaction between open and standardized ecosystems on both sides is emerging as a result of the growing number of efforts to expand 5G connection via LEO satellites, such as SAT 5G (a 5GPPP project supported by the European Union) and Metro Ethernet Forum (MEF). Building a safe, heterogeneous satellite and terrestrial 5G network would also aid telecom operators and LEO satellite providers better integrate their services.

- Considerable Investments in the LEO Satellite Market are a significant aspect boosting the growth of the satellite IoT Communication Market. The investments have been fueled by adaptability, cheap cost, advanced mechanics, simplicity of assembly and launch, mass production, and short life cycles, which would drive market growth in the coming years.

- Moreover, the growing trend of adopting autonomous systems and connected devices in the industrial sectors positively influences the market studied. According to Ericsson, by the end of 2028, almost 60 percent of cellular IoT connections are forecast to be broadband IoT, with 4G connecting the majority. This would create ample opportunities for the market to grow and enhance throughout the forecast period.

- Extreme Space temperature is a critical factor that could restrain the market. Satellites are exposed to the harsh environment of space, which makes the electronic components housed inside the satellites threatened by extreme temperatures. Hence satellites must maintain operational temperatures to avoid system failures so that communication is not affected.

- The COVID-19 pandemic caused shockwaves across every industry worldwide. It had a significant effect on the satellite IoT communication sector. The sector may be protected from the more severe effects of the global pandemic due to its reliance on government contracts in several areas, including the highly dependable and durable nature of satellite communications services, which are essential for disaster communications and backup services. However, there has been an increasing rise in access to terrestrial connectivity services after the pandemic, which left a significant opportunity for satellite IoT communications.

Satellite IoT Communication Market Trends

Low Earth Orbit (LEO) drives the Growth of the Satellite IoT Communication

- Low-Earth Orbit (LEO) satellite constellations, which orbit between 160 and 2000 kilometers above the Earth, are potentially attractive for expanding 5G connectivity to isolated, underserved, and remote geographies where terrestrial coverage is absent. Only about 10 % of the Earth's surface has access to terrestrial connectivity services, which leaves a significant opportunity for satellite IoT communications on the LEO constellations.

- LEO satellites attract significant investment from major players due to their adaptability, affordability, advanced mechanics, and ease of assembly and launch. The satellites have a short lifecycle and are mass-produced. There is a significant demand for low-cost, high-speed internet in the government and commercial sectors like retail, banking, oil, and gas. Also, the need for internet access in rural areas among individual consumers in emerging countries is driving investments in LEO constellations.

- LEO are better suited to low-power communications and lower signal propagation losses, reducing the user equipment's power requirements and making it ideal for contact with low-power IoT devices. Today, most of the LEO satellites for IoT are built mainly for leveraging CubeSat technology, allowing companies to mass-produce components and provide commercial off-the-shelf parts, drastically reducing the cost and time to design and develop satellites. It has become the desired option for incumbent satellite operators and NewSpace start-ups launching satellite IoT communication services.

- Moreover, to increase their consumer base and better meet their demands across various applications, significant companies are also investing, merging with other businesses, and investing in new projects. For instance, in April 2023, Sateliot, the first company to operate a low-Earth orbit (LEO) nanosatellite constellation with 5G-IoT standard, introduced Sateliot_0 "The GroundBreaker," the first-ever 5G standard LEO satellite, to democratize access to the Internet of Things.

- In February 2023, Rivada Space Networks GmbH (RSN), an entirely owned subsidiary of U.S.-based Rivada Networks, Inc., engaged Terran Orbital's wholly owned subsidiary Tyvak Nanosatellite Systems, Inc. to manufacture 300 low-earth-orbit (LEO) satellites for Rivada's innovative "network in the sky." RSN's space-based data network will provide fiber-like low latency and gigabit-per-second data delivery which is ultra-secure and extremely resilient.

North America is Expected to Hold Largest Share

- North America holds a significant share of the Satellite IoT Communication market. The growth is attributed to the growing government spending on military and communication networks. The presence of key significant players, such as Honeywell International, Inc., General Dynamics Corporation, L3Harris Technologies Corporation, and many others, drive the market growth significantly across the region.

