|

市場調查報告書

商品編碼

1408169

託管數位工作場所服務:市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Managed Digital Workplace Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

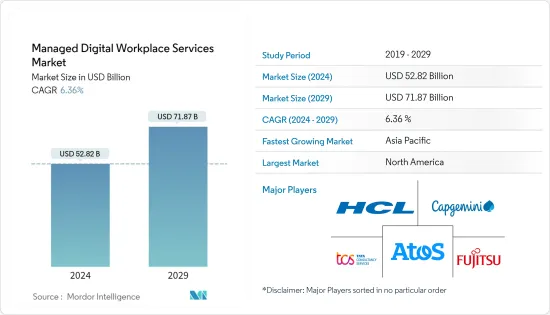

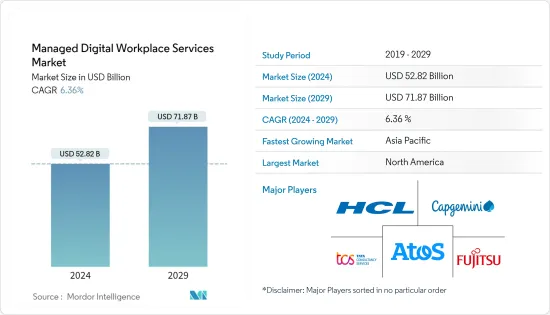

託管數位工作場所服務市場規模預計到 2024 年為 528.2 億美元,預計到 2029 年將達到 718.7 億美元,在預測期內(2024-2029 年)複合年成長率為 6.36%,預計將會成長。

託管數位工作場所服務的促進因素包括技術進步、不斷變化的勞動力人口結構、新技術和工具的可用性、員工對更大彈性的渴望以及強大而關懷的經營團隊,其中包括積極的公司文化。此外,成功的數位轉型也受到有效變革管理、員工參與以及對轉型目標的清晰理解等因素的影響。

主要亮點

- 在預測期內,各種組織擴大採用數位工作場所可能會增加對託管數位工作場所服務的需求。例如,2022 年,beautiful.ai 對 3,000 名高階主管進行了調查,以了解數位工作場所如何影響業務以及遠距工作者的未來。發現 78% 的人同意投入大量財務資源來使數位工作場所取得成功, 80% 正在將財務資源用於幫助管理者在數位化工作場所實現目標的技術和工具。他們回應稱,他們致力於投資該專案。 81% 的人對數位工作將取代辦公室工作持樂觀態度。即使在數位化職場,66% 的人也感覺聯繫更加緊密。

- 此外,IT 技術正在對託管數位工作場所服務產生重大影響。隨著數位平台和自動化的使用越來越多,工作場所變得更有效率和精簡。例如,雲端基礎的設施管理軟體使企業領導者能夠保持井井有條並了解最新情況,從而提高業務績效。此外,數位工作場所技術提供了更好的工作流程和資料管理,重點是通訊、資訊管理和網路安全。

- 此外,人工智慧在管理數位工作場所營運方面變得越來越重要。透過自動化任務和提供智慧型見解,人工智慧使組織能夠簡化工作流程、提高生產力並改善員工體驗。數位工作場所中人工智慧應用的範例包括知識管理、資料管治、資訊管理、最終用戶體驗管理和文件管理。此外,人工智慧還可以幫助組織制定有效的工作場所自動化策略並提高員工生產力。人工智慧技術不斷發展,預計將在塑造數位工作場所的未來方面發揮更加重要的作用。

- 此外,BFSI 行業的技術和客戶形勢的變化可能會在預測期內推動對託管數位工作場所服務的需求。許多 BFSI 行業的公司,例如保險公司瑞士再保險 (Swiss Re),正在與市場供應商合作,以實現雲端基礎的數位工作場所,這種趨勢將在未來幾年加劇,導致BFSI 行業的需求增加,預計需求將會增加。此外,世界各地銀行和保險公司正在進行的數位轉型正在增加數位化工作場所轉型的需求,以提高效率和生產力,進一步增加所研究市場的成長前景。

- 網路犯罪的增加對全球託管數位工作場所服務市場構成了重大挑戰和限制。保護數位資產、防禦網路威脅並遵守資料保護條例是組織面臨的挑戰。由於網路犯罪對客戶信任的影響以及對網路安全加大投資的需要,強力的安全措施和主動安全管理對於提供託管數位工作場所服務至關重要。

