|

市場調查報告書

商品編碼

1408158

噴墨頭:市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Inkjet Printhead - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

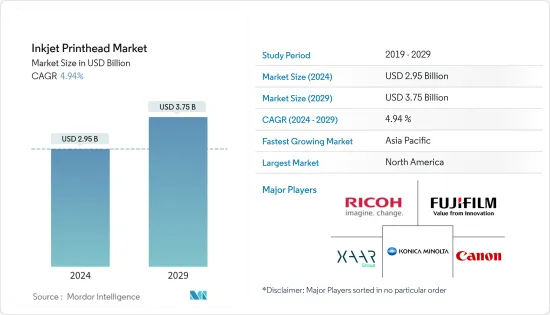

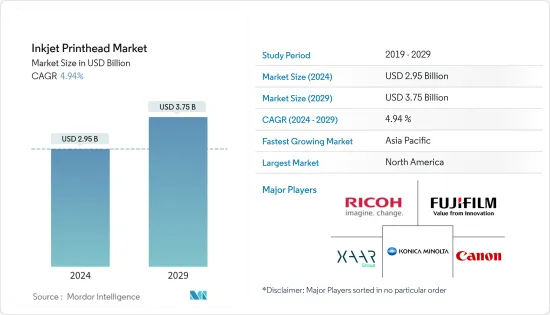

噴墨頭市場規模預計到2024年為29.5億美元,預計到2029年將達到37.5億美元,在預測期內(2024-2029年)複合年成長率為4.94%。

塊狀PZT(鋯鈦酸鉛)或傳統PZT印刷成為工業領域基板印刷的轉捩點。噴墨頭技術也正在進軍磁磚和功能性列印領域。此外,由於薄膜列印頭和塊狀 PZT 列印頭不直接與基材相互作用,因此這些技術在紡織品和標籤列印領域取得了顯著成長。

主要亮點

- 商業領域對噴墨印表機的需求不斷成長,刺激了全球市場的擴張。壓電噴墨頭用於零售業的各種應用。此外,由於噴墨列印技術的快速進步,壓電噴墨頭的全球市場正在擴大。市場主要企業包括京瓷、Konica Minolta、理光、Epson、Canon等。 2022年11月,Meteor Inkjet Ltd.取得美國專利商標局授予的「噴墨噴嘴狀態檢測」美國專利。該專利包括一種用於即時確定基於壓電的工業噴墨頭中噴嘴的運行狀態的系統和方法。本發明利用壓電激勵後來自噴嘴的電回饋的即時監控來捕獲堵塞或堵塞的列印噴嘴。此類技術創新可能會促進所研究市場的成長。

- 由於工業噴墨頭市場將出現成長。在使用噴墨印表機的包裝過程中,經常線上上列印批次資料和代碼。因此,Seiko Epson Corp.於2023年2月宣布,將開始銷售兩款相容溶劑墨水的新型噴墨頭機型。據稱,最新的「I3200(8)-S1HD」和「S800-S1」可與工業應用中使用的各種墨水相容。除了水性墨水、弱溶劑墨水、UV固化墨水外,我們還支援生產印刷中用於數位印刷的墨水,如油性墨水和溶劑墨水。新型噴墨頭擴展了EpsonPrecisionCore 列印頭系列產品,使其能夠更輕鬆地支援標記/編碼、指示牌、印刷電子和其他應用中更廣泛的工業和其他數位列印環境。

- 這些印表機消除了接觸式印刷技術(例如壓花)中常見的問題,例如列印褪色、列印缺失以及薄膜上出現孔洞。標籤、鋁箔、包裝、傳單和紙箱只是使用工業噴墨印表機的數位列印應用的一部分。但由於成本較高,難以大規模量產。

- 儘管噴墨印表機頭技術在過去幾年中取得了長足進步,但一些假冒產品仍可能影響市場成長。這包括解析度和色彩精度限制、列印速度和耐用性等因素。

- 此外,噴墨頭可能很昂貴,特別是當您考慮到它們的高品質和先進功能時。這可能會限制某些預算有限的行業和小型企業的採用。此外,持續的墨水和維護成本也會增加使用噴墨頭的總成本。

- COVID-19 疫情期間,商業印刷的需求下降。由於許多活動被取消,對促銷材料的需求減少。此外,許多組織已轉向遠端工作,無紙化操作的趨勢有所增加。隨著消費者開始使用線上媒體,廣告商開始關注數位媒體而不是實體媒體。所有這些因素都對疫情期間的調查市場產生了重大影響。印刷業最大的管理挑戰之一是確保熟練的生產工人。