- 5G networks play a vital role in assisting policymakers and governments in transforming cities into smart cities, allowing inhabitants to participate and realize socioeconomic benefits from an advanced, digital, data-intensive economy. As a result, authorities would be required to build and upgrade passive assets, such as fiber networks and data centers, which strive to meet the demand for the satellite IoT Communication Market.

- Moreover, the rise in the demand from end-user industries, such as government, agriculture, mining, energy, maritime, and aviation, is enhancing the market growth in the region. Moreover, the region has improved network connectivity and advanced foothold technological infrastructure. For instance, In August 2022, Inmarsat and hiSky created a new scalable IoT solution to provide a cost-efficient offering to IoT adopters while improving connectivity.

- In June 2023, Qualcomm Technologies, Inc. declared two modem chipsets with satellite capability: the Qualcomm 9205S Modem and the Qualcomm 212S Modem. The new Qualcomm modem chipsets primarily power off-grid industrial use cases that need a standalone non-terrestrial network (NTN) connectivity or hybrid connectivity alongside terrestrial networks and enable IoT developers, enterprises, OEMs, and ODMs to harness the key real-time information and insights especially to manage various business projects.

- Also, in December 2022, Iridium Communications Inc. declared the service launch of Iridium Messaging TransportSM, a two-way cloud-native networked data service primarily optimized for use over Iridium Certus and built to make it easier to combine satellite connections to the existing or new IoT solutions. IMT delivers an IP data transport service unique to the Iridium network, built for small-to-moderate messages assisting satellite IoT applications. Integrated with Iridium CloudConnect and Amazon Web Services, the new service can minimize the development costs and the speed time to market for various new Iridium Connected® IoT devices.

Satellite IoT Communication Industry Overview

The satellite IoT communication market is highly competitive and consists of several major players, such as Astrocast, Inmarsat Technologies, Kepler Communications, Ligado Networks, Galaxy Space, and Geely. Only some significant players currently dominate the market in terms of market share. With a prominent market share, these major players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Some of the key developments are:-

In March 2023, Quectel Wireless Solutions, a worldwide IoT solutions provider, launched the CC200A-LB satellite module for IoT industries that uses satellite IoT connectivity offered by ORBCOMM, a worldwide provider of IoT communications and solutions. The module is mainly built to deliver reliable global connectivity and coverage at a cost-effective price point and with ultra-low latency. It is a perfect solution for a vast spectrum of applications, including transportation, maritime, heavy equipment, mining, agriculture, and oil and gas monitoring.

Marlink, a global satellite and terrestrial network solution provider, and OQ Technology, the low Earth orbit (LEO) 5G IoT satellite communications company, signed an MoU for a global distribution partnership towards the distribution of Satellite 5G connectivity and hardware that is compatible with an existing cellular network and based on the 3gpp 5g non-terrestrial network cellular standard.

T-Mobile US and Starlink announced a technology partnership to develop a direct satellite-to-device proposition, which was expected to launch by 2024. Similarly, US-based Omnispace collaborated with the Philippines' mobile operator Smart, a subsidiary of PLDT, to explore interoperability between Smart's 5G network and Omnispace's LEO satellites, using 3GPP-compliant 5G NTN standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development and Growth of 5G Wireless Connectivity

- 4.2.2 Considerable Investments in the LEO Satellite Constellations

- 4.3 Market Challenges

- 4.3.1 Extreme Space Temperature

- 4.4 Industry Attractiveness Model - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Document Management Market

5 MARKET SEGMENTATION

- 5.1 By Type of Orbit

- 5.1.1 Low Earth Orbit (LEO)

- 5.1.2 Medium Earth Orbit (MEO)

- 5.1.3 Geostationary Orbit (GEO)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Iridium Communications Inc.

- 6.1.2 Orbcomm

- 6.1.3 Inmarsat Global Limited

- 6.1.4 Globalstar Inc

- 6.1.5 Fleet Space Technologies Private Limited

- 6.1.6 Viasat, Inc

- 6.1.7 Cobham Limited

- 6.1.8 Boeing

- 6.1.9 L3Harris Technologies