- 疫情結束後,混合工作和現場工作越來越受歡迎。世界各地的組織必須在不同的實體職場環境中適應這種新常態,並改善企業數位工作場所。我們對這種工作輪班進行了分析,以影響對託管數位工作場所服務的需求,這些服務可以改善工作實踐,以確保持續的生產力、營運和業務成功。大流行後,各公司正在共同努力利用數位工作場所。這種合作的加強可能會促進大流行期間研究市場的成長。

託管數位工作場所服務市場趨勢

醫療保健產業有望實現強勁成長

- 醫療保健行業擴大採用新技術來改善患者護理和體驗並改善工作場所管理。醫療保健行業有各種複雜的人員安排,包括大型團隊、兼職、全職、隨叫隨到、季節性、遠端、現場工作人員,以及具有多種角色和專業的工作人員。在這個行業中,涉及許多調整和特殊性,這使得實施管理解決方案非常重要。

- 此外,醫院和其他醫療機構之間對降低人事費用、提高業務效率以及部門整合的需求日益成長,是推動這些解決方案採用的關鍵因素。此外,對醫療保健專業人員不斷成長的需求以及與職場管理解決方案相關的好處(例如職場透明度和靈活的調度)預計也將在預測期內增加醫療保健行業中這些解決方案的採用。

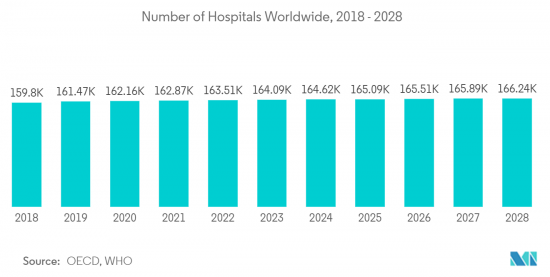

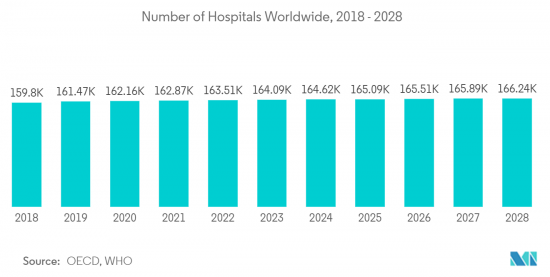

- 此外,對醫療服務的需求不斷成長,導致醫療設施建設投資增加。醫療保健設施市場的成長是由於世界各地人口成長和人口高齡化所致。因此,醫療保健領域託管數位工作場所服務的採用可能會增加。例如,根據經合組織和世界衛生組織的研究,預計未來五年全球醫院數量將穩定增加。資料顯示,五年內醫院數量預計將達到1,66,235所。

- 許多醫療保健提供者正在投資擴大或建造新的醫療設施。例如,2022 年 6 月,南卡羅來納州健康與環境控制部核准Roper St. Francis Healthcare 在該醫院的伯克利縣園區增建一座塔樓。醫療保健設施的擴張預計將增加對數位管理服務的需求,以追蹤資料和整體工作場所管理,進而預計將產生對託管數位工作場所服務的需求。

- 醫療機構需要各種職場管理服務,包括廢棄物管理、保全服務、餐飲服務、清潔服務和技術支援服務,而且需求可能很快就會增加。單獨管理這些服務很困難。工作場所管理服務提供的雲端處理、行動性以及實體和知識自動化等協作工具可讓您輕鬆地同時完成所有工作。快速擴張和數位化趨勢正在迅速增加對託管數位工作場所服務的需求。

亞太地區預計將出現顯著成長

- 亞太地區最近經歷了快速的技術進步和數位轉型。這場數位革命正在徹底改變公司的業務方式,推動對高效、安全的數位工作場所解決方案的需求。託管數位工作場所服務對於組織提高生產力、協作和員工滿意度至關重要。

- 由於改善公民服務、簡化業務和提高效率的需求,亞太地區的政府和公共部門正在經歷快速的數位轉型。許多政府機構正在轉向託管數位工作場所服務 (MDWS) 作為實現這些目標的策略解決方案。此外,亞太地區各國政府也擴大採用數位管道來提供高效率且以公民為中心的服務。