- 此外,許多技術工人將在未來五到十年內退休。這以及對更快、更準確的列印操作的需求正在推動後 COVID-19 列印市場中勞動條件的自動化。因此,噴墨印刷市場的需求正在增加。

噴墨頭市場趨勢

辦公室和消費群的最終用戶類型細分市場佔據最大的市場佔有率

- 噴墨列印並不新鮮,但隨著技術創新改變列印在通訊中的作用,包括個人化、整合、互動/移動和多樣化現實,其使用量持續成長。自從印刷機發明以來,商業印刷一直很普及。

- 科技的普及以及辦公室和個人空間中應用的不斷增加預計將增加全球對噴墨頭的需求。噴墨印表機用於商業印刷企業,以及家庭和小型辦公室,以製作高品質的小冊子、傳單等。

- 此外,多功能設備經常用於商務辦公室和教育場所,例如大學和學校。由於多功能印表機的多功能性,包括影印、列印、紙張管理、掃描和傳真,教育機構對多功能印表機的需求不斷增加。

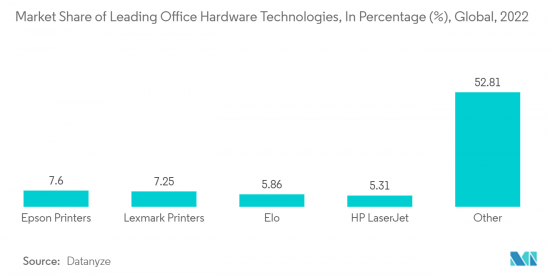

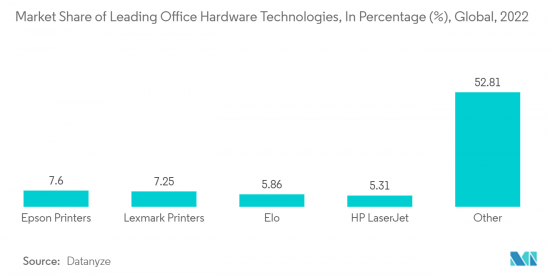

- 此外,一些多功能噴墨印表機還提供 Wi-Fi、液晶螢幕、通用序列匯流排、觸控和藍牙連接選項,以提高使用和操作的便利性。與單功能噴墨印表機相比,多功能噴墨印表機的使用增加是由於這些印表機的成本效益和低變化的結合。根據Datanyze統計,2022年,Epson印表機以7.6%的市場佔有率引領全球辦公室硬體科技產業。

- COVID-19 爆發期間,商業列印的需求下降。此外,許多公司已經採用遠距工作,加速了無紙化趨勢。由於 COVID-19大流行延長了企業停業時間,住宅領域而非辦公領域出現了商機。資訊科技公司鼓勵員工設立家庭辦公室。這對於消費群噴墨列印市場來說是有利的。

- 此外,生產噴墨等數位印刷技術可提供與膠印和其他當今使用的傳統印刷過程相媲美的高品質按需印刷書籍。快速、高品質的商務用噴墨印表機、工作流程解決方案和裝訂選項可幫助書籍印刷商提高效率、列印品質並降低成本。生產噴墨技術的彈性、高速度、低廢棄物和低運行成本使其適合中小批量的經濟高效生產。

- 2022年10月,以數位影像解決方案聞名的Canon美國公司推出了新款MAXIFY GX7020X噴墨印表機。採用大容量連續供墨系統,大容量墨水瓶的使用有助於降低墨水成本。隨著這項技術進步,許多最終用戶現在正在尋求適合在辦公室和家中工作的員工的混合工作解決方案,使他們能夠與經銷商簽訂合約來滿足其組織的需求。

亞太地區預計將佔據主要市場佔有率

- 預計亞太地區噴墨頭市場在整個預測期內將顯著成長。低廉的人事費用和製造成本帶來的巨大前景正在推動這一成長,使亞太地區成為建立生產設施來製造噴墨頭的熱門地點。

- 在中國、印度和其他幾個快速發展國家的推動下,亞太地區已超過世界其他地區,成為最大的印刷油墨市場。該地區是多家著名國際油墨製造商的所在地。 DIC、SAKATA INX CORPORATION、東洋油墨和 T&K Toka 與其他主要製造商一樣,在日本擁有大規模業務。

- 此外,中國是印刷過程中所需的油墨和溶劑成分等創新化學品的主要供應國,因此是許多歐洲印刷公司的供應來源。此外,智慧型手機製造商增加對印表機製造的投資也是推動該地區市場的關鍵因素。

- 2022年12月,噴墨技術製造商賽爾在中國深圳開設了先進的噴墨列印實驗室,由最新的列印頭測試設備和列印製程實驗平台組成。賽爾聲稱使用自己的列印頭、墨水再循環系統和液體,並與當地著名電子公司合作,以實現整個行業供應鏈的協同效應。

- 2022年10月,Epson宣布將投資約35億日圓(2,400萬美元)在日本母公司秋田Epson總部興建新廠。噴墨印表機的基本部件噴墨頭將在這家新工廠生產和組裝。這項投資策略將確保有足夠的生產空間來滿足預期的未來需求成長。透過增加先進的 PrecisionCore MicroTFP 列印頭的噴墨印表機供應量,Epson還可以增加對第三方的印表機頭銷售並豐富其產品陣容。此類投資可能會支持亞太地區研究市場的滲透。

噴墨頭產業概況

由於跨國公司和中小企業的存在,噴墨頭市場適度分散。由於競爭的結果,技術創新不斷加劇,搶佔市場先機,以佔領盡可能大的市場佔有率。理光集團、FUJIFILM Holdings、Canon、Konica Minolta和賽爾公司等市場主要企業正在採取聯盟、創新、收購等策略,以加強其產品供應並獲得永續的競爭優勢。

2022 年 11 月,花王柯林斯與FUJIFILM 整合式 Inkjet Solutions 合作,加強商業印刷領域的噴墨壓印解決方案。客戶可能會受益於FUJIFILM和花王柯林斯之間的合作,擴大服務選項並提高噴墨列印系統硬體的組件可用性。

2022年3月,理光株式會社宣布推出三款新開發的工業噴墨頭:理光MH5422、理光MH5442和理光MH5422 Type A,可作為數位印刷系統的重要組件。新型印表機頭採用理光的高精度技術,實現卓越的影像品質和生產力。此外,透過提高噴嘴表面的耐磨性並使其與多種墨水相容,耐用性也得到了改善。此外,不同的電纜和精確的表面對準特性提高了系統相容性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 噴墨列印市場的關鍵創新

- COVID-19 和最新趨勢對噴墨頭市場成長的影響

- 噴墨印字頭主要類別價格分析

第5章市場動態

- 市場促進因素

- 基於壓電的列印頭在工業和商業領域被採用

- 持續的技術進步

- 市場抑制因素

- 與其他技術相比,成本仍然是阻礙因素

第6章市場區隔

- 依技術類型

- 按需下降

- 熱敏型

- 壓電底座

- 連續式

- 按需下降

- 按類型

- 基於MEMS

- 傳統的

- 按最終用戶

- 辦公室及消費群

- 工業印刷

- 圖文印刷

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭形勢

- 公司簡介

- Ricoh Group

- FUJIFILM Holdings Corporation

- Canon

- Konica Minolta Inc.

- Xaar PLC

- Memjet

- Funai Electric Co.Ltd.

- Kyocera Corporation

- Toshiba Corporation

- HP Inc.

- Seiko Epson Corporation

第8章供應商市場佔有率分析

第9章投資分析

第10章 投資分析市場的未來展望

The Inkjet Printhead Market size is estimated at USD 2.95 billion in 2024, and is expected to reach USD 3.75 billion by 2029, growing at a CAGR of 4.94% during the forecast period (2024-2029).

Bulk PZT (Lead Zirconate Titanate) or conventional PZT printing has been a turning point for substrate printing in the industrial sector, wherein high dots per inch are secondary compared to high-volume. Inkjet printhead technology has made its way into ceramic tiles and functional printing. In addition, as thin-film and bulk PZT printheads do not directly interact with the substrate, these technologies have increased significantly in textiles and label printing.

Key Highlights

- The rising demand for inkjet printers from the commercial sectors is fueling the global market expansion. Piezoelectric inkjet printheads are used in the retail industry for various purposes. Further, the global market for piezoelectric inkjet print heads is expanding because of the rapid enhancements in inkjet printing technology. The major players in the market include Kyocera, Konica Minolta, Ricoh, Epson, Canon, etc. In November 2022, Meteor Inkjet Ltd. was granted a US patent for "Inkjet nozzle status detection" by the United States Patent and Trademark Office. The patent comprises a system and method for determining, in real-time, the operational status of a nozzle in a piezoelectric industrial inkjet printhead. The invention utilizes real-time monitoring of electrical feedback from the nozzle after piezoelectric excitation to catch clogged or clogging print nozzles. Such innovations are likely to boost the growth of the studied market.