- 此外,託管數位服務使政府能夠創建一個員工可以無縫協作、存取相關資訊並快速回應公民詢問和服務請求的職場環境。例如,新加坡的智慧國家計畫專注於利用服務台透過 MyInfo 服務和 Moments of Life 應用程式等平台提供整合數位服務和個人化公民體驗。

- 此外,亞太地區託管數位工作場所服務(MDWS)市場正在強勁成長並擁有巨大潛力。隨著數位化努力、遠距工作採用和營運效率推動業務效率的提高,亞太地區的企業正在認知到 MDWS 解決方案的價值。對無縫遠端協作、改善員工體驗和強大資料安全性的需求不斷成長,推動了市場的發展。

- 此外,隨著政府和企業投資數位轉型計劃,MDWS 提供者擁有獨特的機會來提供客製化解決方案,以滿足亞太市場的獨特需求。隨著新興技術的整合和對創新的關注,亞太地區的MDWS市場預計將進一步擴大,在塑造亞太地區的未來工作和數位賦能方面發揮關鍵作用。

託管數位工作場所服務產業概述

總體而言,競爭對手之間的敵對行動強度很高,預計在預測期內仍將如此。 Atos Se、Fujitsu Ltd、HCL 和 Capgemini 等市場主要企業提供不斷增加和增強的服務。此外,企業正在採取強力的競爭策略來維持市場地位並留住客戶,競爭企業之間的競爭加劇。此外,供應商還專注於提供整合服務,使他們能夠為客戶提供一體化的託管數位工作場所服務。

2023 年 4 月,Stefanini 和菲利普莫里斯國際公司 (PMI) 宣佈建立工作場所解決方案合作夥伴關係。 Stefanini 提供託管服務,例如服務台支援、服務管理、現場支援以及工作場所評分服務(例如端點管理、ITAM 和 M365)。菲利普莫里斯國際公司的約 79,800 名員工將在 80 個國家的 140 個地點以 29 種語言獲得服務,其中包括辦公室、工廠和零售店。

2022 年 9 月,全球科技公司 HCL Technologies (HCL) 和英特爾推出了卓越中心,以加速業界客製化的數位工作場所 (DWP) 產品的開發和採用。該卓越中心配備創新技術和專家,將利用 HCL 的 DWP 解決方案和英特爾的技術組合共同開發解決方案,以實現無縫、互聯和安全的混合工作場所。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 生態系分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 提高服務台數位化的複雜性以解決聯繫問題

- 作為數位轉型舉措的一部分,更多地採用數位解決方案

- 在家工作的趨勢正在增加,多家公司將其視為在家工作選擇

- 市場抑制因素

- 網路犯罪增加

第6章市場區隔

- 按服務

- 服務台

- 最終用戶設備支持

- 數位化工作場所

- 按行業分類

- BFSI

- 衛生保健

- 製造業

- 能源/公用事業

- 政府/公共機構

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭形勢

- 公司簡介

- Atos SE

- Fujitsu Ltd

- HCL Technologies

- Capgemini Services SAS

- Tata Consultancy Services Limited

- Wipro Ltd

- IBM Corporation

- DXC Technology

- Cognizant Technology Solutions Corporation

- NTT Data Corporation

- Stefanini Group

第8章 廠商排名分析

第9章投資分析

第10章市場機會與未來展望

The Managed Digital Workplace Services Market size is estimated at USD 52.82 billion in 2024, and is expected to reach USD 71.87 billion by 2029, growing at a CAGR of 6.36% during the forecast period (2024-2029).

The driving factors that can contribute to managed digital workplace services include technological advancements, changing workforce demographics, availability of new technologies and tools, employee demand for greater flexibility, and a positive company culture facilitated by strong and helpful management. Additionally, successful digital transformations are influenced by factors such as effective change management, employee engagement, and a clear understanding of the goals and objectives of the shift.

Key Highlights

- The rise in adopting digital workplaces by various organizations would drive the demand for managed digital workplace services over the forecasted period. For instance, According to a survey done by beautiful.ai in 2022, which polled 3,000 managers to find out how the digital workplace has affected their businesses and what the future holds for the remote worker, 78% agree that significant financial resources are being directed toward achieving a successful digital workplace, and 80% said their firm is committed to investing financial resources in technology and tools to assist managers in successfully leading and meeting goals in a digital workplace. 81% are optimistic about digital work replacing their in-office setting. In a digital working environment, 66% feel that there is still a strong sense of connection.