- The global market for industrial inkjet printheads is predicted to experience growth during the forecast period due to the increased use of these printers for printing on packaging material and signage. Inline printing of batch data and codes is frequently done during the packaging process with inkjet printers. To that extent, in February 2023, Seiko Epson Corporation announced that it would commence selling two new inkjet printheads that support solvent inks. The latest I3200(8)-S1HD and S800-S1 are claimed to be compatible with a diverse variety of inks utilized for industrial applications. In addition to aqueous, eco-solvent, and UV-cured inks, they support oil-based, solvent, and other types of inks for digital printing applications in production printing. The new inkjet printheads would expand Epson's offerings in the PrecisionCore printhead series and facilitate the company to support a broader range of industrial and other digital printing environments for applications like marking/coding, signage, and printed electronics.

- The problems typically brought on by contact printing techniques like embossing, such as blurry or missing prints and holes in films, are eliminated with these printers. Labels, foils, packaging, leaflets, and cartons are just a few digital printing applications that use industrial inkjet printers. However, high cost is expected to restrain the players from introducing it for bulk production.

- Inkjet printhead technology has advanced significantly over the years, but several imitations could still impact its market growth. This includes factors like limitations in resolution and color accuracy, print speed, and durability.

- Moreover, inkjet printheads can be costly, especially when considering high-quality and advanced features. This can limit their adoption in certain industries or small businesses with budget constraints. Additionally, the ongoing cost of ink and maintenance can add to the overall cost of using inkjet print heads.

- Demand for commercial printing reduced during the COVID-19 outbreak. Many events were canceled, which led to lower demand for promotional materials. Many organizations also moved to remote working, which boosted the trend toward paperless operations. Advertisers emphasized digital over physical media as consumers started using online media. All these factors significantly affected the market studied during the pandemic. One of the biggest operational challenges for the printing industry is finding skilled production workers.

- Moreover, many skilled workers would retire in the next five to 10 years. Due to this and the need for faster and more accurate printing operations, automation has kept pace in the printing market post-COVID-19 working conditions. As a result, the inkjet printing market is witnessing increased demand.

Inkjet Printhead Market Trends

Office and Consumer-based End-user Type Segment Holds Largest Market Share

- While inkjet printing is not new, its usage continues to increase as technological innovations drive the changing role of print in communication, owing to personalization, integration, interactive/mobile, and the realities of diversification. Commercial printing has been popular since the invention of the printing press.

- Technological proliferation and rising applications in offices and personal space are anticipated to increase the demand for inkjet printheads globally. In addition to using inkjet printers in commercial printing businesses to create high-quality brochures, flyers, and other materials, these printers are typically used in homes and small offices.

- Moreover, multifunctional printers are frequently used in business offices and educational settings, such as colleges and schools. The demand for multifunctional printers at educational institutions has increased due to the versatility of these printers in terms of copying, printing, managing paper, scanning, and faxing.

- Additionally, several multifunctional inkjet printers offer Wi-Fi, Liquid Crystal Display screens, and Universal Serial Bus, touch, and Bluetooth connectivity options, improving their usability and control. The use of multifunctional inkjet printers over single functional inkjet printers has increased because of the cost-effectiveness of these printers combined with the low variants. According to Datanyze, in 2022, Epson Printers led the global office hardware technology industry with a market share of 7.6%.

- During the COVID-19 outbreak, demand for business printing fell. Additionally, many businesses adopted remote working, accelerating the trend toward paperless operations. There was an opportunity in the home segment instead of the office segment because of the protracted shutdown of businesses brought on by the COVID-19 pandemic. Information technology companies incentivized employees to set up home offices. This was advantageous for the consumer-based inkjet printing market.

- Additionally, digital printing technology, such as production inkjet, offers high-quality print-on-demand books comparable to offset and other traditional printing processes used today. With high-speed, high-quality commercial inkjet printers, workflow solutions, and finishing options, book printers can help increase efficiency and print quality and keep costs down. Production inkjet technology is suitable for delivering cost-effective production for short to medium run lengths due to its flexibility, high speed, low waste, and low running costs.

- In October 2022, Canon USA Inc., a prominent player in digital imaging solutions, launched its new MAXIFY GX7020X inkjet printer. It utilizes a high-volume continuous ink delivery system that can assist in lowering ink costs by employing high-volume ink bottles. With this technological advancement, numerous end users would be able to engage with a single dealer to meet their organizational needs as they seek hybrid work solutions to suit a staff that works in the office and from home.

Asia-Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific inkjet printhead market is estimated to grow significantly throughout the forecast period. The immense prospects based on low labor and manufacturing costs are responsible for the rise, making the Asia-Pacific region a popular site for setting up production facilities to manufacture inkjet printheads.

- The Asia-Pacific region has overtaken the rest of the world as the largest market for printing ink, driven by China, India, and several other rapidly developing nations. The region is home to several prominent international ink makers. DIC, Sakata INX, Toyo Ink, and T&K Toka have substantial operations in Japan, similar to other major players.

- Additionally, China is a major supplier of innovative chemicals, such as ink and solvent components, which are needed as input materials in printing processes and are, therefore, a supply source for many European printing enterprises. Additionally, the growing investment made in producing these printers by smartphone manufacturers is a key element driving the market in this region.

- In December 2022, Inkjet technology manufacturer Xaar opened an advanced inkjet printing laboratory in Shenzhen, China, comprising its latest printhead test equipment and print process experimentation platforms. Using its printheads, ink recirculation system, and fluids, Xaar claimed that it would collaborate with prominent local electronics companies to achieve synergies across the industry supply chain.

- In October 2022, Epson stated that it would spend approximately JPY 3.5 billion (USD 0.024 billion) building a new plant at the headquarters of its Japanese parent company, Akita Epson. Inkjet printheads, the fundamental components of inkjet printers, would be manufactured and assembled in the new factory. The investment strategy would facilitate sufficient production space to accommodate the expected future increase in demand. Augmenting the supply of inkjet printers with advanced PrecisionCore MicroTFP printheads would also allow Epson to increase printhead sales to third parties and boost its product selection. Such investments would aid in the penetration of the studied market in the Asia-Pacific region.

Inkjet Printhead Industry Overview

The inkjet printhead market is moderately fragmented due to the presence of global players and small and medium-sized enterprises. The competition results in increased innovation to grab the market opportunity to gain the maximum possible market share. The major players in the market, like Ricoh Group, FUJIFILM Holdings Corporation, Canon, Konica Minolta Inc., and Xaar PLC, are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, Kao Collins and FUJIFILM Integrated Inkjet Solutions partnered to strengthen inkjet imprinting solutions for the commercial imprinting sector. Customers were likely to benefit from improved service choices and increased parts availability for inkjet print system hardware through the combined efforts of Fujifilm and Kao Collins.

In March 2022, Ricoh Company Ltd. released three newly developed industrial-grade inkjet printheads, RICOH MH5422, RICOH MH5442, and RICOH MH5422 Type A, which could be used as essential components in digital printing systems. The new printheads use Ricoh's high-precision technology to deliver outstanding picture quality and productivity. They increased endurance due to better nozzle surface abrasion resistance and a wide range of ink compatibility. Ricoh also increased system compatibility using different cables and high-precision surface alignment characteristics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Technological Innovations in Inkjet Printing Market

- 4.5 Impact of COVID-19 and Recent Trends on the Growth of the Inkjet Printhead Market

- 4.6 Pricing Analysis of Inkjet Printheads in Key Categories

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Piezo-Based Printheads Witnessing Higher Adoption In Industrial and Commercial Segments

- 5.1.2 Ongoing Technological Advancements

- 5.2 Market Restraints

- 5.2.1 Cost Remains a Key Prohibitive Factor Compared to Other Technologies

6 MARKET SEGMENTATION

- 6.1 By Technology Type

- 6.1.1 Drop-on-demand

- 6.1.1.1 Thermal

- 6.1.1.2 Piezo-based

- 6.1.2 Continuous

- 6.1.1 Drop-on-demand

- 6.2 By Type

- 6.2.1 MEMS-based

- 6.2.2 Conventional

- 6.3 By End-user Type

- 6.3.1 Office and Consumer-Based

- 6.3.2 Industrial Printing

- 6.3.3 Graphic Printing

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ricoh Group

- 7.1.2 FUJIFILM Holdings Corporation

- 7.1.3 Canon

- 7.1.4 Konica Minolta Inc.

- 7.1.5 Xaar PLC

- 7.1.6 Memjet

- 7.1.7 Funai Electric Co.Ltd.

- 7.1.8 Kyocera Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 HP Inc.

- 7.1.11 Seiko Epson Corporation

![工業印刷噴墨頭市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1342042.png)