- Furthermore, information technology has significantly impacted managed digital workplace services. With the increasing use of digital platforms and automation, workplaces have become more efficient and streamlined. Cloud-based facilities management software, for example, has enabled business leaders to stay organized and up-to-date, resulting in improved business performance. Additionally, digital workplace technologies have focused on communication, information management, and cybersecurity, providing better workflows and data management.

- Furthermore, artificial intelligence is increasingly important in managing digital workplace operations. By automating tasks and providing intelligent insights, AI enables organizations to streamline workflows, increase productivity, and improve employee experience. Some examples of AI applications in the digital workplace include knowledge management, data governance, information management, end-user experience management, and document management. Additionally, AI can help organizations formulate effective workplace automation strategies and increase employee productivity. As AI technology continues to evolve, it is expected to play an even more significant role in shaping the future of the digital workplace.

- Further, the changing technology and customer experience landscape in the BFSI sector will drive the demand for managed digital workplace services over the forecast period. Many BFSI sector companies, such as Swiss Re, an insurance firm, have partnered with market vendors to enable a cloud-based digital workplace, and the trend is expected to strengthen in the coming years, with the demand expected to increase from the BFSI sector. Further, the growing digital transformation in banks and insurance firms worldwide necessitates the need for digital workplace transformation for enhanced efficiency and productivity, thus further providing growth prospects for the studied market.

- For the global market for managed digital workplace services, the rising incidences of cybercrime present significant challenges and constraints. Securing digital assets, defending against cyber threats, and adhering to data protection regulations are challenging for organizations. Strong security measures and proactive security management are crucial in delivering managed digital workplace services due to the impact of cybercrime on customer trust and the requirement for greater investments in cybersecurity.

- Post-pandemic, hybrid work, and on-site work are gaining traction. Organizations worldwide must adapt to this new normal in different physical workplace settings or improvements in the corporate digital workplace. This work shift is analyzed to influence the demand for managed digital workplace services to improve work practices to ensure that productivity, operations, and business success continue. Post-pandemic, various firms have collaborated to use the benefits of the digital workplace; such a rise in collaborations would push the growth of the studied market during the pandemic.

Managed Digital Workplace Services Market Trends

Healthcare Sector Expected to Witness Robust Growth

- Incorporating emerging technologies in the healthcare industry is prevailing, owing to enhanced patient treatment and experience and better workplace management. It has been understood that the healthcare industry presents various staffing complexities, including larger teams, a mix of part-time, full-time, on-call, seasonal, remote, and on-site workers, and workers of multiple roles and specializations. A great deal of coordination and specificity is involved in the industry, making deploying a management solution crucial.

- Moreover, the increasing need to reduce labor costs in hospitals and other health facilities, increased operational efficiency, and consolidation in the sector are some of the primary factors driving the adoption of these solutions. Further, the growing demand for healthcare professionals and benefits associated with workplace management solutions, such as transparency and flexible scheduling of workplaces in the industry, is also expected to increase the adoption of these solutions in the healthcare sector during the forecast period.

- Further, there is an increase in investment in the construction of healthcare facilities due to the increased need for healthcare services. This increase in the market for healthcare facilities is caused due to the rise in population and the growing aging population across various regions worldwide. This will likely expand the healthcare sector's adoption of managed digital workplace services. For instance, as per the survey by OECD and WHO, the number of hospitals worldwide is expected to rise steadily over the next five years. According to the data, the number of hospitals is expected to reach 1,66,235 in five years.

- Many healthcare providers are investing in expanding and constructing new healthcare facilities. For instance, in June 2022, the South Carolina Department of Health and Environmental Control approved Roper St. Francis Healthcare's Certificate of Need's additional tower on the hospital's Berkeley County campus. The expansion of healthcare facilities is anticipated to create augmented demand for digital management services to keep track of the data and overall workplace management, which in turn is projected to generate demand for managed digital workplace services.

- Healthcare establishments require various workplace management services, such as Waste Management, Security Services, Catering Services, Cleaning Services, Technical Support Services, and many more, whose demand will likely increase shortly. These services are difficult to manage individually. Collaboration tools such as cloud computing, mobility, and physical and knowledge automation provided by workplace management services make it easy to handle it all simultaneously. Rapid expansion and digitalization trends have crested demand for managed digital workplace services.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region has experienced rapid technological advancements and digital transformation recently. This digital revolution has significantly changed businesses' operations, increasing demand for efficient and secure digital workplace solutions. Managed Digital Workplace Services have emerged as a critical enabler for organizations to enhance productivity, collaboration, and employee satisfaction.

- The Government and Public sector in the Asia-Pacific region are experiencing rapid digital transformation driven by the need to enhance citizen services, streamline operations, and improve efficiency. Many government organizations are turning to Managed Digital Workplace Services (MDWS) as a strategic solution to achieve these goals. Furthermore, governments across the Asia-Pacific are increasingly adopting digital channels to provide efficient and citizen-centric services.

- Moreover, managed digital services enable governments to create work environments that empower employees to collaborate seamlessly, access relevant information, and promptly respond to citizen inquiries and service requests. For instance, Singapore's Smart Nation initiative focuses on leveraging service desks to provide integrated digital services and personalized citizen experiences through platforms like the MyInfo service and the Moments of Life app.

- Furthermore, the managed digital workplace services (MDWS) market in the Asia-Pacific region is experiencing robust growth and holds immense potential. With increasing digitalization efforts, remote work adoption, and the drive for operational efficiency, organizations across the region recognize the value of MDWS solutions. The market is fueled by the growing demand for seamless remote collaboration, enhanced employee experiences, and robust data security.

- Further, as governments and enterprises invest in digital transformation initiatives, MDWS providers have a unique opportunity to offer tailored solutions that cater to the specific needs of the Asia-Pacific market. With the convergence of emerging technologies and a focus on innovation, the MDWS market in the region is poised for further expansion, playing a vital role in shaping the future of work and digital empowerment in the Asia-Pacific.

Managed Digital Workplace Services Industry Overview

Overall, the intensity of competitive rivalry is high and expected to remain the same throughout the forecasted period. Major players in the market, such as Atos Se, Fujitsu Ltd, HCL, and Capgemini, are constantly providing increased and enhanced offerings. Additionally, companies are employing powerful competitive strategies to sustain themselves in the market and retain their clients, thereby intensifying competitive rivalry. Further, the vendors are focusing on offering integrated services to the client where all-in-one managed digital workplace service can be provided to the client.

In April 2023, Stefanini, with workplace solution collaboration, Stefanini and Phillip Morris International (PMI) announced a partnership. Stefanini will provide managed services such as service desk support, service management, onsite support, and workplace core services such as End Point Management, ITAM, and M365. Phillip Morris International's approximately 79,800 employees will be served in 29 languages throughout 80 countries and 140 sites, including offices, factories, and retail stores.

In September 2022, HCL Technologies (HCL), a global technology company, and Intel launched a Center of Excellence to foster the creation and adoption of industry-tailored Digital Workplace (DWP) offerings. Equipped with innovative technologies and experts, the Center of Excellence will leverage HCL's DWP solutions and Intel's technology portfolio to co-create solutions enabling seamless, connected, secure hybrid workplaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Levels of Digitization in the Service Desk for Contact Resolution

- 5.1.2 Increase in Adoption of Digital Solutions as part of Digital Transformation Initiatives

- 5.1.3 Rise of Work from Home Employees with Several Companies Considering it as a Permanent Alternative

- 5.2 Market Restraints

- 5.2.1 Increasing Incidents of Cybercrime

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Service Desk

- 6.1.2 End-user Device Support

- 6.1.3 Digital Workplace

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Manufacturing

- 6.2.4 Energy and Utility

- 6.2.5 Government and Public Sector

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atos SE

- 7.1.2 Fujitsu Ltd

- 7.1.3 HCL Technologies

- 7.1.4 Capgemini Services SAS

- 7.1.5 Tata Consultancy Services Limited

- 7.1.6 Wipro Ltd

- 7.1.7 IBM Corporation

- 7.1.8 DXC Technology

- 7.1.9 Cognizant Technology Solutions Corporation

- 7.1.10 NTT Data Corporation

- 7.1.11 Stefanini Group